Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am doing corporate finance course and i have a question I want to calculate cost of debts in leases for a company called Proximus

I am doing corporate finance course and i have a question

I want to calculate cost of debts in leases for a company called Proximus BE

So i want to calculate the cost of leases and cost ratio for year 2022

I have provided screenshots from their annual report the leases part

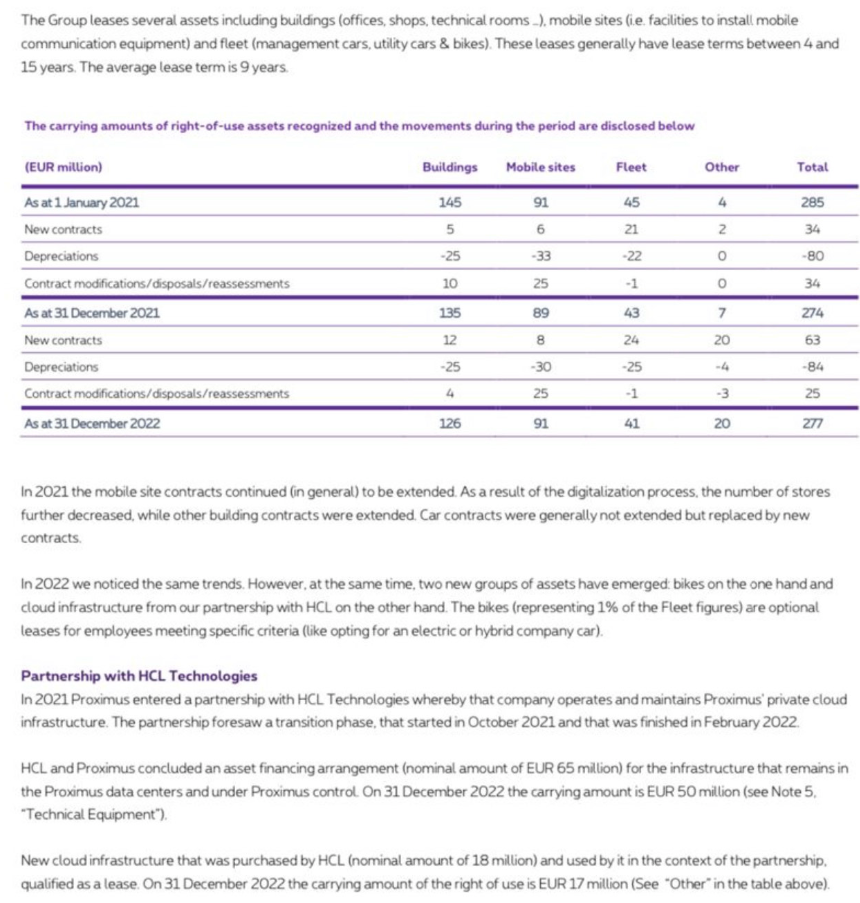

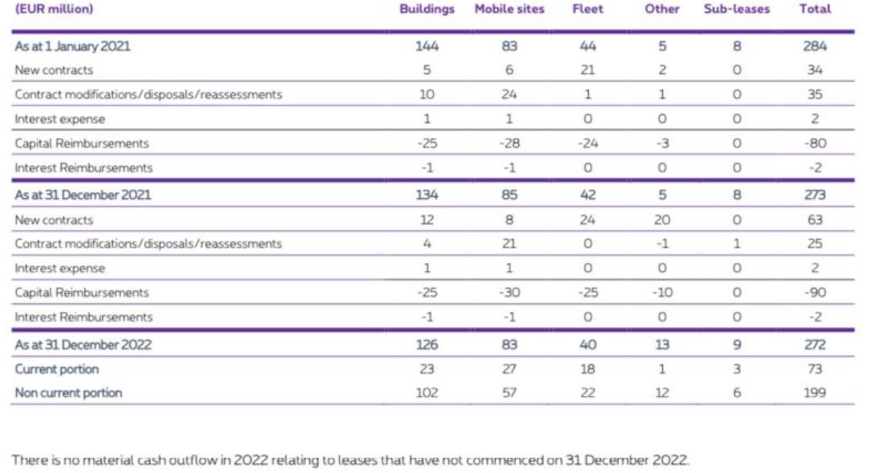

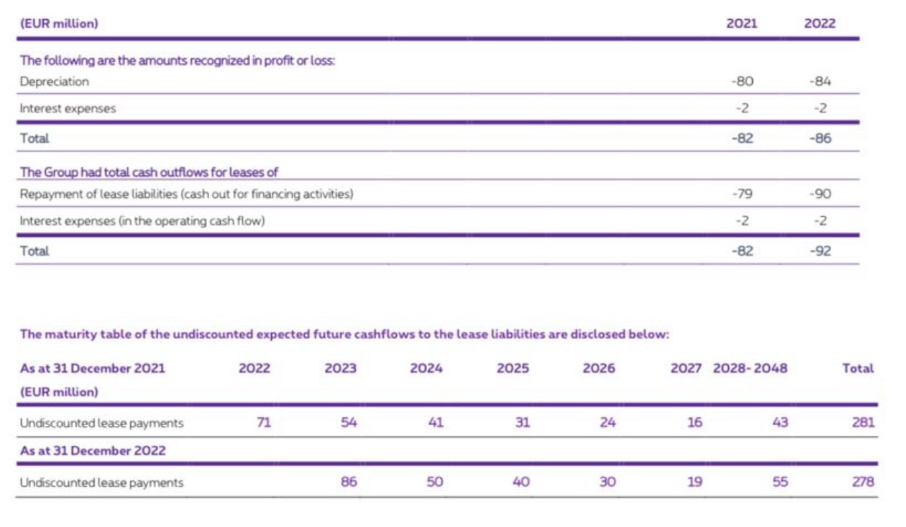

The Group leases several assets including buildings (offices, shops, technical rooms_), mobile sites (i.e. facilities to install mobile communication equipment) and fleet (management cars, utility cars & bikes). These leases generally have lease terms between 4 and 15 years. The average lease term is 9 years. The carrying amounts of right-of-use assets recognized and the movements during the period are disclosed below In 2021 the mobile site contracts continued (in general) to be extended. As a result of the digitalization process, the number of stores further decreased, while other building contracts were extended. Car contracts were generally not extended but replaced by new contracts. In 2022 we noticed the same trends. However, at the same time, two new groups of assets have emerged. bikes on the one hand and cloud infrastructure from our partnership with HCL on the other hand. The bikes (representing 1% of the Fleet figures) are optional leases for employees meeting specific criteria (like opting for an electric or hybrid company car). Partnership with HCL Technologies In 2021 Proximus entered a partnership with HCL Technologies whereby that company operates and maintains Proximus' private cloud infrastructure. The partnership foresaw a transition phase, that started in October 2021 and that was finished in February 2022. HCL and Proximus concluded an asset financing arrangement (nominal amount of EUR 65 million) for the infrastructure that remains in the Proximus data centers and under Proximus control. On 31 December 2022 the carrying amount is EUR 50 million (see Note 5. "Technical Equipment") New cloud infrastructure that was purchased by HCL (nominal amount of 18 million) and used by it in the context of the partnership. qualified as a lease. On 31 December 2022 the carrying amount of the right of use is EUR 17 million (See "Other" in the table above). There is no material cash outflow in 2022 relating to leases that have not commenced on 31 December 2022. (EUR mitlion) 2021 The following are the amounts recognized in profit or loss: \begin{tabular}{l} Depreciation \\ Interest expenses \\ Total \\ The Group had total cash outflows for leases of \\ Repayment of lease liabilities (cash out for financing activities) \\ \hline Interest expenses (in the operating cash flow) \\ Total \end{tabular} The maturity table of the undiscounted expected future cashflows to the lease liabilities are disclosed below: As at 31 December 2021 2022 2023 2024 2025 2026202720282048 Total (EUR miltion) The Group leases several assets including buildings (offices, shops, technical rooms_), mobile sites (i.e. facilities to install mobile communication equipment) and fleet (management cars, utility cars & bikes). These leases generally have lease terms between 4 and 15 years. The average lease term is 9 years. The carrying amounts of right-of-use assets recognized and the movements during the period are disclosed below In 2021 the mobile site contracts continued (in general) to be extended. As a result of the digitalization process, the number of stores further decreased, while other building contracts were extended. Car contracts were generally not extended but replaced by new contracts. In 2022 we noticed the same trends. However, at the same time, two new groups of assets have emerged. bikes on the one hand and cloud infrastructure from our partnership with HCL on the other hand. The bikes (representing 1% of the Fleet figures) are optional leases for employees meeting specific criteria (like opting for an electric or hybrid company car). Partnership with HCL Technologies In 2021 Proximus entered a partnership with HCL Technologies whereby that company operates and maintains Proximus' private cloud infrastructure. The partnership foresaw a transition phase, that started in October 2021 and that was finished in February 2022. HCL and Proximus concluded an asset financing arrangement (nominal amount of EUR 65 million) for the infrastructure that remains in the Proximus data centers and under Proximus control. On 31 December 2022 the carrying amount is EUR 50 million (see Note 5. "Technical Equipment") New cloud infrastructure that was purchased by HCL (nominal amount of 18 million) and used by it in the context of the partnership. qualified as a lease. On 31 December 2022 the carrying amount of the right of use is EUR 17 million (See "Other" in the table above). There is no material cash outflow in 2022 relating to leases that have not commenced on 31 December 2022. (EUR mitlion) 2021 The following are the amounts recognized in profit or loss: \begin{tabular}{l} Depreciation \\ Interest expenses \\ Total \\ The Group had total cash outflows for leases of \\ Repayment of lease liabilities (cash out for financing activities) \\ \hline Interest expenses (in the operating cash flow) \\ Total \end{tabular} The maturity table of the undiscounted expected future cashflows to the lease liabilities are disclosed below: As at 31 December 2021 2022 2023 2024 2025 2026202720282048 Total (EUR miltion)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started