Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Charger, Inc. purchased 30% of Raider, Corp.'s outstanding common stock by issuing Charger's common stock worth S100,000 (the total par value of issued shares

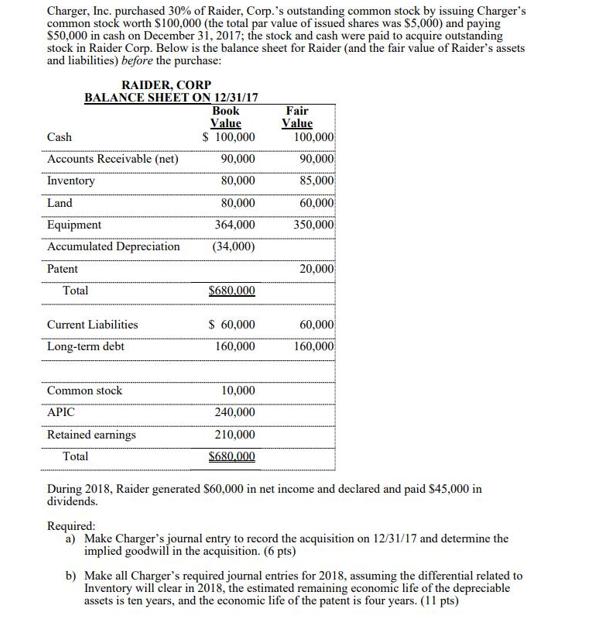

Charger, Inc. purchased 30% of Raider, Corp.'s outstanding common stock by issuing Charger's common stock worth S100,000 (the total par value of issued shares was $5,000) and paying S50,000 in cash on December 31, 2017; the stock and cash were paid to acquire outstanding stock in Raider Corp. Below is the balance sheet for Raider (and the fair value of Raider's assets and liabilities) before the purchase: RAIDER, CORP BALANCE SHEET ON 12/31/17 ook Value $ 100,000 90,000 Fair Value 100,000 Cash Accounts Receivable (net) Inventory 90,000 85,000 80,000 Land 80,000 60,000 Equipment 364,000 350,000 Accumulated Depreciation (34,000) Patent 20,000 Total $680.000 Current Liabilities $ 60,000 60,000 Long-term debt 160,000 160,000 Common stock 10,000 APIC 240,000 Retained earnings 210,000 Total $680.000 During 2018, Raider generated S60,000 in net income and declared and paid $45,000 in dividends. Required: a) Make Charger's journal entry to record the acquisition on 12/31/17 and determine the implied goodwill in the acquisition. (6 pts) b) Make all Charger's required journal entries for 2018, assuming the differential related to Inventory will clear in 2018, the estimated remaining economic life of the depreciable assets is ten years, and the economic life of the patent is four years. (11 pts)

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Equity investment method is applicable when the stake of purchase of other company stock is below ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started