Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I already had this posted once on Chegg. The answer was WRONG. Please see below. I got the asnwer from Chegg below. IT IS WRONG.

I already had this posted once on Chegg. The answer was WRONG. Please see below.

I got the asnwer from Chegg below. IT IS WRONG. Can someone help resolve this?

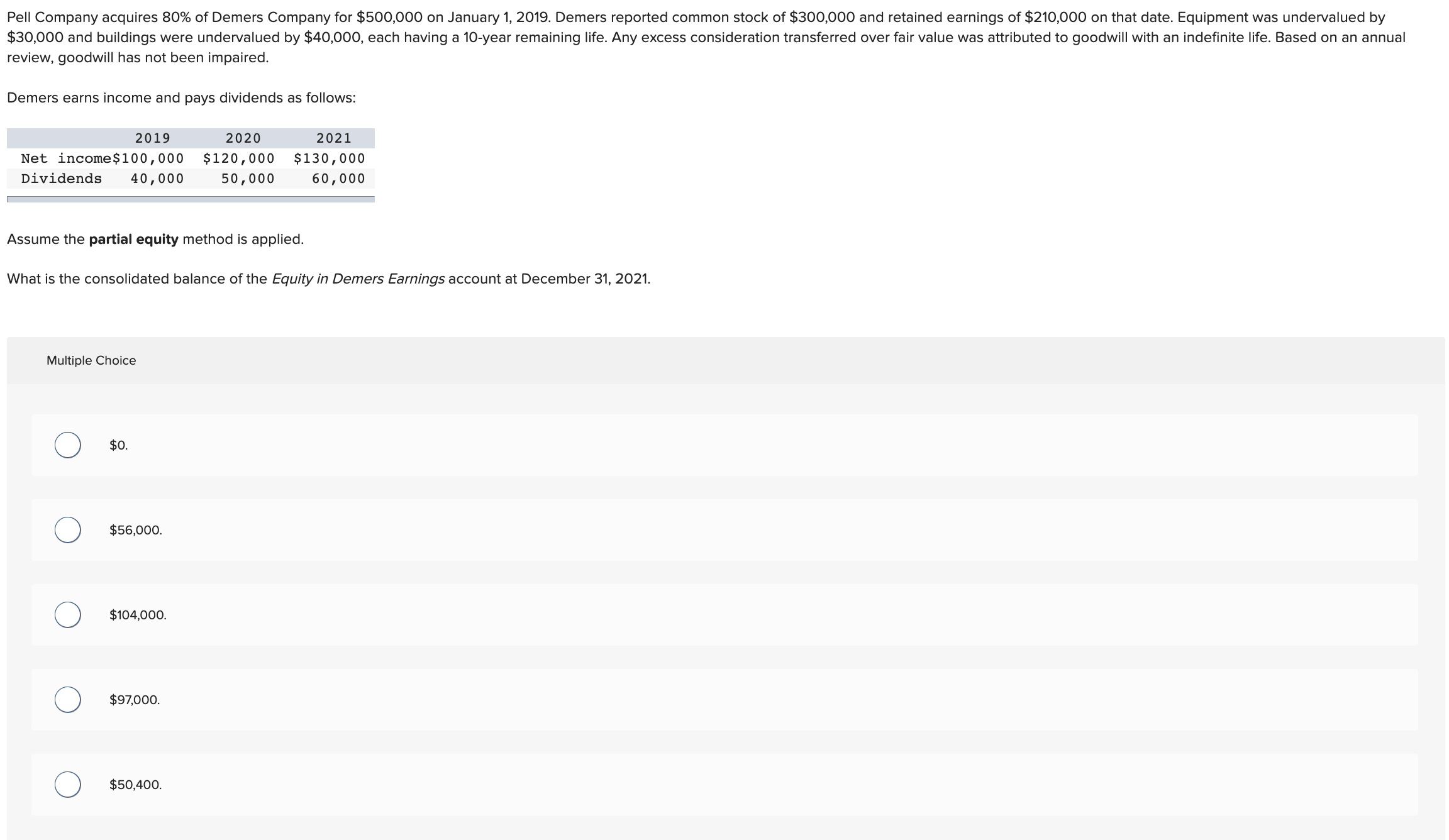

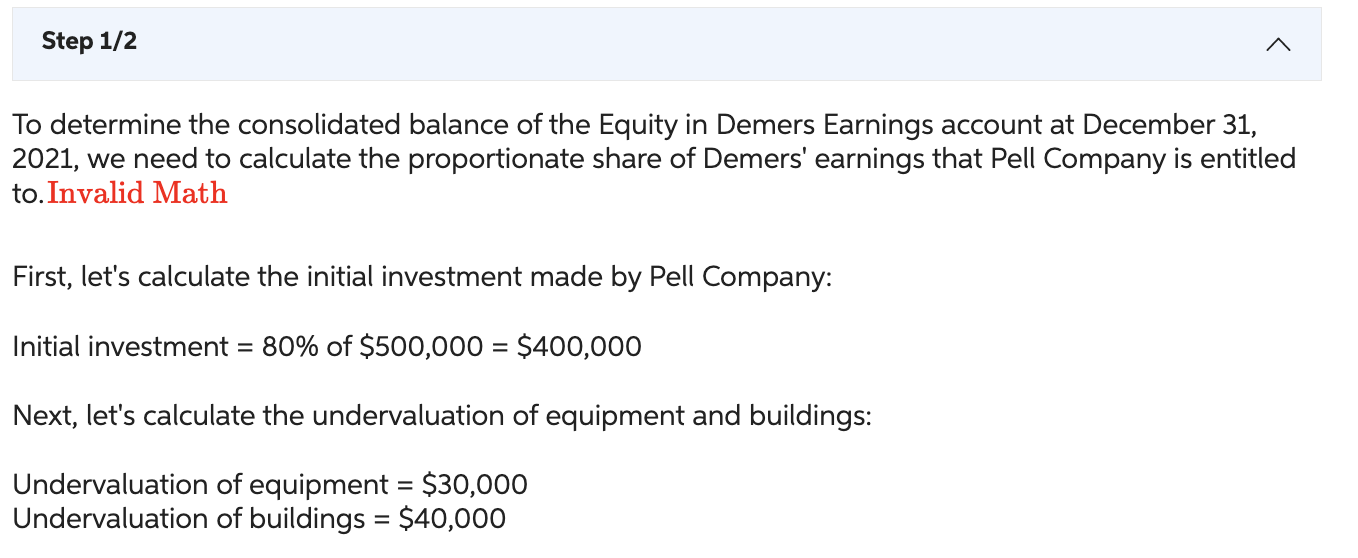

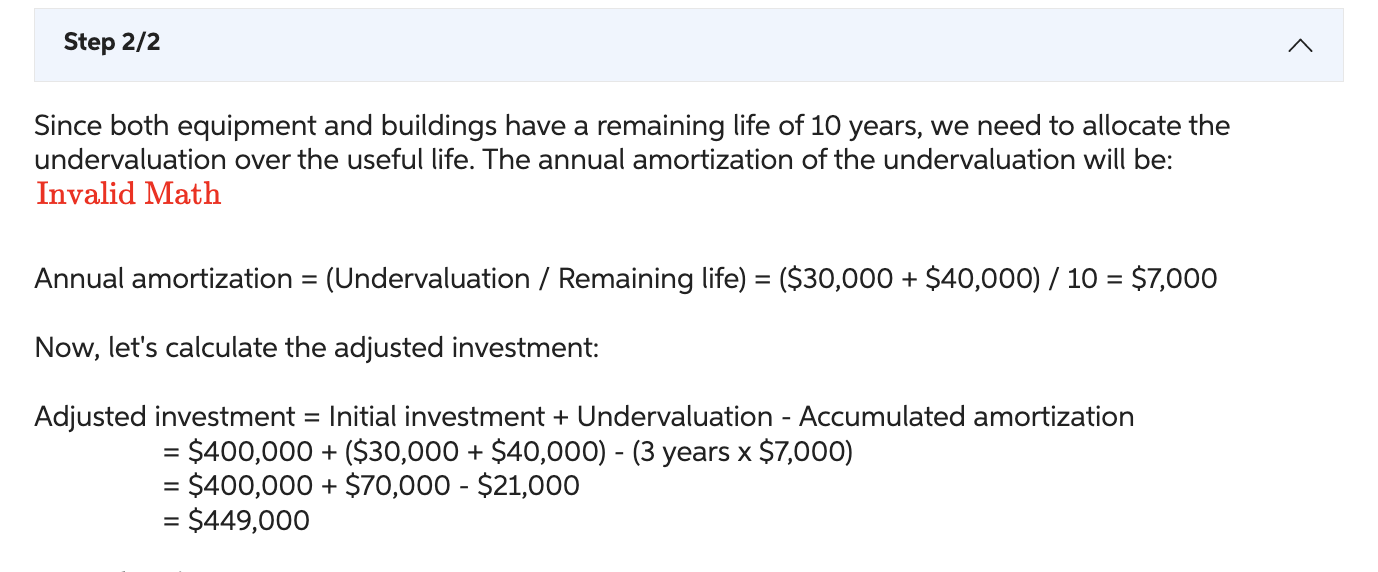

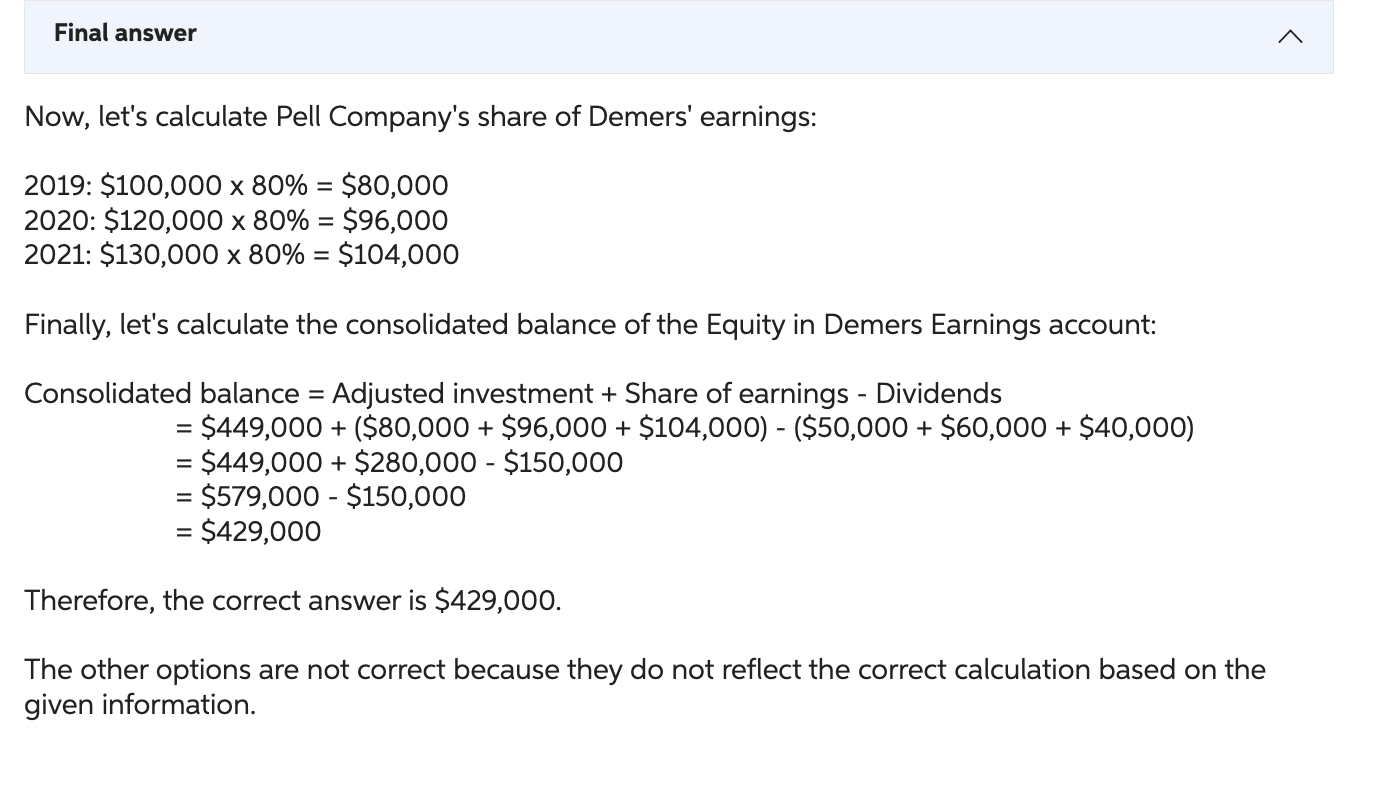

review, goodwill has not been impaired. Demers earns income and pays dividends as follows: Assume the partial equity method is applied. What is the consolidated balance of the Equity in Demers Earnings account at December 31, 2021. Multiple Choice $0. $56,000. $104,000. $97,000. $50,400. To determine the consolidated balance of the Equity in Demers Earnings account at December 31, 2021, we need to calculate the proportionate share of Demers' earnings that Pell Company is entitled to.Invalid Math First, let's calculate the initial investment made by Pell Company: Initial investment =80% of $500,000=$400,000 Next, let's calculate the undervaluation of equipment and buildings: Undervaluation of equipment =$30,000 Undervaluation of buildings =$40,000 Since both equipment and buildings have a remaining life of 10 years, we need to allocate the undervaluation over the useful life. The annual amortization of the undervaluation will be: Invalid Math Annual amortization =( Undervaluation / Remaining life )=($30,000+$40,000)/10=$7,000 Now, let's calculate the adjusted investment: Adjusted investment = Initial investment + Undervaluation - Accumulated amortization =$400,000+($30,000+$40,000)(3years$7,000)=$400,000+$70,000$21,000=$449,000 Now, let's calculate Pell Company's share of Demers' earnings: 2019:$100,00080%=$80,0002020:$120,00080%=$96,0002021:$130,00080%=$104,000 Finally, let's calculate the consolidated balance of the Equity in Demers Earnings account: Consolidatedbalance=Adjustedinvestment+ShareofearningsDividends=$449,000+($80,000+$96,000+$104,000)($50,000+$60,000+$40,000)=$449,000+$280,000$150,000=$579,000$150,000=$429,000 Therefore, the correct answer is $429,000. The other options are not correct because they do not reflect the correct calculation based on the given information

review, goodwill has not been impaired. Demers earns income and pays dividends as follows: Assume the partial equity method is applied. What is the consolidated balance of the Equity in Demers Earnings account at December 31, 2021. Multiple Choice $0. $56,000. $104,000. $97,000. $50,400. To determine the consolidated balance of the Equity in Demers Earnings account at December 31, 2021, we need to calculate the proportionate share of Demers' earnings that Pell Company is entitled to.Invalid Math First, let's calculate the initial investment made by Pell Company: Initial investment =80% of $500,000=$400,000 Next, let's calculate the undervaluation of equipment and buildings: Undervaluation of equipment =$30,000 Undervaluation of buildings =$40,000 Since both equipment and buildings have a remaining life of 10 years, we need to allocate the undervaluation over the useful life. The annual amortization of the undervaluation will be: Invalid Math Annual amortization =( Undervaluation / Remaining life )=($30,000+$40,000)/10=$7,000 Now, let's calculate the adjusted investment: Adjusted investment = Initial investment + Undervaluation - Accumulated amortization =$400,000+($30,000+$40,000)(3years$7,000)=$400,000+$70,000$21,000=$449,000 Now, let's calculate Pell Company's share of Demers' earnings: 2019:$100,00080%=$80,0002020:$120,00080%=$96,0002021:$130,00080%=$104,000 Finally, let's calculate the consolidated balance of the Equity in Demers Earnings account: Consolidatedbalance=Adjustedinvestment+ShareofearningsDividends=$449,000+($80,000+$96,000+$104,000)($50,000+$60,000+$40,000)=$449,000+$280,000$150,000=$579,000$150,000=$429,000 Therefore, the correct answer is $429,000. The other options are not correct because they do not reflect the correct calculation based on the given information Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started