Answered step by step

Verified Expert Solution

Question

1 Approved Answer

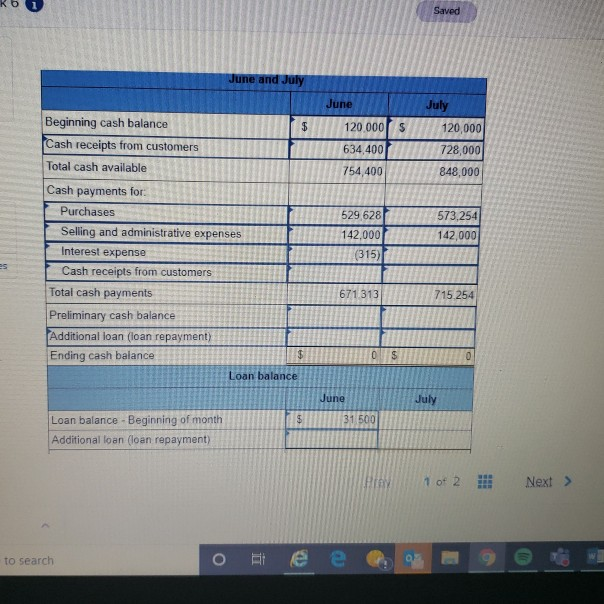

I am having a problem figuring out the Interest Expense for July. For June I multiplied 31500x12/12 What is the formula for July and I

I am having a problem figuring out the Interest

Expense for July. For June I multiplied 31500x12/12 What is the formula for July and I need help with the other formulas

Saved June and July June July 120.000 5 634,400 754,400 120,000 728,000 848,000 Beginning cash balance $ Cash receipts from customers Total cash available Cash payments for Purchases Selling and administrative expenses Interest expense Cash receipts from customers Total cash payments Preliminary cash balance Additional loan (loan repayment) Ending cash balance Loan balance 529 628 142,000 (315) 573,254 142,000 67 715 254 Loan balance - Beginning of month Additional loan (loan repayment) 1 of 2 Next > to search o te e Q. 39 Saved Help Save & E Chec 6,000 5,000 4,380 TAV, 960,000 959,000 688,000 cent experience shows that 30% of credit sales is collected in the month of the sale, 40% in the month after nd month after the sale, and 5% proves to be uncollectible. The product's purchase price is $110 per unit. 60% onth is paid in that month and the other 40% is paid in the next month. The company has a policy to maintain ory of 23% of the next month's unit sales plus a safety stock of 55 units. The April 30 and May 31 actual stent with this policy. Selling and administrative expenses for the year are $1,704,000 and are paid evenly sh. The company's minimum cash balance at month-end is $120,000. This minimum is maintained, if cash from the bank. If the balance exceeds $120,000, the company repays as much of the loan as it can minimum. This type of loan carries an annual 12% interest rate. On May 31, the loan balance is $31.500, and nce is $120,000 at shows the computation of cash collections of its credit sales (accounts receivable) in each of the months of at shows the computation of budgeted ending inventories in units) for April May June and July ise purchases budget for May June, and July. Report calculations in units and then show the dollar amount of owing the computation of cash payments for product purchases for June and July t for June and July, including any loan activity and interest expense. Compute the loan balance at the end of Pte 1 of 2 Next > o B e e Q 1 9 wa Adres 0 http://tinerary Saved June and July June July 120.000 5 634,400 754,400 120,000 728,000 848,000 Beginning cash balance $ Cash receipts from customers Total cash available Cash payments for Purchases Selling and administrative expenses Interest expense Cash receipts from customers Total cash payments Preliminary cash balance Additional loan (loan repayment) Ending cash balance Loan balance 529 628 142,000 (315) 573,254 142,000 67 715 254 Loan balance - Beginning of month Additional loan (loan repayment) 1 of 2 Next > to search o te e Q. 39 Saved Help Save & E Chec 6,000 5,000 4,380 TAV, 960,000 959,000 688,000 cent experience shows that 30% of credit sales is collected in the month of the sale, 40% in the month after nd month after the sale, and 5% proves to be uncollectible. The product's purchase price is $110 per unit. 60% onth is paid in that month and the other 40% is paid in the next month. The company has a policy to maintain ory of 23% of the next month's unit sales plus a safety stock of 55 units. The April 30 and May 31 actual stent with this policy. Selling and administrative expenses for the year are $1,704,000 and are paid evenly sh. The company's minimum cash balance at month-end is $120,000. This minimum is maintained, if cash from the bank. If the balance exceeds $120,000, the company repays as much of the loan as it can minimum. This type of loan carries an annual 12% interest rate. On May 31, the loan balance is $31.500, and nce is $120,000 at shows the computation of cash collections of its credit sales (accounts receivable) in each of the months of at shows the computation of budgeted ending inventories in units) for April May June and July ise purchases budget for May June, and July. Report calculations in units and then show the dollar amount of owing the computation of cash payments for product purchases for June and July t for June and July, including any loan activity and interest expense. Compute the loan balance at the end of Pte 1 of 2 Next > o B e e Q 1 9 wa Adres 0 http://tineraryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started