Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am having issues getting the right formula. Please solve and explain. Thanks! Part 1: You are considering the purchase of a new SUV for

I am having issues getting the right formula. Please solve and explain. Thanks!

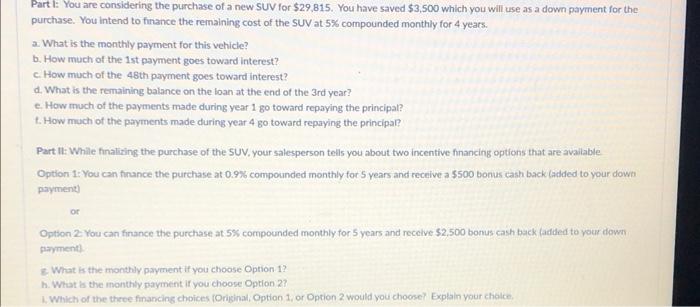

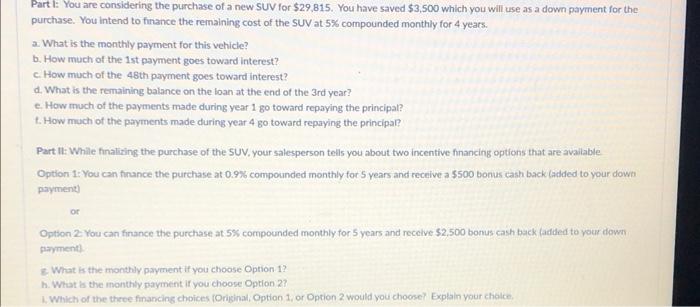

Part 1: You are considering the purchase of a new SUV for $29,815. You have saved $3,500 which you will use as a down payment for the purchase. You intend to finance the reinaining cost of the SUV at 5% compounded monthly for 4 years. a. What is the monthly payment for this vehicle? b. How much of the 1st payment goes toward interest? c. How much of the 48 th payment goes toward interest? d. What is the remaining balance on the loan at the end of the 3rd year? e. How much of the payments made during year 1go toward repaying the principal? t. How much of the payments made during year 4 go toward repaying the principar? Part It: While finalizing the purchase of the SUV, your salesperson tells you about two incentive financing options that are available Option 1:You can finance the purchase at 0.9% compounded monthly for 5 years and receive a $500 bonus cash back ladded to your down payment) or Option 2 You can finance the purchase at 58 compounded monthly for 5 years and receive $2,500 bonus cash back fadded to your down parmment). 8. What is the monthy payment if you choose Option 1 ? h. What is the monthiy payment if you choose Option 2? 1. Which of the there financing choices \{Original; Option 1, or Option 2 would you choosel Explain your cholice. Part 1: You are considering the purchase of a new SUV for $29,815. You have saved $3,500 which you will use as a down payment for the purchase. You intend to finance the reinaining cost of the SUV at 5% compounded monthly for 4 years. a. What is the monthly payment for this vehicle? b. How much of the 1st payment goes toward interest? c. How much of the 48 th payment goes toward interest? d. What is the remaining balance on the loan at the end of the 3rd year? e. How much of the payments made during year 1go toward repaying the principal? t. How much of the payments made during year 4 go toward repaying the principar? Part It: While finalizing the purchase of the SUV, your salesperson tells you about two incentive financing options that are available Option 1:You can finance the purchase at 0.9% compounded monthly for 5 years and receive a $500 bonus cash back ladded to your down payment) or Option 2 You can finance the purchase at 58 compounded monthly for 5 years and receive $2,500 bonus cash back fadded to your down parmment). 8. What is the monthy payment if you choose Option 1 ? h. What is the monthiy payment if you choose Option 2? 1. Which of the there financing choices \{Original; Option 1, or Option 2 would you choosel Explain your cholice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started