Question

I am able to figure out part A and B on my own. But I am having troubles with part C and D. ITS is

I am able to figure out part A and B on my own. But I am having troubles with part C and D.

ITS is the Interest Tax Shield, OCC is Opportunity Cost of Capital

My professor gave me the answers for these two parts and they are

C) Value of Interest Tax Shield for Series B = 101.1111

for Commericial Paper = 70.0000

Value of Debt = 324.7296 Return on Debt = .0567

D) Value of Interest Tax Shield Series C = 13.1473

Value of Debt and Return on Debt are unchanged

Value of Emblematic's portfolio of ITS = 189.7540

OCC = .0561

Step by step solution would be helpful. Thank you.

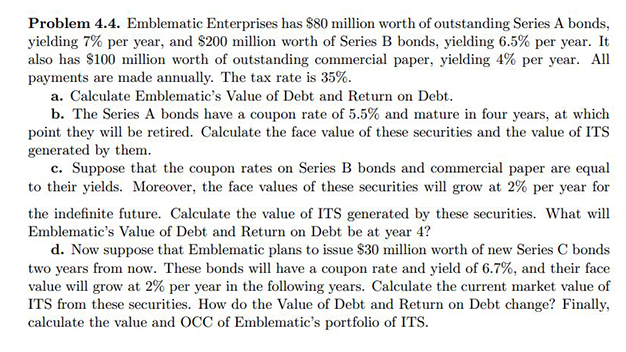

Problem 4.4. Emblematic Enterprises has S80 million worth of outstanding Series A bonds, yielding 7% per year, and $200 million worth of Series B bonds, yielding 6.5% per year. It also has $100 million worth of outstanding commercial paper, yielding 4% per year. All payments are made annually. The tax rate is 35% a. Calculate Emblematic's Value of Debt and Return on Debt. b. The Series A bonds have a coupon rate of 5.5% and mature in four years, at which point they will be retired. Calculate the face value of these securities and the value of ITS generated by them. c. Suppose that the coupon rates on Series B bonds and commercial paper are equal to their yields. Moreover, the face values of these securities will grow at 2% per year for the indefinite future. Calculate the value of ITS generated by these securities. What will Emblematic's Value of Debt and Return on Debt be at year 4? d. Now suppose that Emblematic plans to issue $30 million worth of new Series C bonds two years from now. These bonds will have a coupon rate and yield of 6.7%, and their face value will grow at 2% per year in the following years. Calculate the current market value of ITS from securities. How do the Value of Debt and Return on Debt change? Finally, calculate the value and OCC of Emblematic's portfolio of ITS. Problem 4.4. Emblematic Enterprises has S80 million worth of outstanding Series A bonds, yielding 7% per year, and $200 million worth of Series B bonds, yielding 6.5% per year. It also has $100 million worth of outstanding commercial paper, yielding 4% per year. All payments are made annually. The tax rate is 35% a. Calculate Emblematic's Value of Debt and Return on Debt. b. The Series A bonds have a coupon rate of 5.5% and mature in four years, at which point they will be retired. Calculate the face value of these securities and the value of ITS generated by them. c. Suppose that the coupon rates on Series B bonds and commercial paper are equal to their yields. Moreover, the face values of these securities will grow at 2% per year for the indefinite future. Calculate the value of ITS generated by these securities. What will Emblematic's Value of Debt and Return on Debt be at year 4? d. Now suppose that Emblematic plans to issue $30 million worth of new Series C bonds two years from now. These bonds will have a coupon rate and yield of 6.7%, and their face value will grow at 2% per year in the following years. Calculate the current market value of ITS from securities. How do the Value of Debt and Return on Debt change? Finally, calculate the value and OCC of Emblematic's portfolio of ITSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started