i also posted my answer on the second page its partially correct. please correct and update. the unit table is 100% correct.

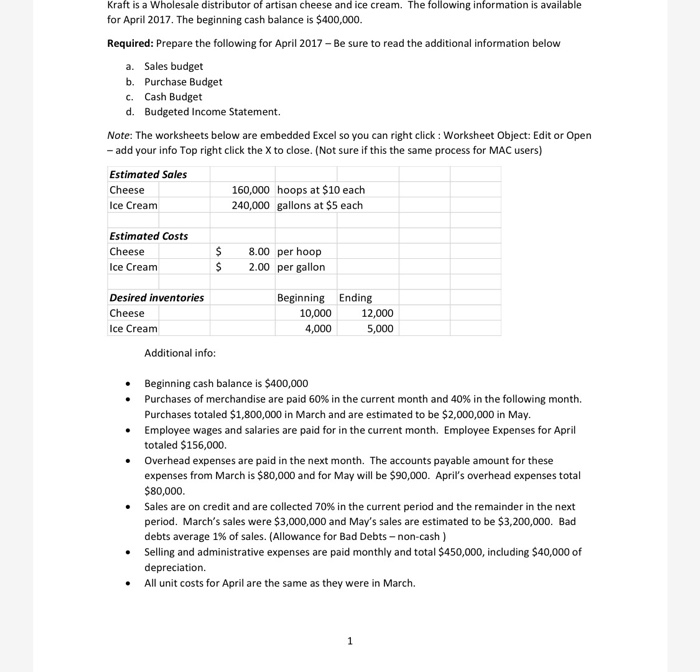

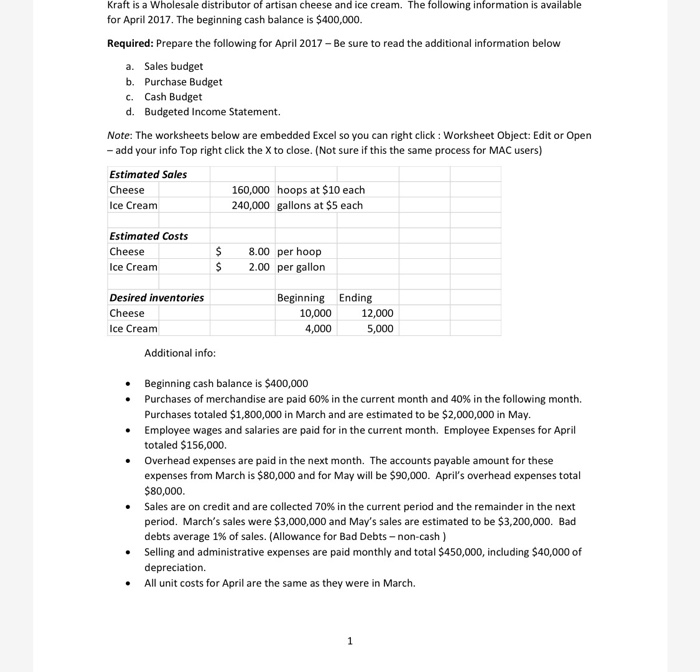

Kraft is a Wholesale distributor of artisan cheese and ice cream. The following information is availa for April 2017. The beginning cash balance is $400,000 Required: Prepare the following for April 2017 - Be sure to read the additional information below a. Sales budget b. Purchase Budget C. Cash Budget d. Budgeted Income Statement. Note: The worksheets below are embedded Excel so you can right click: Worksheet Object: Edit or Open - add your info Top right click the X to close. (Not sure if this the same process for MAC users) Estimated Sales Cheese Ice Cream 160,000 hoops at $10 each 240,000 gallons at $5 each Estimated Costs Cheese Ice Cream $ $ 8.00 per hoop 2.00 per gallon Desired inventories Cheese Ice Cream Beginning 10,000 4,000 Ending 12,000 5,000 Additional info: Beginning cash balance is $400,000 merchandise are paid 60% in the current month and 40% in the following month. Purchases totaled $1,800,000 in March and are estimated to be $2,000,000 in May. Employee wages and salaries are paid for in the current month. Employee Expenses for April totaled $156,000. Overhead expenses are paid in the next month. The accounts payable amount for these expenses from March is $80,000 and for May will be $90,000. April's overhead expenses total $80,000 Sales are on credit and are collected 70% in the current period and the remainder in the next period. March's sales were $3,000,000 and May's sales are estimated to be $3,200,000. Bad debts average 1% of sales. (Allowance for Bad Debts -non-cash) Selling and administrative expenses are paid monthly and total $450,000, including $40,000 of depreciation. All unit costs for April are the same as they were in March. Kraft Sales Budget For the Month of April Cheese Ice Cream Total Units 160000 240000 Price 10 5 Sales 1600000 1200000 2800000 2800 Kraft Purchase Budget For the Month of April Cheese Ice Cream Total Sales needs Desired ending inventory Total Less: Beginning inventory Purchases 160000 12,000 172,000 (10,000) 162,000 240000 5,000 245,000 4,000) 241,000 400000 17,000 417,000 - 14000 403000 | Dollars Sales needs Desired ending inventory Total Less: Beginning inventory Purchases needed 160000 12,000 172,000 (10,000) 162,000 240000 400000 5,000 17,000 245,000 417,000 (4,000) -14000 241,000 403000 I Kraft Cash Budget For the Month of April 400,000 1,940,400 891,000 Cash Balance - Beginning Collections on sales Current month sales (2.8m X.70) Previous month sales (3.0m X.29) Cash available from operations Less: Budgeted Disbursements March purchases April purchases Wages and salaries Overhead (March) Selling & Administrative 720,000 1,066,800 156.000 80,000 410000 Cash balance, ending 798,600 Kraft is a Wholesale distributor of artisan cheese and ice cream. The following information is availa for April 2017. The beginning cash balance is $400,000 Required: Prepare the following for April 2017 - Be sure to read the additional information below a. Sales budget b. Purchase Budget C. Cash Budget d. Budgeted Income Statement. Note: The worksheets below are embedded Excel so you can right click: Worksheet Object: Edit or Open - add your info Top right click the X to close. (Not sure if this the same process for MAC users) Estimated Sales Cheese Ice Cream 160,000 hoops at $10 each 240,000 gallons at $5 each Estimated Costs Cheese Ice Cream $ $ 8.00 per hoop 2.00 per gallon Desired inventories Cheese Ice Cream Beginning 10,000 4,000 Ending 12,000 5,000 Additional info: Beginning cash balance is $400,000 merchandise are paid 60% in the current month and 40% in the following month. Purchases totaled $1,800,000 in March and are estimated to be $2,000,000 in May. Employee wages and salaries are paid for in the current month. Employee Expenses for April totaled $156,000. Overhead expenses are paid in the next month. The accounts payable amount for these expenses from March is $80,000 and for May will be $90,000. April's overhead expenses total $80,000 Sales are on credit and are collected 70% in the current period and the remainder in the next period. March's sales were $3,000,000 and May's sales are estimated to be $3,200,000. Bad debts average 1% of sales. (Allowance for Bad Debts -non-cash) Selling and administrative expenses are paid monthly and total $450,000, including $40,000 of depreciation. All unit costs for April are the same as they were in March. Kraft Sales Budget For the Month of April Cheese Ice Cream Total Units 160000 240000 Price 10 5 Sales 1600000 1200000 2800000 2800 Kraft Purchase Budget For the Month of April Cheese Ice Cream Total Sales needs Desired ending inventory Total Less: Beginning inventory Purchases 160000 12,000 172,000 (10,000) 162,000 240000 5,000 245,000 4,000) 241,000 400000 17,000 417,000 - 14000 403000 | Dollars Sales needs Desired ending inventory Total Less: Beginning inventory Purchases needed 160000 12,000 172,000 (10,000) 162,000 240000 400000 5,000 17,000 245,000 417,000 (4,000) -14000 241,000 403000 I Kraft Cash Budget For the Month of April 400,000 1,940,400 891,000 Cash Balance - Beginning Collections on sales Current month sales (2.8m X.70) Previous month sales (3.0m X.29) Cash available from operations Less: Budgeted Disbursements March purchases April purchases Wages and salaries Overhead (March) Selling & Administrative 720,000 1,066,800 156.000 80,000 410000 Cash balance, ending 798,600