Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I already solved it, nevermind. 1. Smith buys 100 shares of stock ABC at the same time Brown buys 100 shares of stock XYZ. Both

I already solved it, nevermind.

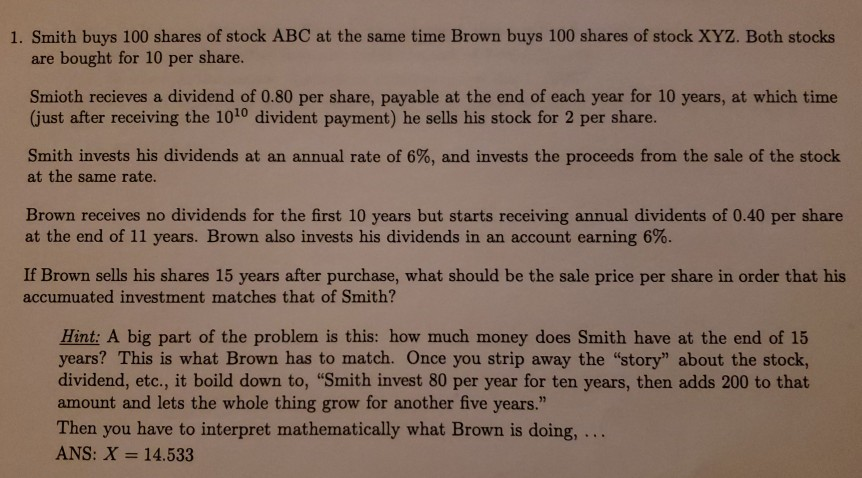

1. Smith buys 100 shares of stock ABC at the same time Brown buys 100 shares of stock XYZ. Both stocks are bought for 10 per share. Smioth recieves a dividend of 0.80 per share, payable at the end of each year for 10 years, at which time (just after receiving the 100 divident payment) he sells his stock for 2 per share. Smith invests his dividends at an annual rate of 6%, and invests the proceeds from the sale of the stock at the same rate. Brown receives no dividends for the first 10 years but starts receiving annual dividents of 0.40 per share at the end of 11 years. Brown also invests his dividends in an account earning 6%. If Brown sells his shares 15 years after purchase, what should be the sale price per share in order that his accumuated investment matches that of Smith? Hint: A big part of the problem is this: how much money does Smith have at the end of 15 years? This is what Brown has to match. Once you strip away the "story" about the stock, dividend, etc., it boild down to, "Smith invest 80 per year for ten years, then adds 200 to that amount and lets the whole thing grow for another five years." Then you have to interpret mathematically what Brown is doing, ... ANS: X = 14.533Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started