Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i am having difficulties balancing not sure why on January 1, 2021 the general ledger of ACME Fireworks includes the following account balances Accounts Accounts

i am having difficulties balancing not sure why

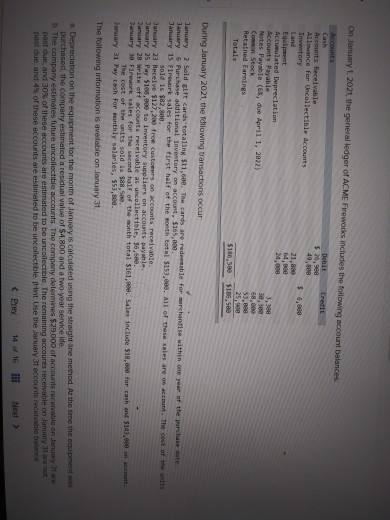

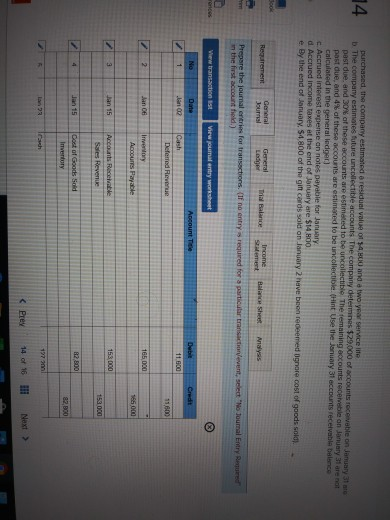

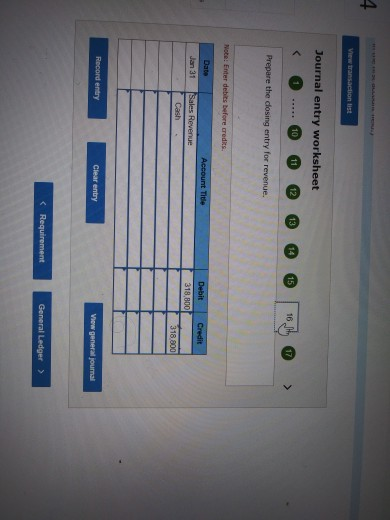

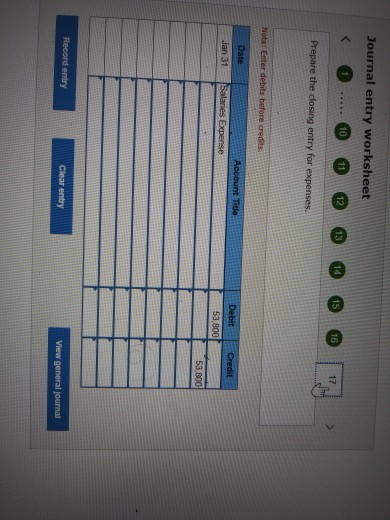

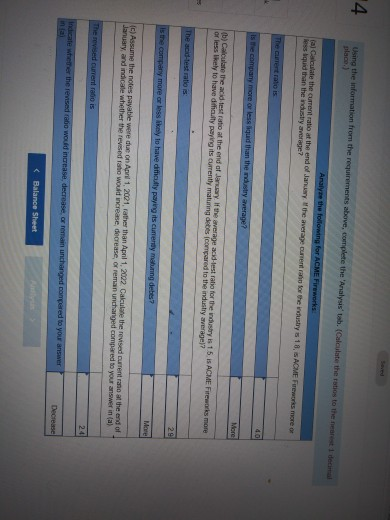

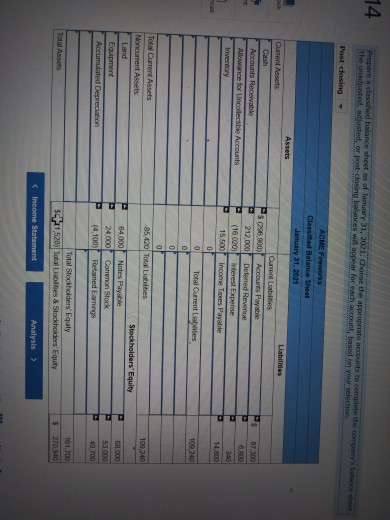

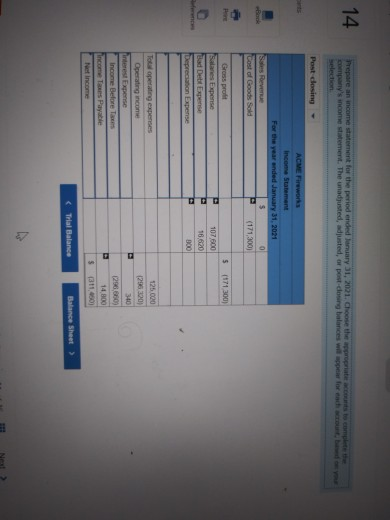

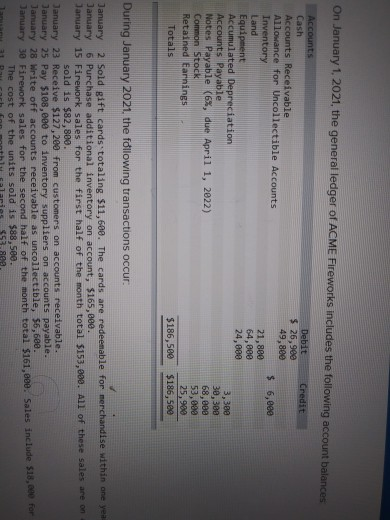

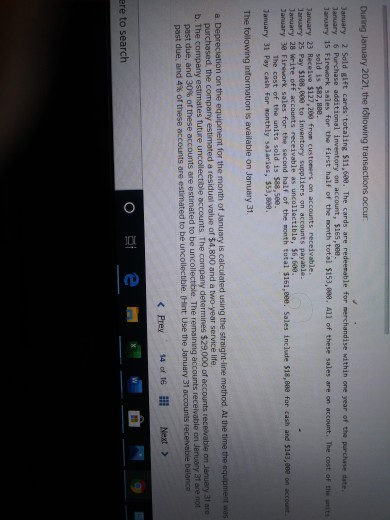

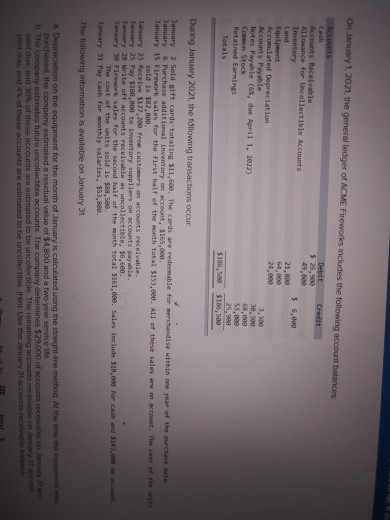

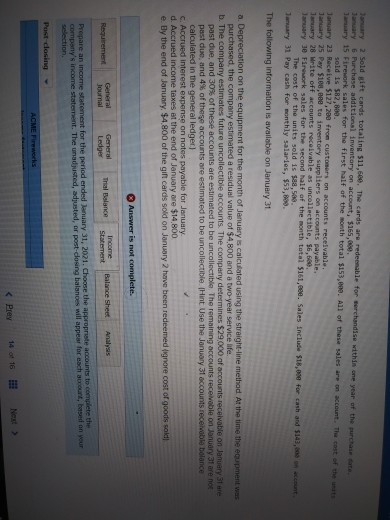

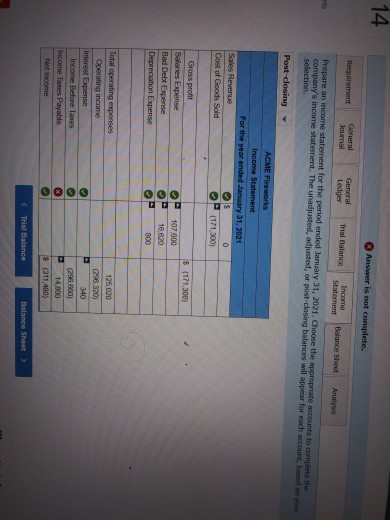

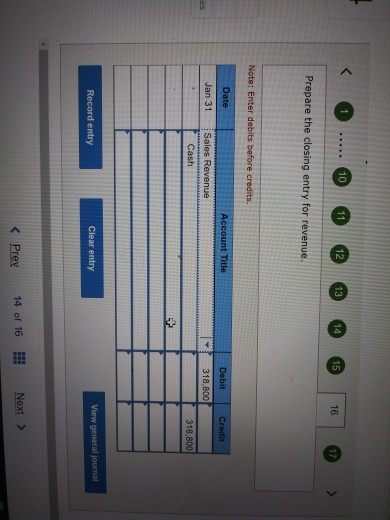

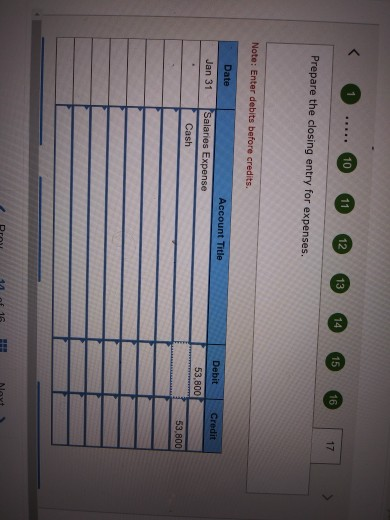

on January 1, 2021 the general ledger of ACME Fireworks includes the following account balances Accounts Accounts Receivable Allowance for Uncollectible Accounts Investor Land Fat Accumulated Depreciation Accounts Payable Notes Payable (6x, due April 1, 2022) Common Stock Retained Earnings Totals Equipment Debit Credit 5,900 49,500 21,800 14,860 24,000 3,300 30,00 68,000 53,880 25,990 $180,500 $106,500 During January 2021 the filowing transactions occur January 2 Sold gift cards totaling $11,600. The cards are redeemable for marchandise within one year of the purchase date January 6 Purchase additional inventory on account, $165,000 January 15 Firework sales for the first half of the month total $153,690. All of these sales are on account. The cost of the units sold is $82,800 January 23 Receive $127,209 froe customers on accounts receivable January 25 Pay 5105,000 to imventory Suppliers on accounts payable Danuary 28 Write oft accounts receivable as uncollectible, $6,500 January 30 Firework sales for the second half of the month total $161,00. Sales Include $18,000 for msh and $143.00 on cout The cost of the units sold is $8,500 January 31 Pay cash for monthly salaries, 553,600. The following information is available on January 31 Depreciation on the equipment for the month of January is calculated using the straight-ane method. At the time the equipments purchased the company estimated a residual value of $4.800 and a two-year service life. The company estimates future uncollectible accounts. The company determines $29.000 of accounts receivable on January past due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 71 are not past due, and 45 of these accounts are estimated to be uncollectble. (Hint Use the January 3t accounts receivable balance 4. View transaction ist Journal entry worksheet 10 11 12 13 15 16 17 Prepare the closing entry for revenue. Note: Enter debits before credits Date Account Title Debit Credit Jan 31 Sales Revenue Cash 318,800 318 800 Record entry Clear entry View general journal Journal entry worksheet 14 Prepare an income statement for the period ended January 31, 2021. Choose the appropriate to complete company's income statement. The unadjusted, adjusted, or post-closing balances will appear for each oth Selection Post closing- ACV Fireworks Income Statement For the year ended January 31, 2021 Sales Revenue S 0 Cost of Goods Sold (171,300 5 (171300) Gross profit Salanes Expense Bad Det Expense Depreciation Expense 107600 16,620 300 Total operating expenses Operating income interest Expense Income Before Tas Income Taxes Payable Net Income 125.000 1206200 340 1296 860) 14800 311.50 $ e ere to search On January 1 2021, the general ledger of ACME Fireworks includes the following account balances Dobit Casti Credit $ 26,980 Accounts Receivable Allowance for Uncollectible Accounts Inventory $ 6,000 21,800 Land 54,00 Equipment Accumulated Depreciation 24,000 Accounts Payable Hites Payable (6x, due April 1, 2022) 38,3 68,000 Coreon Stock Retained Earnings 25.900 Totals $136,500 $185,500 During January 2021, the following transactions occur January 2 Sold gift cards totaling $11,600. The cards are redeemable for merchandise within one year of the purchase date January 6 Purchase additional Inventory on account, 5165,000 January 15 Firework sales for the first half of the month total $153,000. All of these sales are on account. The rest of the sold is $82,000 January 23 Receive $121,200 from customers on accounts receivable January 25 Pay $10,000 to inventory suppliers on accounts payable Jamuary 28 Write off accounts receivable as uncollectible, 56,600. January 10 Firework sales for the second half of the month total $161,000. Sales include $10,000 for cash and $14,000 stunt The cost of the units sold is $88,500 January 31 tay cash for monthly salaries, $53,8ee. The following information is available on January 31 Depreciation on the equipment for the month of January is calculated using the straight line method At the time there purchased the company estimated a residual value of $4,800 and a two year service D. The company estimates future uncollectible accounts. The company determines $29.000 of accounts receive on January past due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January pasi due and of these accounts are estimated to be uncollectible. (Hint Use the January 31 accounts recebalan January 2 Sold gift cards totaling 511,600. The cards are redeemable for cerchandise within one year of the purchase January 6 Purchase additional inventory on account, $165,000 Jary 15 Firework sales for the first half of the month total $153,000. All of these sales are on account. The cost of the sold is 582,800. January 23 Receive $127, 200 from customers on accounts receivable January 25 Pay $100,eee to inventory suppliers on accounts payable. laruary 28 Write off accounts receivable as uncollectible, 56,600 January 10 Firework sales for the second half of the month total $161,00. Sales include $18,000 for cash and $147,00 The cost of the units sold is 8,500 January 31 Pay cash for monthly salaries, $53,800 The following information is available on January 31 a. Depreciation on the equipment for the month of January is calculated using the straight-line method At the time the coupment was purchased, the company timated ual value of $4,800 and a two-year service afe b. The company estimates future uncollectible accounts. The company determines $29,000 of accounts receivable on January 31 are past due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January at are not past due, and 4% of these accounts are estimated to be uncollectible. (Hint Use the January 31 accounts receivable balance calculated in the general ledger) c. Accrued interest expense on notes payable for January d. Accrued income taxes at the end of January are $14,800 e. By the end of January $4.800 of the gift cards sold on January 2 have been redeemed ignore cost of goods sold Answer is not complete General General Requirement Income Thal Balance Balance Sheet Journal Ledger Statement Prepare an income statement for the period ended January 31, 2021. Choose the appropriate accounts to complete the company's income statement. The unadjusted, adjusted, or post-dosing balances will appear for each count, based on your selection Post-clasing ACME Fireworks 14 of 16 Prey Next > 14 Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Analyse Prepare an income statement for the period ended January 31, 2021. Choose the appropriate accounts to complete the company's income statement. The unadjusted, adjusted, or post-closing balances will appear for each account based on your selection Post-closing ACME Fireworks Income Statement For the year ended January 31, 2021 Sales Revenue s 0 Cost of Goods Sold (171,300 oo $ (171,300) Gross pront Salaries Expense Bad Debt Expense Depreciation Expense ooo 107,600 16.620 800 Total operating expenses Operating income Interest Expense Income Before Taxes Income Taxes Payable Net Income 126,020 (296,320) 340 (296 660) 14,900 $ (311,480) x (Trial Balance Balance Sheet > 10 11 12 13 14 15 16 17 Prepare the closing entry for revenue. Note: Enter debits before credits Date Account Title Debit Credit Jan 31 es 318,800 Sales Revenue Cash 318,800 + Record entry Clear entry View general journal ... 10 11 12 13 14 15 16 17 Prepare the closing entry for expenses. Note: Enter debits before credits. Date Jan 31 Credit Account Title Salaries Expense Cash Debit 53,800 53,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started