Question

I am having difficulty creating a trial balance sheet for Dec-31st which includes the balance sheet from Dec-23rd and the remaining journalized transactions. (All can

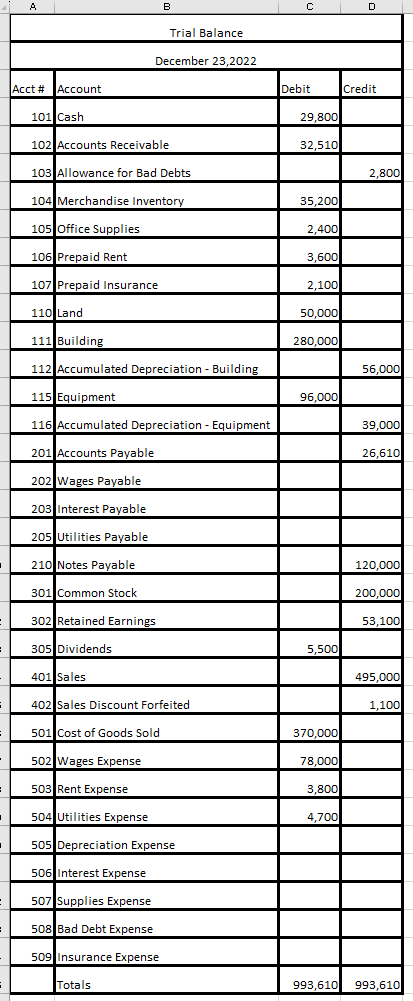

I am having difficulty creating a trial balance sheet for Dec-31st which includes the balance sheet from Dec-23rd and the remaining journalized transactions. (All can be found below.) Please read everything below. The total for Dec-31st trial balance should be $1,010,560 for Debit and Credit. Help would be greatly appreciated.

The image below is of the Dec-23 Trial Balance sheet.

The rest of the journal statements below have been journalized.

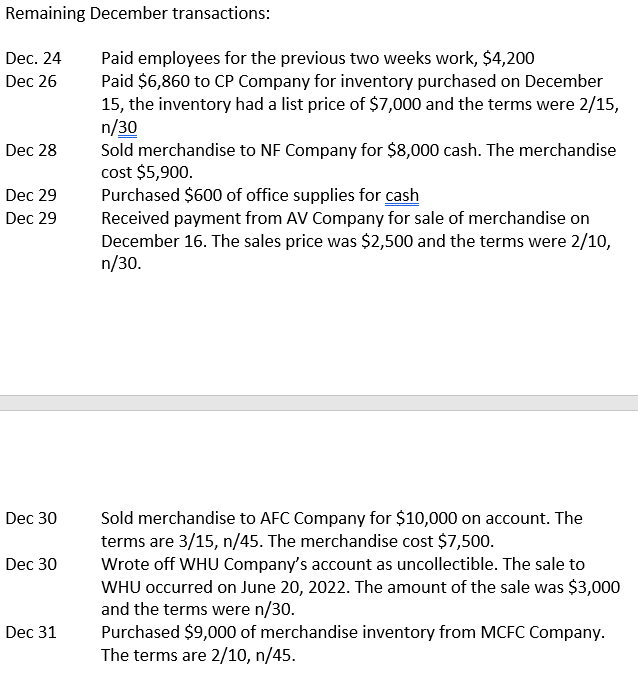

==Here what the transactions above have been journalized as. == =============================================== Dec. 24: To record payment to workers for previous two weeks work Debit Wages Expense for $4,200 Credit Cash for $4,200

Dec 26: To record purchase of inventory from KP Company with 2/15, n/30 terms Debit Inventory for $6,860 Credit Accounts Payable for $6,860

Dec 28: To record sale of merchandise to MF Company for $8,000 cash Debit Cash for $8,000 Credit Sales Revenue for $8,000 Debit Cost of Goods Sold for $5,900 Credit Inventory for $5,900

Dec 29: To record purchase of office supplies for cash Debit Office Supplies for $600 Credit Cash for $600

Dec 29: To record receipt of payment from AW Company for sale of merchandise with 2/10, n/30 terms Debit Cash for $2,450 ([$2,500 - ($2,500 * 0.02)]) Credit Accounts Receivable for $2,500

Dec 30: To record sale of merchandise to APC Company on account with 3/15, n/45 terms Debit Accounts Receivable for $9,700 ([$10,000 - ($10,000 * 0.03)]) Credit Sales Revenue for $10,000 Debit Cost of Goods Sold for $7,500 Credit Inventory for $7,500

Dec 30: To record writing off WHY Company's account as uncollectible Debit Bad Debt Expense for $3,000 Credit Accounts Receivable for $3,000

Dec 31: To record purchase of merchandise inventory from MSPC Company with 2/10, n/45 terms Debit Inventory for $8,820 ([$9,000 - ($9,000 * 0.02)]) Credit Accounts Payable for$8,820

December 31 Trial Balance Debits and Credits =$1,010,560 Remaining December transactions: Dec. 24 Paid employees for the previous two weeks work, $4,200 Dec 26 Paid $6,860 to CP Company for inventory purchased on December 15 , the inventory had a list price of $7,000 and the terms were 2/15, n/30 Dec 28 Sold merchandise to NF Company for $8,000 cash. The merchandise cost $5,900. Dec 29 Purchased $600 of office supplies for cash Dec 29 Received payment from AV Company for sale of merchandise on December 16 . The sales price was $2,500 and the terms were 2/10, n/30. Dec 30 Sold merchandise to AFC Company for $10,000 on account. The terms are 3/15,n/45. The merchandise cost $7,500. Dec 30 Wrote off WHU Company's account as uncollectible. The sale to WHU occurred on June 20,2022 . The amount of the sale was $3,000 and the terms were n/30. Dec 31 Purchased $9,000 of merchandise inventory from MCFC Company. The terms are 2/10, n/45Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started