I am having trouble fully understanding these.

...

....

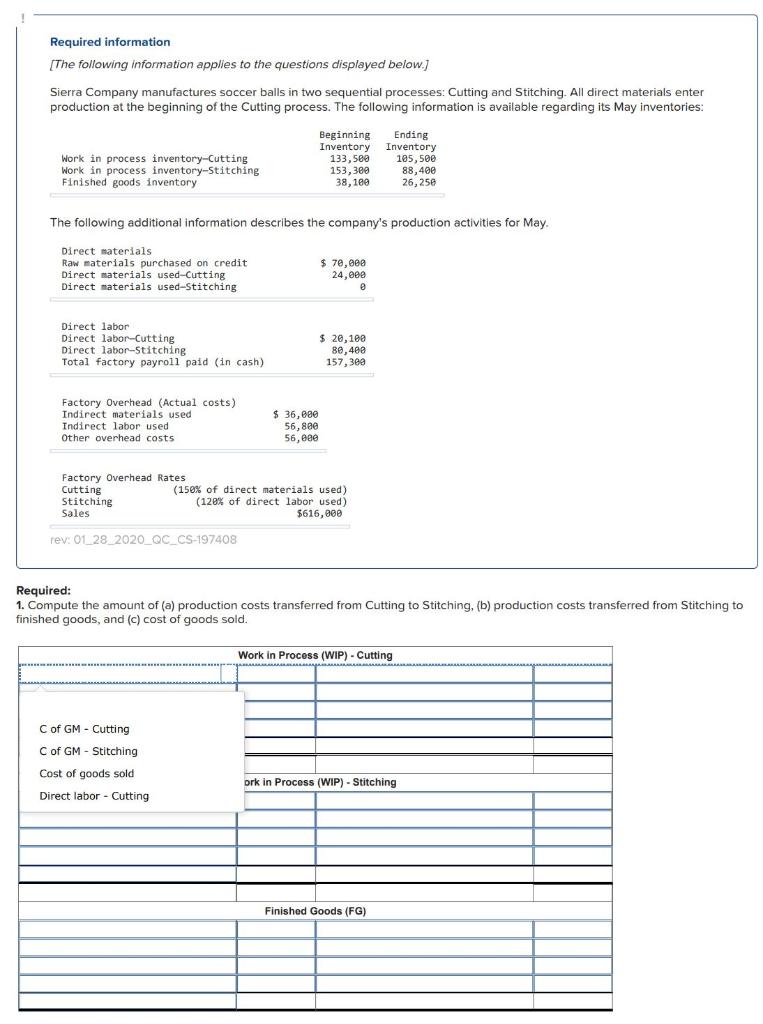

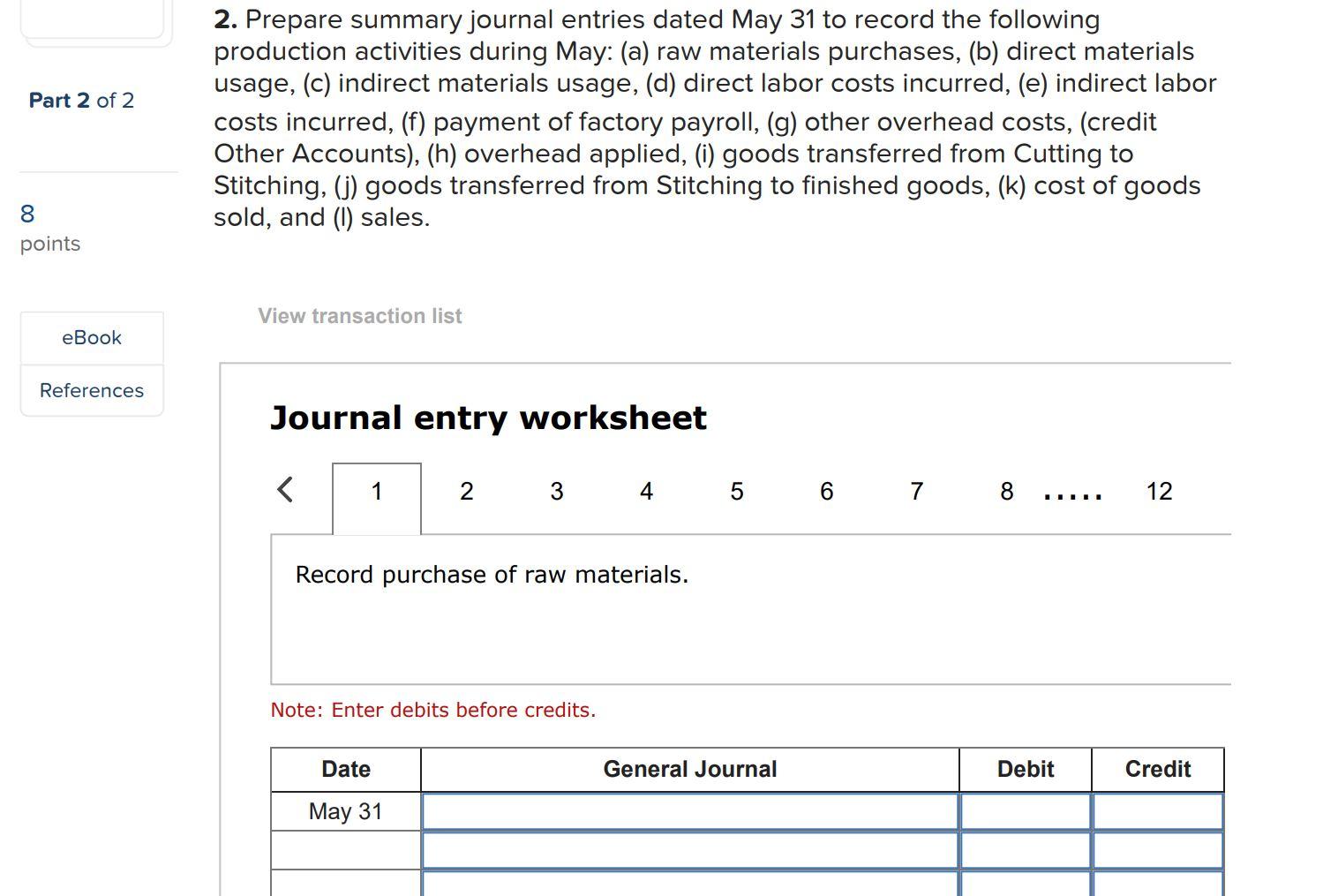

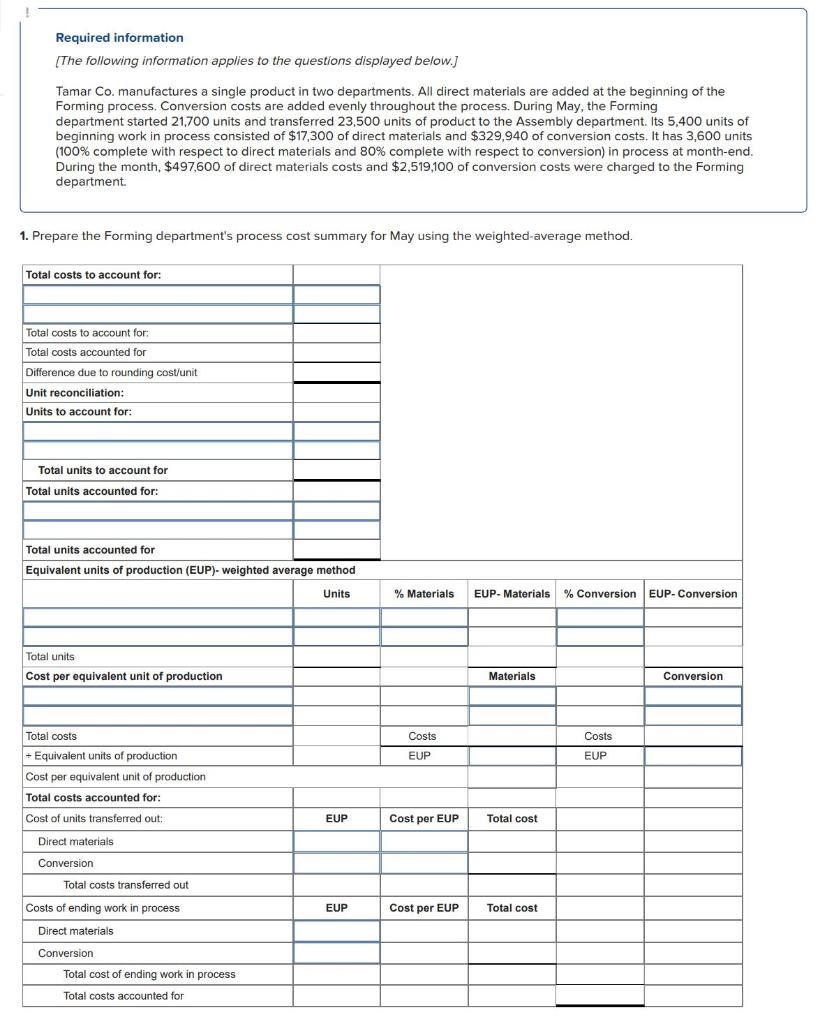

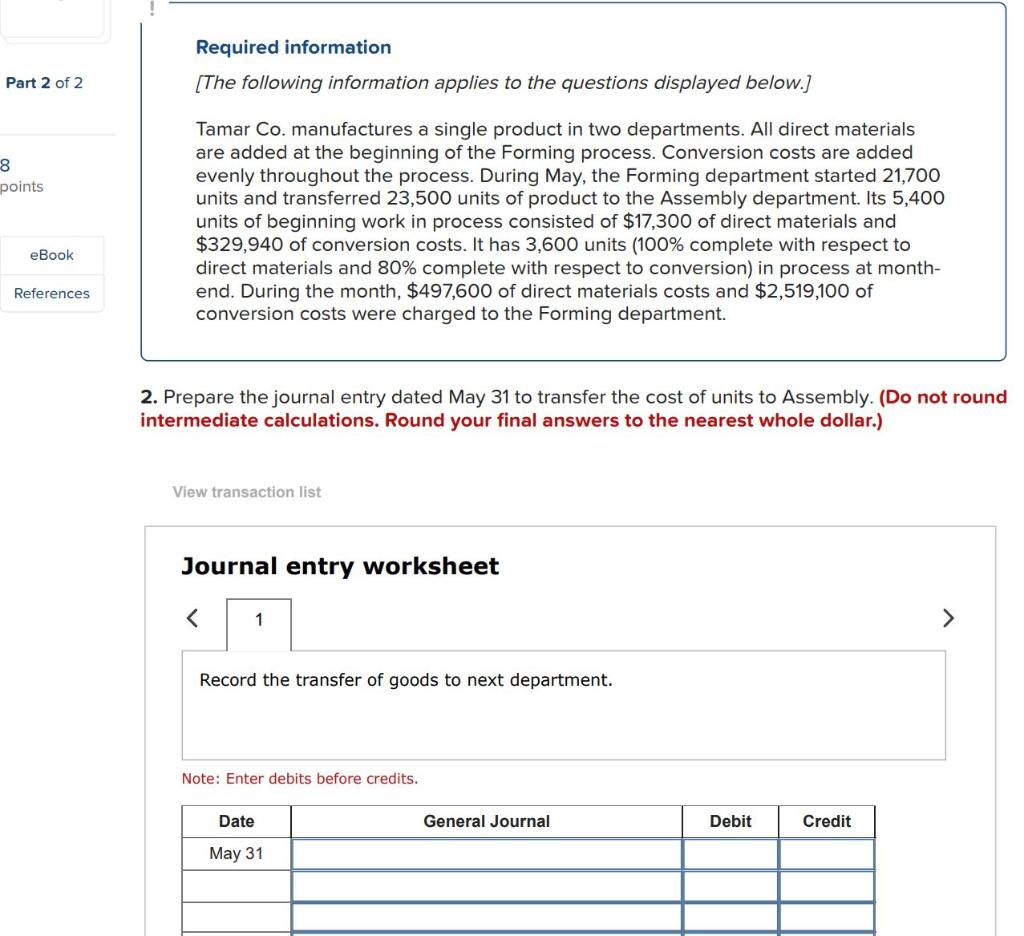

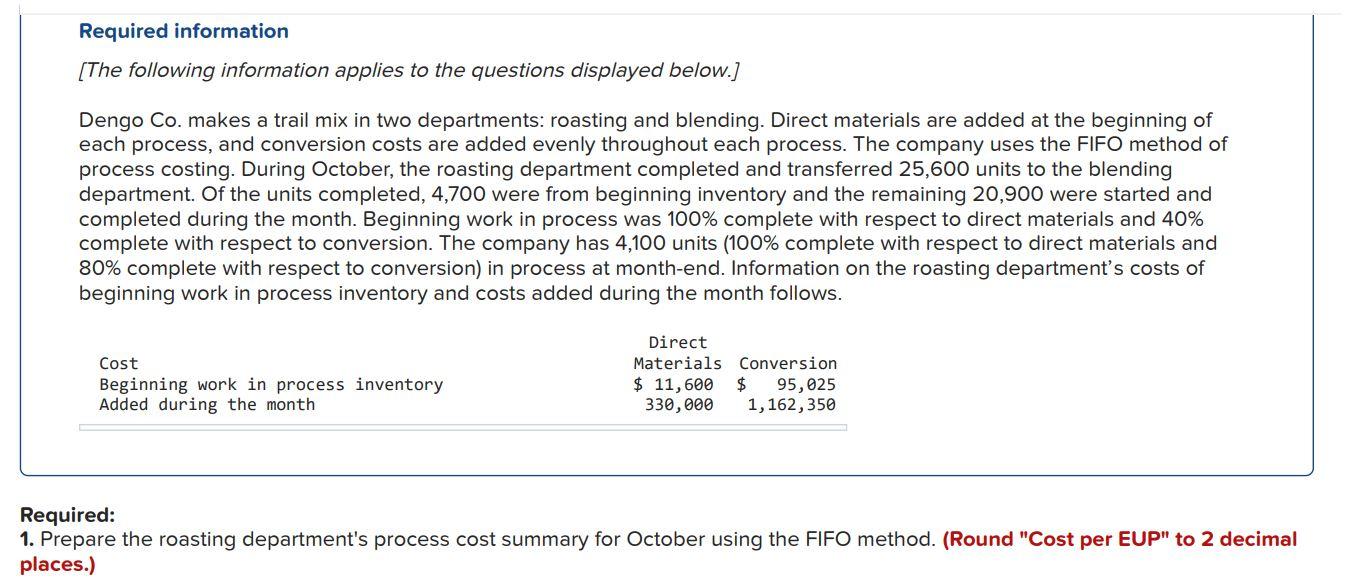

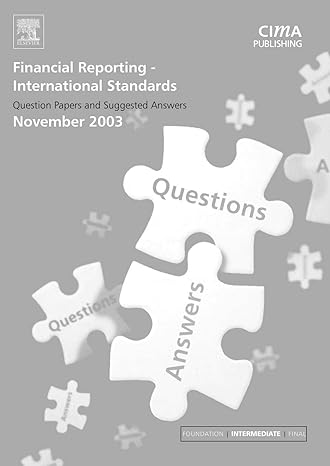

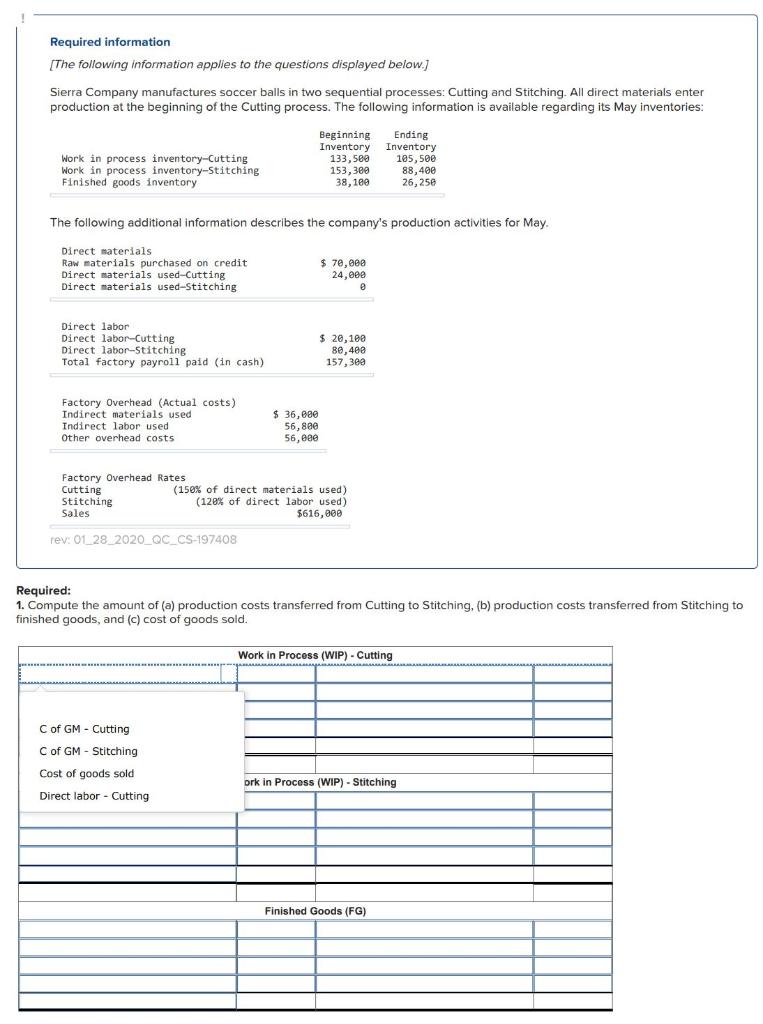

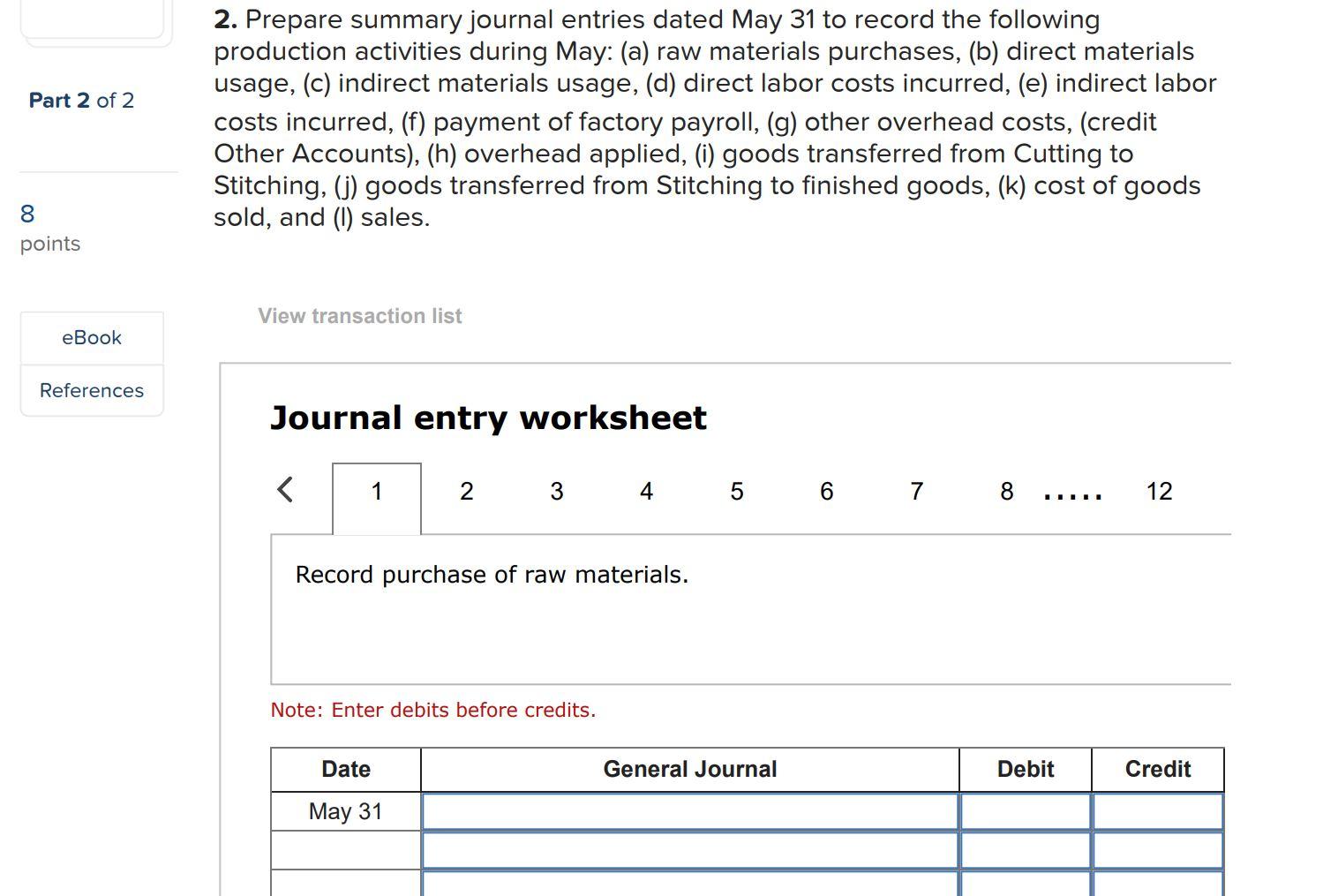

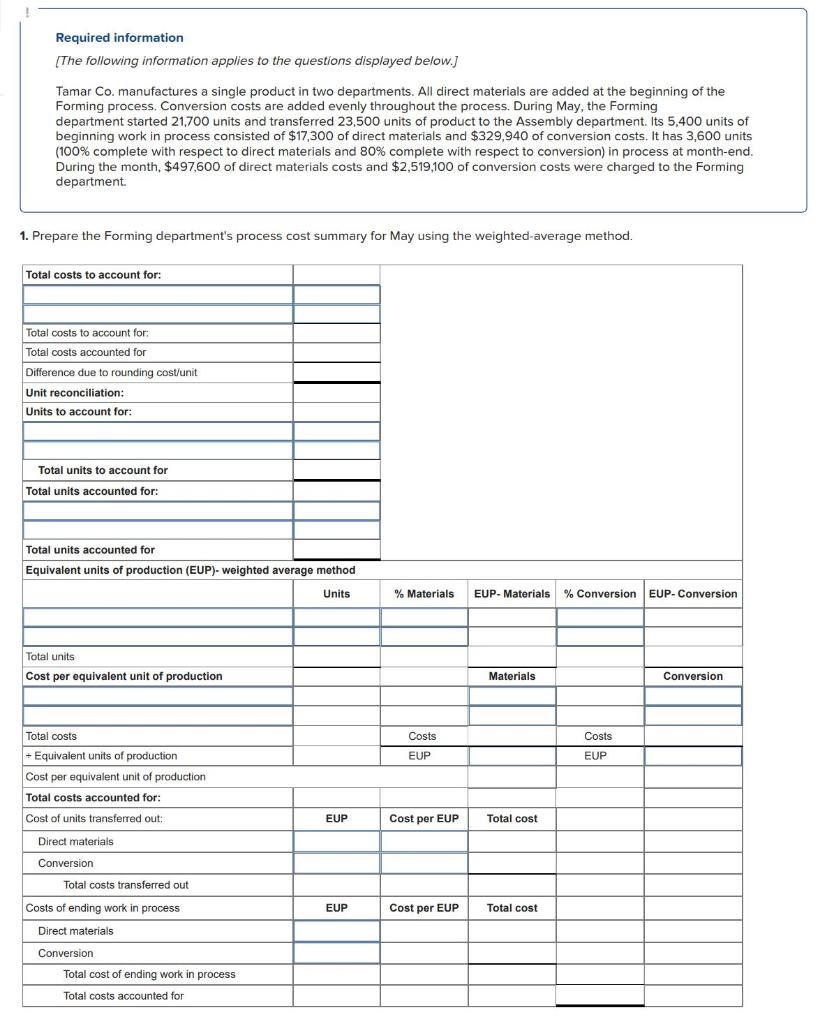

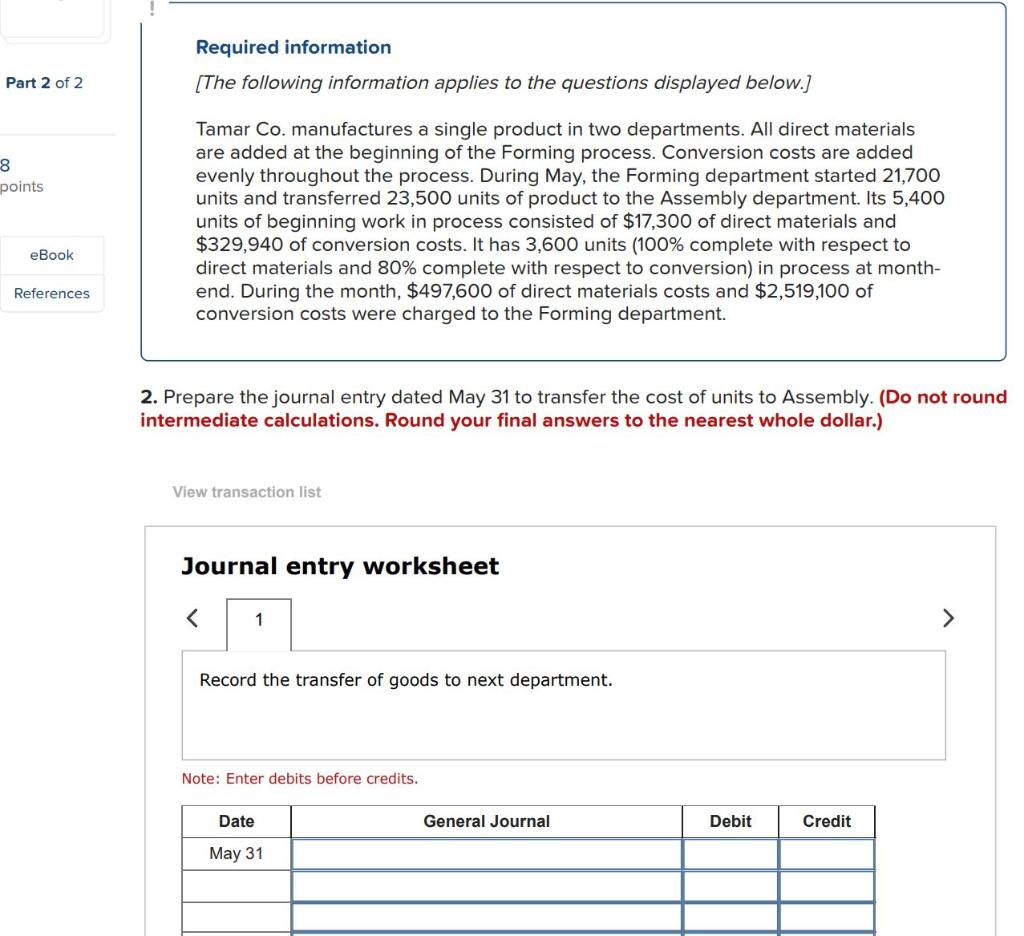

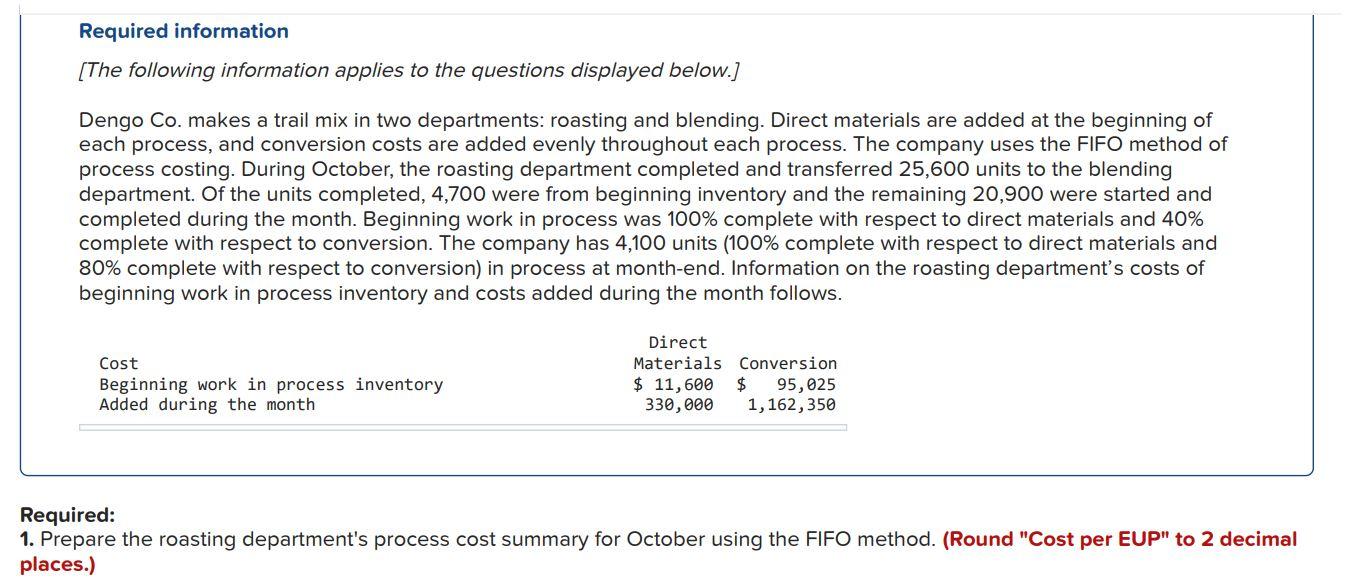

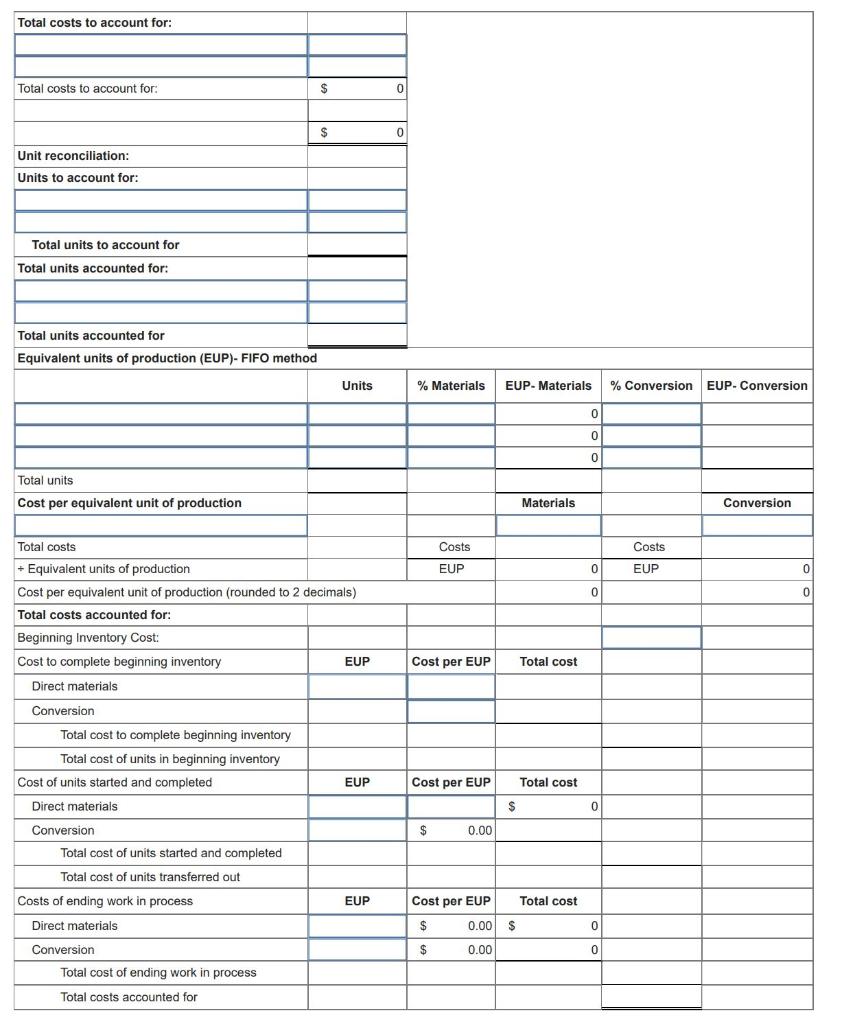

Required information [The following information applies to the questions displayed below.) Sierra Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory Beginning Ending Inventory Inventory 133,500 105,50 153,300 88,400 38,100 26,25 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching $ 70,000 24,000 Direct labor Direct labor-Cutting Direct labor-Stitching Total factory payroll paid (in cash) $ 20,100 80,488 157,388 Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs $ 36,080 56,880 56, eee Factory Overhead Rates Cutting (150% of direct materials used) Stitching (128% of direct labor used) Sales $616,000 rev: 01_28_2020_QC_CS-197408 Required: 1. Compute the amount of (a) production costs transferred from Cutting to Stitching, (b) production costs transferred from Stitching to finished goods, and (c) cost of goods sold. Work in Process (WIP) - Cutting C C of GM - Cutting C of GM - Stitching Cost of goods sold Direct labor - Cutting ork in Process (WIP) - Stitching Finished Goods (FG) Part 2 of 2 2. Prepare summary journal entries dated May 31 to record the following production activities during May: (a) raw materials purchases, (b) direct materials usage, (c) indirect materials usage, (d) direct labor costs incurred, (e) indirect labor costs incurred, (f) payment of factory payroll, (g) other overhead costs, (credit Other Accounts), (h) overhead applied, (i) goods transferred from Cutting to Stitching, (j) goods transferred from Stitching to finished goods, (k) cost of goods sold, and (1) sales. 8 points View transaction list eBook References Journal entry worksheet Record the transfer of goods to next department. Note: Enter debits before credits. Date General Journal Debit Credit May 31 Required information (The following information applies to the questions displayed below.] Dengo Co. makes a trail mix in two departments: roasting and blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. During October, the roasting department completed and transferred 25,600 units to the blending department. Of the units completed, 4,700 were from beginning inventory and the remaining 20,900 were started and completed during the month. Beginning work in process was 100% complete with respect to direct materials and 40% complete with respect to conversion. The company has 4,100 units (100% complete with respect to direct materials and 80% complete with respect to conversion) in process at month-end. Information on the roasting department's costs of beginning work in process inventory and costs added during the month follows. Cost Beginning work in process inventory Added during the month Direct Materials Conversion $ 11,600 $ 95,025 330,000 1,162,350 Required: 1. Prepare the roasting department's process cost summary for October using the FIFO method. (Round "Cost per EUP" to 2 decimal places.) Total costs to account for: Total costs to account for: $ 0 $ 0 Unit reconciliation: Units to account for: Total units to account for Total units accounted for: Total units accounted for Equivalent units of production (EUP)- FIFO method Units % Materials EUP-Materials % Conversion EUP- Conversion 0 0 0 Total units Cost per equivalent unit of production Materials Conversion Total costs Costs Costs EUP 0 EUP 0 0 0 + Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total costs accounted for: Beginning Inventory Cost: Cost to complete beginning inventory EUP Cost per EUP Total cost Direct materials Conversion Total cost to complete beginning inventory Total cost of units in beginning inventory Cost of units started and completed EUP Cost per EUP Total cost $ 0 $ 0.00 Direct materials Conversion Total cost of units started and completed Total cost of units transferred out Costs of ending work in process Direct materials Conversion Total cost of ending work in process Total costs accounted for EUP Cost per EUP Total cost $ 0.00 $ $ 0.00 0 0 Required information [The following information applies to the questions displayed below.) Sierra Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory Beginning Ending Inventory Inventory 133,500 105,50 153,300 88,400 38,100 26,25 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching $ 70,000 24,000 Direct labor Direct labor-Cutting Direct labor-Stitching Total factory payroll paid (in cash) $ 20,100 80,488 157,388 Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs $ 36,080 56,880 56, eee Factory Overhead Rates Cutting (150% of direct materials used) Stitching (128% of direct labor used) Sales $616,000 rev: 01_28_2020_QC_CS-197408 Required: 1. Compute the amount of (a) production costs transferred from Cutting to Stitching, (b) production costs transferred from Stitching to finished goods, and (c) cost of goods sold. Work in Process (WIP) - Cutting C C of GM - Cutting C of GM - Stitching Cost of goods sold Direct labor - Cutting ork in Process (WIP) - Stitching Finished Goods (FG) Part 2 of 2 2. Prepare summary journal entries dated May 31 to record the following production activities during May: (a) raw materials purchases, (b) direct materials usage, (c) indirect materials usage, (d) direct labor costs incurred, (e) indirect labor costs incurred, (f) payment of factory payroll, (g) other overhead costs, (credit Other Accounts), (h) overhead applied, (i) goods transferred from Cutting to Stitching, (j) goods transferred from Stitching to finished goods, (k) cost of goods sold, and (1) sales. 8 points View transaction list eBook References Journal entry worksheet Record the transfer of goods to next department. Note: Enter debits before credits. Date General Journal Debit Credit May 31 Required information (The following information applies to the questions displayed below.] Dengo Co. makes a trail mix in two departments: roasting and blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. During October, the roasting department completed and transferred 25,600 units to the blending department. Of the units completed, 4,700 were from beginning inventory and the remaining 20,900 were started and completed during the month. Beginning work in process was 100% complete with respect to direct materials and 40% complete with respect to conversion. The company has 4,100 units (100% complete with respect to direct materials and 80% complete with respect to conversion) in process at month-end. Information on the roasting department's costs of beginning work in process inventory and costs added during the month follows. Cost Beginning work in process inventory Added during the month Direct Materials Conversion $ 11,600 $ 95,025 330,000 1,162,350 Required: 1. Prepare the roasting department's process cost summary for October using the FIFO method. (Round "Cost per EUP" to 2 decimal places.) Total costs to account for: Total costs to account for: $ 0 $ 0 Unit reconciliation: Units to account for: Total units to account for Total units accounted for: Total units accounted for Equivalent units of production (EUP)- FIFO method Units % Materials EUP-Materials % Conversion EUP- Conversion 0 0 0 Total units Cost per equivalent unit of production Materials Conversion Total costs Costs Costs EUP 0 EUP 0 0 0 + Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total costs accounted for: Beginning Inventory Cost: Cost to complete beginning inventory EUP Cost per EUP Total cost Direct materials Conversion Total cost to complete beginning inventory Total cost of units in beginning inventory Cost of units started and completed EUP Cost per EUP Total cost $ 0 $ 0.00 Direct materials Conversion Total cost of units started and completed Total cost of units transferred out Costs of ending work in process Direct materials Conversion Total cost of ending work in process Total costs accounted for EUP Cost per EUP Total cost $ 0.00 $ $ 0.00 0 0