Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i added another picture. but the beginning of the problem states, kim decides early in her career that she wishes to save aggressively for retirement.

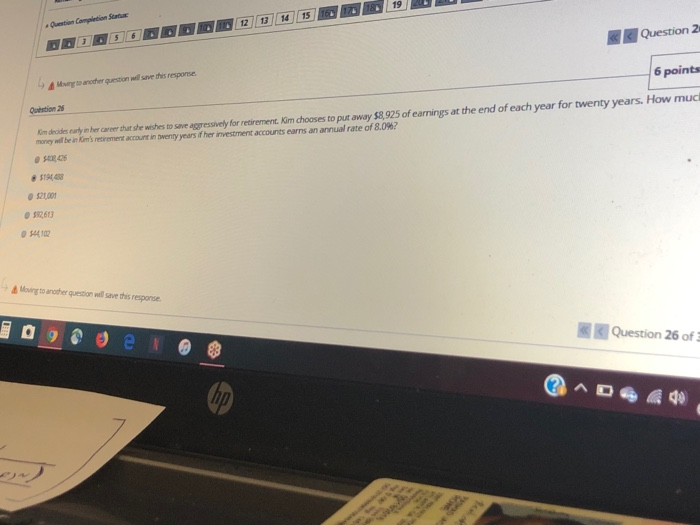

i added another picture. but the beginning of the problem states, kim decides early in her career that she wishes to save aggressively for retirement. kim chooses to put away 8,925 of earnings at the end of each year for twenty years. how much money will be in Kims retirement account in twenty years if her investment accounts earns an annual rate of 8.0%

Conpien d g Tie 50i 30 26 27 28 29 24 25 Q Capion Sttu 1s 12 13 14 15 Question 26 o 4Maing o aner question will save this resporse 6 points Sav Qutstion 2 for twenty years. How much m deodes early n her career that she wishes to save aggressively for retirement. Kim chooses to put away $8925 of earnings at the end noy will be in ims retirement account in bwerty years f her investment accounts earns an annual rate of &.0% of each year 12100 es92613 544 102 Moving to another question will save this response Question 26 of 3 19 173 164 Question Campietion Status 14 12 12 3 Question 2 Mary to anocher question wl save thes response 6 points Oustion 26 Km decides early in her career that she wishes to save aggressively for retirement Kim chooses to put away $8,925 of earnings at the end of each year for twenty years. How muc money will be in Kim's retirement account in bwenty years if her investment accounts earns an annual rate of 8.0%? S4 436 S194488 521,001 S92,613 0 544 102 AMong to anoher question will save this response e Question 26 of 2^D hp ww Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started