Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I already figured out the net pension expense for 20X1, 20X2 and 20x3 Here: A. Help with making a schedule which identifies the changes in

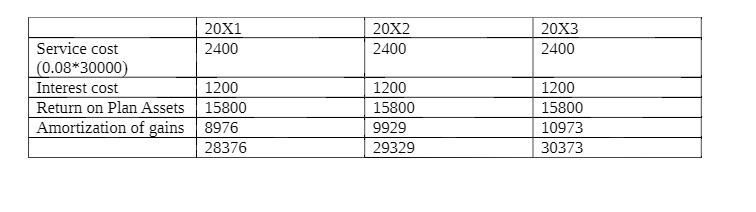

I already figured out the net pension expense for 20X1, 20X2 and 20x3 Here:

A. Help with making a schedule which identifies the changes in the PBO and Plan Asset account balances and the funded status for 20X1, 20X2 and 20X3.

B. Now assume that the actual return on plan assets in 20X2 was $6,230 higher than the projected return an actuarial adjustment increased the PBO by $32, 580. Calculate pension expense for 20X2 and 20X3. If pension expense is unchanged in 20X2 and/or 20X3

from the amounts determined in item "1", explain why.

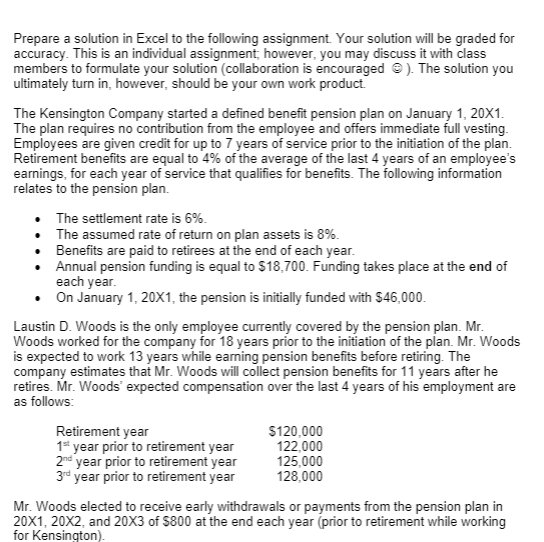

. . Prepare a solution in Excel to the following assignment. Your solution will be graded for accuracy. This is an individual assignment, however, you may discuss it with class members to formulate your solution (collaboration is encouraged ). The solution you ultimately turn in, however, should be your own work product. The Kensington Company started a defined benefit pension plan on January 1, 20X1. The plan requires no contribution from the employee and offers immediate full vesting. Employees are given credit for up to 7 years of service prior to the initiation of the plan. Retirement benefits are equal to 4% of the average of the last 4 years of an employee's earnings, for each year of service that qualifies for benefits. The following information relates to the pension plan. The settlement rate is 6%. The assumed rate of return on plan assets is 8%. Benefits are paid to retirees at the end of each year. Annual pension funding is equal to $18,700. Funding takes place at the end of each year. On January 1, 20X1, the pension is initially funded with $46,000 Laustin D. Woods is the only employee currently covered by the pension plan. Mr. Woods worked for the company for 18 years prior to the initiation of the plan. Mr. Woods is expected to work 13 years while earning pension benefits before retiring. The company estimates that Mr. Woods will collect pension benefits for 11 years after he retires. Mr. Woods' expected compensation over the last 4 years of his employment are as follows: Retirement year $120,000 14 year prior to retirement year 122,000 2nd year prior to retirement year 125,000 3rd year prior to retirement year 128,000 Mr. Woods elected to receive early withdrawals or payments from the pension plan in 20X1, 20X2, and 20x3 of $800 at the end each year (prior to retirement while working for Kensington) 20X2 2400 20X3 2400 20X1 Service cost 2400 (0.08*30000) Interest cost 1200 Return on Plan Assets 15800 Amortization of gains 8976 28376 1200 15800 9929 29329 1200 15800 10973 30373 . . Prepare a solution in Excel to the following assignment. Your solution will be graded for accuracy. This is an individual assignment, however, you may discuss it with class members to formulate your solution (collaboration is encouraged ). The solution you ultimately turn in, however, should be your own work product. The Kensington Company started a defined benefit pension plan on January 1, 20X1. The plan requires no contribution from the employee and offers immediate full vesting. Employees are given credit for up to 7 years of service prior to the initiation of the plan. Retirement benefits are equal to 4% of the average of the last 4 years of an employee's earnings, for each year of service that qualifies for benefits. The following information relates to the pension plan. The settlement rate is 6%. The assumed rate of return on plan assets is 8%. Benefits are paid to retirees at the end of each year. Annual pension funding is equal to $18,700. Funding takes place at the end of each year. On January 1, 20X1, the pension is initially funded with $46,000 Laustin D. Woods is the only employee currently covered by the pension plan. Mr. Woods worked for the company for 18 years prior to the initiation of the plan. Mr. Woods is expected to work 13 years while earning pension benefits before retiring. The company estimates that Mr. Woods will collect pension benefits for 11 years after he retires. Mr. Woods' expected compensation over the last 4 years of his employment are as follows: Retirement year $120,000 14 year prior to retirement year 122,000 2nd year prior to retirement year 125,000 3rd year prior to retirement year 128,000 Mr. Woods elected to receive early withdrawals or payments from the pension plan in 20X1, 20X2, and 20x3 of $800 at the end each year (prior to retirement while working for Kensington) 20X2 2400 20X3 2400 20X1 Service cost 2400 (0.08*30000) Interest cost 1200 Return on Plan Assets 15800 Amortization of gains 8976 28376 1200 15800 9929 29329 1200 15800 10973 30373

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started