Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am building an amortization schedule in Excel for a project and found this Amortization Schedule to use as a format. However, I need to

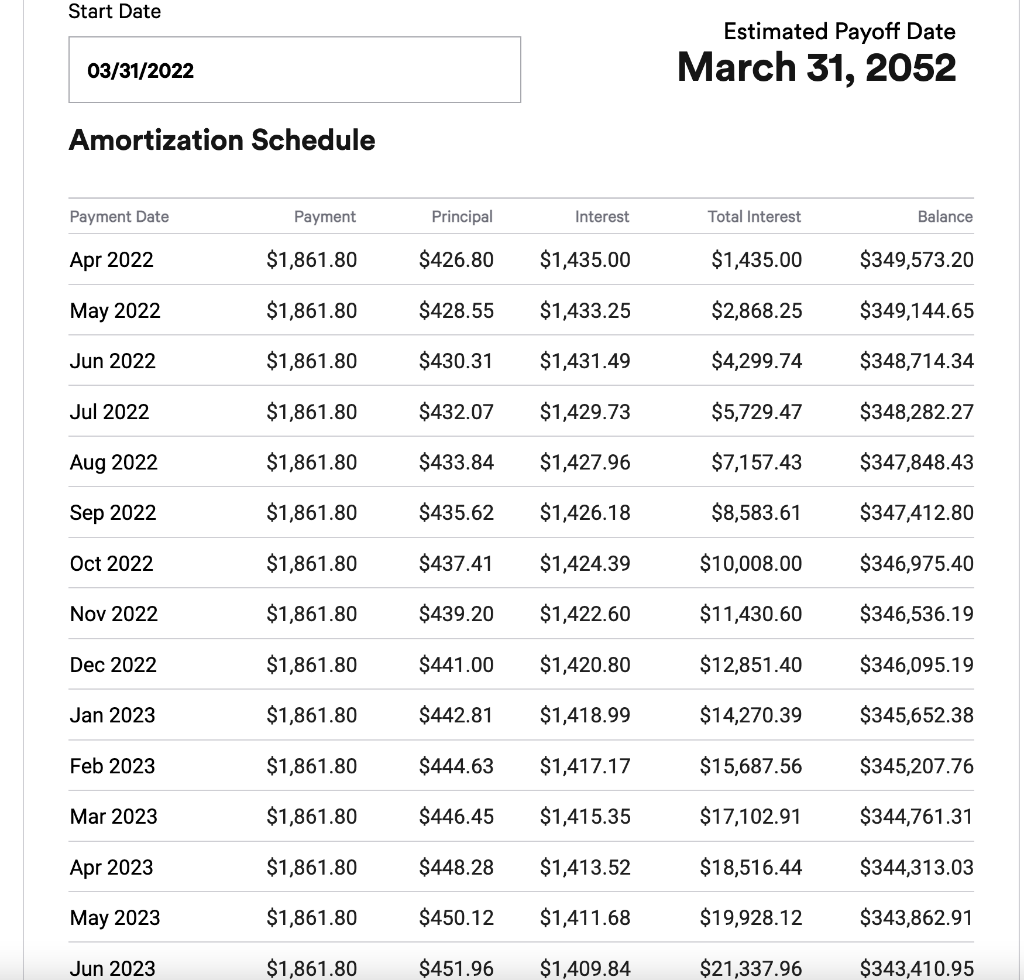

I am building an amortization schedule in Excel for a project and found this Amortization Schedule to use as a format. However, I need to know how to calculate the balances of Principal, Interest, Total Interest, and Balance in Excel. I have the answers on the screenshot but need to know how to calculate them in Excel. This screenshot is what I'm using:

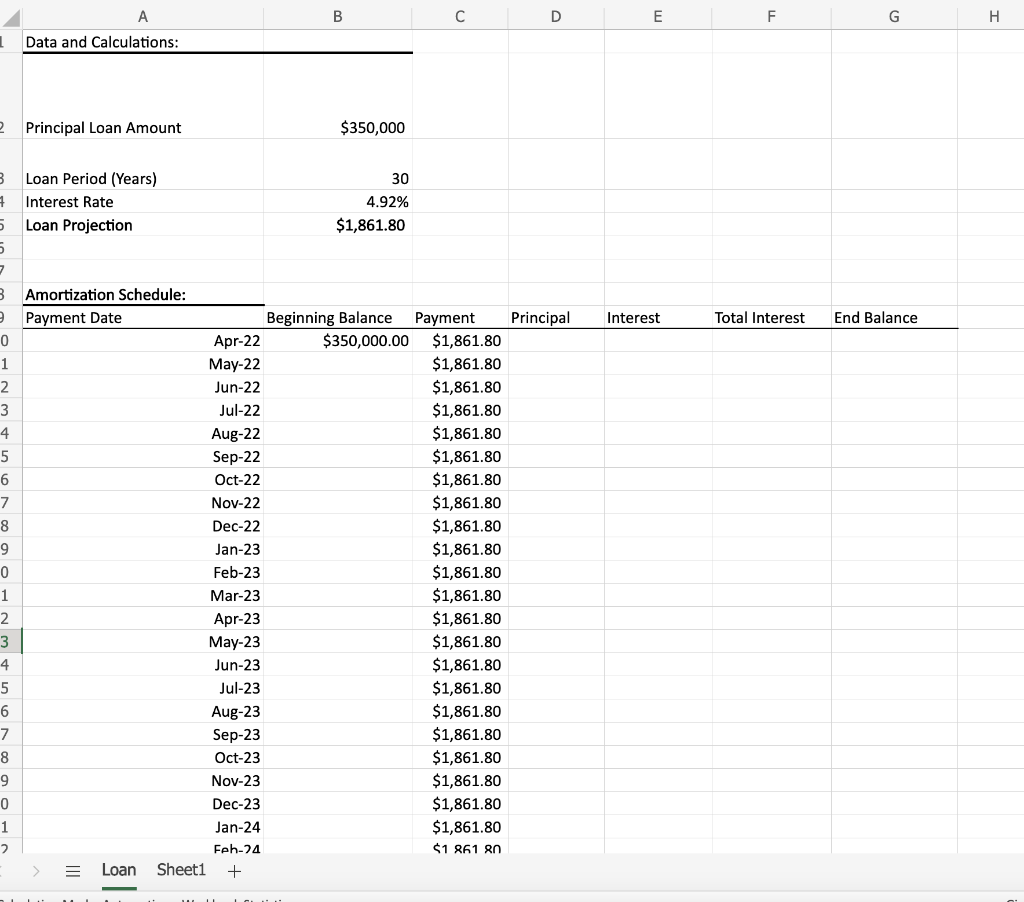

This is my excel sheet thus far:

Thank you so much!

Start Date Estimated Payoff Date March 31, 2052 03/31/2022 Amortization Schedule Payment Date Payment Principal Interest Total Interest Balance Apr 2022 $1,861.80 $426.80 $1,435.00 $1,435.00 $349,573.20 May 2022 $1,861.80 $428.55 $1,433.25 $2,868.25 $349,144.65 Jun 2022 $1,861.80 $430.31 $1,431.49 $4,299.74 $348,714.34 Jul 2022 $1,861.80 $432.07 $1,429.73 $5,729.47 $348,282.27 Aug 2022 1,861.80 $433.84 $1,427.96 $7,157.43 $347,848.43 Sep 2022 $1,861.80 $435.62 $1,426.18 $8,583.61 $347,412.80 Oct 2022 $1,861.80 $437.41 $1,424.39 $10,008.00 $346,975.40 Nov 2022 $1,861.80 $439.20 $1,422.60 $11,430.60 $346,536.19 Dec 2022 $1,861.80 $441.00 $1,420.80 $12,851.40 $346,095.19 Jan 2023 $1,861.80 $442.81 $1,418.99 $14,270.39 $345,652.38 Feb 2023 $1,861.80 $444.63 $1,417.17 $15,687.56 $345,207.76 Mar 2023 $1,861.80 $446.45 $1,415.35 $17,102.91 $344,761.31 Apr 2023 $1,861.80 $448.28 $1,413.52 $18,516.44 $344,313.03 May 2023 $1,861.80 $450.12 $1,411.68 $19,928.12 $343,862.91 Jun 2023 $1,861.80 $451.96 $1,409.84 $21,337.96 $343,410.95 B D E F G . Data and Calculations: 2 Principal Loan Amount $350,000 B Loan Period (Years) Interest Rate 5 Loan Projection 30 4.92% $1,861.80 7 3 Principal Interest Total Interest End Balance 2 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4. 5 6 7 8 9 0 1 2 Amortization Schedule: Payment Date Beginning Balance Payment Apr-22 $350,000.00 $1,861.80 May-22 $1,861.80 Jun-22 $1,861.80 Jul-22 $1,861.80 Aug-22 $1,861.80 Sep-22 $1,861.80 Oct-22 $1,861.80 Nov-22 $1,861.80 Dec-22 $1,861.80 Jan-23 $1,861.80 Feb-23 $1,861.80 Mar-23 $1,861.80 $1,861.80 May-23 $1,861.80 Jun-23 $1,861.80 Jul-23 $1,861.80 Aug-23 $1,861.80 Sep-23 $1,861.80 Oct-23 $1,861.80 Nov-23 $1,861.80 Dec-23 $1,861.80 Jan-24 $1,861.80 Feh-24 $1 861 an = Loan Sheet1 + Apr-23Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started