Answered step by step

Verified Expert Solution

Question

1 Approved Answer

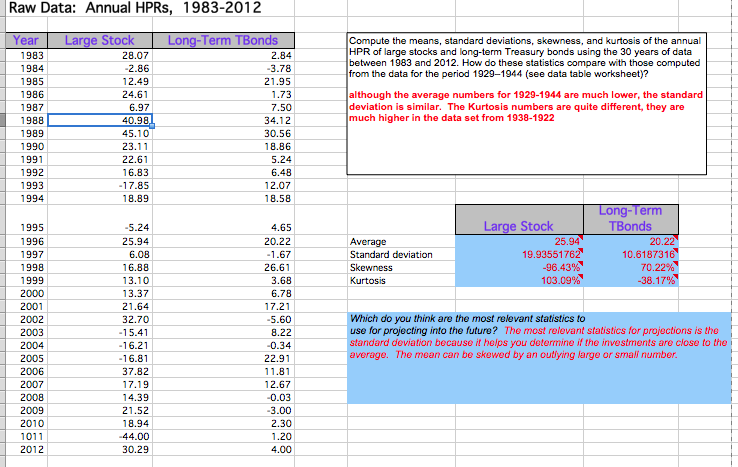

I always make errors on the excel standard deviation formula. Did I use the correct formulas and do my answers (in red) seem correct? thank

I always make errors on the excel standard deviation formula. Did I use the correct formulas and do my answers (in red) seem correct? thank you

Raw Data: Annual HPRs, 1983-2012 Year Large Stock Compute the means, standard deviations, skewness, and kurtosis of the annual HPR of large stocks and long-term Treasury bonds using the 30 years of data between 1983 and 2012. How do these statistics compare with those computed from the data for the period 1929-1944 (see data table worksheet)? Term TBonds 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 28.07 2.84 12.49 21.95 although the average numbers for 1929-1944 are much lower, the standard deviation is similar. The Kurtosis numbers are quite different, they are much higher in the data set from 1938-1922 6.97 7.50 45.10 23.11 22.61 16.83 17.85 18.89 30.56 18.86 6.48 12.07 18.58 ng-Termm TBonds Large Stock 5.24 25.94 6.08 16.88 13.10 13.37 21.64 32.70 4.65 20.22 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 1011 Average Standard deviation 25.94 20.22 19.93551762 10.618731 -96.43%" 103.09 26.61 70.22% Kurtosis -38.1 6.78 17.21 h do you think are the most relevant statistics to 8.22 0.34 22.91 use for projecting into the future? The most relevant statistics for projections is the standard deviation because it helps you dietermine if the investments are close to the average. The mean can be skewed by an outiying large or smali number 16.21 37.82 14.39 12.67 0.03 18.94 44.00 2.30 1.20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started