Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am having trouble calculating bad debt expense. Have tried 800,000*0.02 but that is not working. Have also done 813000*0.02 and 787000*0.02. I even added

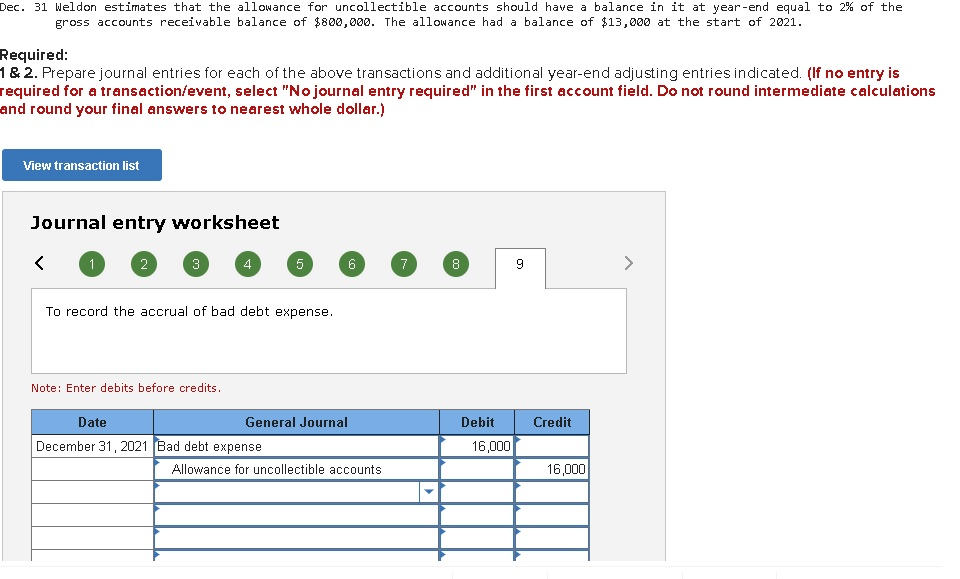

I am having trouble calculating bad debt expense. Have tried 800,000*0.02 but that is not working. Have also done 813000*0.02 and 787000*0.02. I even added tried adding and subtracting the 13000 from 800000*0.02 and couldn't solve. Please help. Thanks!

Dec. 31 Weldon estimates that the allowance for uncollectible accounts should have a balance in it at year-end equal to 2% of the gross accounts receivable balance of $800,000. The allowance had a balance of $13,000 at the start of 2021. Required: 1 & 2. Prepare journal entries for each of the above transactions and additional year-end adjusting entries indicated. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations and round your final answers to nearest whole dollar.) View transaction list Journal entry worksheet 7 To record the accrual of bad debt expense. Note: Enter debits before credits. Credit Date General Journal December 31, 2021 (Bad debt expense Allowance for uncollectible accounts Debit 16,000 16,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started