Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am having a hard time finding the weights for these questions. Here is my data. 5. Optimal capital allocation with the addition of the

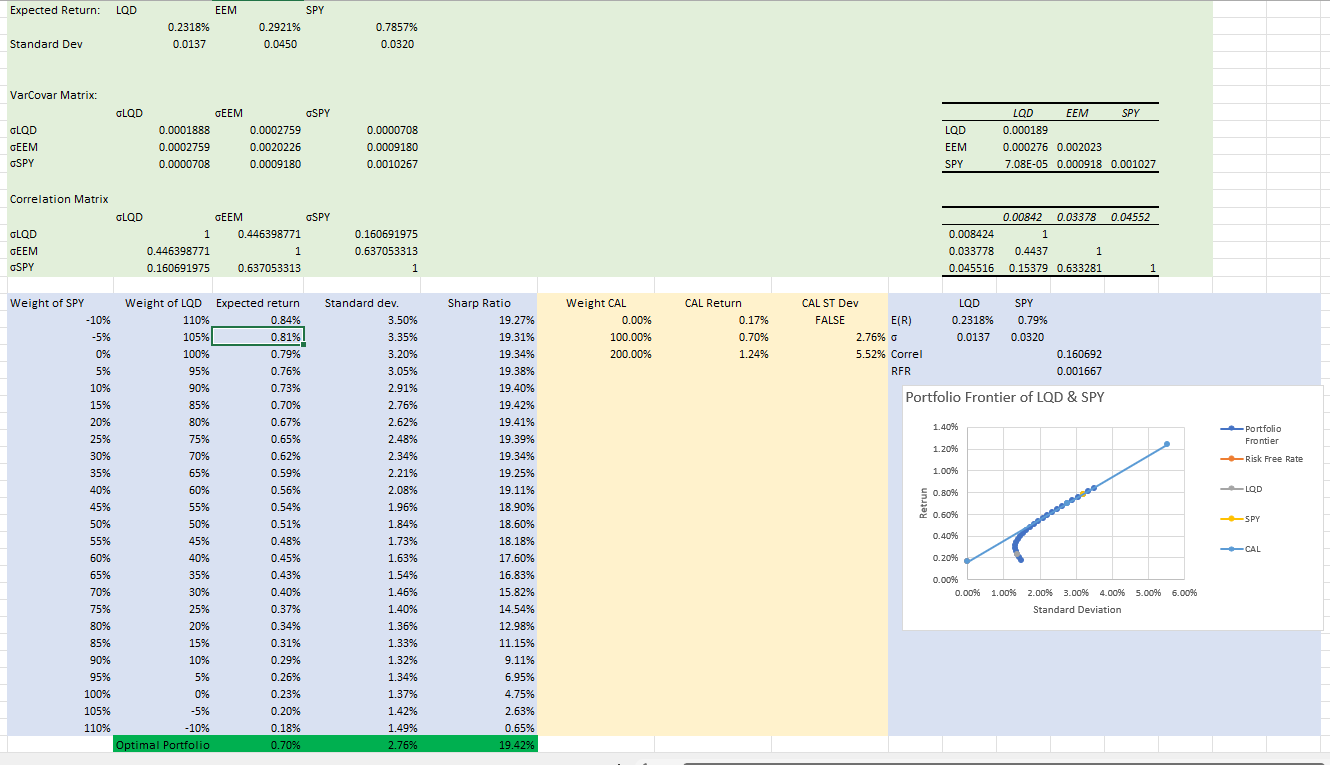

I am having a hard time finding the weights for these questions. Here is my data.

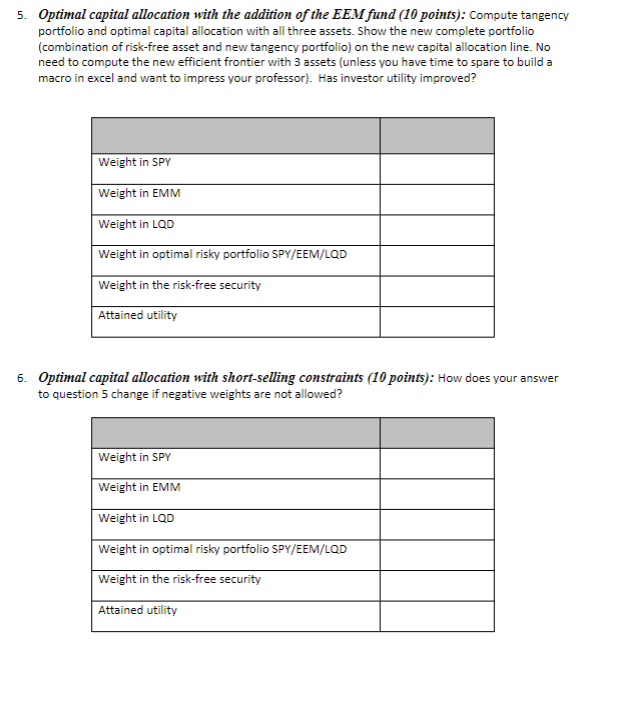

5. Optimal capital allocation with the addition of the EEM fund (10 points): Compute tangency portfolio and optimal capital allocation with all three assets. Show the new complete portfolio (combination of risk-free asset and new tangency portfolio) on the new capital allocation line. No need to compute the new efficient frontier with 3 assets (unless you have time to spare to build a macro in excel and want to impress your professor). Has investor utility improved? 6. Optimal capital allocation with short-selling constraints (10 points): How does your answer to question 5 change if negative weights are not allowed? 5. Optimal capital allocation with the addition of the EEM fund (10 points): Compute tangency portfolio and optimal capital allocation with all three assets. Show the new complete portfolio (combination of risk-free asset and new tangency portfolio) on the new capital allocation line. No need to compute the new efficient frontier with 3 assets (unless you have time to spare to build a macro in excel and want to impress your professor). Has investor utility improved? 6. Optimal capital allocation with short-selling constraints (10 points): How does your answer to question 5 change if negative weights are not allowed

5. Optimal capital allocation with the addition of the EEM fund (10 points): Compute tangency portfolio and optimal capital allocation with all three assets. Show the new complete portfolio (combination of risk-free asset and new tangency portfolio) on the new capital allocation line. No need to compute the new efficient frontier with 3 assets (unless you have time to spare to build a macro in excel and want to impress your professor). Has investor utility improved? 6. Optimal capital allocation with short-selling constraints (10 points): How does your answer to question 5 change if negative weights are not allowed? 5. Optimal capital allocation with the addition of the EEM fund (10 points): Compute tangency portfolio and optimal capital allocation with all three assets. Show the new complete portfolio (combination of risk-free asset and new tangency portfolio) on the new capital allocation line. No need to compute the new efficient frontier with 3 assets (unless you have time to spare to build a macro in excel and want to impress your professor). Has investor utility improved? 6. Optimal capital allocation with short-selling constraints (10 points): How does your answer to question 5 change if negative weights are not allowed Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started