Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am going to buy a car (Not a Tesla!!). I will finance the whole purchase (no down payment) with a new car loan

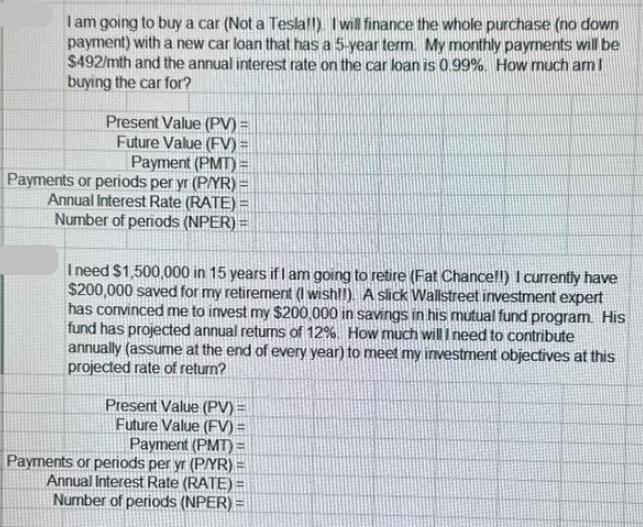

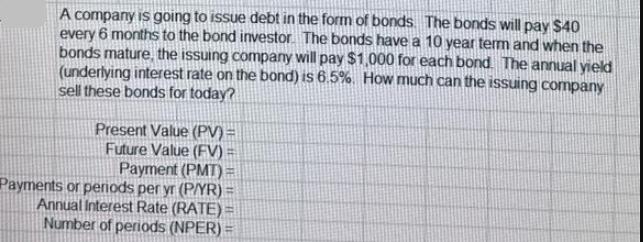

I am going to buy a car (Not a Tesla!!). I will finance the whole purchase (no down payment) with a new car loan that has a 5-year term. My monthly payments will be $492/mth and the annual interest rate on the car loan is 0.99%. How much am I buying the car for? Present Value (PV)= Future Value (FV) = Payment (PMT): Payments or periods per yr (P/YR) Annual Interest Rate (RATE) = Number of periods (NPER): I need $1,500,000 in 15 years if I am going to retire (Fat Chance!!) I currently have $200,000 saved for my retirement (I wish!!). A slick Wallstreet investment expert has convinced me to invest my $200,000 in savings in his mutual fund program. His fund has projected annual returns of 12%. How much will I need to contribute annually (assume at the end of every year) to meet my investment objectives at this projected rate of return? Present Value (PV) = Future Value (FV)= Payment (PMT)= Payments or periods per yr (P/YR)= Annual Interest Rate (RATE) = Number of periods (NPER) = A company is going to issue debt in the form of bonds. The bonds will pay $40 every 6 months to the bond investor. The bonds have a 10 year term and when the bonds mature, the issuing company will pay $1,000 for each bond. The annual yield (underlying interest rate on the bond) is 6.5%. How much can the issuing company sell these bonds for today? Present Value (PV)= Future Value (FV) Payment (PMT) Payments or periods per yr (P/YR) Annual Interest Rate (RATE) = Number of periods (NPER)

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

For the car loan Present Value PV Amount being borrowed 28920 Future Value FV 0 assuming no balloon ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started