I am having trouble getting all of the numbers in the correct place. Here is the information. I need the journal entries and the unadjusted, and adjusted balance sheet.

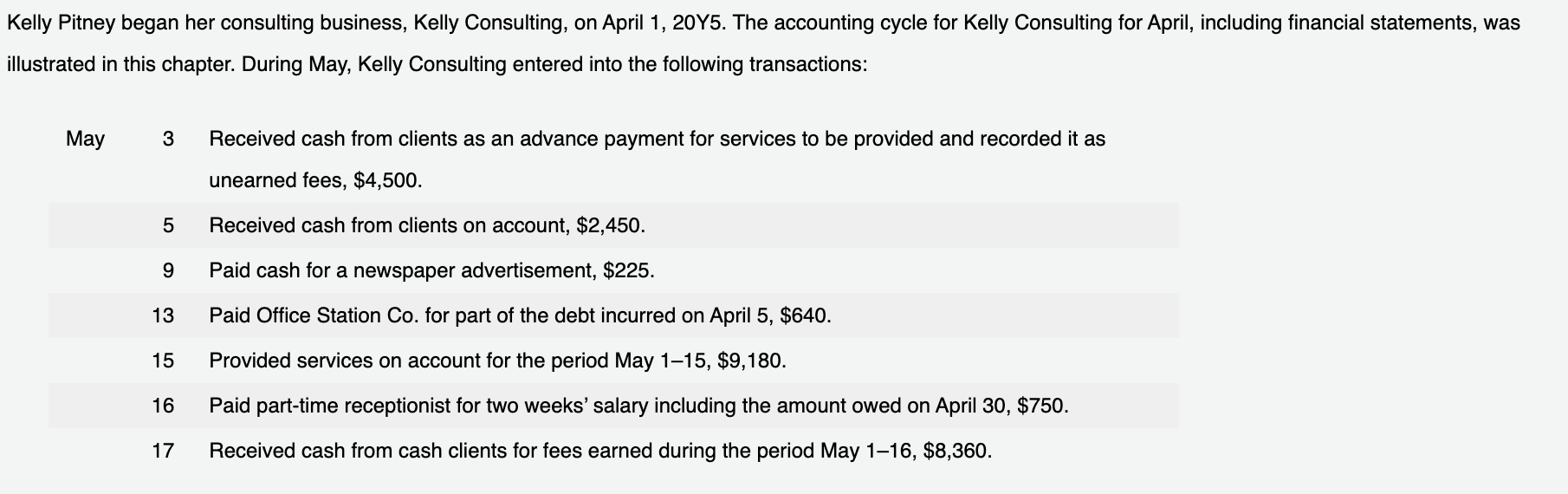

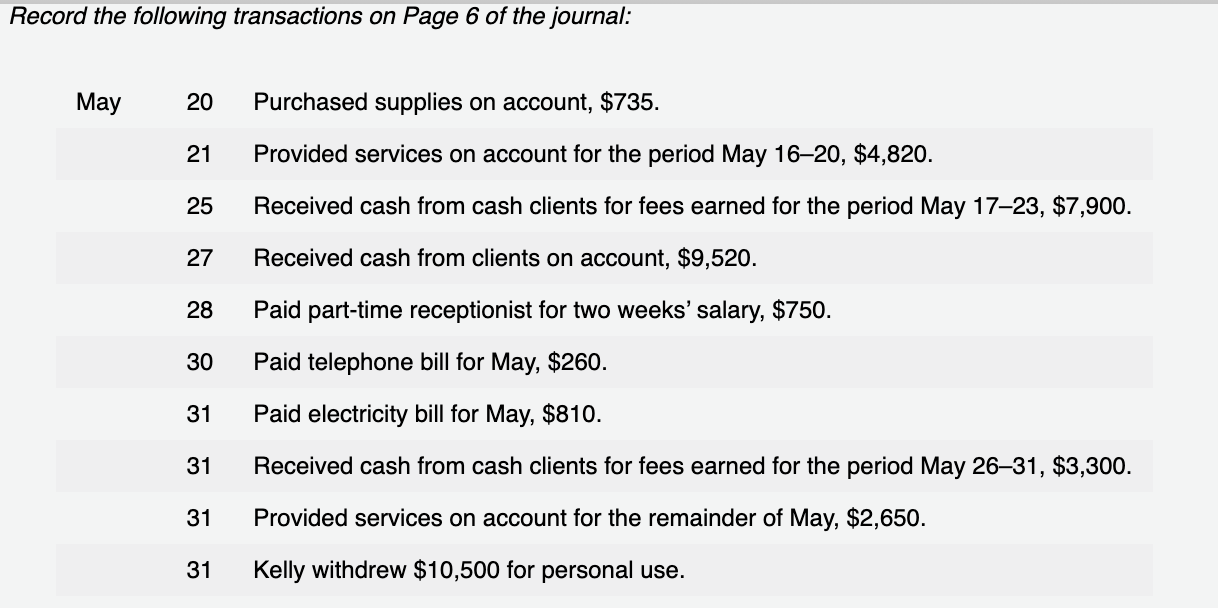

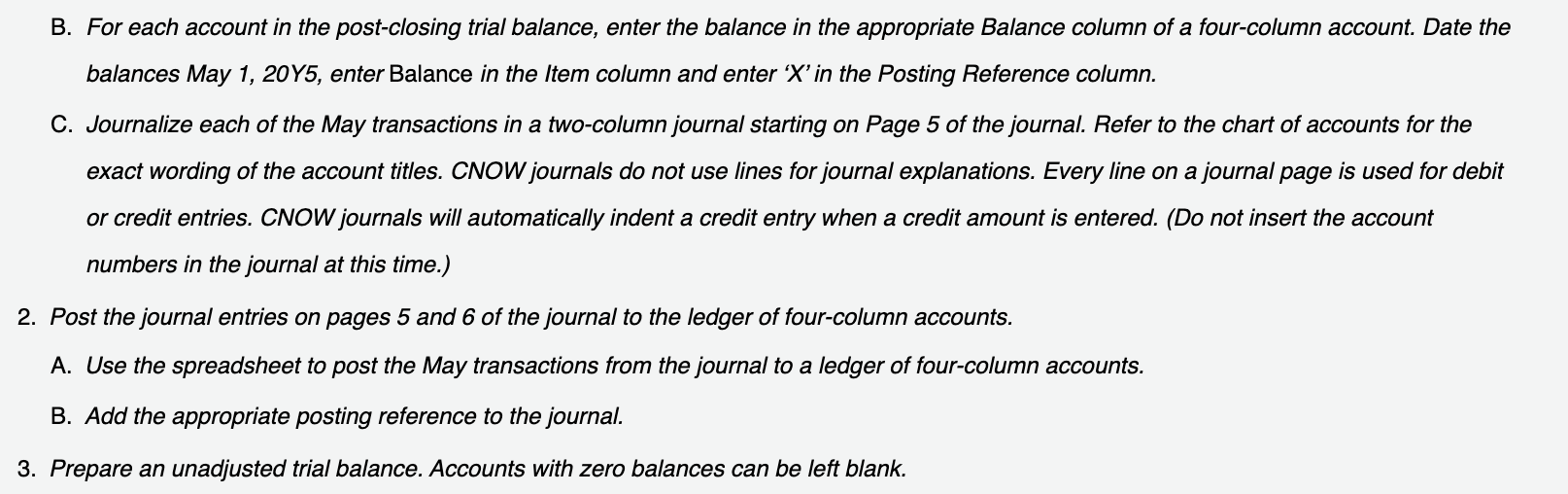

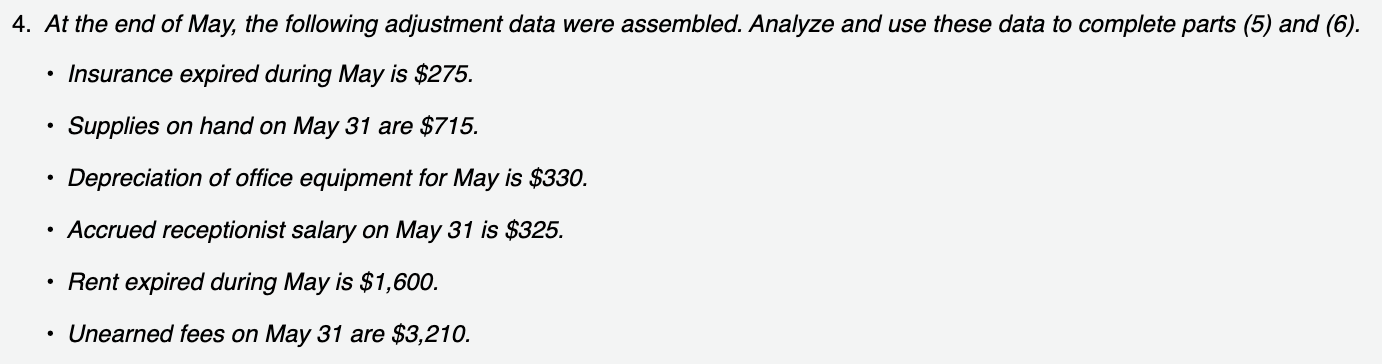

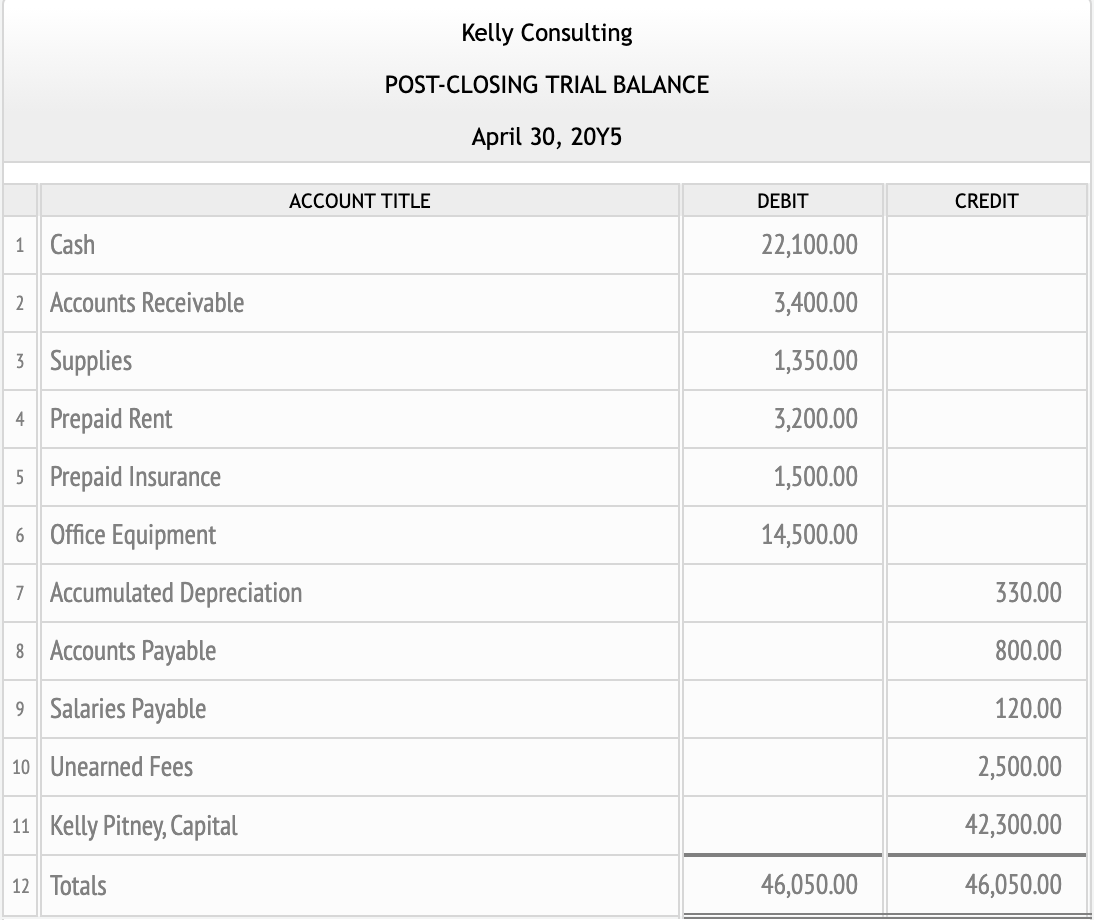

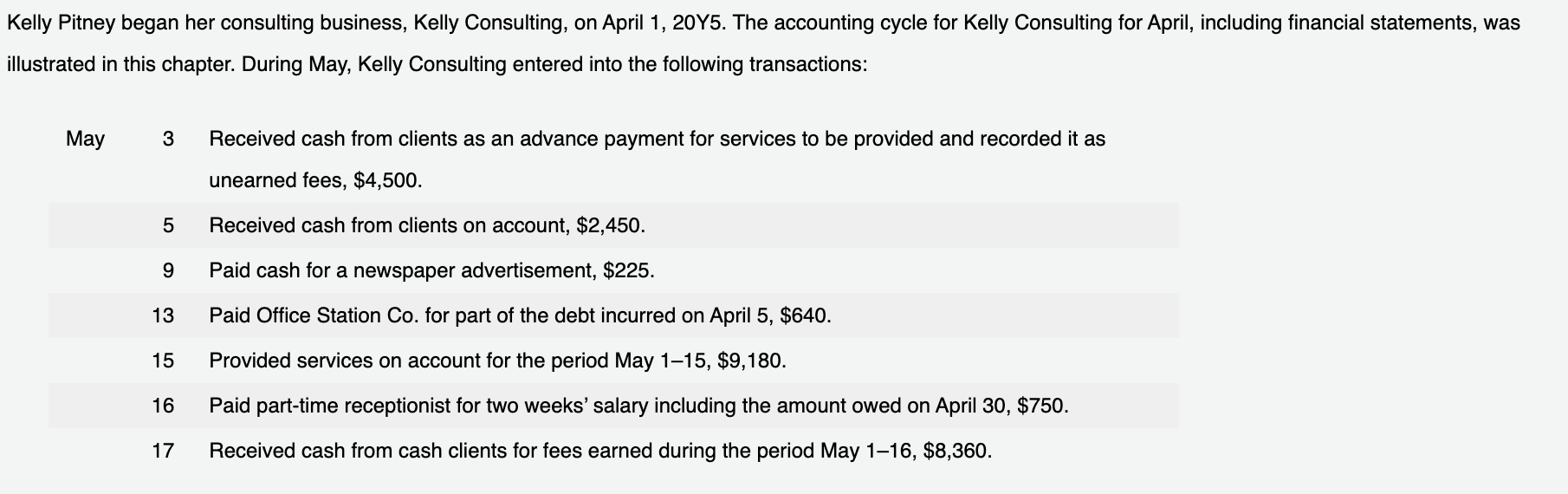

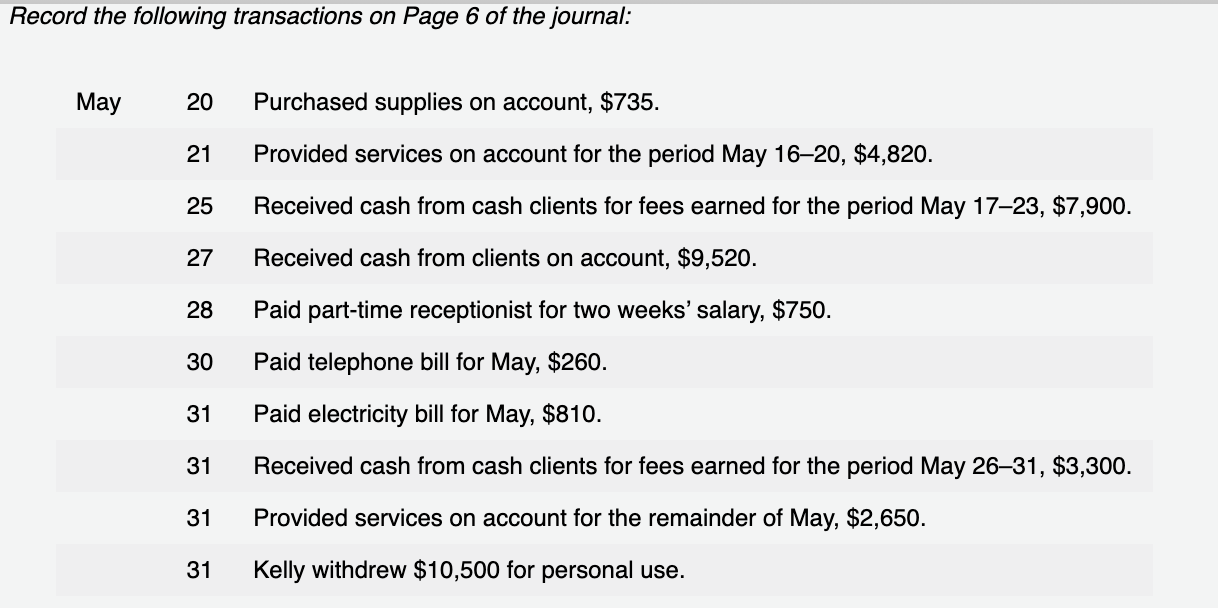

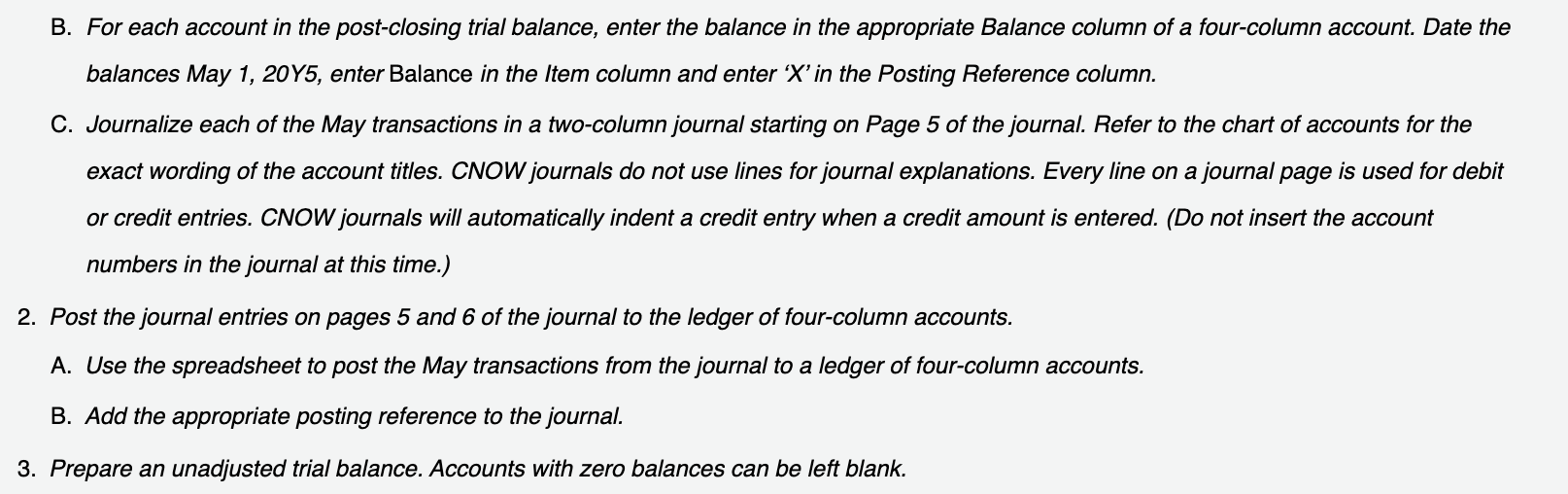

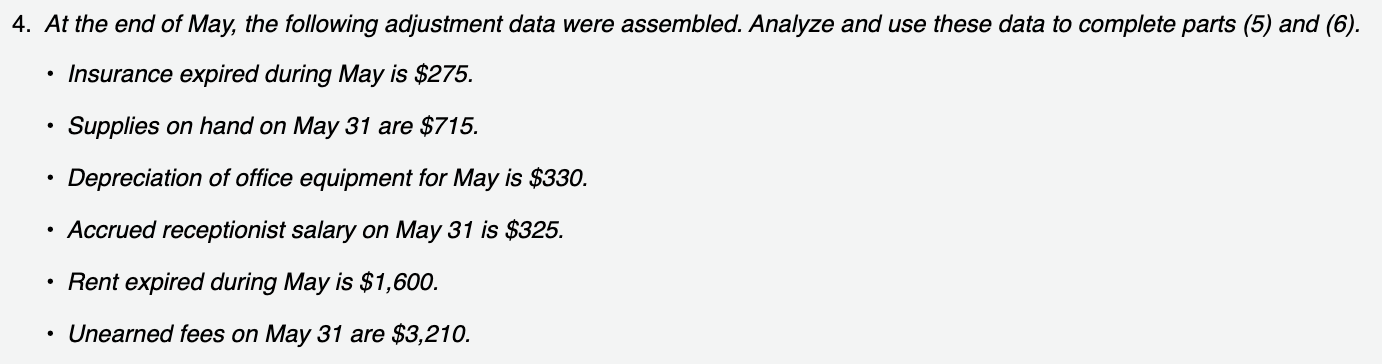

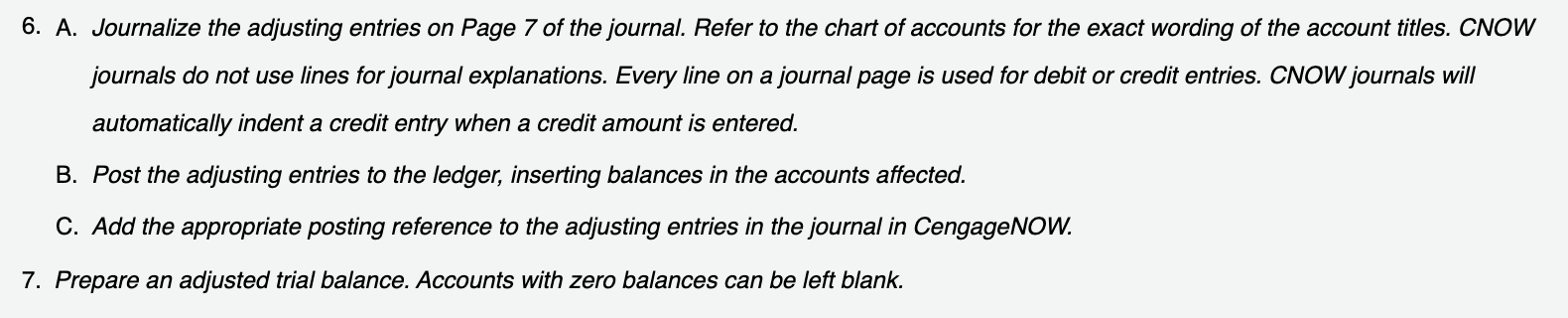

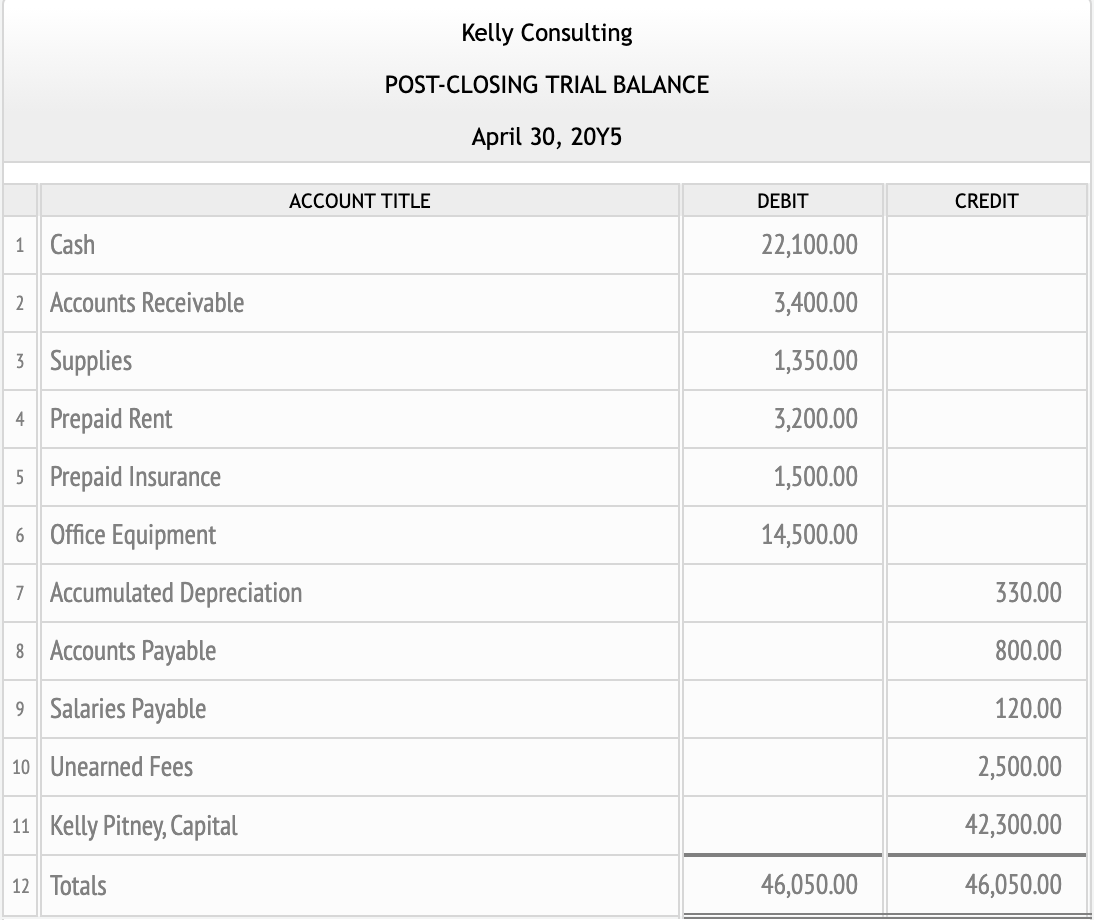

Kelly Pitney began her consulting business, Kelly Consulting, on April 1,20Y5. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3 Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $4,500. 5 Received cash from clients on account, $2,450. 9 Paid cash for a newspaper advertisement, \$225. 13 Paid Office Station Co. for part of the debt incurred on April 5, $640. 15 Provided services on account for the period May 115,$9,180. 16 Paid part-time receptionist for two weeks' salary including the amount owed on April 30,$750. 17 Received cash from cash clients for fees earned during the period May 116,$8,360. Record the following transactions on Page 6 of the journal: May 20 Purchased supplies on account, $735. 21 Provided services on account for the period May 16-20, $4,820. 25 Received cash from cash clients for fees earned for the period May 17-23, $7,900. 27 Received cash from clients on account, $9,520. 28 Paid part-time receptionist for two weeks' salary, \$750. 30 Paid telephone bill for May, \$260. 31 Paid electricity bill for May, $810. 31 Received cash from cash clients for fees earned for the period May 2631,$3,300. 31 Provided services on account for the remainder of May, $2,650. 31 Kelly withdrew $10,500 for personal use. B. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 20Y5, enter Balance in the Item column and enter ' X ' in the Posting Reference column. C. Journalize each of the May transactions in a two-column journal starting on Page 5 of the journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. (Do not insert the account numbers in the journal at this time.) 2. Post the journal entries on pages 5 and 6 of the journal to the ledger of four-column accounts. A. Use the spreadsheet to post the May transactions from the journal to a ledger of four-column accounts. B. Add the appropriate posting reference to the journal. 3. Prepare an unadjusted trial balance. Accounts with zero balances can be left blank. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). - Insurance expired during May is $275. - Supplies on hand on May 31 are $715. - Depreciation of office equipment for May is $330. - Accrued receptionist salary on May 31 is $325. - Rent expired during May is $1,600. - Unearned fees on May 31 are \$3,210. 6. A. Journalize the adjusting entries on Page 7 of the journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. B. Post the adjusting entries to the ledger, inserting balances in the accounts affected. C. Add the appropriate posting reference to the adjusting entries in the journal in CengageNOW. 7. Prepare an adjusted trial balance. Accounts with zero balances can be left blank. Kelly Consulting POST-CLOSING TRIAL BALANCE April 30, 20Y5