i am having a hard time with the schedule C

the check fogure for it is 3'050

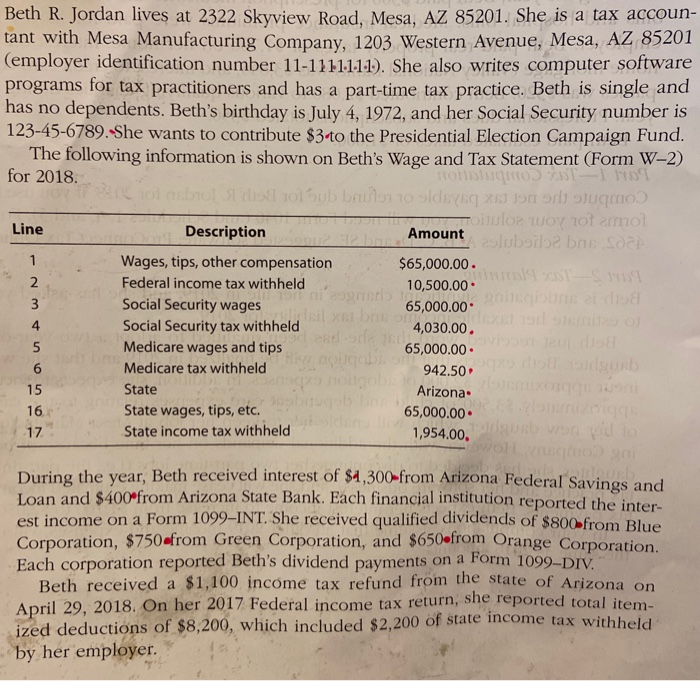

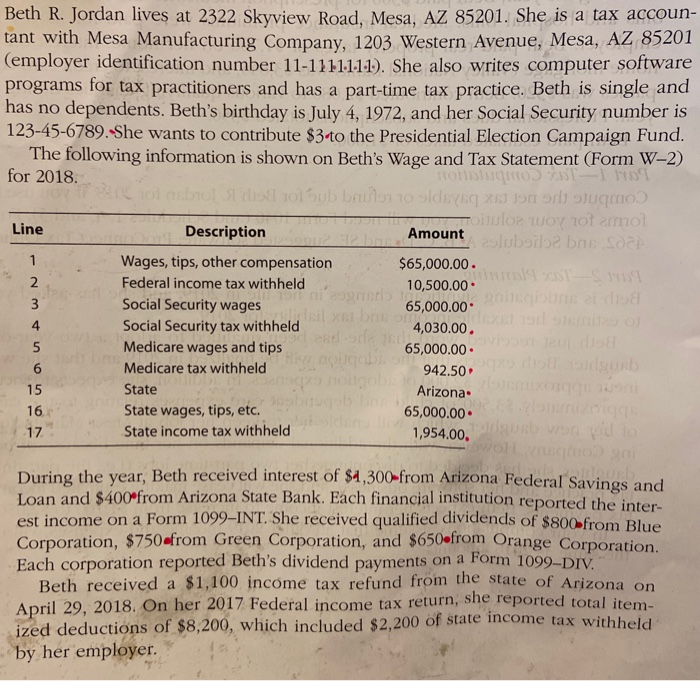

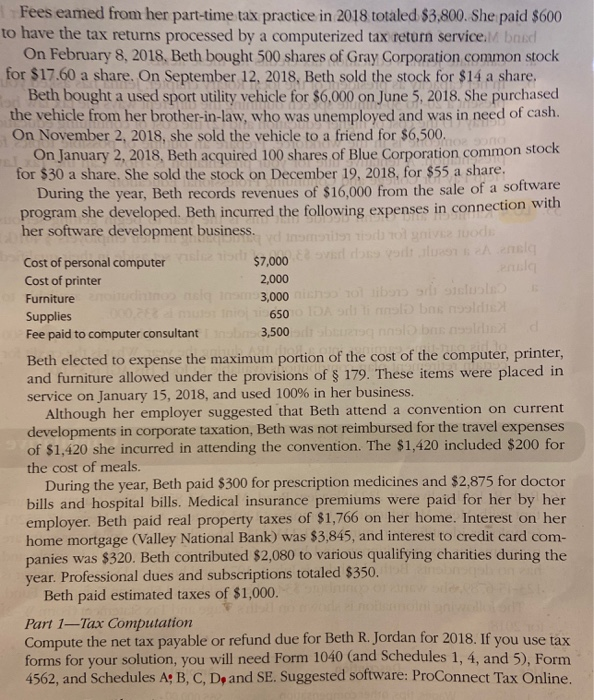

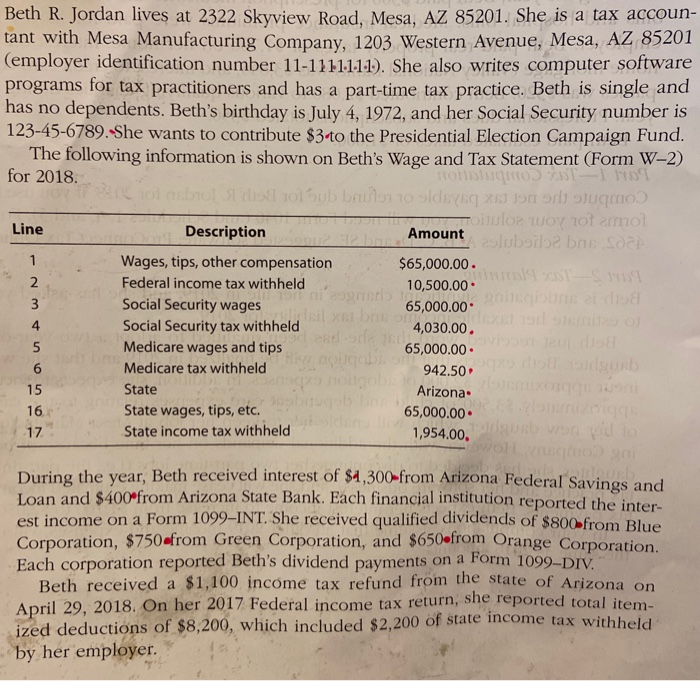

1 2 3 4 Beth R. Jordan lives at 2322 Skyview Road, Mesa, AZ 85201. She is a tax accoun- tant with Mesa Manufacturing Company, 1203 Western Avenue, Mesa, AZ 85201 (employer identification number 11-1111111). She also writes computer software programs for tax practitioners and has a part-time tax practice. Beth is single and has no dependents. Beth's birthday is July 4, 1972, and her Social Security number is 123-45-6789. She wants to contribute $34o the Presidential Election Campaign Fund. The following information is shown on Beth's Wage and Tax Statement (Form W-2) for 2018 stoso TINDI asbrol 101 Sub bruilo 10 days Xon o umo o muoy totamol Line Description Amount olubada bas son Wages, tips, other compensation $65,000.00 Federal income tax withheld grote 10,500.00 Social Security wages 65,000.00 XS bir Social Security tax withheld 4,030.00. 5 Medicare wages and tips 65,000.00 piger 6 Medicare tax withheld 942.50 Tursunb rogol 15 State Arizona 16 State wages, tips, etc. 65,000.00 17 State income tax withheld 1,954.00. Vaata 21 During the year, Beth received interest of $4,300-from Arizona Federal Savings and Loan and $400from Arizona State Bank. Each financial institution reported the inter- est income on a Form 1099-INT. She received qualified dividends of $800 from Blue Corporation, $750 from Green Corporation, and $650-from Orange Corporation. Each corporation reported Beth's dividend payments on a Form 1099-DIV. Beth received a $1,100 income tax refund from the state of Arizona on April 29, 2018. On her 2017 Federal income tax return, she reported total item- ized deductions of $8,200, which included $2,200 of state income tax withheld by her employer. Fees eamed from her part-time tax practice in 2018 totaled $3,800. She paid $600 to have the tax returns processed by a computerized tax return service. bard On February 8, 2018, Beth bought 500 shares of Gray Corporation common stock for $17.60 a share. On September 12, 2018, Beth sold the stock for $14 a share. Beth bought a used sport utility vehicle for $6,000 on June 5, 2018. She purchased the vehicle from her brother-in-law, who was unemployed and was in need of cash. On November 2, 2018, she sold the vehicle to a friend for $6,500. On January 2, 2018, Beth acquired 100 shares of Blue Corporation common stock for $30 a share. She sold the stock on December 19, 2018, for $55 a share. During the year, Beth records revenues of $16,000 from the sale of a software program she developed. Beth incurred the following expenses in connection with her software development business. Inom todo o give bodi Cost of personal computer $7,000 van Cost of printer 2,000 Furniture no nel 3,000 101 best sistol Supplies 650 Dalo bongo Fee paid to computer consultant 3,500 banglo brus og Beth elected to expense the maximum portion of the cost of the computer, printer, and furniture allowed under the provisions of $ 179. These items were placed in service on January 15, 2018, and used 100% in her business. Although her employer suggested that Beth attend a convention on current developments in corporate taxation, Beth was not reimbursed for the travel expenses of $1,420 she incurred in attending the convention. The $1,420 included $200 for the cost of meals. During the year, Beth paid $300 for prescription medicines and $2,875 for doctor bills and hospital bills. Medical insurance premiums were paid for her by her employer. Beth paid real property taxes of $1,766 on her home. Interest on her home mortgage (Valley National Bank) was $3,845, and interest to credit card com- panies was $320. Beth contributed $2,080 to various qualifying charities during the year. Professional dues and subscriptions totaled $350. Beth paid estimated taxes of $1,000. Part 1Tax Computation Compute the net tax payable or refund due for Beth R. Jordan for 2018. If you use tax forms for your solution, you will need Form 1040 (and Schedules 1, 4, and 5), Form 4562, and Schedules A, B, C, D, and SE. Suggested software: ProConnect Tax Online