Answered step by step

Verified Expert Solution

Question

1 Approved Answer

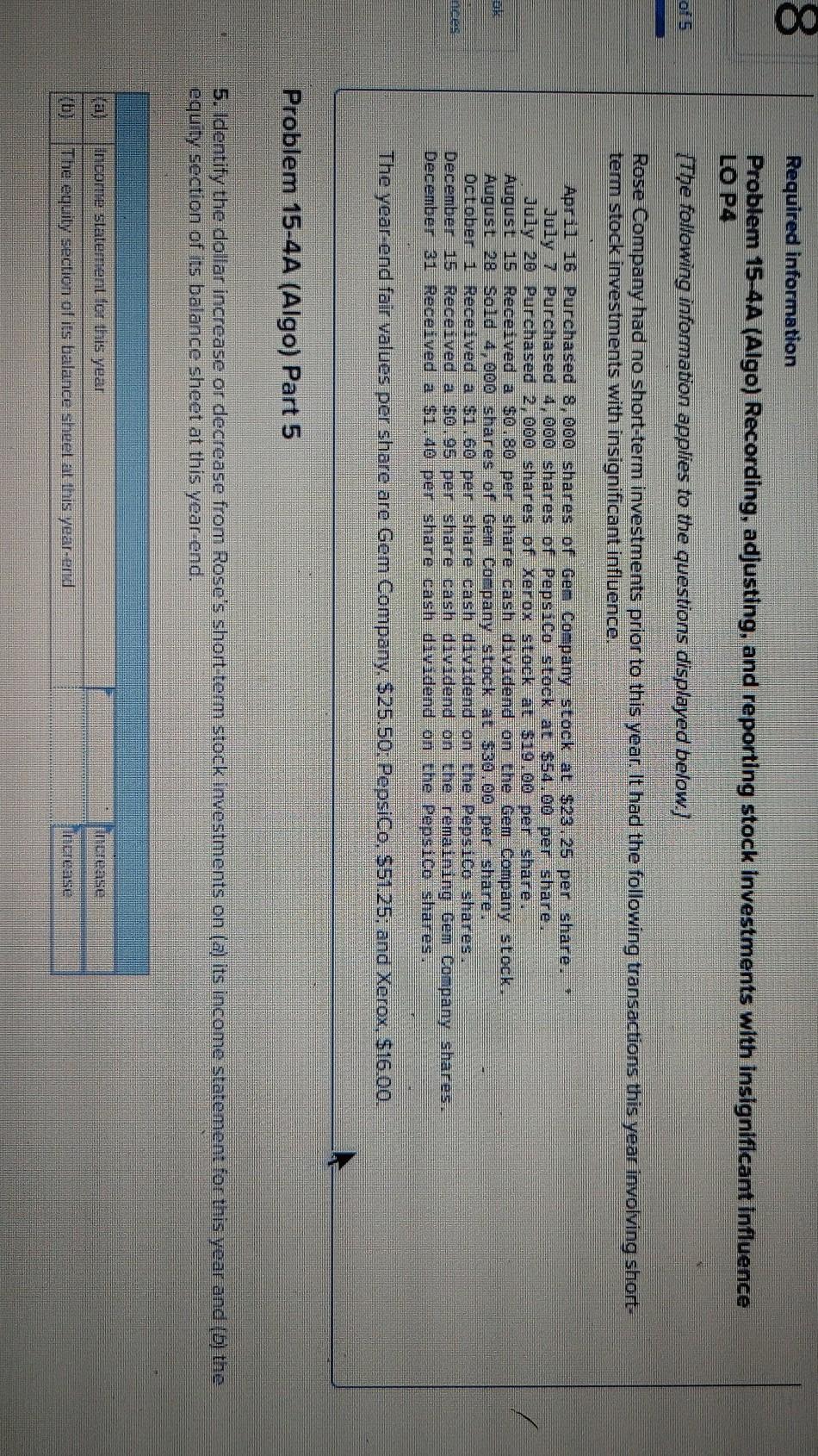

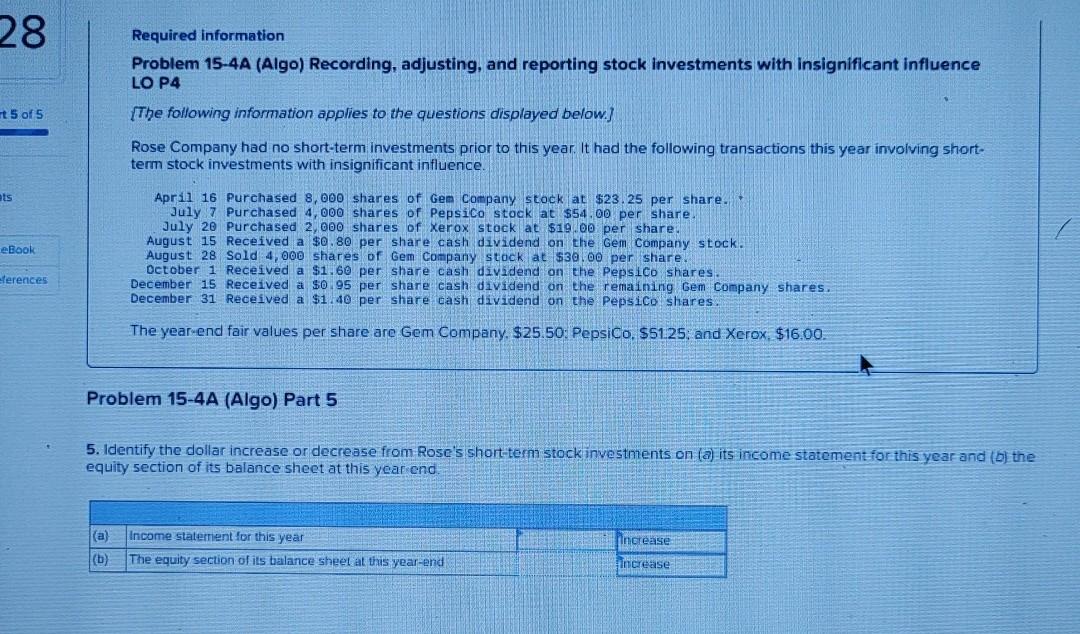

I am having trouble finding these 2 numbers. The increase part is correct. For A I have added all dividends plus the income from the

I am having trouble finding these 2 numbers. The increase part is correct. For A I have added all dividends plus the income from the stock sale and it says it's wrong.

8 Required information Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LO P4 {The following information applies to the questions displayed below.} Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short- term stock investments with insignificant influence. April 16 Purchased 8,000 shares of Gem Company stock at $23.25 per. share. + July 7 Purchased 4,000 shares of PepsiCo stock at $54.00 per share. July 20 Purchased 2,000 shares of Xerox stock at $19.00 per share. August 15 Received a $0.80 per share cash dividend on the Gem Company stock. August 28 Sold 4,000 shares of Gem Company stock at $30.00 per share. October 1 Received a $1.60 per share cash dividend on the PepsiCo shares. December 15 Received a $0.95 per share cash dividend on the remaining Gem Company shares. December 31 Received a $1.40 per share cash dividend on the PepsiCo shares. The year-end fair values per share are Gem Company. $25.50: PepsiCo. $51.25; and Xerox. $16.00. Problem 15-4A (Algo) Part 5 5. Identify the dollar increase or decrease from Rose's short-term stock investments on (a) its income statement for this year and (5) the equity section of its balance sheet at this year-end. Lilase Incontre statement for this year The equity section of its balance sheel at this year-end Increase 28 Required information Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LO P4 t 5 of 5 [The following information applies to the questions displayed below.) Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short- term stock investments with insignificant influence. ets eBook April 16 Purchased 8,000 shares of Gem Company stock at $23.25 per share. July 7 Purchased 4,000 shares of PepsiCo stock at $54.00 per share. July 20 Purchased 2,000 shares of Xerox stock at $19.00 per share. August 15 Received a $0.80 per share cash dividend on the Gem Company stock. August 28 Sold 4,000 shares of Gem Company stock at $30.00 per share. October 1 Received a $1.60 per share cash dividend on the PepsiCo shares December 15 Received a $0.95 per share cash dividend on the remaining Gem Company shares. December 31 Received a $1.40 per share cash dividend on the PepsiCo shares. eferences The year-end fair values per share are Gem Company. $25.50: PepsiCo. $51.25: and Xerox, $16.00. Problem 15-4A (Algo) Part 5 5. Identify the dollar increase or decrease from Rose's short-term stock investments on la its income statement for this year and (b) the equity section of its balance sheet at this year end. Income statement for this year The equity section of its balance sheet at this year-end increase Increase (b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started