Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I already have the answer for part (I) Please I need urgent help with part (ii), (iii) and (iv) Delta Fund, a South African-based investment

I already have the answer for part (I)

Please I need urgent help with part (ii), (iii) and (iv)

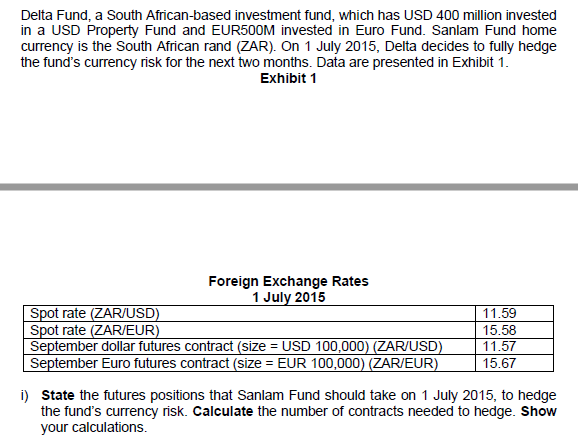

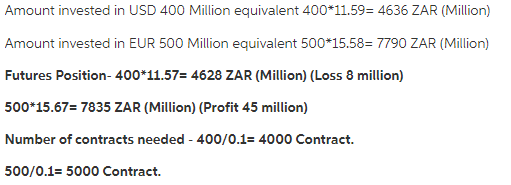

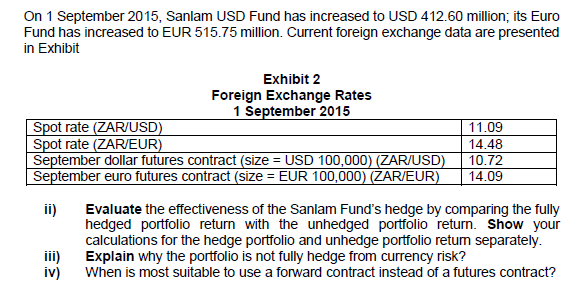

Delta Fund, a South African-based investment fund, which has USD 400 million invested in a USD Property Fund and EUR500M invested in Euro Fund. Sanlam Fund home currency is the South African rand (ZAR). On 1 July 2015, Delta decides to fully hedge the fund's currency risk for the next two months. Data are presented in Exhibit 1. Exhibit 1 Foreign Exchange Rates 1 July 2015 Spot rate (ZAR/USD) 11.59 Spot rate (ZAR/EUR) 15.58 September dollar futures contract (size = USD 100,000) (ZAR/USD) 11.57 September Euro futures contract (size = EUR 100,000) (ZAR/EUR) 15.67 i) State the futures positions that Sanlam Fund should take on 1 July 2015, to hedge the fund's currency risk. Calculate the number of contracts needed to hedge. Show your calculations. Amount invested in USD 400 Million equivalent 400*11.59= 4636 ZAR (Million) Amount invested in EUR 500 Million equivalent 500*15.58= 7790 ZAR (Million) Futures Position- 400*11.57= 4628 ZAR (Million) (Loss 8 million) 500*15.67= 7835 ZAR (Million) (Profit 45 million) Number of contracts needed - 400/0.1= 4000 Contract. 500/0.1= 5000 Contract. On 1 September 2015, Sanlam USD Fund has increased to USD 412.60 million; its Euro Fund has increased to EUR 515.75 million. Current foreign exchange data are presented in Exhibit Exhibit 2 Foreign Exchange Rates 1 September 2015 Spot rate (ZAR/USD) 11.09 Spot rate (ZAR/EUR) 14.48 September dollar futures contract (size = USD 100,000) (ZAR/USD) 10.72 September euro futures contract (size = EUR 100,000) (ZAR/EUR) 14.09 ii) Evaluate the effectiveness of the Sanlam Fund's hedge by comparing the fully hedged portfolio return with the unhedged portfolio return show your calculations for the hedge portfolio and unhedge portfolio retum separately. iii) Explain why the portfolio is not fully hedge from currency risk? iv) When is most suitable to use a forward contract instead of a futures contractStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started