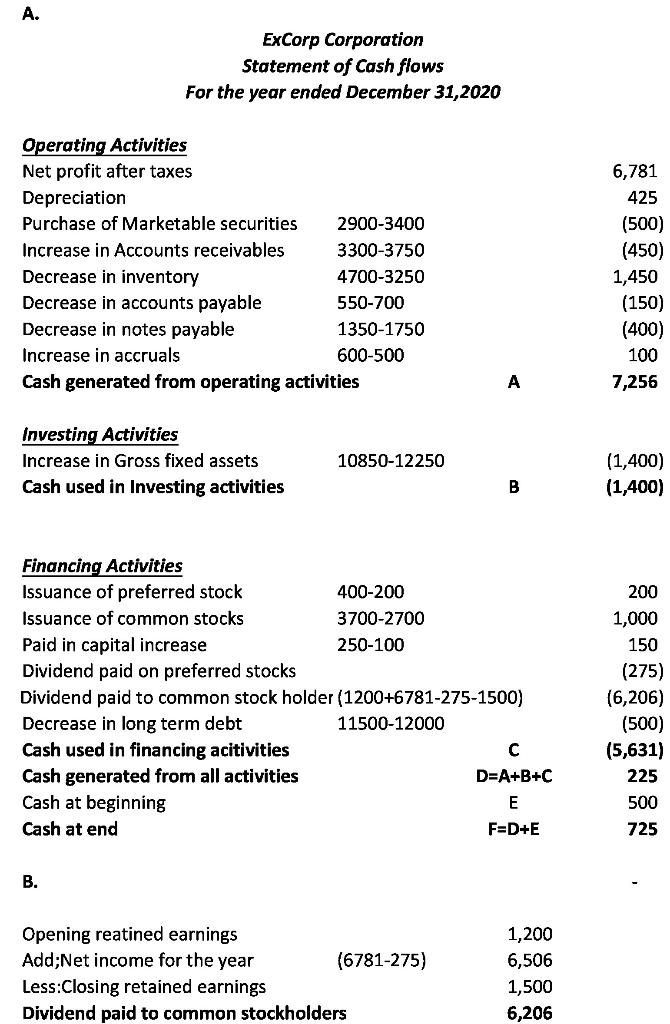

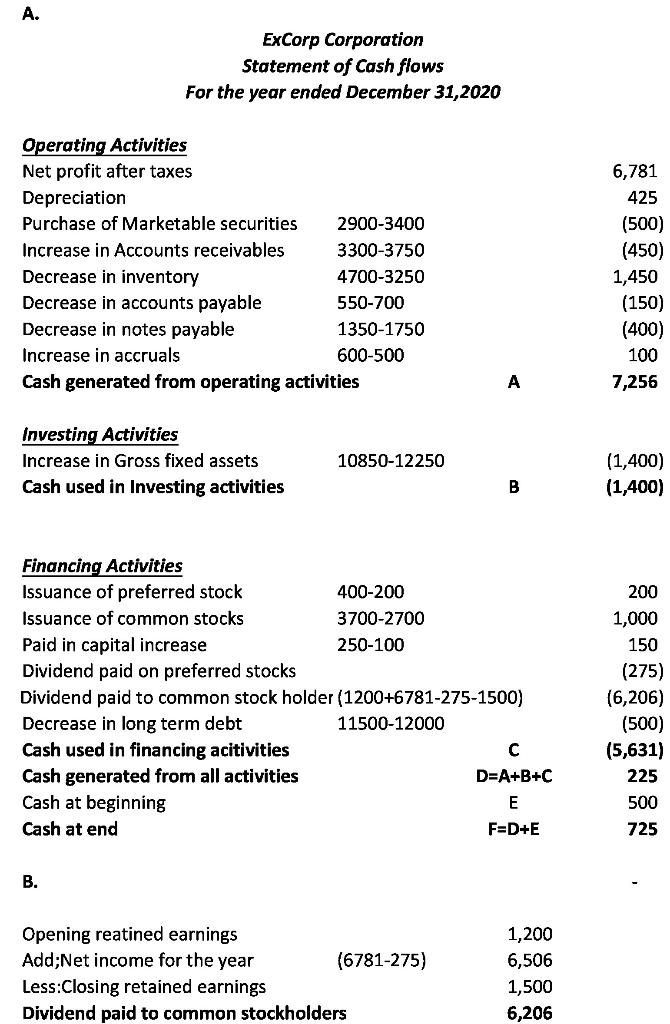

I already Put together a Statement of Cash Flows for the year ended December 31, 2020, for the corporation, organized by cash flow from operating activities, cash flow from investment activities, and cash flow from financing activities, and made the computations for the cash dividends utilizing the data given below.

This is the Statement of Cash Flow that I prepared... Evaluate / Analyze each part of the statement.

Operating activities

Financing Activities

Investing Activities

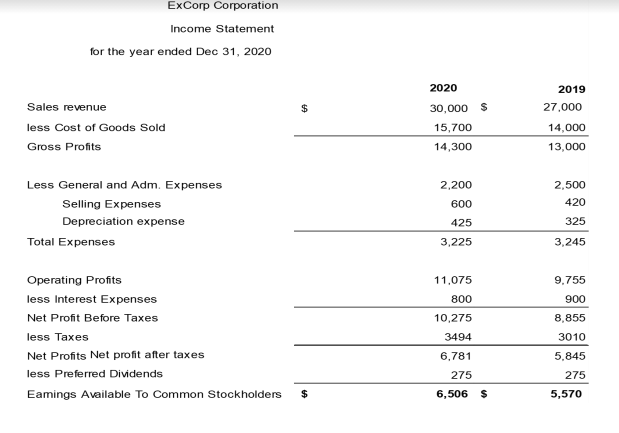

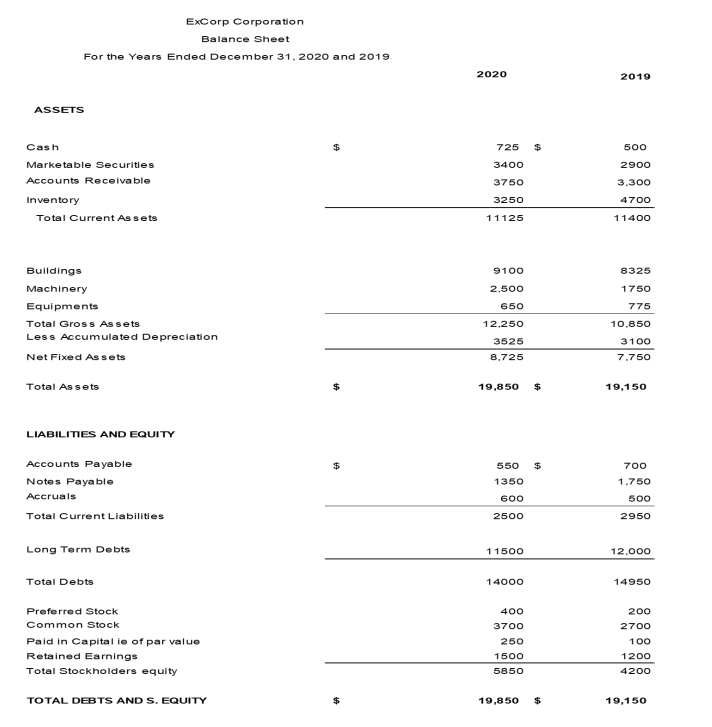

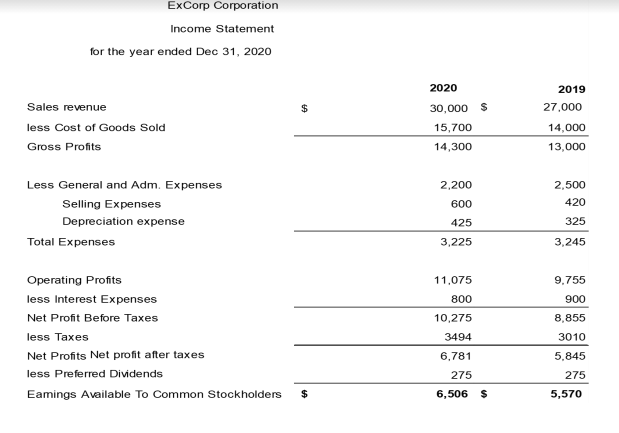

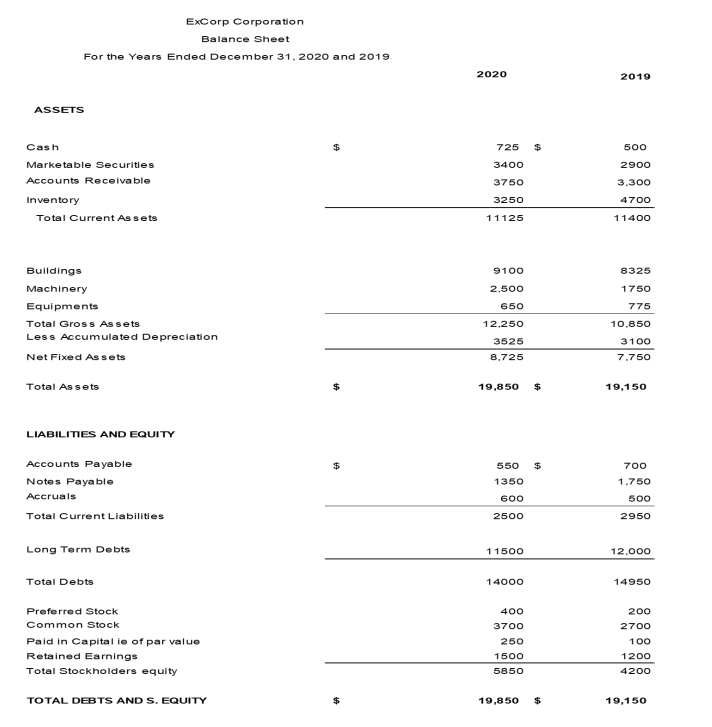

ExCorp Corporation Income Statement for the year ended Dec 31, 2020 $ Sales revenue less Cost of Goods Sold Gross Profits 2020 30,000 $ 15,700 14,300 2019 27,000 14,000 13,000 2,200 2,500 420 600 Less General and Adm. Expenses Selling Expenses Depreciation expense Total Expenses 325 425 3,225 3,245 11.075 9.755 900 Operating Profits less Interest Expenses Net Profit Before Taxes less Taxes Net Profits Net profit after taxes less Preferred Dividends Eamings Available To Common Stockholders 800 10,275 3494 8,855 3010 5,845 6.781 275 275 6,506 $ 5,570 ExCorp Corporation Balance Sheet For the Years Ended December 31, 2020 and 2019 2020 2019 ASSETS $ 725 $ 3400 Cash Marketable Securities Accounts Receivable Inventory Total Current Assets 500 2900 3.300 3750 3250 4700 11400 11125 9100 2.500 Buildings Machinery Equipments Total Gross Assets Less Accumulated Depreciation Net Fixed Assets 8325 1750 775 10.850 650 12.250 3525 8.725 3100 7.750 Total Assets $ 19,850 $ 19,150 $ 550 $ 700 LIABILITIES AND EQUITY Accounts Payable Notes Payable Accruals Total Current Liabilities 1.750 1350 600 2500 500 2950 Long Term Debts 11500 12.000 Total Debts 14000 14950 Preferred Stock Common Stock Paid in Capital ie of par value Retained Earnings Total Stockholders equity 400 3700 250 1500 5850 200 2700 100 1200 4200 TOTAL DEBTS AND S. EQUITY $ 19,850 $ 19,150 A. ExCorp Corporation Statement of Cash flows For the year ended December 31, 2020 Operating Activities Net profit after taxes Depreciation Purchase of Marketable securities 2900-3400 Increase in Accounts receivables 3300-3750 Decrease in inventory 4700-3250 Decrease in accounts payable 550-700 Decrease in notes payable 1350-1750 Increase in accruals 600-500 Cash generated from operating activities 6,781 425 (500) (450) 1,450 (150) (400) 100 7,256 Investing Activities Increase in Gross fixed assets Cash used in Investing activities 10850-12250 (1,400) (1,400) B Financing Activities Issuance of preferred stock 400-200 Issuance of common stocks 3700-2700 Paid in capital increase 250-100 Dividend paid on preferred stocks Dividend paid to common stock holder (1200+6781-275-1500) Decrease in long term debt 11500-12000 Cash used in financing acitivities C Cash generated from all activities D=A+B+C Cash at beginning E Cash at end F=D+E 200 1,000 150 (275) (6,206) (500) (5,631) 225 500 725 B. Opening reatined earnings Add;Net income for the year (6781-275) Less:Closing retained earnings Dividend paid to common stockholders 1,200 6,506 1,500 6,206 ExCorp Corporation Income Statement for the year ended Dec 31, 2020 $ Sales revenue less Cost of Goods Sold Gross Profits 2020 30,000 $ 15,700 14,300 2019 27,000 14,000 13,000 2,200 2,500 420 600 Less General and Adm. Expenses Selling Expenses Depreciation expense Total Expenses 325 425 3,225 3,245 11.075 9.755 900 Operating Profits less Interest Expenses Net Profit Before Taxes less Taxes Net Profits Net profit after taxes less Preferred Dividends Eamings Available To Common Stockholders 800 10,275 3494 8,855 3010 5,845 6.781 275 275 6,506 $ 5,570 ExCorp Corporation Balance Sheet For the Years Ended December 31, 2020 and 2019 2020 2019 ASSETS $ 725 $ 3400 Cash Marketable Securities Accounts Receivable Inventory Total Current Assets 500 2900 3.300 3750 3250 4700 11400 11125 9100 2.500 Buildings Machinery Equipments Total Gross Assets Less Accumulated Depreciation Net Fixed Assets 8325 1750 775 10.850 650 12.250 3525 8.725 3100 7.750 Total Assets $ 19,850 $ 19,150 $ 550 $ 700 LIABILITIES AND EQUITY Accounts Payable Notes Payable Accruals Total Current Liabilities 1.750 1350 600 2500 500 2950 Long Term Debts 11500 12.000 Total Debts 14000 14950 Preferred Stock Common Stock Paid in Capital ie of par value Retained Earnings Total Stockholders equity 400 3700 250 1500 5850 200 2700 100 1200 4200 TOTAL DEBTS AND S. EQUITY $ 19,850 $ 19,150 A. ExCorp Corporation Statement of Cash flows For the year ended December 31, 2020 Operating Activities Net profit after taxes Depreciation Purchase of Marketable securities 2900-3400 Increase in Accounts receivables 3300-3750 Decrease in inventory 4700-3250 Decrease in accounts payable 550-700 Decrease in notes payable 1350-1750 Increase in accruals 600-500 Cash generated from operating activities 6,781 425 (500) (450) 1,450 (150) (400) 100 7,256 Investing Activities Increase in Gross fixed assets Cash used in Investing activities 10850-12250 (1,400) (1,400) B Financing Activities Issuance of preferred stock 400-200 Issuance of common stocks 3700-2700 Paid in capital increase 250-100 Dividend paid on preferred stocks Dividend paid to common stock holder (1200+6781-275-1500) Decrease in long term debt 11500-12000 Cash used in financing acitivities C Cash generated from all activities D=A+B+C Cash at beginning E Cash at end F=D+E 200 1,000 150 (275) (6,206) (500) (5,631) 225 500 725 B. Opening reatined earnings Add;Net income for the year (6781-275) Less:Closing retained earnings Dividend paid to common stockholders 1,200 6,506 1,500 6,206