Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am currently working on my consumer economics/financial literacy book. I took an accounting class about 2 years ago but I dont remember how to

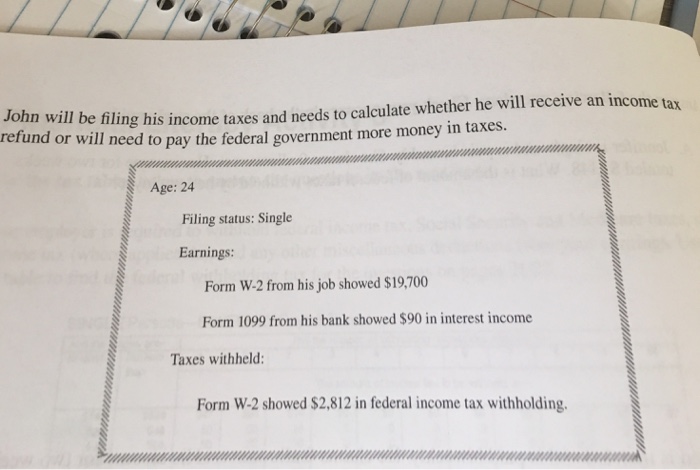

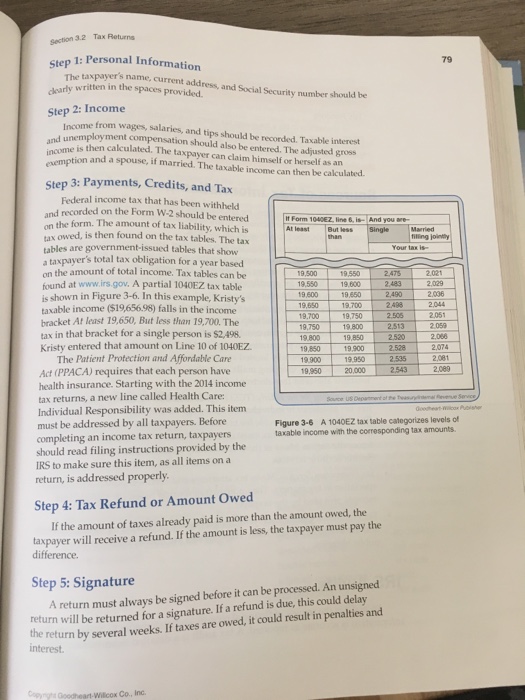

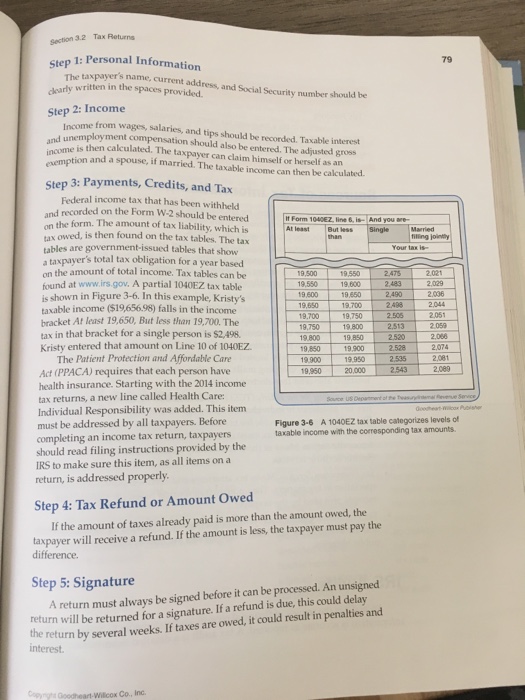

I am currently working on my consumer economics/financial literacy book. I took an accounting class about 2 years ago but I dont remember how to do this problem. The first photo is the exam, the second is the table on the study guide (p.22) and the last one is the textbook photo on page 79

31. Use the information from page 22 of your study guide and Figure 3-6 on page 79 in your textbook to answer the following questions. A. If John's filing status was Married what is John's taxable income? B. If John's filing status was Married, how much would his tax refund be? C. How does your marital status affect how much is paid in federal income taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started