Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am having trouble solving these questions. 2:37 PM Sat Jul 18 '5' 87%E} 2:37 PM Apple Sat Jul 18 Bing Google Yahoo a v2.cengagenow.com

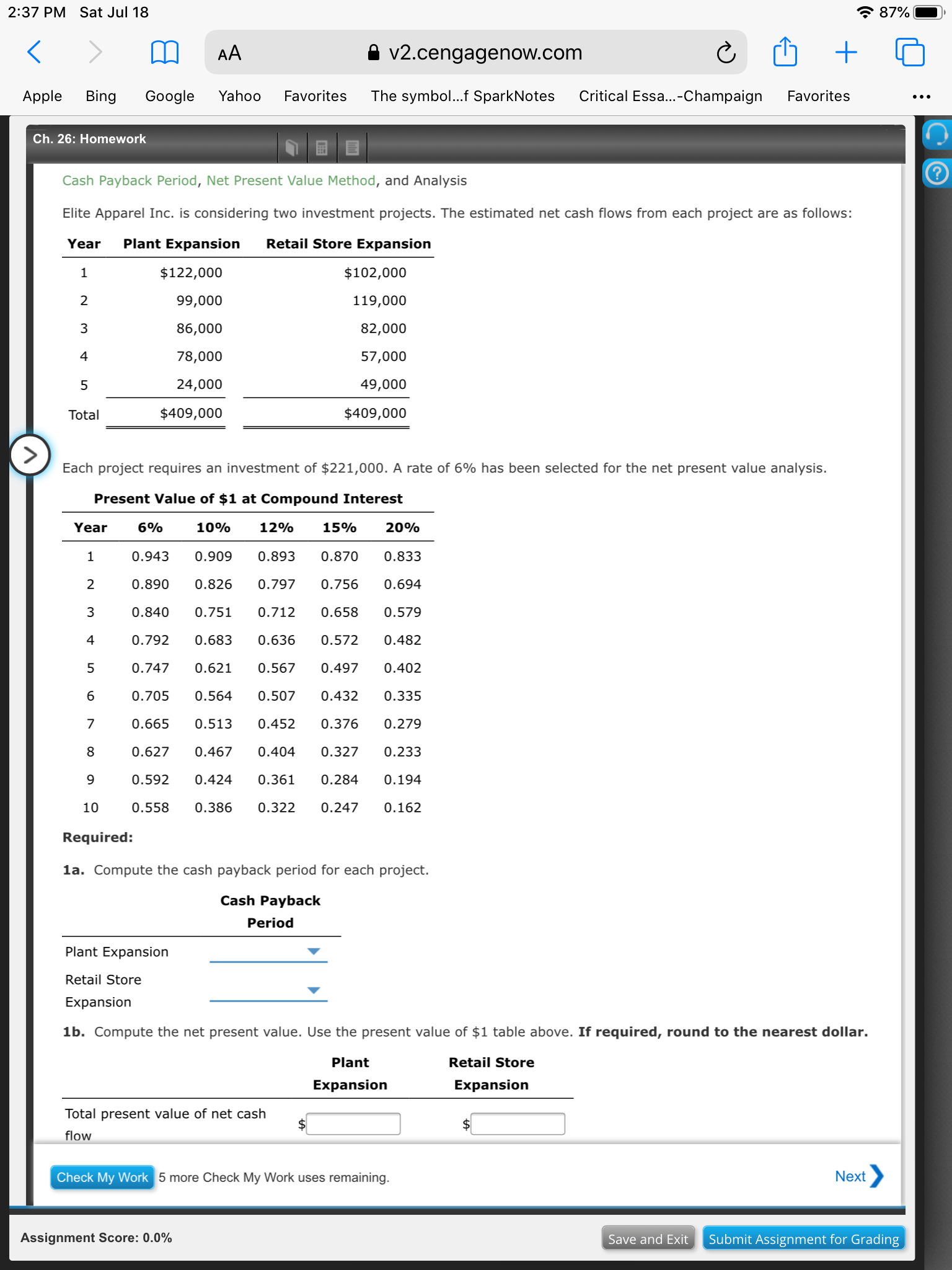

I am having trouble solving these questions.

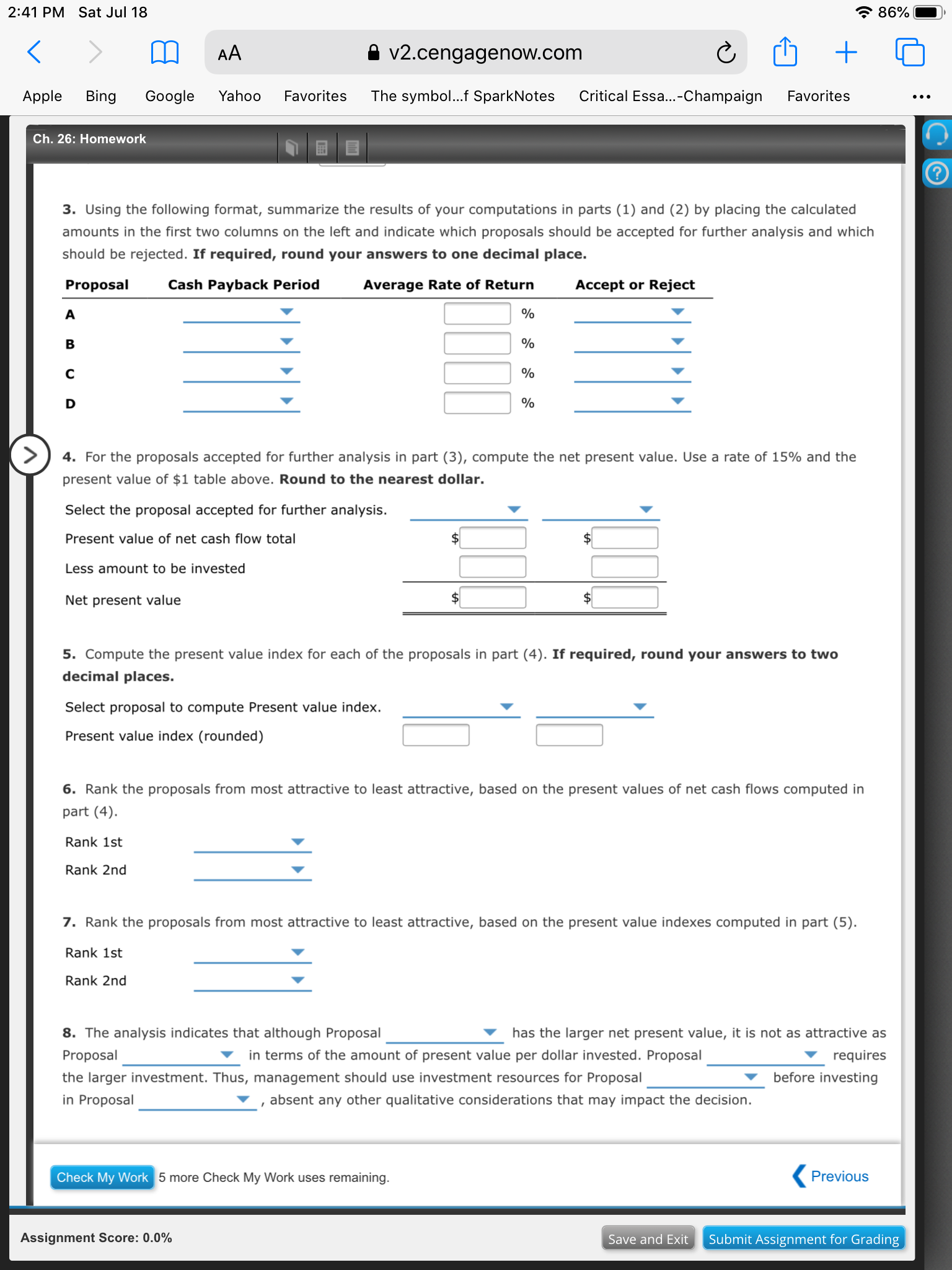

2:37 PM Apple Sat Jul 18 Bing Google Yahoo a v2.cengagenow.com Favorites The symbol ...f SparkNotes Critical Essa...-Champaign 870/0 Favorites Ch. 26: Homework Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Year Plant Expansion 1 2 3 4 5 Total $122,000 99,000 86,000 78,000 24,000 $409,000 Retail Store Expansion $102,000 119,000 82,000 57,000 49,000 $409,000 Each project requires an investment of $221,000. A rate of 6% has been selected for the net present value analysis. Present Value of $1 at Compound Interest Year 1 2 3 4 5 6 7 8 9 10 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 O. 424 0.386 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 o. 284 0.247 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 O. 194 0.162 Required: Ia. Compute the cash payback period for each project. Cash Payback Period Plant Expansion Retail Store Expansion 1b. Compute the net present value. Use the present value of $1 table above. If required, round to the nearest dollar. Plant Expansion Total present value of net cash flow Check My Work 5 more Check My Work uses remaining. Assignment Score: 0.0% Retail Store Expansion Save and Exit Next Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started