I am having difficulty starting a cost accounting project. I am confident I can work through the problem and entire project if I knew how to get it started. There is a lot of information, and the professor specifies that everything is PRETAX. Every problem I have worked thus far has included tax. If I could have some guidance as to how to start this project (what numbers are relevant to use) and/or how to set it up, that would be helpful.

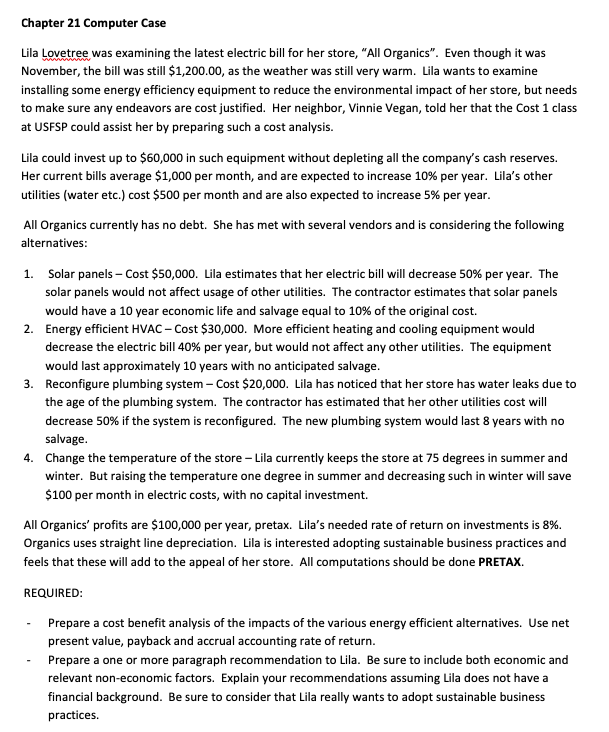

Chapter 21 Computer Case Lila Lovetree was examining the latest electric bill for her store, "All Organics". Even though it was November, the bill was still $1,200.00, as the weather was still very warm. Lila wants to examine installing some energy efficiency equipment to reduce the environmental impact of her store, but needs to make sure any endeavors are cost justified. Her neighbor, Vinnie Vegan, told her that the Cost 1 class at USFSP could assist her by preparing such a cost analysis. Lila could invest up to $60,000 in such equipment without depleting all the company's cash reserves. Her current bills average $1,000 per month, and are expected to increase 10% per year. Lila's other utilities (water etc.) cost $500 per month and are also expected to increase 5% per year. All Organics currently has no debt. She has met with several vendors and is considering the following alternatives: 1. Solar panels - Cost $50,000. Lila estimates that her electric bill will decrease 50% per year. The solar panels would not affect usage of other utilities. The contractor estimates that solar panels would have a 10 year economic life and salvage equal to 10% of the original cost. 2. Energy efficient HVAC - Cost $30,000. More efficient heating and cooling equipment would decrease the electric bill 40% per year, but would not affect any other utilities. The equipment would last approximately 10 years with no anticipated salvage. 3. Reconfigure plumbing system - Cost $20,000. Lila has noticed that her store has water leaks due to the age of the plumbing system. The contractor has estimated that her other utilities cost will decrease 50% if the system is reconfigured. The new plumbing system would last 8 years with no salvage. 4. Change the temperature of the store - Lila currently keeps the store at 75 degrees in summer and winter. But raising the temperature one degree in summer and decreasing such in winter will save $100 per month in electric costs, with no capital investment. All Organics' profits are $100,000 per year, pretax. Lila's needed rate of return on investments is 8%. Organics uses straight line depreciation. Lila is interested adopting sustainable business practices and feels that these will add to the appeal of her store. All computations should be done PRETAX. REQUIRED: Prepare a cost benefit analysis of the impacts of the various energy efficient alternatives. Use net present value, payback and accrual accounting rate of return. Prepare a one or more paragraph recommendation to Lila. Be sure to include both economic and relevant non-economic factors. Explain your recommendations assuming Lila does not have a financial background. Be sure to consider that Lila really wants to adopt sustainable business practices