Question

I am having trouble establishing a cash in flow and out flow for this portion of my project. I feel confident that once I have

I am having trouble establishing a cash in flow and out flow for this portion of my project. I feel confident that once I have guidance on this portion, I can proceed with NPV, payback and ARROR.

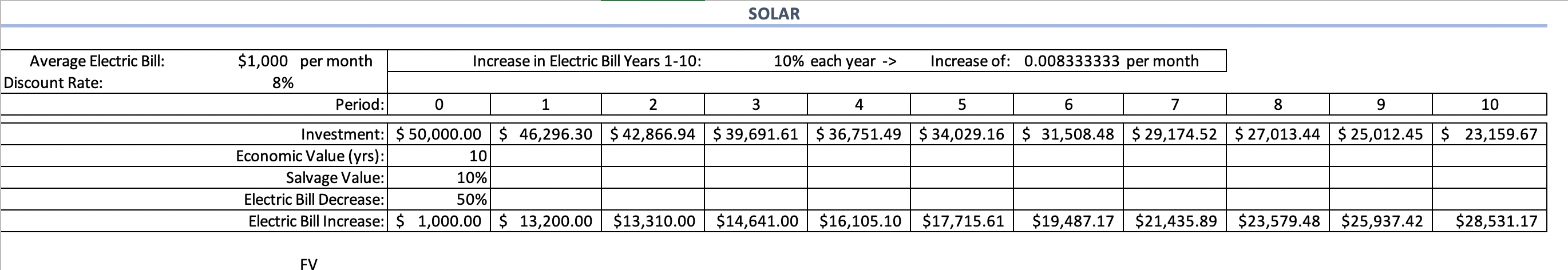

SUMMARY: The average electric bill is $1000 per month with an expected increase of 10% each year over a period of 10 years without solar. The initial investment in the solar panels is $50,000. Salvage value is 10% with an expected decrease in the bill by 50% per year.

I need to re-evaluate the numbers in the top row of my table again, so I will go back to that. For now, I need to establish the cash flows, and I feel like I am completely lost with that. Everything is PRETAX as well. Thank you for ANY guidance that will put me on the right path!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started