Answered step by step

Verified Expert Solution

Question

1 Approved Answer

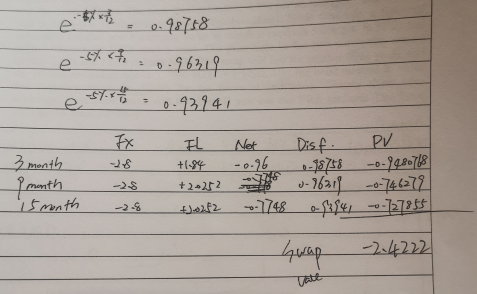

I already know the last step of this question, but I don't know how the PV value is obtained. Please tell me, thank you. D

I already know the last step of this question, but I don't know how the PV value is obtained. Please tell me, thank you.

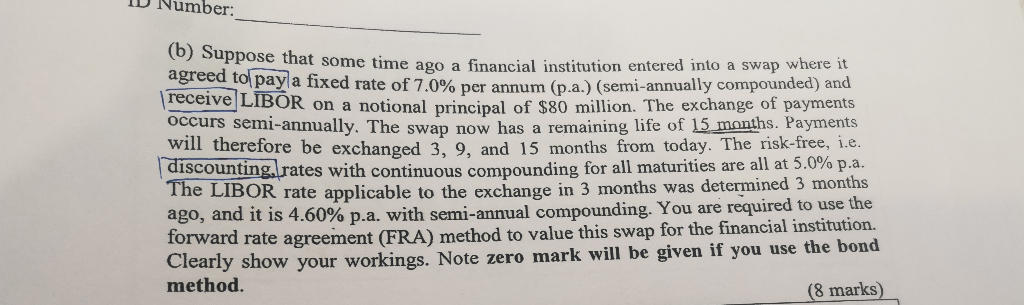

D Number: (b) Suppose that some time ago a financial institution entered into a swap where it agreed to pay a fixed rate of 7.0% per annum (p.a.) (semi- annually compounded) and receiveLIBOR on a notional principal of $80 million. The exchange of payments Occurs semi-annually. The swap now has a remaining life of 15 months. Payments will therefore be exchanged 3, 9, and 15 months from today. The risk-free, i.e. discounting, rates with continu ous compounding for all maturiti es are all at 5.0% p.a. The LIBOR rate applicable to the exchange in 3 months was determined 3 months ago, and it is 4.60% p.a. with semi-annual compounding. You are required to use the forward rate agreement (FRA) method to value this swap for the financial institution. Clearly show your workings. Note zero mark will be given if you use the bond method. (8 marks) -96319 0-13141 e Fx PV Dis f EL Not menth --26 F-" -762 0-74272 +1-9 Yonth -28 +222 -2 0- Tate D Number: (b) Suppose that some time ago a financial institution entered into a swap where it agreed to pay a fixed rate of 7.0% per annum (p.a.) (semi- annually compounded) and receiveLIBOR on a notional principal of $80 million. The exchange of payments Occurs semi-annually. The swap now has a remaining life of 15 months. Payments will therefore be exchanged 3, 9, and 15 months from today. The risk-free, i.e. discounting, rates with continu ous compounding for all maturiti es are all at 5.0% p.a. The LIBOR rate applicable to the exchange in 3 months was determined 3 months ago, and it is 4.60% p.a. with semi-annual compounding. You are required to use the forward rate agreement (FRA) method to value this swap for the financial institution. Clearly show your workings. Note zero mark will be given if you use the bond method. (8 marks) -96319 0-13141 e Fx PV Dis f EL Not menth --26 F-" -762 0-74272 +1-9 Yonth -28 +222 -2 0- TateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started