Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i am doing a project and need help to resolving problems Do they own or rent the building facilities and how could we know? What

i am doing a project and need help to resolving problems

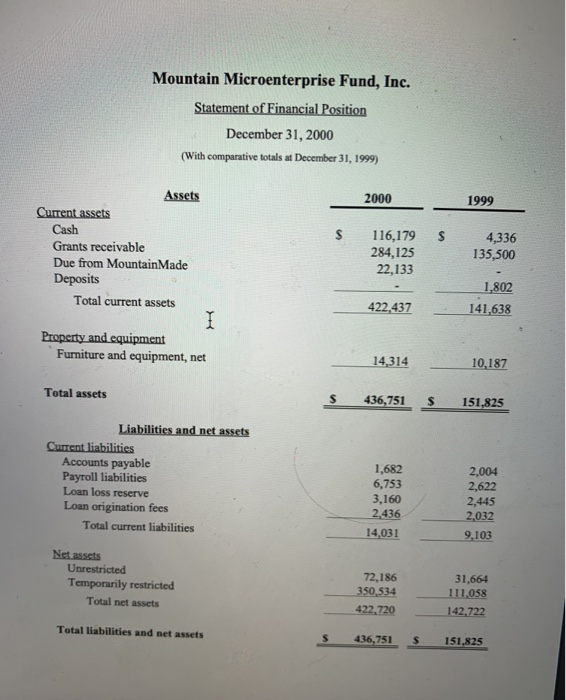

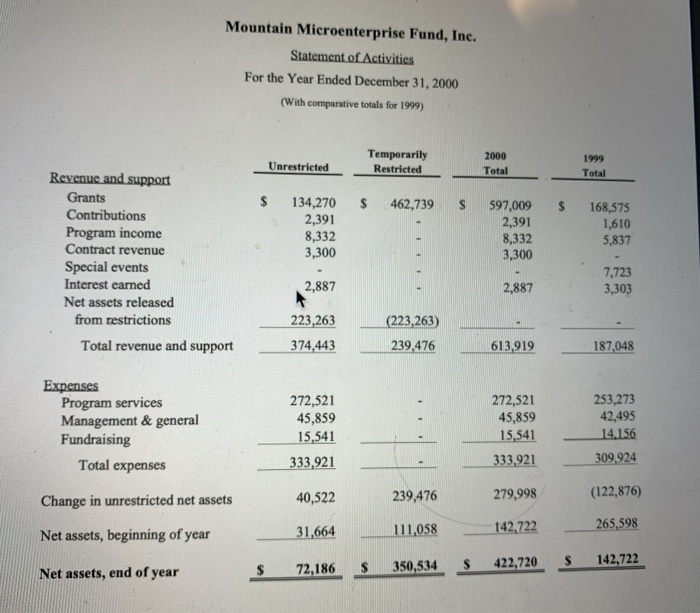

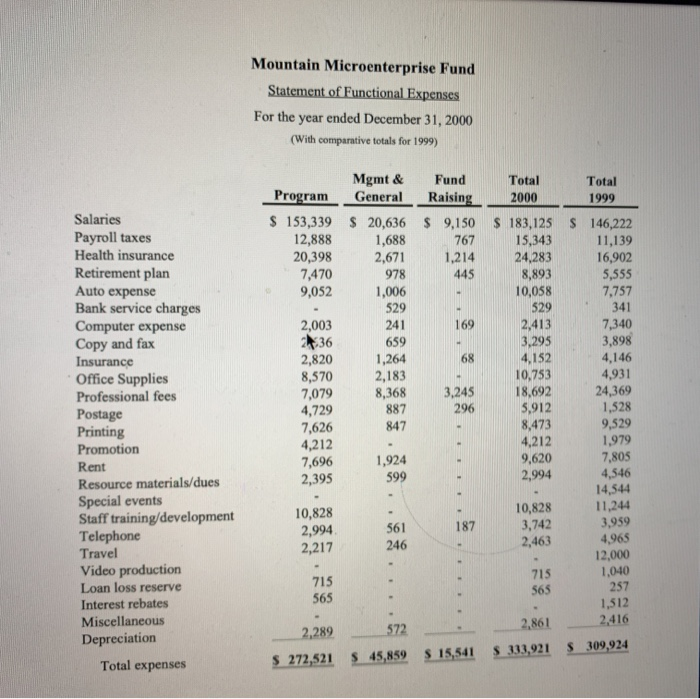

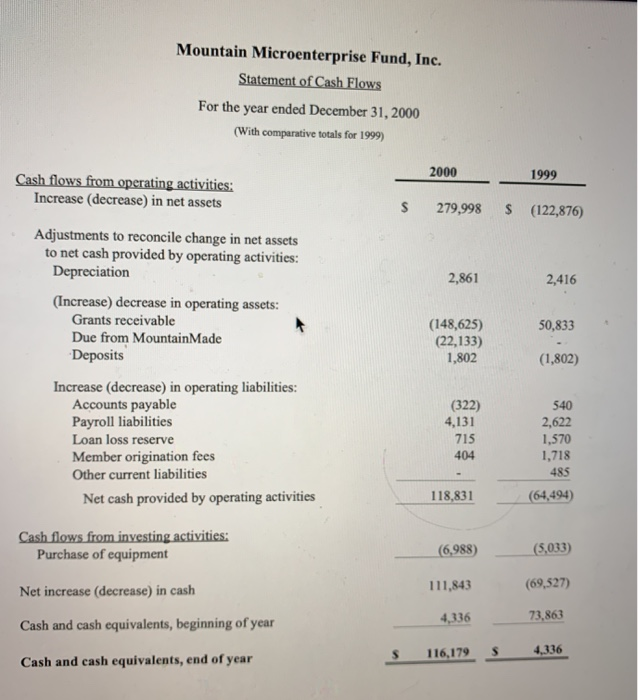

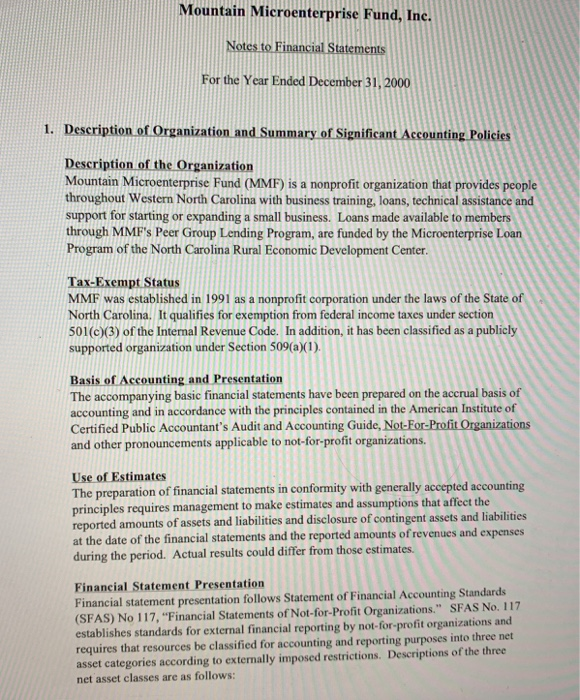

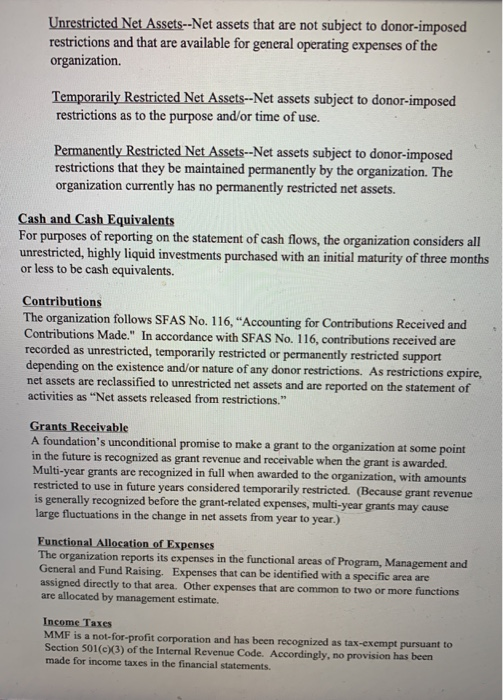

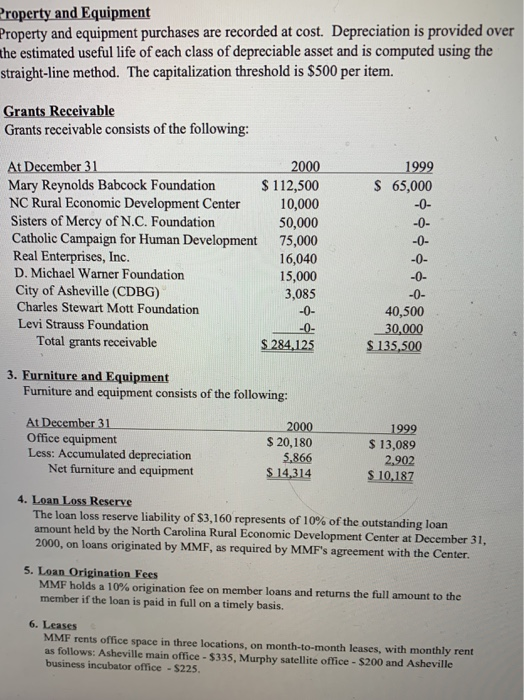

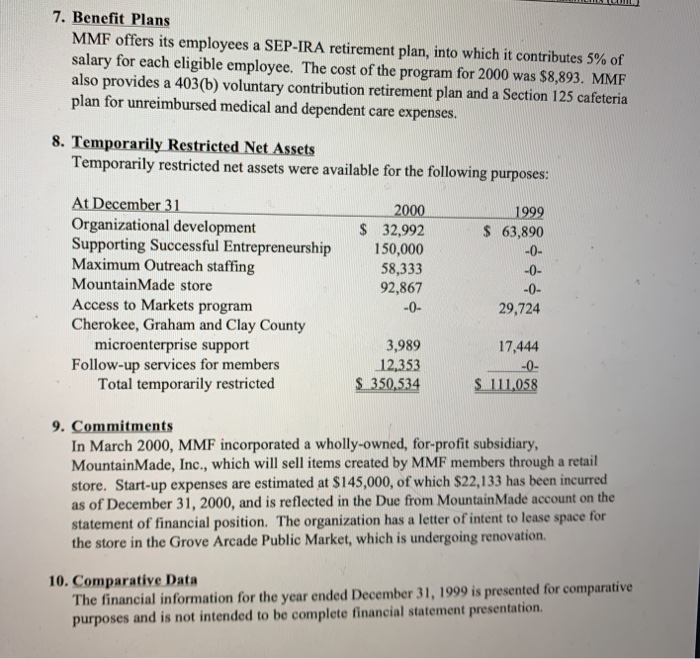

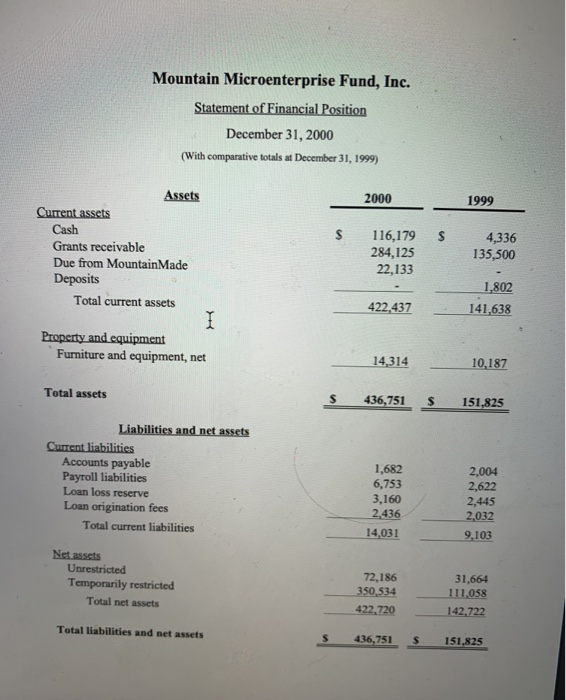

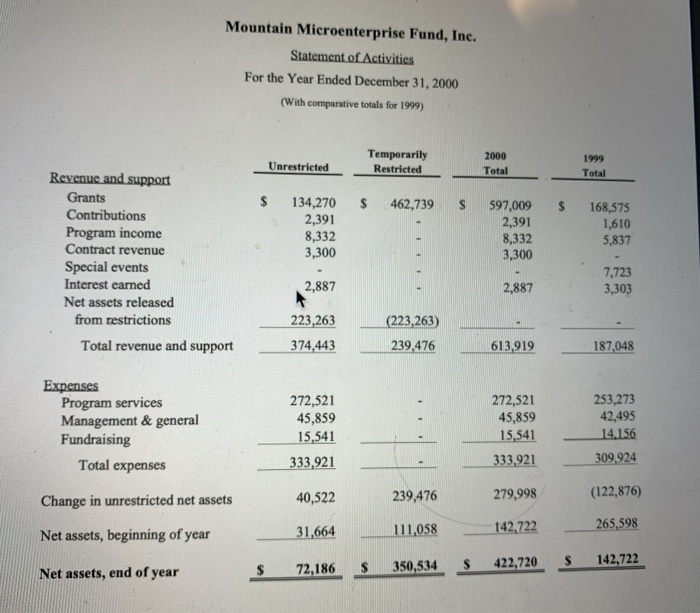

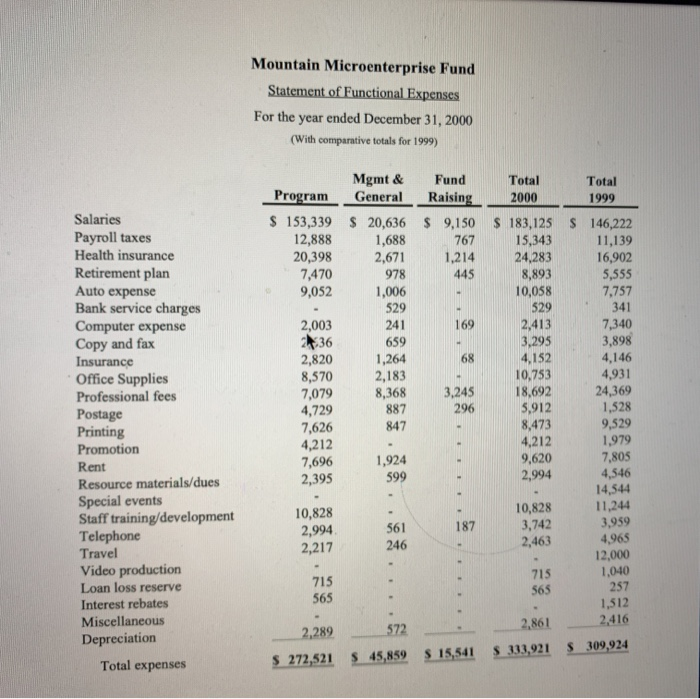

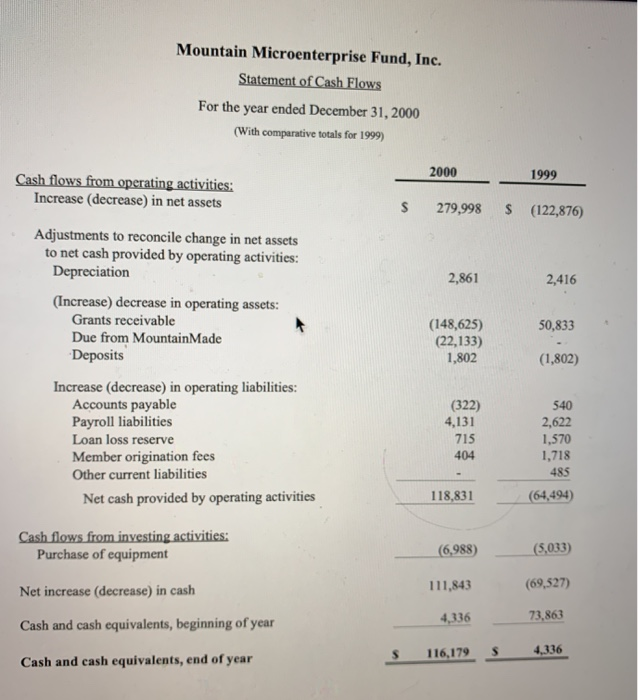

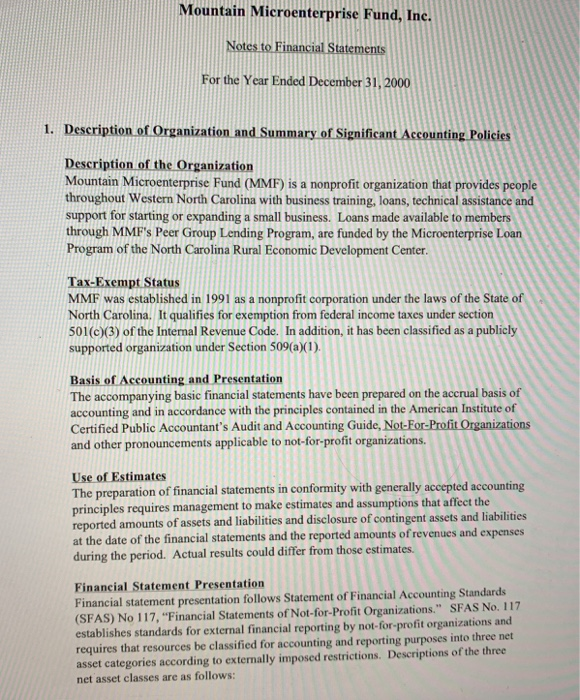

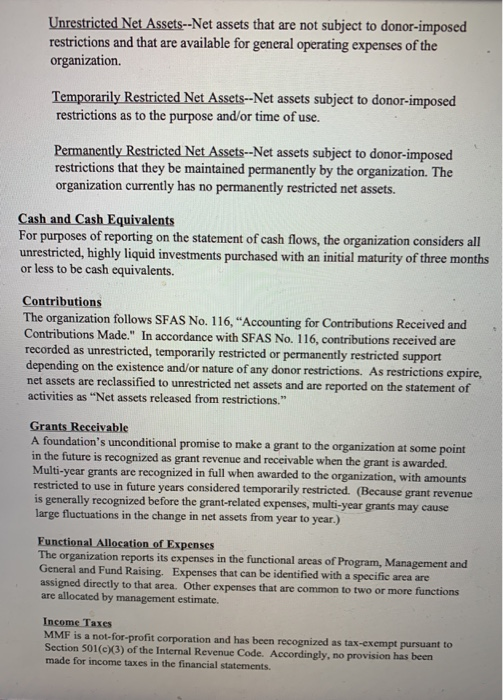

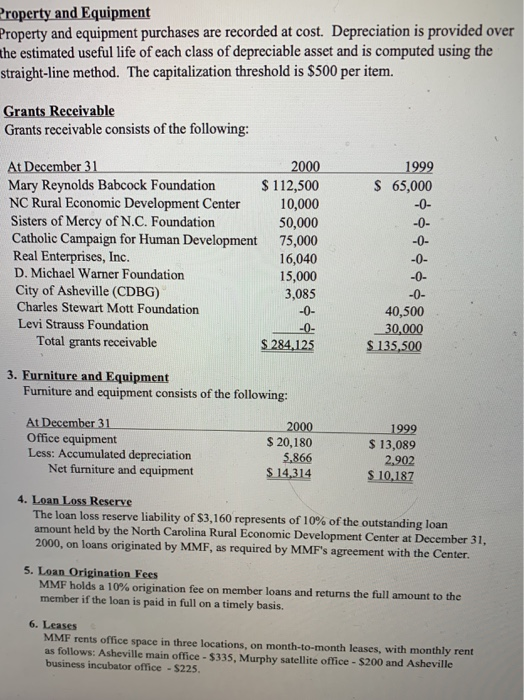

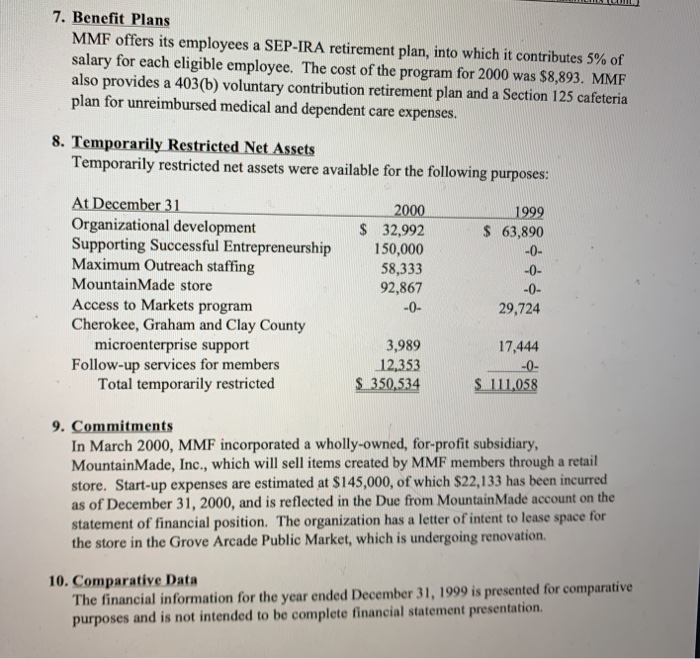

Mountain Microenterprise Fund, Inc. Statement of Financial Position December 31, 2000 (With comparative totals at December 31, 1999) 2000 1999 $ $ Assets Current assets Cash Grants receivable Due from Mountain Made Deposits Total current assets 116,179 284,125 22,133 4,336 135,500 1,802 141,638 422,437 Property and equipment Furniture and equipment, net 14,314 10,187 Total assets 436,751 $ 151,825 Liabilities and net assets Current liabilities Accounts payable Payroll liabilities Loan loss reserve Loan origination fees Total current liabilities 1,682 6,753 3,160 2,436 14,031 2,004 2,622 2,445 2,032 9,103 Net assets Unrestricted Temporarily restricted Total net assets 72,186 350,534 422.720 31,664 111,058 142,722 Total liabilities and net assets 436,751 S 151,825 Mountain Microenterprise Fund, Inc. Statement of Activities For the Year Ended December 31, 2000 (With comparative totals for 1999) Unrestricted Temporarily Restricted 2000 Total 1999 Total $ $ 462,739 S $ 134,270 2,391 8,332 3,300 597,009 2,391 8,332 3,300 168,575 1,610 5,837 Revenue and support Grants Contributions Program income Contract revenue Special events Interest earned Net assets released from restrictions Total revenue and support 2,887 2,887 7,723 3,303 223,263 (223,263) 374,443 239,476 613,919 187,048 Expenses Program services Management & general Fundraising Total expenses 272,521 45,859 15,541 333,921 272,521 45,859 15,541 333.921 253,273 42,495 14.156 309,924 Change in unrestricted net assets 40,522 239,476 (122,876) 279,998 31,664 111,058 142,722 Net assets, beginning of year 265,598 $ Net assets, end of year 72,186 $ 350,534 $ 422,720 S 142,722 Mountain Microenterprise Fund, Inc. Statement of Cash Flows For the year ended December 31, 2000 (With comparative totals for 1999) 2000 1999 Cash flows from operating activities: Increase (decrease) in net assets $ 279,998 $ (122,876) Adjustments to reconcile change in net assets to net cash provided by operating activities: Depreciation 2,861 2,416 (Increase) decrease in operating assets: Grants receivable Due from MountainMade Deposits 50,833 (148,625) (22,133) 1,802 (1,802) Increase (decrease) in operating liabilities: Accounts payable Payroll liabilities Loan loss reserve Member origination fees Other current liabilities Net cash provided by operating activities (322) 4,131 715 404 540 2,622 1,570 1,718 485 (64,494) 118,831 Cash flows from investing activities: Purchase of equipment (6,988) (5,033) Net increase (decrease) in cash 111,843 (69,527) Cash and cash equivalents, beginning of year 73,863 4,336 116,179 S 4,336 Cash and cash equivalents, end of year Mountain Microenterprise Fund, Ine. Notes to Financial Statements For the Year Ended December 31, 2000 1. Description of Organization and Summary of Significant Accounting Policies Description of the Organization Mountain Microenterprise Fund (MMF) is a nonprofit organization that provides people throughout Western North Carolina with business training, loans, technical assistance and support for starting or expanding a small business. Loans made available to members through MMF's Peer Group Lending Program, are funded by the Microenterprise Loan Program of the North Carolina Rural Economic Development Center. Tax-Exempt Status MMF was established in 1991 as a nonprofit corporation under the laws of the State of North Carolina. It qualifies for exemption from federal income taxes under section 501(c)(3) of the Internal Revenue Code. In addition, it has been classified as a publicly supported organization under Section 509(a)(1). Basis of Accounting and Presentation The accompanying basic financial statements have been prepared on the accrual basis of accounting and in accordance with the principles contained in the American Institute of Certified Public Accountant's Audit and Accounting Guide, Not-For-Profit Organizations and other pronouncements applicable to not-for-profit organizations. Use of Estimates The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates. Financial Statement Presentation Financial statement presentation follows Statement of Financial Accounting Standards (SFAS) No 117, "Financial Statements of Not-for-Profit Organizations." SFAS No. 117 establishes standards for external financial reporting by not-for-profit organizations and requires that resources be classified for accounting and reporting purposes into three net asset categories according to externally imposed restrictions. Descriptions of the three net asset classes are as follows: Unrestricted Net Assets--Net assets that are not subject to donor-imposed restrictions and that are available for general operating expenses of the organization. Temporarily Restricted Net Assets--Net assets subject to donor-imposed restrictions as to the purpose and/or time of use. Permanently Restricted Net Assets--Net assets subject to donor-imposed restrictions that they be maintained permanently by the organization. The organization currently has no permanently restricted net assets. Cash and Cash Equivalents For purposes of reporting on the statement of cash flows, the organization considers all unrestricted, highly liquid investments purchased with an initial maturity of three months or less to be cash equivalents. Contributions The organization follows SFAS No. 116, Accounting for Contributions Received and Contributions Made." In accordance with SFAS No. 116, contributions received are recorded as unrestricted, temporarily restricted or permanently restricted support depending on the existence and/or nature of any donor restrictions. As restrictions expire, net assets are reclassified to unrestricted net assets and are reported on the statement of activities as Net assets released from restrictions." Grants Receivable A foundation's unconditional promise to make a grant to the organization at some point in the future is recognized as grant revenue and receivable when the grant is awarded. Multi-year grants are recognized in full when awarded to the organization, with amounts restricted to use in future years considered temporarily restricted. (Because grant revenue is generally recognized before the grant-related expenses, multi-year grants may cause large fluctuations in the change in net assets from year to year.) Functional Allocation of Expenses The organization reports its expenses in the functional areas of Program, Management and General and Fund Raising. Expenses that can be identified with a specific area are assigned directly to that area. Other expenses that are common to two or more functions are allocated by management estimate. Income Taxes MMF is a not-for-profit corporation and has been recognized as tax-exempt pursuant to Section 501(C)(3) of the Internal Revenue Code. Accordingly, no provision has been made for income taxes in the financial statements. Property and Equipment Property and equipment purchases are recorded at cost. Depreciation is provided over the estimated useful life of each class of depreciable asset and is computed using the straight-line method. The capitalization threshold is $500 per item. Grants Receivable Grants receivable consists of the following: 1999 65,000 At December 31 2000 Mary Reynolds Babcock Foundation $112,500 NC Rural Economic Development Center 10,000 Sisters of Mercy of N.C. Foundation 50,000 Catholic Campaign for Human Development 75,000 Real Enterprises, Inc. 16,040 D. Michael Warner Foundation 15,000 City of Asheville (CDBG) 3,085 Charles Stewart Mott Foundation -0- Levi Strauss Foundation -0- Total grants receivable $ 284,125 -0- 40,500 30,000 $ 135,500 3. Furniture and Equipment Furniture and equipment consists of the following: At December 31 Office equipment Less: Accumulated depreciation Net furniture and equipment 2000 $ 20,180 5,866 $ 14,314 1999 $ 13,089 2.902 $ 10,187 4. Loan Loss Reserve The loan loss reserve liability of $3,160 represents of 10% of the outstanding loan amount held by the North Carolina Rural Economic Development Center at December 31, 2000, on loans originated by MMF, as required by MMF's agreement with the Center 5. Loan Origination Fees MMF holds a 10% origination fee on member loans and returns the full amount to the member if the loan is paid in full on a timely basis. 6. Leases MMF rents office space in three locations, on month-to-month leases, with monthly rent as follows: Asheville main office - $335. Murphy satellite office - $200 and Asheville business incubator office - $225. LUI 7. Benefit Plans MMF offers its employees a SEP-IRA retirement plan, into which it contributes 5% of salary for each eligible employee. The cost of the program for 2000 was $8,893. MMF also provides a 403(b) voluntary contribution retirement plan and a Section 125 cafeteria plan for unreimbursed medical and dependent care expenses. 8. Temporarily Restricted Net Assets Temporarily restricted net assets were available for the following purposes: $ 1999 $ 63,890 At December 31 Organizational development Supporting Successful Entrepreneurship Maximum Outreach staffing MountainMade store Access to Markets program Cherokee, Graham and Clay County microenterprise support Follow-up services for members Total temporarily restricted 2000 32,992 150,000 58,333 92,867 -O- 29,724 17,444 3,989 12,353 $ 350,534 -0- $ 111,058 9. Commitments In March 2000, MMF incorporated a wholly-owned, for-profit subsidiary, Mountain Made, Inc., which will sell items created by MMF members through a retail store. Start-up expenses are estimated at $145,000, of which $22,133 has been incurred as of December 31, 2000, and is reflected in the Due from Mountain Made account on the statement of financial position. The organization has a letter of intent to lease space for the store in the Grove Arcade Public Market, which is undergoing renovation. 10. Comparative Data The financial information for the year ended December 31, 1999 is presented for comparative purposes and is not intended to be complete financial statement presentation

Do they own or rent the building facilities and how could we know?

What is the percent change in the total assets for the years 1999 to 2000?

What the percent change in temporarily restricted net assets for the years 1999 to 2000?

What proportion of net assets were restricted on this day December 31, 2000?

The total insurance expenses was 4,152 in the year 2000. How much insurance expense did they attribute to the program expenses?

Calculate the return of total assets for ROA for the 1999 to 2000 years

return on total assets = increase in total net assets/total assets

Is ROA favorable or unfavorable and why?

What is the calculation for days of cash on hand rario for the year 2000

Days of cash on hand=cash/operation expenses to depreciation/365

Does the days of cash on hand ration indicaiton liquodity problem and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started