I am adding the other pictures below

These are all the pics I have

These are all the pics I have

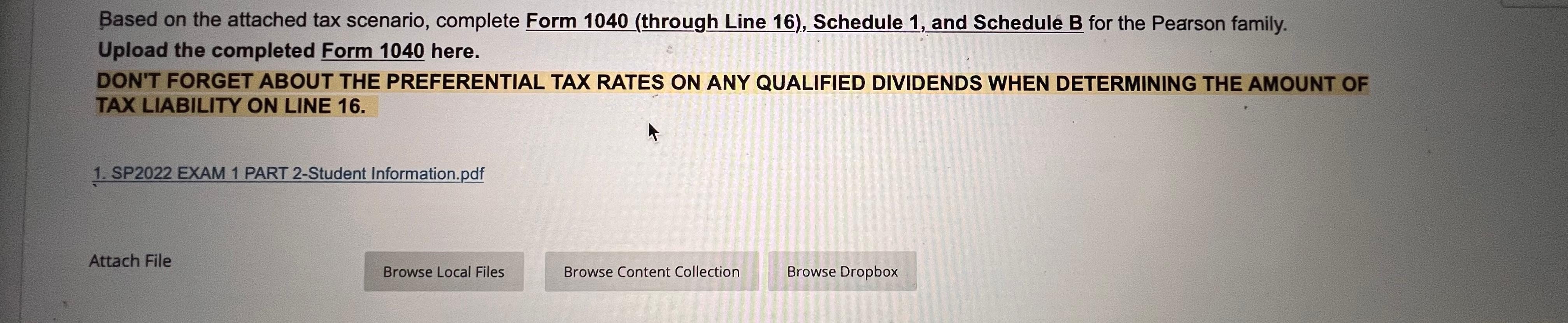

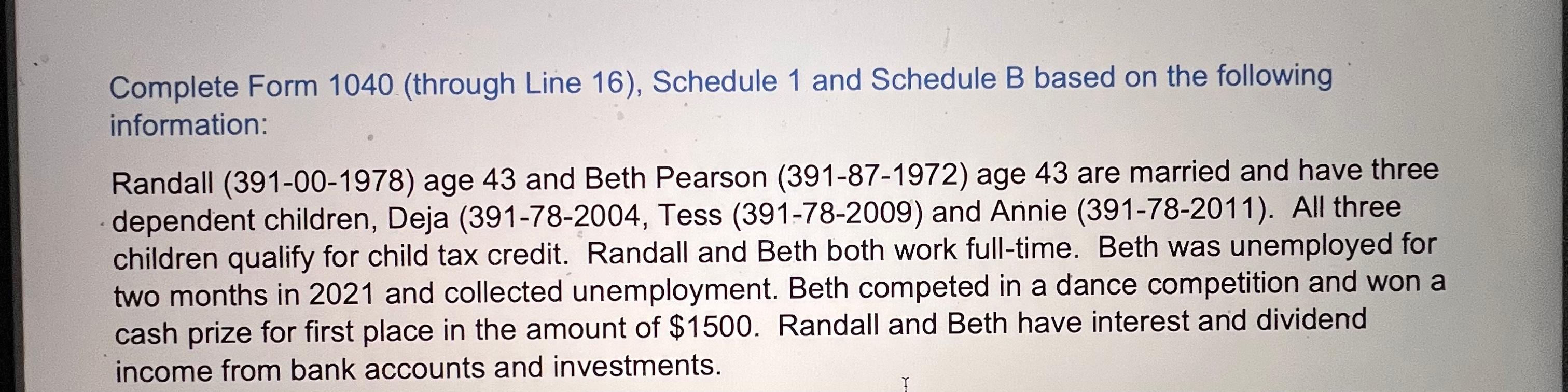

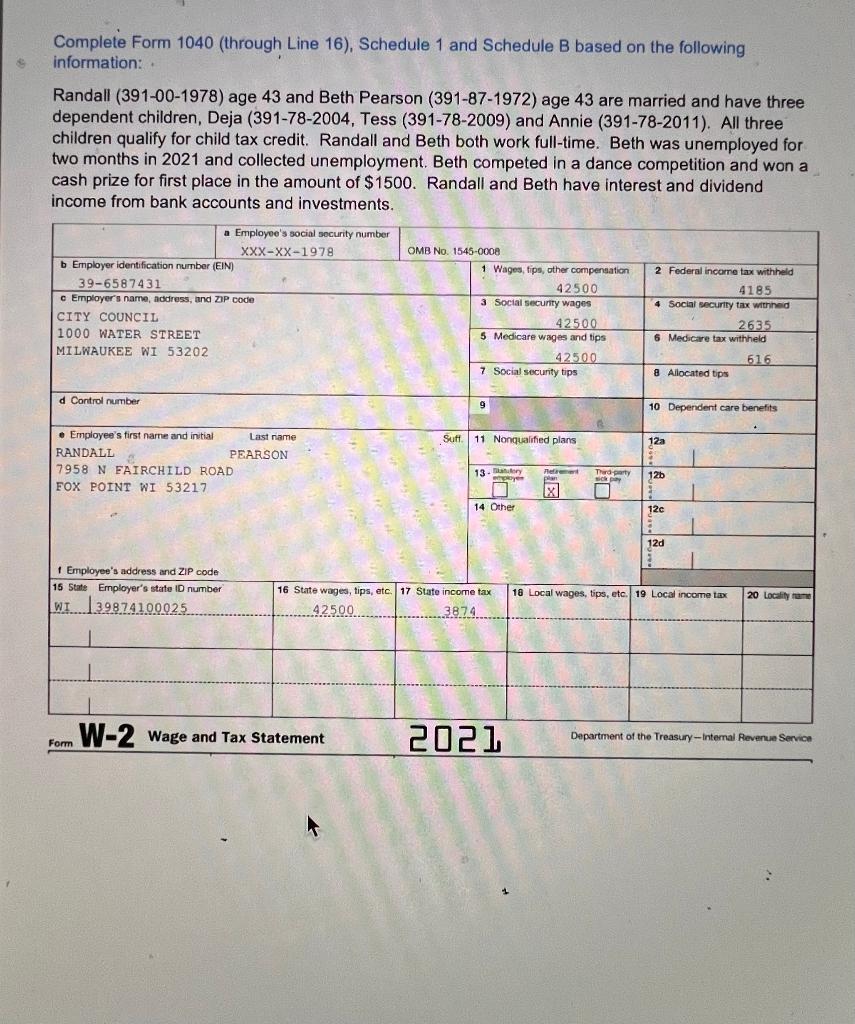

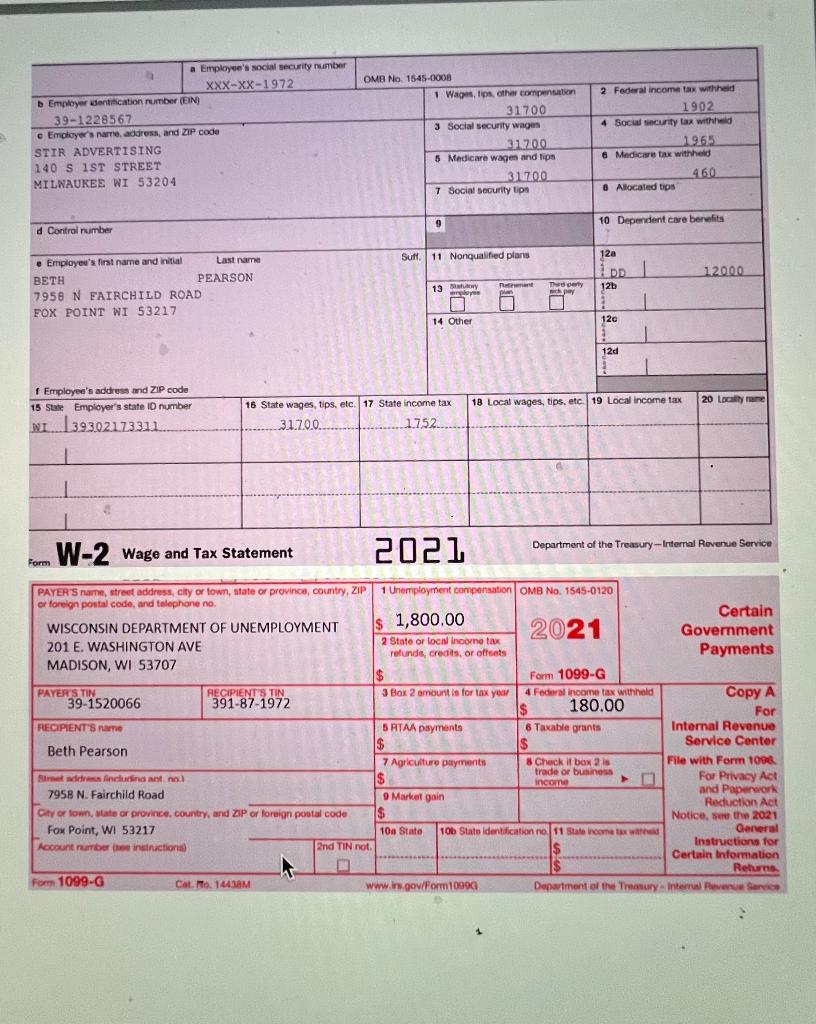

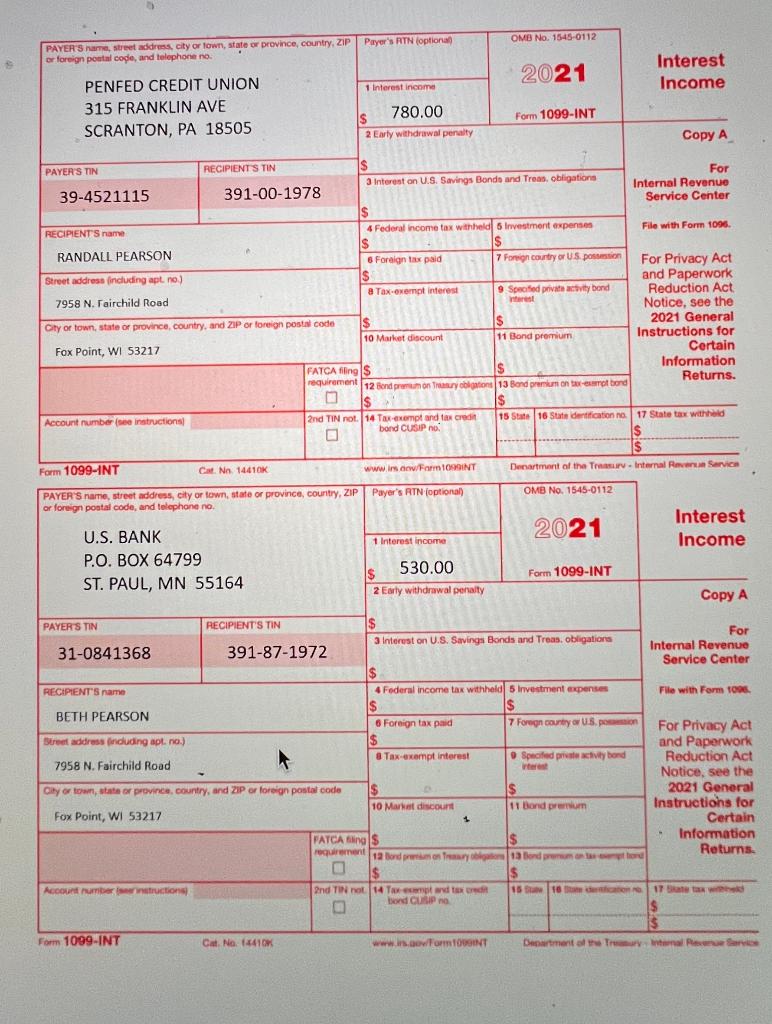

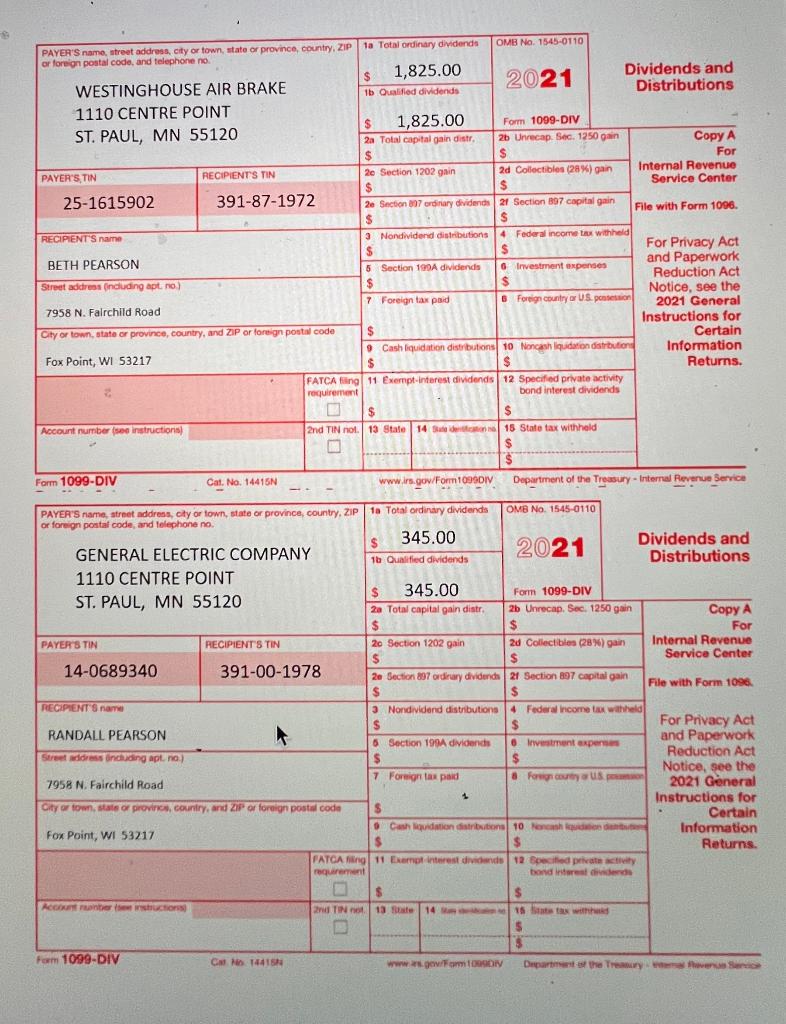

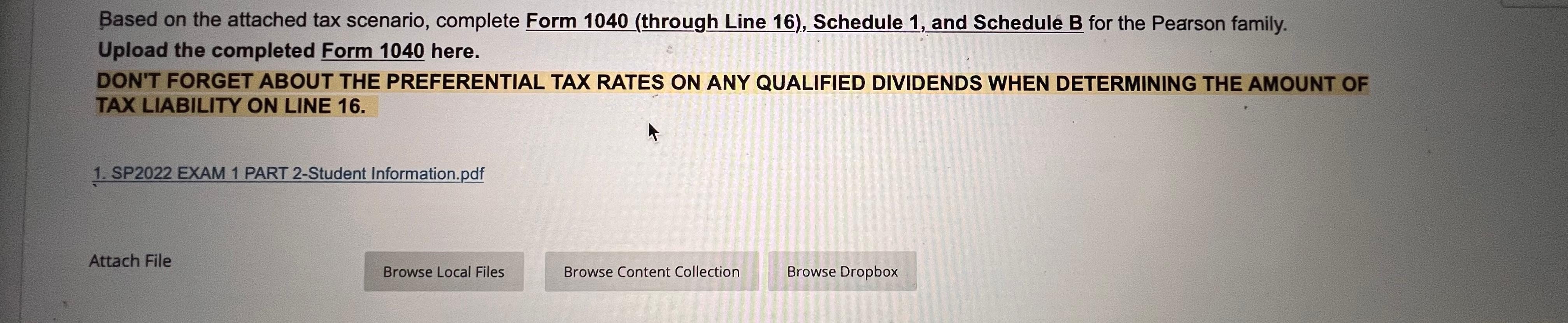

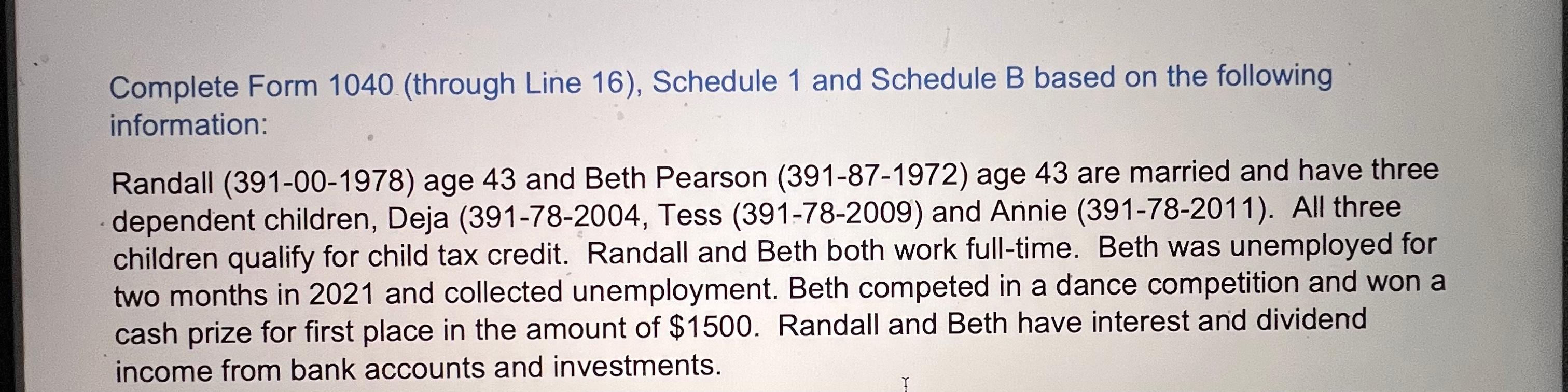

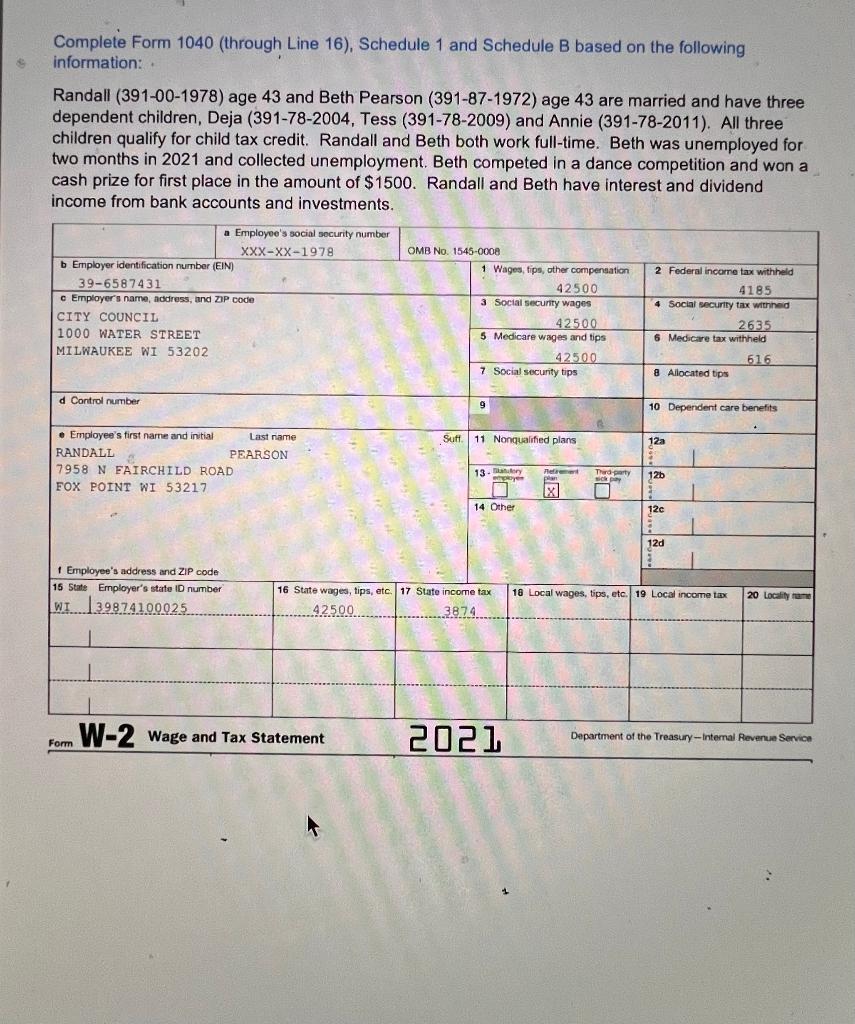

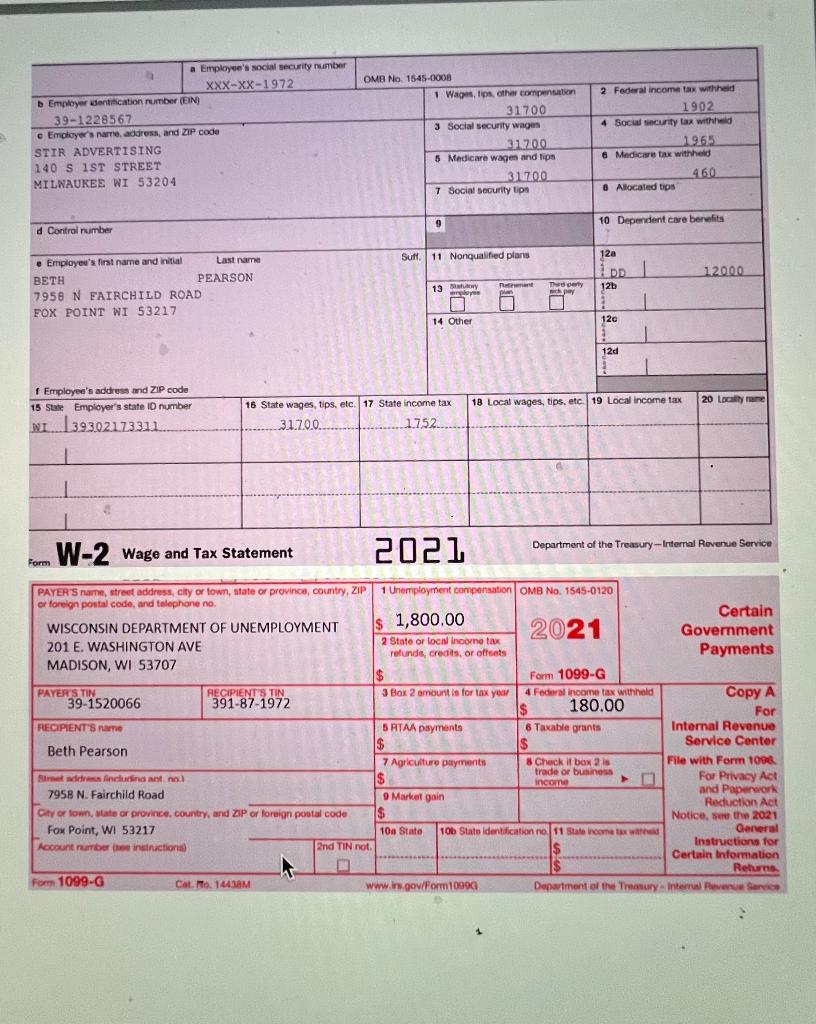

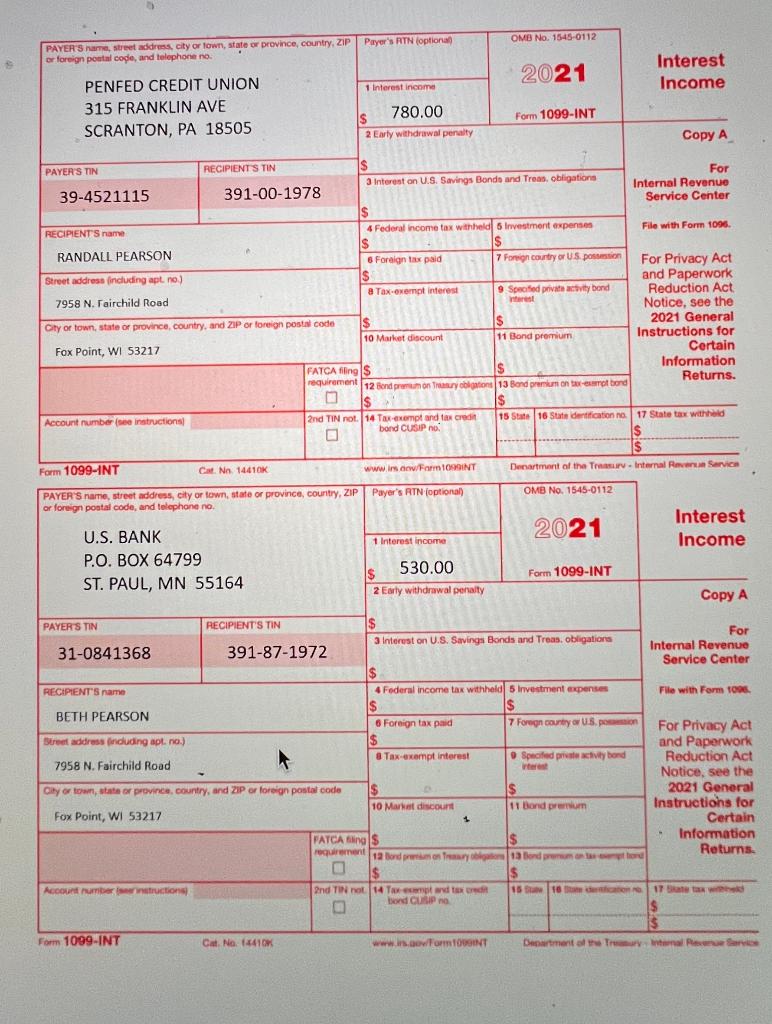

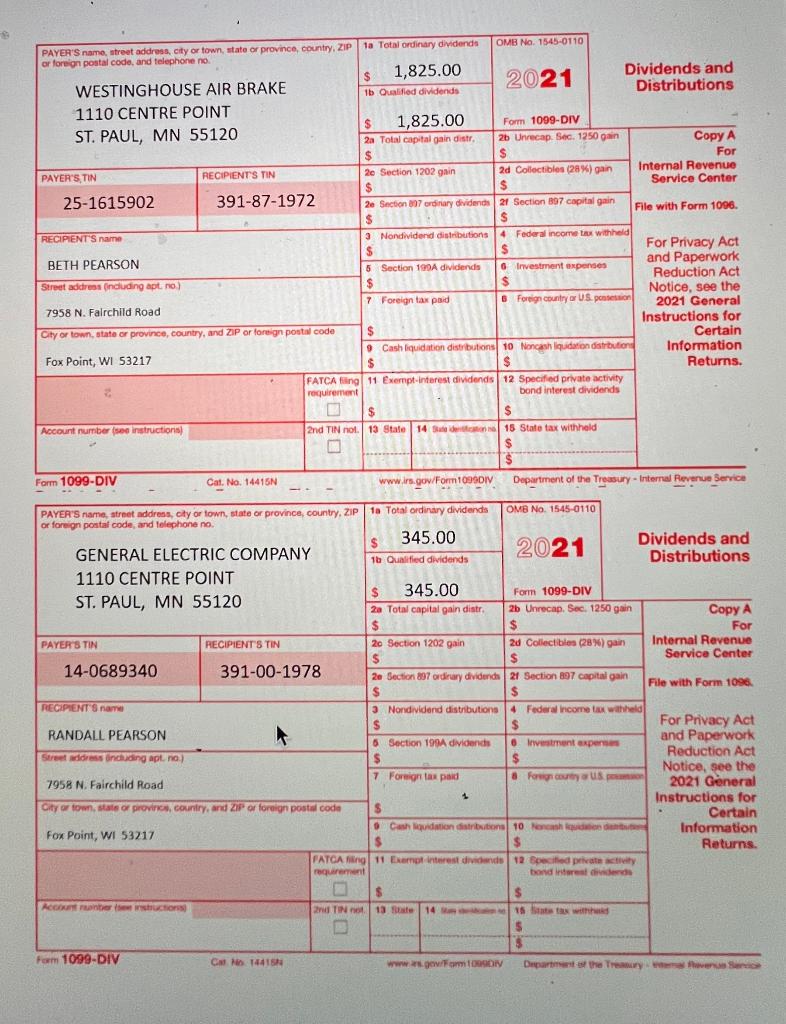

Based on the attached tax scenario, complete Form 1040 (through Line 16), Schedule 1, and Schedule B for the Pearson family. Upload the completed Form 1040 here. DON'T FORGET ABOUT THE PREFERENTIAL TAX RATES ON ANY QUALIFIED DIVIDENDS WHEN DETERMINING THE AMOUNT OF TAX LIABILITY ON LINE 16. 1. SP2022 EXAM 1 PART 2-Student Information.pdf Attach File Browse Local Files Browse Content Collection Browse Dropbox Complete Form 1040. (through Line 16), Schedule 1 and Schedule B based on the following information: Randall (391-00-1978) age 43 and Beth Pearson (391-87-1972) age 43 are married and have three dependent children, Deja (391-78-2004, Tess (391-78-2009) and Annie (391-78-2011). All three children qualify for child tax credit. Randall and Beth both work full-time. Beth was unemployed for two months in 2021 and collected unemployment. Beth competed in a dance competition and won a cash prize for first place in the amount of $1500. Randall and Beth have interest and dividend income from bank accounts and investments. Complete Form 1040 (through Line 16), Schedule 1 and Schedule B based on the following information: Randall (391-00-1978) age 43 and Beth Pearson (391-87-1972) age 43 are married and have three dependent children, Deja (391-78-2004, Tess (391-78-2009) and Annie (391-78-2011). All three children qualify for child tax credit. Randall and Beth both work full-time. Beth was unemployed for two months in 2021 and collected unemployment. Beth competed in a dance competition and won a cash prize for first place in the amount of $1500. Randall and Beth have interest and dividend income from bank accounts and investments. a Employee's social security number XXX-XX-1978 b Employer identification number (EIN) 39-6587431 c Employer's name, address, and ZIP code CITY COUNCIL 1000 WATER STREET MILWAUKEE WI 53202 OMB No. 1545-0008 1 Wages, tips, other compensation 42500 3 Social Security wages 42500 5 Medicare wages and tips 42500 7 Social security tips 2 Federal income tax withheld 4185 4 Social security tax withhed 2635 6 Medicare tax withheld 616 8 Allocated tips d Control number 9 10 Dependent care benefits Suff 11 Nonqualified plans 12a Employee's first name and initial Last name RANDALL PEARSON 7958 NEAIRCHILD ROAD FOX POINT WI 53217 13. Mary nere plan Therdorty 12b MILEY xl 14 Other 126 12d 1 Employee's address and ZIP code 15 State Employer's state ID number WI 1.39874100025 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 16 State wages, tips, etc. 17 State income tax 42500 3874 W-2 Wage and Tax Statement Form 2021 Department of the Treasury - Internal Revenue Service a Employee's social security number xxx-xx-1972 Employer dertification number (EIN) 39-1228567 e Employer's name, address, and ZIP code STIR ADVERTISING 140 S 1ST STREET MILNAUKEE WI 53204 OMB No 1545-0008 1 Wages, tips, other compensation 31700 3 Social Security wages 31700 5 Medicare wage and tips 31700 7 Social Security tips 2 Federal income tax withheld 1902 4 Socul security tax withheld 1965 6 Medicare tax withheld 460 & Allocated tips 9 10 Dependent care benefits d Control number Suff 12a 11 Nonqualified plans DD 1 12000 Employee's first name and initial Last name BETH PEARSON 7958 N FAIRCHILD ROAD FOX POINT WI 53217 13 May Ty pey 12b angles 14 Other 120 12d 1 Employee's address and ZIP code 15 State Employer's state ID number 18 Local wages, tips, etc. 19 Local income tax 20 locum 16 State wages, tips, etc. 17 State income tax 31.7.0.0. 1752.. NI 139302173311 2021 form W-2 Wage and Tax Statement Department of the Treasury-Internal Revenue Service PAYER'Snart, street address, city or town, state or province, country, ZIP 1 Unemployment compensation OMB No 1545-0120 , of foreign postal code and telephone no Certain WISCONSIN DEPARTMENT OF UNEMPLOYMENT $ 1,800.00 2021 Government 201 E. WASHINGTON AVE 2 State or locis income tax refunds, credits, or offsets Payments MADISON, WI 53707 $ Form 1099-G PAYER'S TIN RECIPIENT'S TIN 3 Box 2 amount in for tax your 4. Federal income tax withheld 39-1520066 Copy A 391-87-1972 $ 180.00 For RECIPIENTS name 5 RTAA payments 6 Taxable grants Internal Revenue 15 $ Service Center Beth Pearson 7 Agriculture payments 8 Check if box 2 is File with Form 1096 maddesincluind act no.1 $ trade or business For Privacy Act income 7958 N. Fairchild Road o Market gain and Paperwork Reduction Act City or town, state or province, country, and ZIP of foreign postal code IS Notice, see the 2021 Fox Point, WI 53217 10a State 10b State Identification no. 11 Station tax with General Account number og instruction 2nd TIN not Instructions for $ Certain Information Returns Form 1099-G Catto. 14438M www.in.gov/Form10990 Department of the Treasury - Internal Revenge Service OMB No. 1545-0112 PAYER S name, street address, city or lown, state or province, country, ZIP Payer's RTN (optional , or foreign postal code, and telephone no. 2021 Interest Income 1 Interest income PENFED CREDIT UNION 315 FRANKLIN AVE SCRANTON, PA 18505 $ S 780.00 2 Early withdrawal penalty Form 1099-INT Copy A PAYER'S TIN RECIPIENTS TIN IS For 3 Interest on U.S. Savings Bonds and Treas, obligations 39-4521115 391-00-1978 Internal Revenue Service Center IS RECIPIENTS name 4 Federal income tax withheld Investment expenses File with Form 1096 IS Is RANDALL PEARSON 6 Foreign tax paid 7 Formign country or US post For Privacy Act Street address including apt.no) $ and Paperwork 8 Tax exempt interest 9 Specified private activity bond 7958 N. Fairchild Road Reduction Act ferest Notice, see the City or town, state or province, country, and ZIP or foreign postal code IS $ 2021 General 10 Market discount 11 Bond premium Instructions for Fox Point, WI 53217 Certain FATCA filing S $ IS Information requirement 12 Bond premium on Treasury obligations 13 Bond premium on temot bord Returns. Is $ Account number (see instructions 2nd TIN not. 14 Tax-exempt and tax credit 15 State 16 State identification no. 17 State tax withheld bond CUSIP n. $ Form 1099-INT Cat No. 14410K www.in/FormTOROINT Denartment of the Tr. Internal Revenue Service OMB No. 1545-0112 PAYER'S name, street address, city or town, state or province, country, ZIPPayer's RTN (optional) or foreign postal code, and telephone no 2021 Interest Income 1 Interest income U.S. BANK P.O. BOX 64799 ST. PAUL, MN 55164 $ 530.00 2 Early withdrawal penalty Form 1099-INT Copy A PAYER'S TIN RECIPIENT'S TIN For 3 Interest on U.S. Savings Bonds and Treas, obligations Internal Revenue 31-0841368 391-87-1972 Service Center $ RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses File with Form To $ BETH PEARSON 6 Foreign tax paid 7 Foreign country U.S. For Privacy Act Siret address induding apl. no.) $ and Paperwork 8 Tax-exempt interest Specified pretty bond Reduction Act 7958 N. Fairchild Road Veres Notice, see the Cilly or town, state or province, country, and ZIP or foreign postal code $ $ 2021 General 10 Mare discount 11 Bond premium Instructions for Fox Point, WI 53217 1 Certain FATCA ing $ Information requirement 12 Bordpremo Trary 13 Blond Returns $ $ Accorrumbernstructions 2nd TIN not. 14 Tweemad tax 15 16 17 Bond CUP no $ Form 1099-INT Cat No. 14410 www.color TOINT Denartment of the Try Wa Paris 2021 PAYER'S name, street address, city or town, state or province, country, ZIP 1a Total ordinary dividends OMB No. 1545-0110 or foreign postal code and telephone no $ 1,825.00 Dividends and WESTINGHOUSE AIR BRAKE 1b Qualified dividends Distributions 1110 CENTRE POINT $ 1,825.00 Form 1009-DIV ST. PAUL, MN 55120 2a Total capital gain distr 2b Unrecap Sec. 1250 gain Copy A $ For RECIPIENTS TIN PAYER'S, TIN 2e Section 1202 gain 2d Collectibles (28%) gain Internal Revenue $ $ Service Center 25-1615902 391-87-1972 2e Section 107 ordinary dividend 21 Section 897 capital gain File with Form 1096 $ $ e RECIPIENT'S name 9 Nondividend distributions | Federal income tax withheld $ $ For Privacy Act BETH PEARSON and Paperwork 5 Section 190A dividends Investment expenses Reduction Act Street address including apt.no $ $ Notice, see the 7 Foreign tax paid 6 . Foreign country a US presion 7958 N. Fairchild Road 2021 General Instructions for City or town, state or province, country, and ZIP or foreign postal code s Certain 9 Cash liquidation distributions 10 Noncash liquidation distributions Information Fox Point, WI 53217 $ $ Returns. FATCA filing 11 Exempt interest dividends 12 Specified private activity requirement bond interest dividends $ $ Account numbers instructions 2nd TIN not 13 State 13 State 14 Sterne 15 Stato tax withheld S Form 1099-DIV --- Cat No. 14415N www.irs.gov/Form 10990IV --- Department of the Treasury - Internal Revenue Service 2021 PAYER'S name, street address, city or town, state or province, country, ZIP 10 Total ordinary dividends OMB No 1545-0110 or foreign postal code, and tolephone no s 345.00 Dividends and GENERAL ELECTRIC COMPANY 1b Qualified dividends Distributions 1110 CENTRE POINT $ $ 345.00 Form 1099-DIV ST. PAUL, MN 55120 2a Total capital gain distr 2b Unrecap. Soc. 1250 gain Copy A $ $ For PAYER'S TIN RECIPIENTS TIN 20 Section 1202 gain 2d Collectibles (28%) gain Internal Revenue $ $ $ Service Center 14-0689340 391-00-1978 2e Section 897 ordinary dividend 21 Section 897 capital gain File with Form 1096 $ $ RECIPIENT'S name 3 Nondividend distribution Federal income tax withheld $ $ For Privacy Act RANDALL PEARSON Section 199A dividends and Paperwork 0itment expers Street Address inciding apt no) Reduction Act $ $ Notice, see the 7 Foreign tax paid 7958 N. Fairchild Road & 8 forgot Us 2021 General Instructions for City or town, stats or province, country, and ZIP or foreign postal code $ Certain Cash quidation distribution 10 cash Fox Point, WI 53217 Information $ Returns FATCA in 11 Examplinterest dividends 12 Specified private activity requirement biondire dividende 1 S $ ACG untersuctions CH| | | | | | 13 e 14 5 $ Form 1099-DIV CN 14415 www/ FOON Department of the Truth Based on the attached tax scenario, complete Form 1040 (through Line 16), Schedule 1, and Schedule B for the Pearson family. Upload the completed Form 1040 here. DON'T FORGET ABOUT THE PREFERENTIAL TAX RATES ON ANY QUALIFIED DIVIDENDS WHEN DETERMINING THE AMOUNT OF TAX LIABILITY ON LINE 16. 1. SP2022 EXAM 1 PART 2-Student Information.pdf Attach File Browse Local Files Browse Content Collection Browse Dropbox Complete Form 1040. (through Line 16), Schedule 1 and Schedule B based on the following information: Randall (391-00-1978) age 43 and Beth Pearson (391-87-1972) age 43 are married and have three dependent children, Deja (391-78-2004, Tess (391-78-2009) and Annie (391-78-2011). All three children qualify for child tax credit. Randall and Beth both work full-time. Beth was unemployed for two months in 2021 and collected unemployment. Beth competed in a dance competition and won a cash prize for first place in the amount of $1500. Randall and Beth have interest and dividend income from bank accounts and investments. Complete Form 1040 (through Line 16), Schedule 1 and Schedule B based on the following information: Randall (391-00-1978) age 43 and Beth Pearson (391-87-1972) age 43 are married and have three dependent children, Deja (391-78-2004, Tess (391-78-2009) and Annie (391-78-2011). All three children qualify for child tax credit. Randall and Beth both work full-time. Beth was unemployed for two months in 2021 and collected unemployment. Beth competed in a dance competition and won a cash prize for first place in the amount of $1500. Randall and Beth have interest and dividend income from bank accounts and investments. a Employee's social security number XXX-XX-1978 b Employer identification number (EIN) 39-6587431 c Employer's name, address, and ZIP code CITY COUNCIL 1000 WATER STREET MILWAUKEE WI 53202 OMB No. 1545-0008 1 Wages, tips, other compensation 42500 3 Social Security wages 42500 5 Medicare wages and tips 42500 7 Social security tips 2 Federal income tax withheld 4185 4 Social security tax withhed 2635 6 Medicare tax withheld 616 8 Allocated tips d Control number 9 10 Dependent care benefits Suff 11 Nonqualified plans 12a Employee's first name and initial Last name RANDALL PEARSON 7958 NEAIRCHILD ROAD FOX POINT WI 53217 13. Mary nere plan Therdorty 12b MILEY xl 14 Other 126 12d 1 Employee's address and ZIP code 15 State Employer's state ID number WI 1.39874100025 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 16 State wages, tips, etc. 17 State income tax 42500 3874 W-2 Wage and Tax Statement Form 2021 Department of the Treasury - Internal Revenue Service a Employee's social security number xxx-xx-1972 Employer dertification number (EIN) 39-1228567 e Employer's name, address, and ZIP code STIR ADVERTISING 140 S 1ST STREET MILNAUKEE WI 53204 OMB No 1545-0008 1 Wages, tips, other compensation 31700 3 Social Security wages 31700 5 Medicare wage and tips 31700 7 Social Security tips 2 Federal income tax withheld 1902 4 Socul security tax withheld 1965 6 Medicare tax withheld 460 & Allocated tips 9 10 Dependent care benefits d Control number Suff 12a 11 Nonqualified plans DD 1 12000 Employee's first name and initial Last name BETH PEARSON 7958 N FAIRCHILD ROAD FOX POINT WI 53217 13 May Ty pey 12b angles 14 Other 120 12d 1 Employee's address and ZIP code 15 State Employer's state ID number 18 Local wages, tips, etc. 19 Local income tax 20 locum 16 State wages, tips, etc. 17 State income tax 31.7.0.0. 1752.. NI 139302173311 2021 form W-2 Wage and Tax Statement Department of the Treasury-Internal Revenue Service PAYER'Snart, street address, city or town, state or province, country, ZIP 1 Unemployment compensation OMB No 1545-0120 , of foreign postal code and telephone no Certain WISCONSIN DEPARTMENT OF UNEMPLOYMENT $ 1,800.00 2021 Government 201 E. WASHINGTON AVE 2 State or locis income tax refunds, credits, or offsets Payments MADISON, WI 53707 $ Form 1099-G PAYER'S TIN RECIPIENT'S TIN 3 Box 2 amount in for tax your 4. Federal income tax withheld 39-1520066 Copy A 391-87-1972 $ 180.00 For RECIPIENTS name 5 RTAA payments 6 Taxable grants Internal Revenue 15 $ Service Center Beth Pearson 7 Agriculture payments 8 Check if box 2 is File with Form 1096 maddesincluind act no.1 $ trade or business For Privacy Act income 7958 N. Fairchild Road o Market gain and Paperwork Reduction Act City or town, state or province, country, and ZIP of foreign postal code IS Notice, see the 2021 Fox Point, WI 53217 10a State 10b State Identification no. 11 Station tax with General Account number og instruction 2nd TIN not Instructions for $ Certain Information Returns Form 1099-G Catto. 14438M www.in.gov/Form10990 Department of the Treasury - Internal Revenge Service OMB No. 1545-0112 PAYER S name, street address, city or lown, state or province, country, ZIP Payer's RTN (optional , or foreign postal code, and telephone no. 2021 Interest Income 1 Interest income PENFED CREDIT UNION 315 FRANKLIN AVE SCRANTON, PA 18505 $ S 780.00 2 Early withdrawal penalty Form 1099-INT Copy A PAYER'S TIN RECIPIENTS TIN IS For 3 Interest on U.S. Savings Bonds and Treas, obligations 39-4521115 391-00-1978 Internal Revenue Service Center IS RECIPIENTS name 4 Federal income tax withheld Investment expenses File with Form 1096 IS Is RANDALL PEARSON 6 Foreign tax paid 7 Formign country or US post For Privacy Act Street address including apt.no) $ and Paperwork 8 Tax exempt interest 9 Specified private activity bond 7958 N. Fairchild Road Reduction Act ferest Notice, see the City or town, state or province, country, and ZIP or foreign postal code IS $ 2021 General 10 Market discount 11 Bond premium Instructions for Fox Point, WI 53217 Certain FATCA filing S $ IS Information requirement 12 Bond premium on Treasury obligations 13 Bond premium on temot bord Returns. Is $ Account number (see instructions 2nd TIN not. 14 Tax-exempt and tax credit 15 State 16 State identification no. 17 State tax withheld bond CUSIP n. $ Form 1099-INT Cat No. 14410K www.in/FormTOROINT Denartment of the Tr. Internal Revenue Service OMB No. 1545-0112 PAYER'S name, street address, city or town, state or province, country, ZIPPayer's RTN (optional) or foreign postal code, and telephone no 2021 Interest Income 1 Interest income U.S. BANK P.O. BOX 64799 ST. PAUL, MN 55164 $ 530.00 2 Early withdrawal penalty Form 1099-INT Copy A PAYER'S TIN RECIPIENT'S TIN For 3 Interest on U.S. Savings Bonds and Treas, obligations Internal Revenue 31-0841368 391-87-1972 Service Center $ RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses File with Form To $ BETH PEARSON 6 Foreign tax paid 7 Foreign country U.S. For Privacy Act Siret address induding apl. no.) $ and Paperwork 8 Tax-exempt interest Specified pretty bond Reduction Act 7958 N. Fairchild Road Veres Notice, see the Cilly or town, state or province, country, and ZIP or foreign postal code $ $ 2021 General 10 Mare discount 11 Bond premium Instructions for Fox Point, WI 53217 1 Certain FATCA ing $ Information requirement 12 Bordpremo Trary 13 Blond Returns $ $ Accorrumbernstructions 2nd TIN not. 14 Tweemad tax 15 16 17 Bond CUP no $ Form 1099-INT Cat No. 14410 www.color TOINT Denartment of the Try Wa Paris 2021 PAYER'S name, street address, city or town, state or province, country, ZIP 1a Total ordinary dividends OMB No. 1545-0110 or foreign postal code and telephone no $ 1,825.00 Dividends and WESTINGHOUSE AIR BRAKE 1b Qualified dividends Distributions 1110 CENTRE POINT $ 1,825.00 Form 1009-DIV ST. PAUL, MN 55120 2a Total capital gain distr 2b Unrecap Sec. 1250 gain Copy A $ For RECIPIENTS TIN PAYER'S, TIN 2e Section 1202 gain 2d Collectibles (28%) gain Internal Revenue $ $ Service Center 25-1615902 391-87-1972 2e Section 107 ordinary dividend 21 Section 897 capital gain File with Form 1096 $ $ e RECIPIENT'S name 9 Nondividend distributions | Federal income tax withheld $ $ For Privacy Act BETH PEARSON and Paperwork 5 Section 190A dividends Investment expenses Reduction Act Street address including apt.no $ $ Notice, see the 7 Foreign tax paid 6 . Foreign country a US presion 7958 N. Fairchild Road 2021 General Instructions for City or town, state or province, country, and ZIP or foreign postal code s Certain 9 Cash liquidation distributions 10 Noncash liquidation distributions Information Fox Point, WI 53217 $ $ Returns. FATCA filing 11 Exempt interest dividends 12 Specified private activity requirement bond interest dividends $ $ Account numbers instructions 2nd TIN not 13 State 13 State 14 Sterne 15 Stato tax withheld S Form 1099-DIV --- Cat No. 14415N www.irs.gov/Form 10990IV --- Department of the Treasury - Internal Revenue Service 2021 PAYER'S name, street address, city or town, state or province, country, ZIP 10 Total ordinary dividends OMB No 1545-0110 or foreign postal code, and tolephone no s 345.00 Dividends and GENERAL ELECTRIC COMPANY 1b Qualified dividends Distributions 1110 CENTRE POINT $ $ 345.00 Form 1099-DIV ST. PAUL, MN 55120 2a Total capital gain distr 2b Unrecap. Soc. 1250 gain Copy A $ $ For PAYER'S TIN RECIPIENTS TIN 20 Section 1202 gain 2d Collectibles (28%) gain Internal Revenue $ $ $ Service Center 14-0689340 391-00-1978 2e Section 897 ordinary dividend 21 Section 897 capital gain File with Form 1096 $ $ RECIPIENT'S name 3 Nondividend distribution Federal income tax withheld $ $ For Privacy Act RANDALL PEARSON Section 199A dividends and Paperwork 0itment expers Street Address inciding apt no) Reduction Act $ $ Notice, see the 7 Foreign tax paid 7958 N. Fairchild Road & 8 forgot Us 2021 General Instructions for City or town, stats or province, country, and ZIP or foreign postal code $ Certain Cash quidation distribution 10 cash Fox Point, WI 53217 Information $ Returns FATCA in 11 Examplinterest dividends 12 Specified private activity requirement biondire dividende 1 S $ ACG untersuctions CH| | | | | | 13 e 14 5 $ Form 1099-DIV CN 14415 www/ FOON Department of the Truth

These are all the pics I have

These are all the pics I have