Answered step by step

Verified Expert Solution

Question

1 Approved Answer

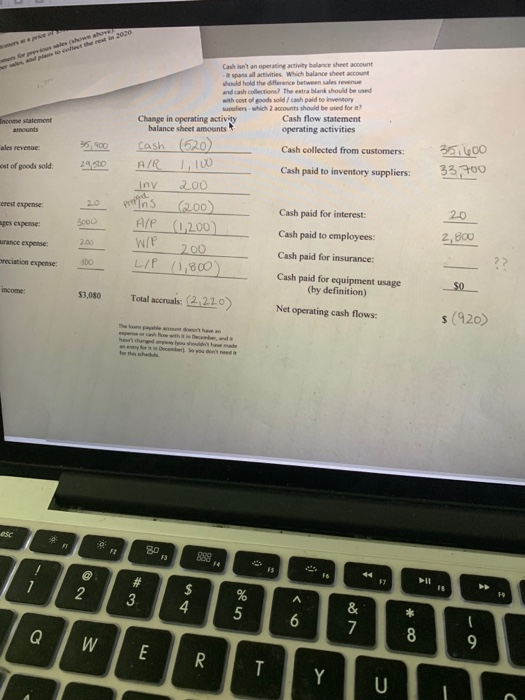

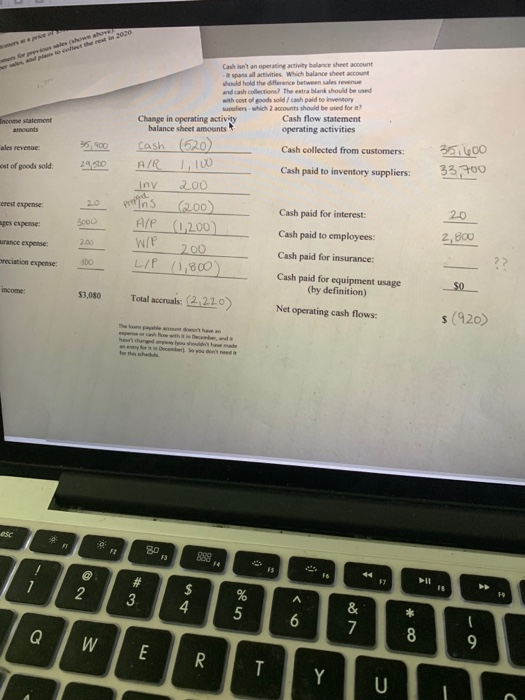

I am having trouble determining what goes in this middle column between my Income statement and cash flow statement. I emailed my professor the photo

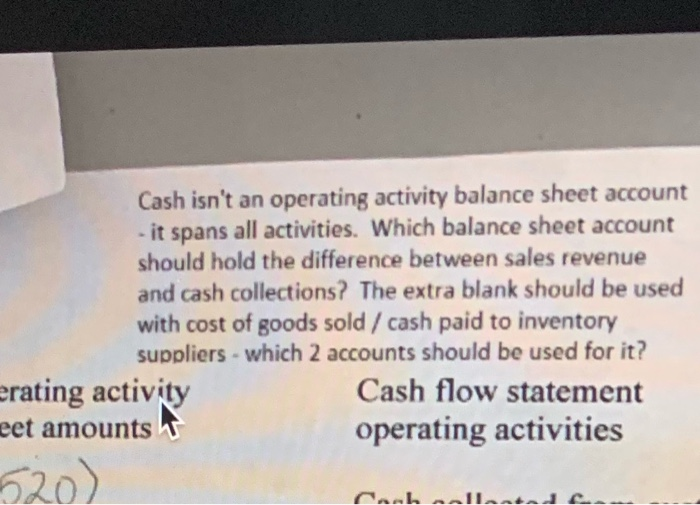

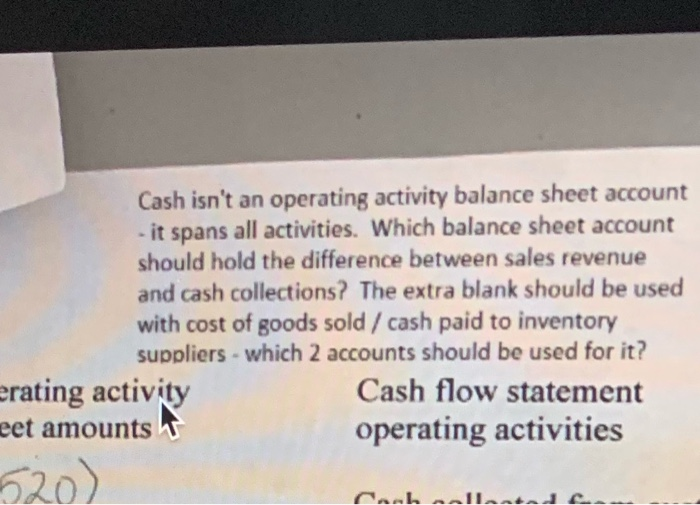

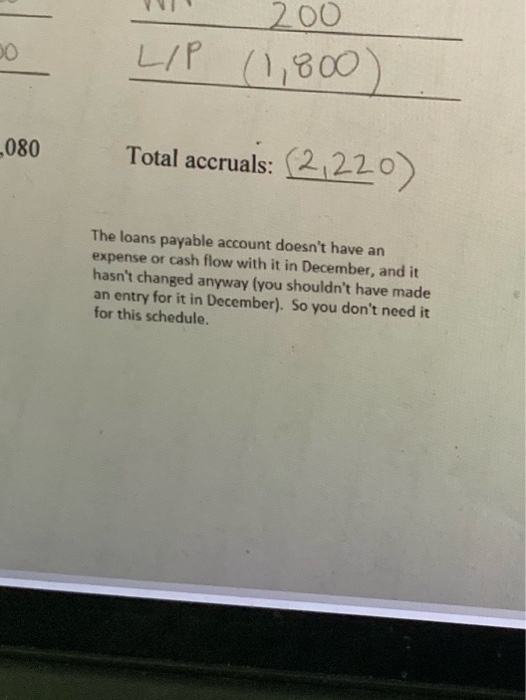

I am having trouble determining what goes in this middle column between my Income statement and cash flow statement. I emailed my professor the photo attached and he sent it it back with the top and bottom notes on what to fix.... i dont understand what would replace cash and the other columns he mentioned. ignore the income statement side and cash flow side, those are correct! (i added close ups of his comments in order to see it better)

i just need the label for the middle columns that go in between no numbers! so for examble, he commented saying that one is difference between sales rev and cash collections, what would that be? net income?

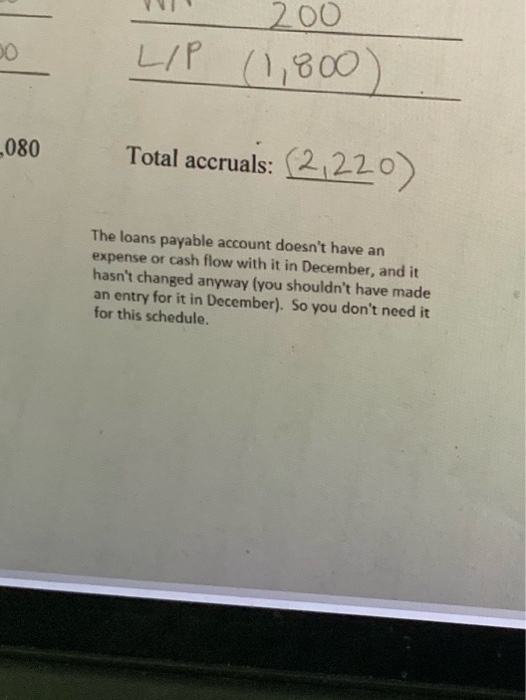

Cashisn't an operating activity balance sheet account pasal activities. Which balance sheet account Whould hold the difference between sales revenue and cash collections. The extra Wank should be used with cost of goods sold cash paid to inventory soliers which accounts should be used for it? Change in operating activity Cash flow statement balance sheet amounts operating activities Income statement ales revenue 35.900 Cash collected from customers: 35,600 33,700 ost of goods sold: Cash paid to inventory suppliers: erest expense: Cash (520) AIR 1,100 iny 200 pretins (200) A/ P0200 W/P 200 L/ P 1 ,800 Cash paid for interest: 20 ages expense: 2, 800 aurance expense: Cash paid to employees: Cash paid for insurance: reciation expense DO Cash paid for equipment usage (by definition) income: SO $3,080 Total accruals: 2,220) Net operating cash flows: $(920) Cash isn't an operating activity balance sheet account it spans all activities. Which balance sheet account should hold the difference between sales revenue and cash collections? The extra blank should be used with cost of goods sold / cash paid to inventory suppliers - which 2 accounts should be used for it? erating activity Cash flow statement eet amounts operating activities 620) Challenc LIP 200 (1,800) -080 Total accruals: (2,220) The loans payable account doesn't have an expense or cash flow with it in December, and it hasn't changed anyway you shouldn't have made an entry for it in December). So you don't need it for this schedule. Cashisn't an operating activity balance sheet account pasal activities. Which balance sheet account Whould hold the difference between sales revenue and cash collections. The extra Wank should be used with cost of goods sold cash paid to inventory soliers which accounts should be used for it? Change in operating activity Cash flow statement balance sheet amounts operating activities Income statement ales revenue 35.900 Cash collected from customers: 35,600 33,700 ost of goods sold: Cash paid to inventory suppliers: erest expense: Cash (520) AIR 1,100 iny 200 pretins (200) A/ P0200 W/P 200 L/ P 1 ,800 Cash paid for interest: 20 ages expense: 2, 800 aurance expense: Cash paid to employees: Cash paid for insurance: reciation expense DO Cash paid for equipment usage (by definition) income: SO $3,080 Total accruals: 2,220) Net operating cash flows: $(920) Cash isn't an operating activity balance sheet account it spans all activities. Which balance sheet account should hold the difference between sales revenue and cash collections? The extra blank should be used with cost of goods sold / cash paid to inventory suppliers - which 2 accounts should be used for it? erating activity Cash flow statement eet amounts operating activities 620) Challenc LIP 200 (1,800) -080 Total accruals: (2,220) The loans payable account doesn't have an expense or cash flow with it in December, and it hasn't changed anyway you shouldn't have made an entry for it in December). So you don't need it for this schedule Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started