Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i already have the answer, but show me the work on how do this Global Corp. expects sales to grow by 8% next year. Assume

i already have the answer, but show me the work on how do this

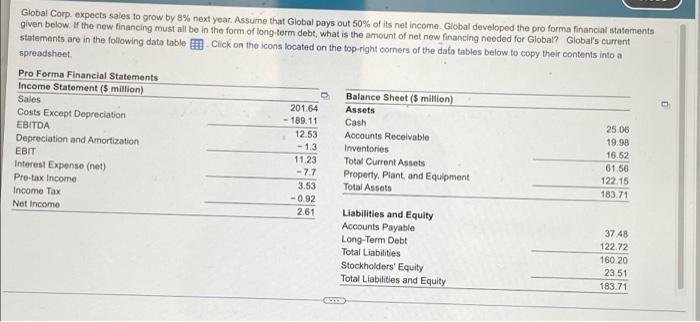

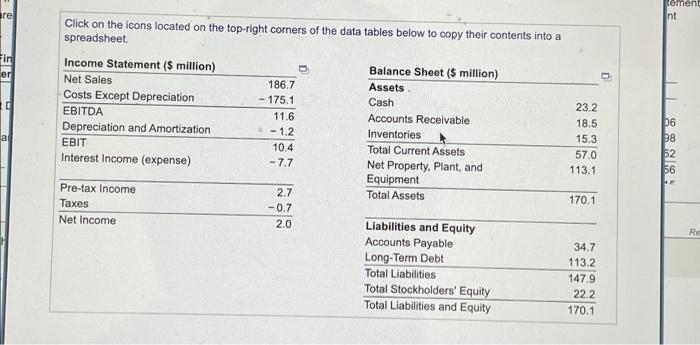

Global Corp. expects sales to grow by 8% next year. Assume that Global pays out 50% of its net income. Global developed the pro forma financial statements given below. If the new financing must all be in the form of long-term debt, what is the amount of net new financing needed for Global? Global's current Click on the icons located on the top-right corners of the data tables below to copy their contents into a statements are in the following data table spreadsheet Pro Forma Financial Statements Income Statement ($ million) Sales Balance Sheet ($ million) 201.64 Assets -189.11 Cash Costs Except Depreciation EBITDA 12.53 Accounts Receivable 25.06 19.98 16.52 Depreciation and Amortization. -1.3 Inventories EBIT 11.23 Total Current Assets 61.56 Interest Expense (net) -7.7 Property, Plant, and Equipment 122.15 Pre-tax Income 3.53 Total Assets 183.71 Income Tax -0.92 Net Income 2.61 Liabilities and Equity Accounts Payable 37 48 Long-Term Debt 122.72 Total Liabilities 160.20 Stockholders' Equity 23.51 Total Liabilities and Equity 183.71 GIE are Fin er 0 a Click on the icons located on the top-right corners of the data tables below to copy their contents into a spreadsheet. Income Statement ($ million) Balance Sheet ($ million) Net Sales 186.7 Assets Costs Except Depreciation -175.1 Cash 23.2 EBITDA 11.6 Accounts Receivable 18.5. Depreciation and Amortization -1.2 Inventories 15.3 EBIT 10.4 Total Current Assets 57.0 Interest Income (expense) -7.7 Net Property, Plant, and 113.1 Equipment Pre-tax Income 2.7 Total Assets 170.1 Taxes -0.7 Net Income 2.0 Liabilities and Equity Accounts Payable 34.7 Long-Term Debt 113.2 Total Liabilities 147.9 Total Stockholders' Equity 22.2 Total Liabilities and Equity 170.1 ON 0 tement nt 06 98 52 56 Re

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started