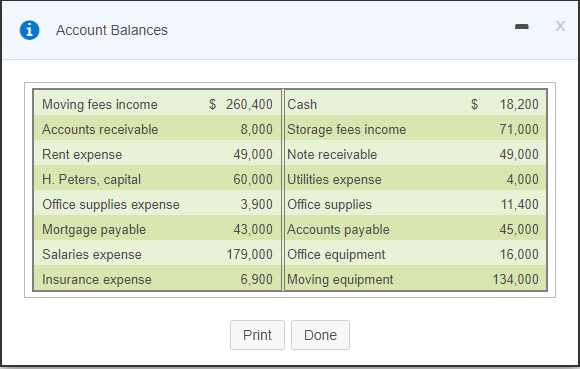

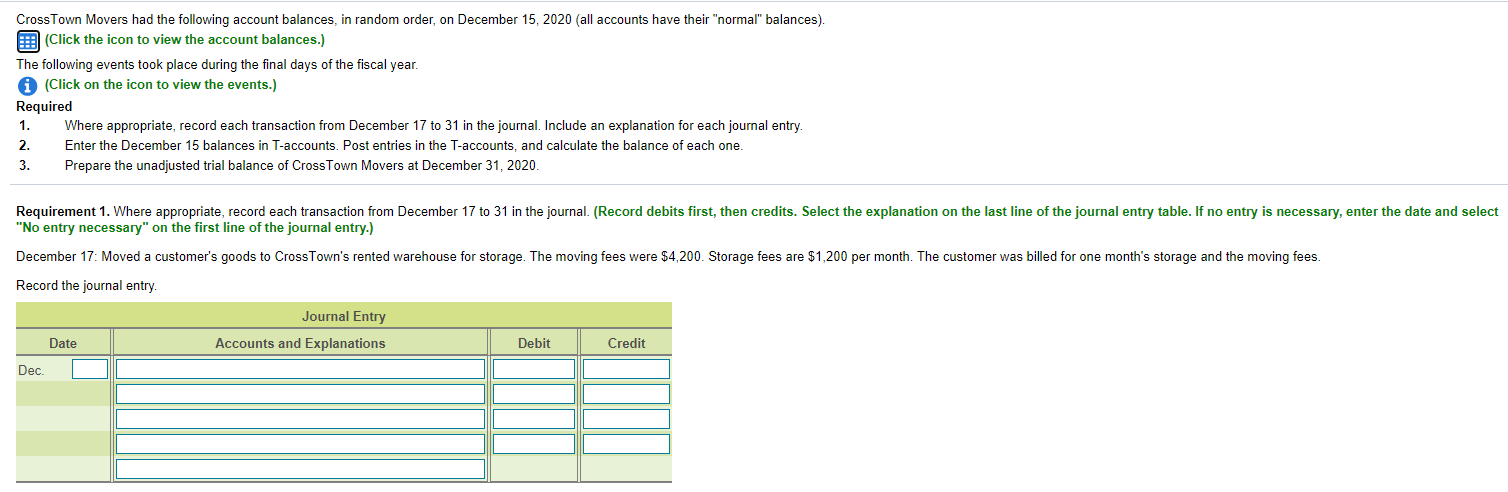

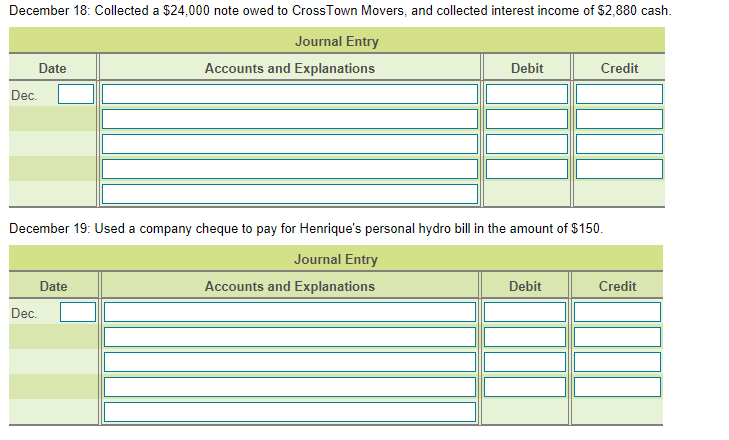

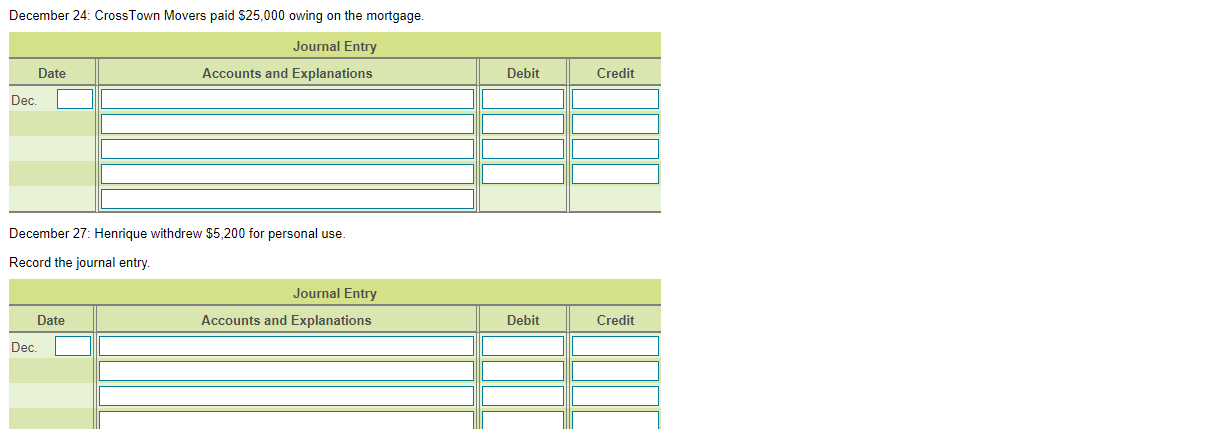

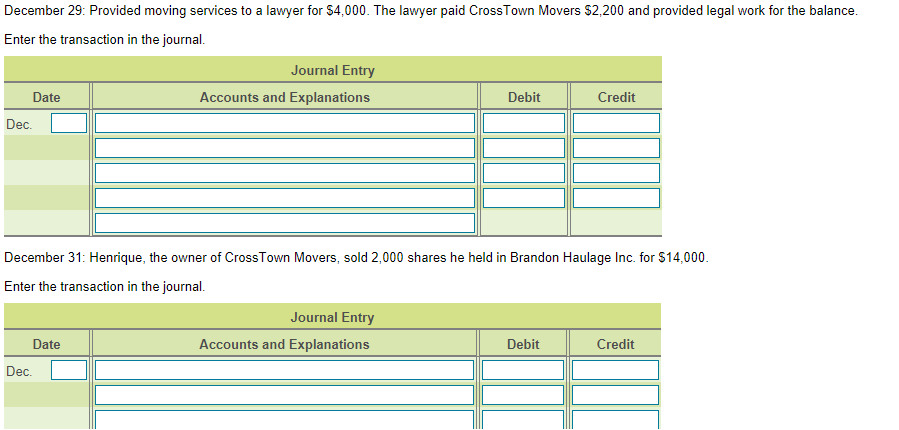

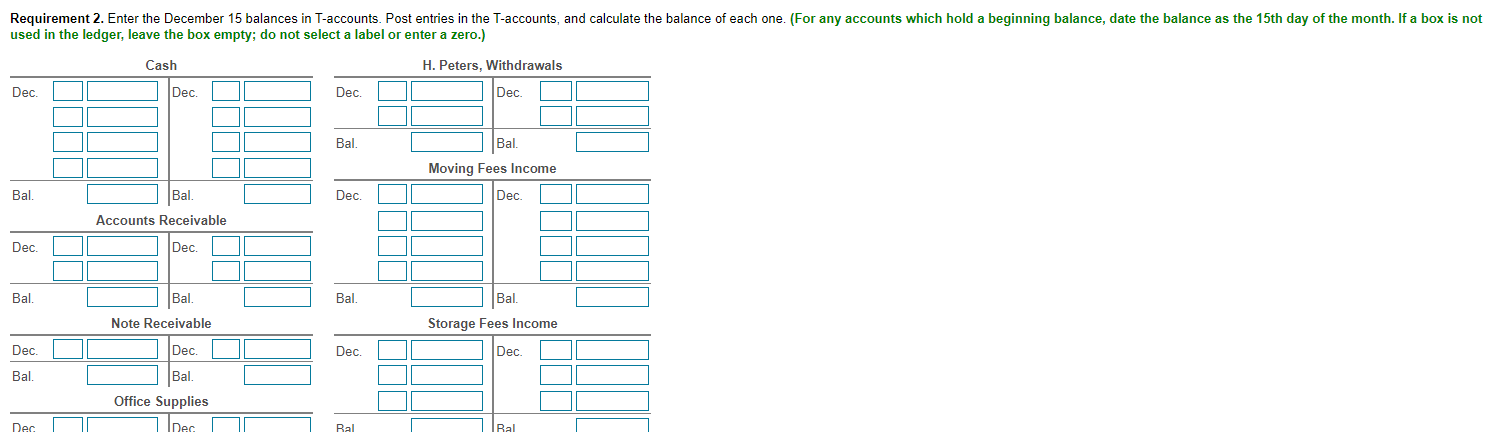

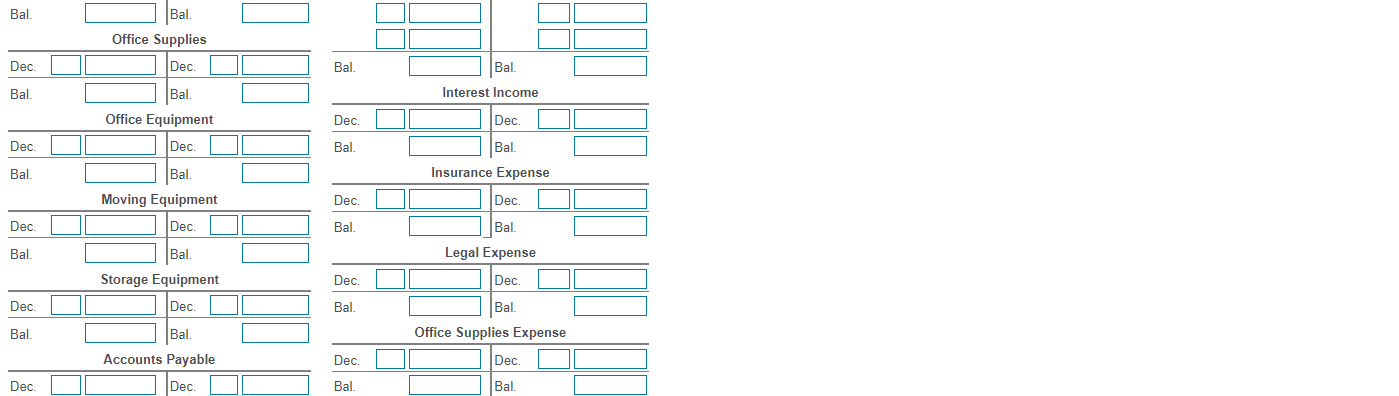

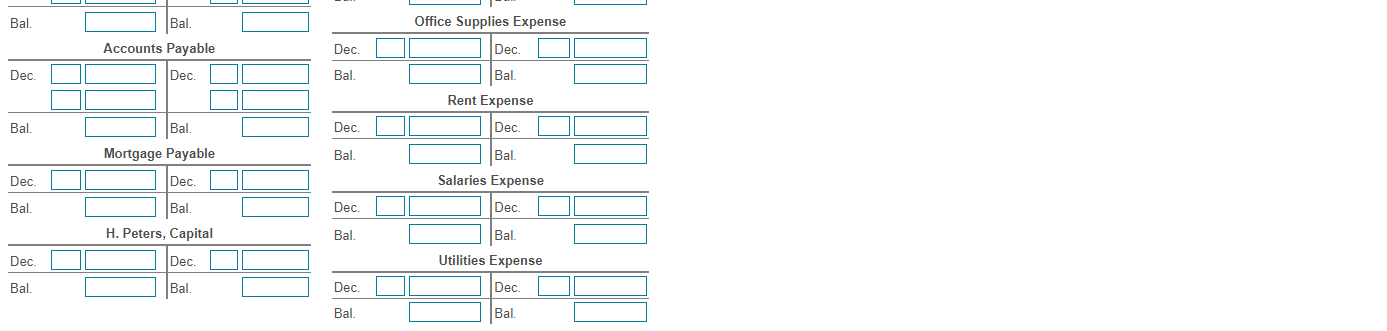

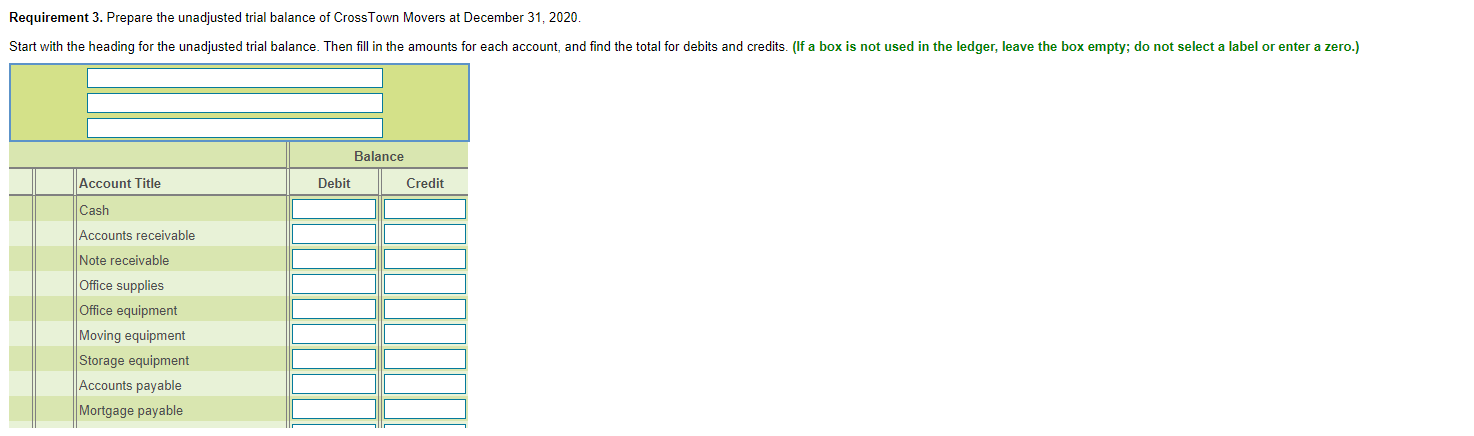

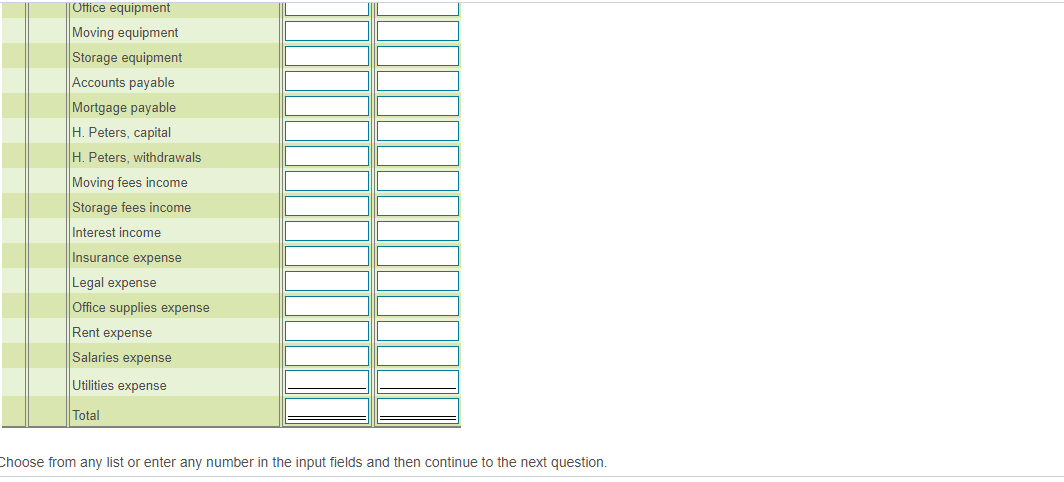

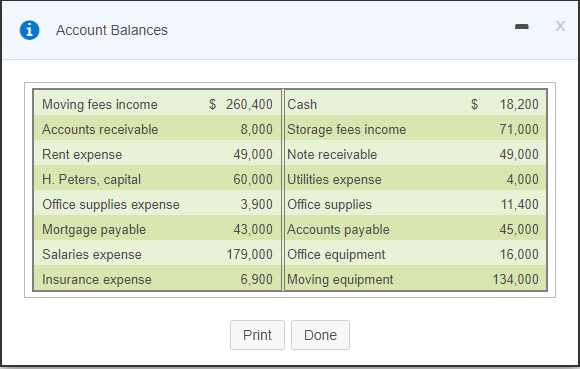

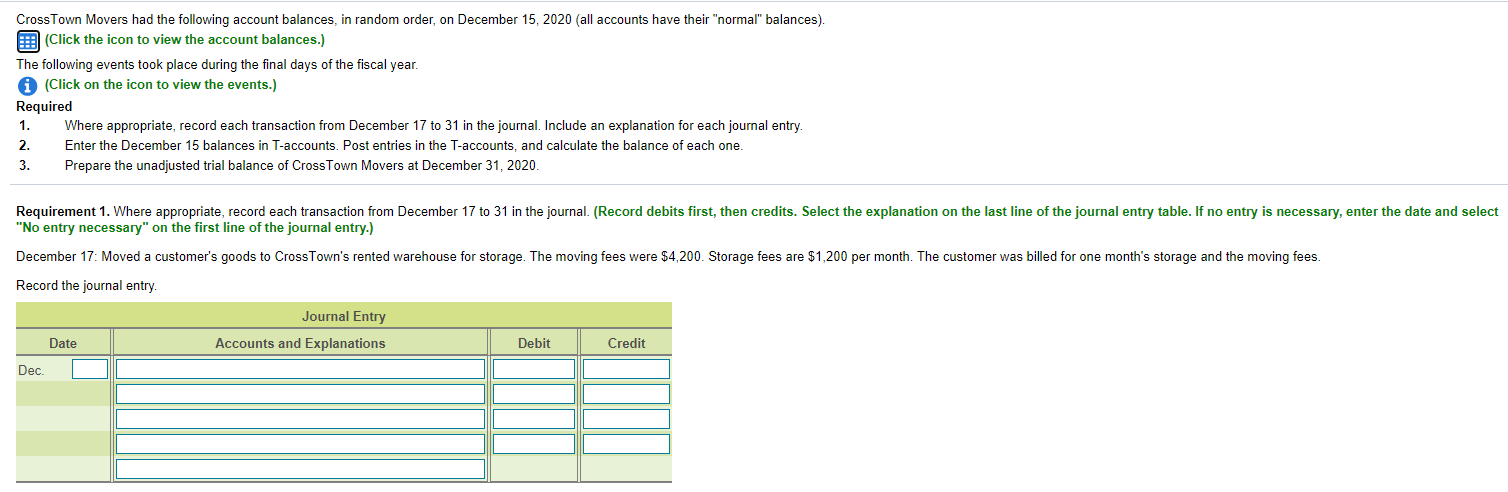

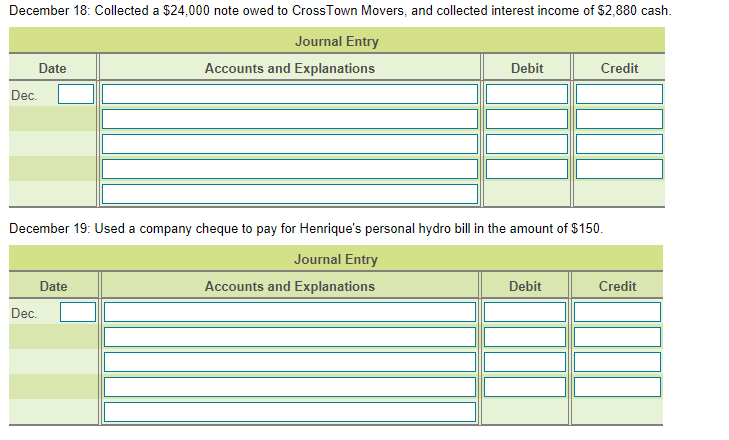

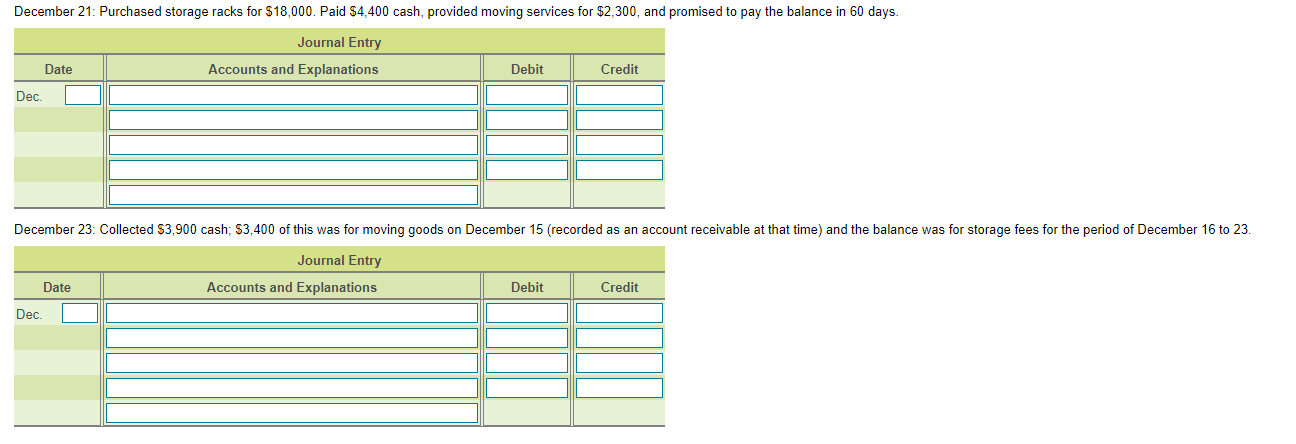

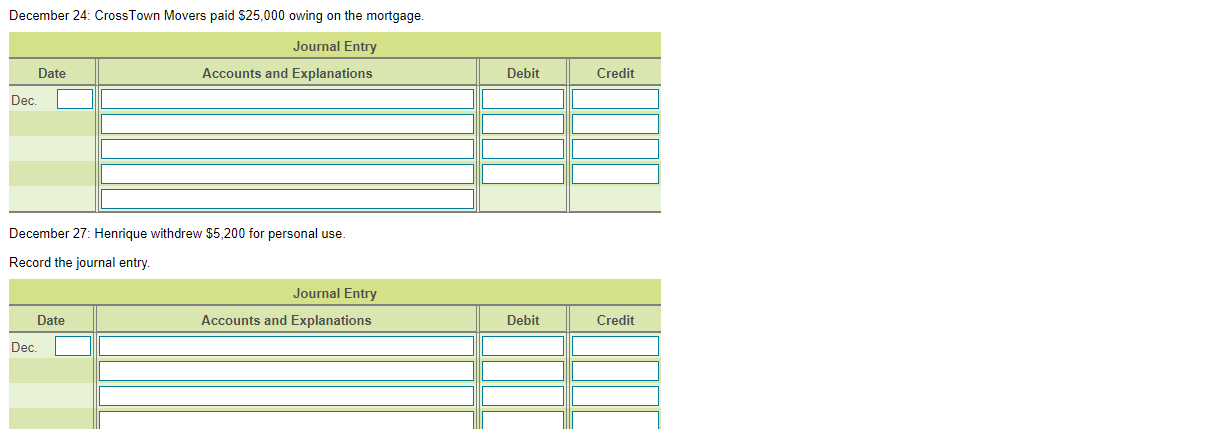

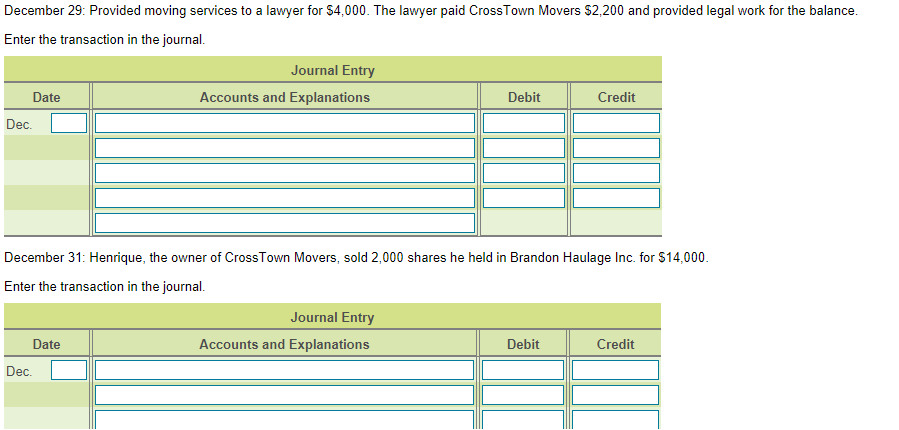

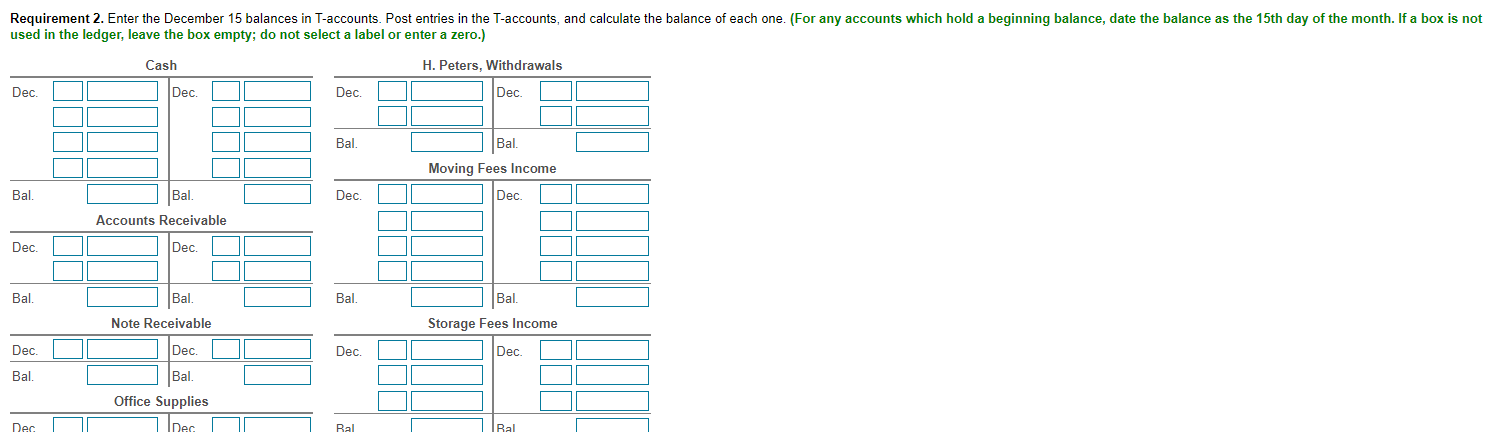

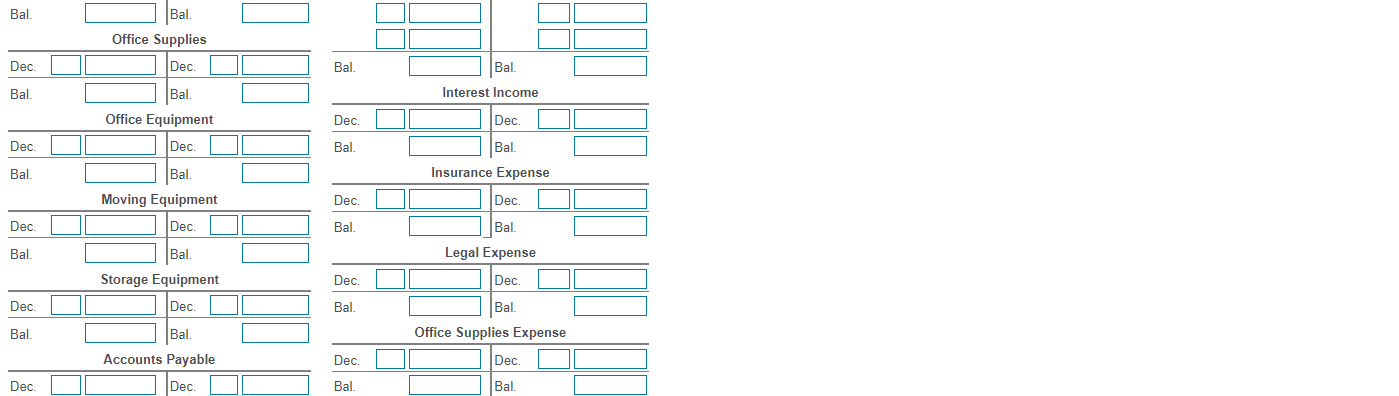

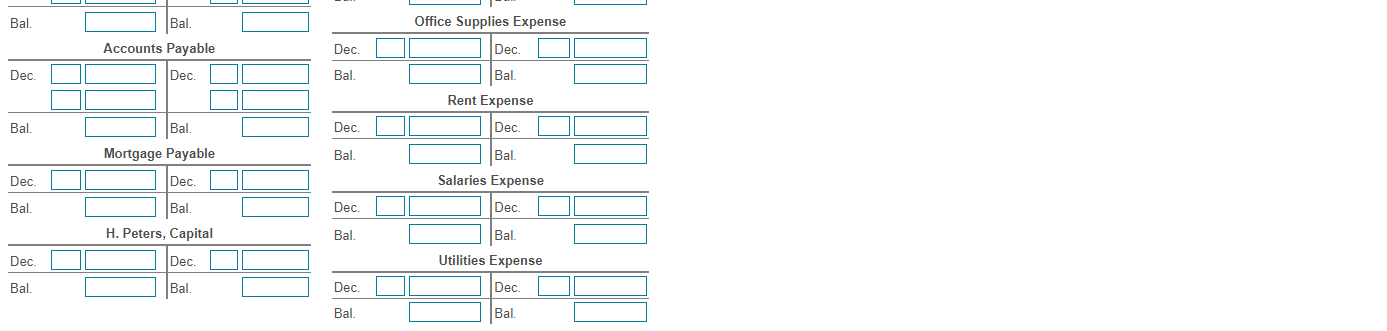

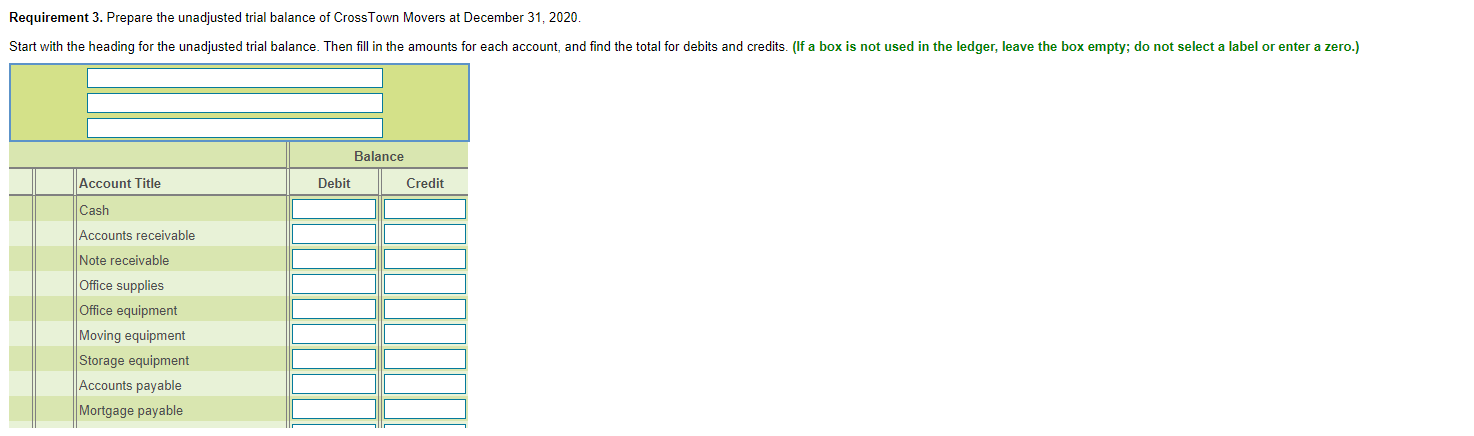

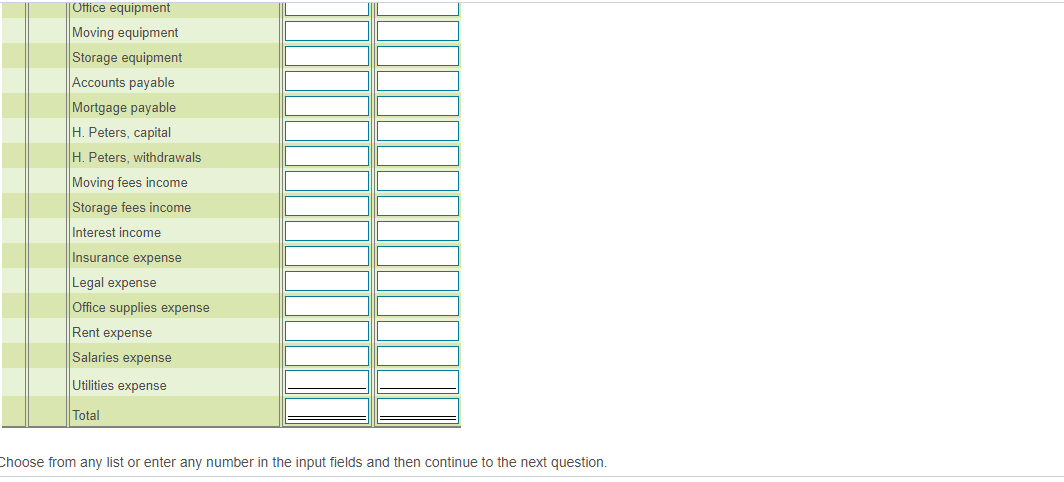

i Account Balances - 18,200 71,000 Moving fees income Accounts receivable Rent expense H. Peters, capital Office supplies expense Mortgage payable Salaries expense Insurance expense $ 260,400 Cash 8,000 Storage fees income 49,000 Note receivable 60,000 Utilities expense 3,900 Office supplies 43,000 Accounts payable 179,000 Office equipment 6,900 Moving equipment 49,000 4,000 11,400 45,000 16,000 134,000 Print Done CrossTown Movers had the following account balances, in random order, on December 15, 2020 (all accounts have their "normal" balances). 2 (Click the icon to view the account balances.) The following events took place during the final days of the fiscal year. (Click on the icon to view the events.) Required 1. Where appropriate, record each transaction from December 17 to 31 in the journal. Include an explanation for each journal entry. 2. Enter the December 15 balances in T-accounts. Post entries in the T-accounts, and calculate the balance of each one. 3. Prepare the unadjusted trial balance of CrossTown Movers at December 31, 2020 Requirement 1. Where appropriate, record each transaction from December 17 to 31 in the journal. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. If no entry is necessary, enter the date and select "No entry necessary" on the first line of the journal entry.) December 17: Moved a customer's goods to CrossTown's rented warehouse for storage. The moving fees were $4,200. Storage fees are $1,200 per month. The customer was billed for one month's storage and the moving fees. Record the journal entry. Journal Entry Accounts and Explanations Date Debit Credit Dec December 18: Collected a $24,000 note owed to CrossTown Movers, and collected interest income of $2,880 cash. Journal Entry Accounts and Explanations Debit Credit Date Dec. December 19: Used a company cheque to pay for Henrique's personal hydro bill in the amount of $150. Journal Entry Accounts and Explanations Date Debit Credit Dec. December 21: Purchased storage racks for $18,000. Paid $4,400 cash, provided moving services for $2,300, and promised to pay the balance in 60 days. Journal Entry Accounts and Explanations Date Debit Credit Dec. December 23: Collected $3,900 cash; $3,400 of this was for moving goods on December 15 (recorded as an account receivable at that time) and the balance was for storage fees for the period of December 16 to 23. Journal Entry Date Accounts and Explanations Debit Credit Dec. December 24: CrossTown Movers paid $25,000 owing on the mortgage. Journal Entry Accounts and Explanations Date Debit Credit Dec. December 27: Henrique withdrew $5,200 for personal use. Record the journal entry Journal Entry Accounts and Explanations Date Debit Credit Dec. December 29: Provided moving services to a lawyer for $4,000. The lawyer paid CrossTown Movers $2,200 and provided legal work for the balance. Enter the transaction in the journal. Journal Entry Date Accounts and Explanations Debit Credit Dec. December 31: Henrique, the owner of CrossTown Movers, sold 2,000 shares he held in Brandon Haulage Inc. for $14,000. Enter the transaction in the journal. Journal Entry Accounts and Explanations Date Debit Credit Dec Requirement 2. Enter the December 15 balances in T-accounts. Post entries in the T-accounts, and calculate the balance of each one. (For any accounts which hold a beginning balance, date the balance as the 15th day of the month. If a box is not used in the ledger, leave the box empty; do not select a label or enter a zero.) Cash H. Peters, Withdrawals Dec. Dec. Dec. Dec Bal. Bal. Moving Fees Income Bal. Bal. Dec. Dec. Accounts Receivable Dec. Dec. Ball Bal Bal. Bal. Note Receivable Storage Fees Income Dec. Dec. Dec. Bal. Dec. Bal. Office Supplies Dec. Toer 1 Ral Ral Bal. Bal. Office Supplies Dec. Dec. Bal. Bal. Interest Income Bal. Bal. Office Equipment Dec. Dec. Bal. Dec. Dec. Bal. II Bal. Insurance Expense Bal. Moving Equipment Dec. Dec. Dec. Dec. Bal. Bal. Bal. Legal Expense Bal Storage Equipment Dec. Dec. Dec. Dec. Bal. Bal. Bal. Accounts Payable Dec. Bal. Office Supplies Expense Dec. Dec. Dec. Bal. Bal. Bal. Bal. Accounts Payable Dec. Office Supplies Expense Dec Dec. Dec. Bal. Bal Rent Expense Bal Dec. Dec. Bal. Mortgage Payable Bal Bal. Dec. Dec. Salaries Expense Bal Dec. Dec Bal. H. Peters, Capital Bal Bal. Dec. Dec. Utilities Expense Bal Bal. Dec. Dec Bal. Bal. Requirement 3. Prepare the unadjusted trial balance of CrossTown Movers at December 31, 2020. Start with the heading for the unadjusted trial balance. Then fill in the amounts for each account, and find the total for debits and credits. (If a box is not used in the ledger, leave the box empty; do not select a label or enter a zero.) Balance Account Title Debit Credit Cash Accounts receivable Note receivable Office supplies Office equipment Moving equipment Storage equipment Accounts payable Mortgage payable Office equipment Moving equipment Storage equipment Accounts payable Mortgage payable H. Peters, capital H. Peters, withdrawals Moving fees income Storage fees income Interest income Insurance expense Legal expense Office supplies expense Rent expense Salaries expense Utilities expense Total Choose from any list or enter any number in the input fields and then continue to the next