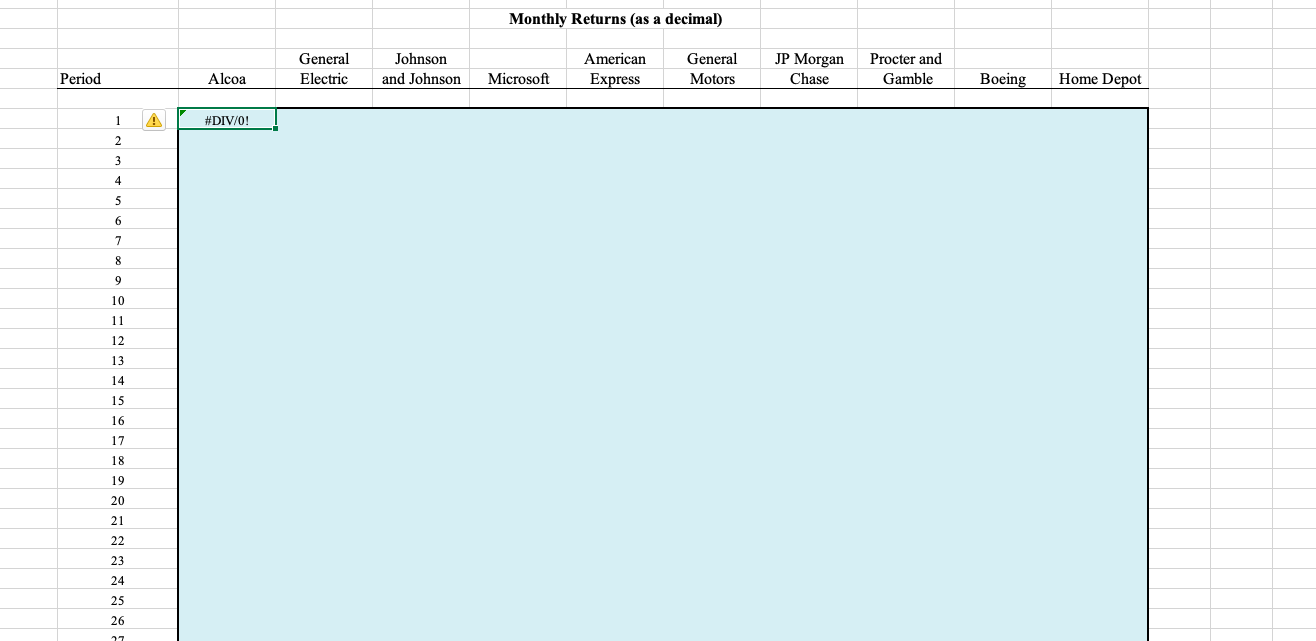

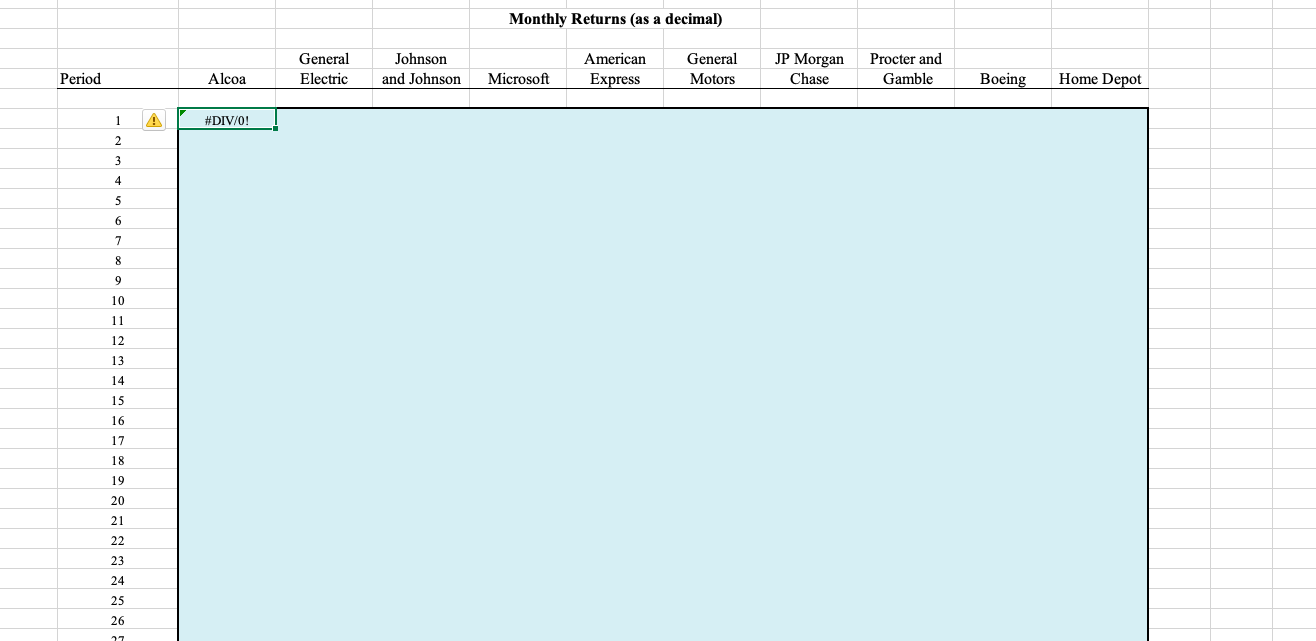

I am having trouble with the equation. I had =('Question #1 Calculations'!C10'-Question #1 Calculations'!C9)/'Question #1 Calculations'!C9 but it did not give me a number which resulted to being able to drag to the other companies.

I am having trouble with the equation. I had =('Question #1 Calculations'!C10'-Question #1 Calculations'!C9)/'Question #1 Calculations'!C9 but it did not give me a number which resulted to being able to drag to the other companies.

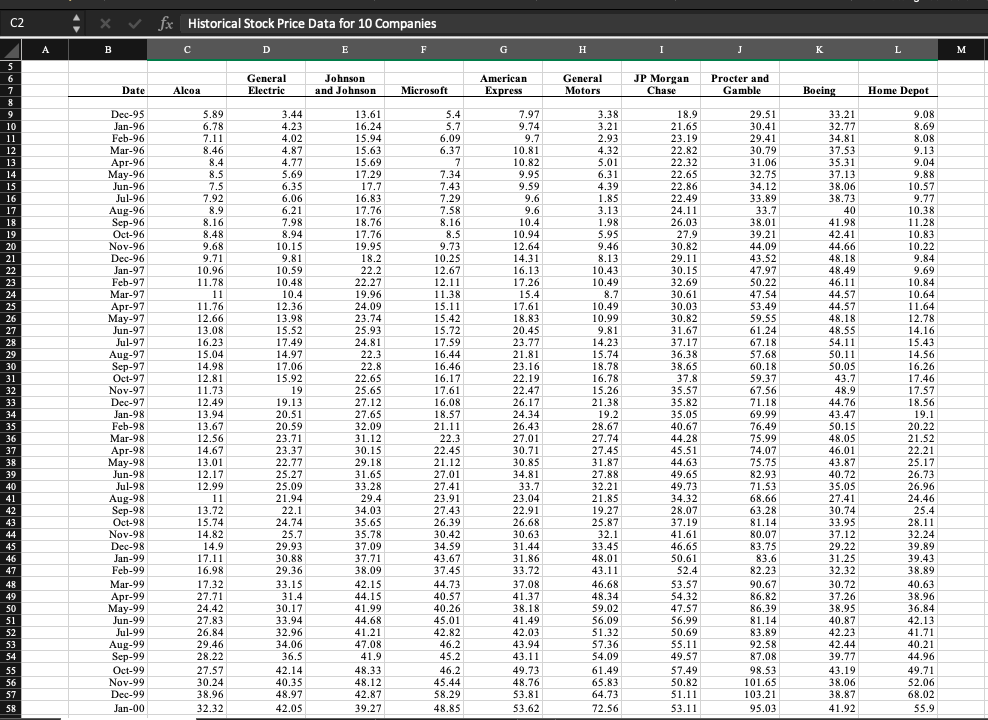

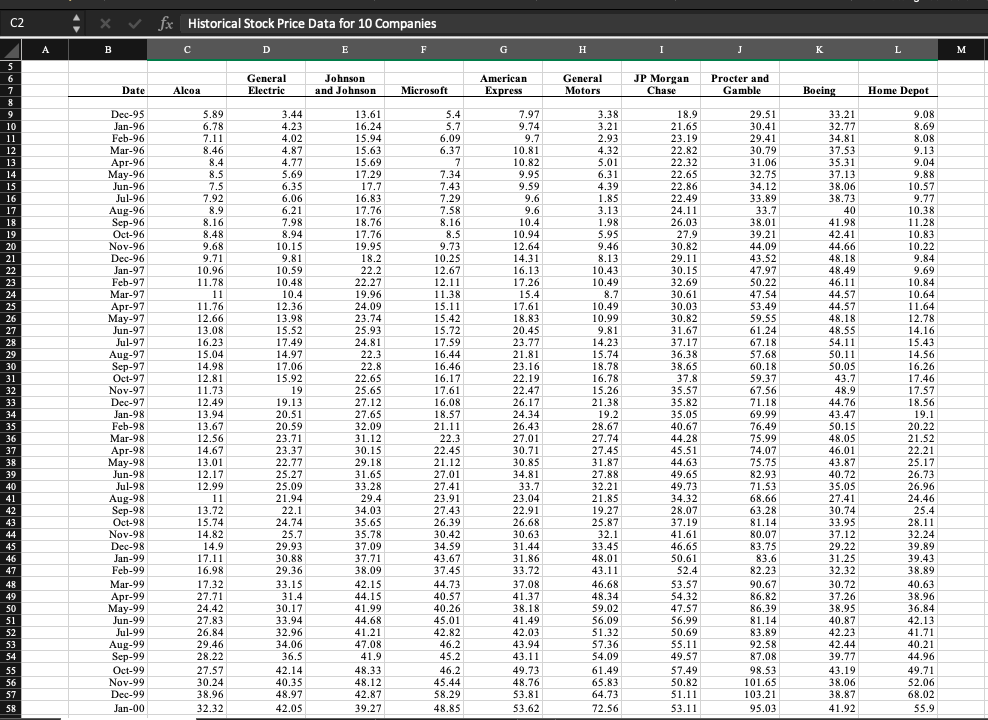

1. You are given historical, monthly stock prices for 10 companies in the sheet labeled Question 1 Data. Use this data to make the following calculations in the sheet labeled Question 1 Calculations (a) Calculate the monthly returns for each company. You need only do this for one cell, and you can copy this calculation to all other cells. (b) Using the monthly returns, calculate the mean return and standard deviation of returns for each company. (c) Based on your preferences for risk, construct a portfolio based on these 10 stocks. You can take long (positive weights) or short positions (negative weights), but the sum of the weights must sum to l. (Note that the summary statistics for these choices are graphed in the sheet labeled "Question 1 Graph.) (d) Briefly explain your philosophy for the choices that made in part (d). C2 X fx Historical Stock Price Data for 10 Companies A B D E F G H 1 J K L M General Electric Johnson and Johnson American Express Date General Motors JP Morgan Chase Procter and Gamble Alcos Microsoft Boeing Home Depot 5.4 5.7 6.09 6.37 7 7.34 7.43 7.29 7.58 8.16 8.5 S 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 Dec-95 Jan-96 Feb-96 Mar-96 Apr-96 May-96 Jun-96 Jul-96 Aug-96 Sep-96 Oct-96 Nov-96 Dec-96 Jan-97 Feb-97 Mar-97 Apr-97 May-97 Jun-97 Jul-97 Aug-97 Sep-97 Oct-97 Nov-97 Dec-97 Jan-98 Feb-98 Mar-98 Apr-98 May-98 Jun-98 Jul-98 Aug-98 Sep-98 Oct-98 Noy-98 Dec-98 Jan-99 Feb-99 Mar-99 Apr-99 May-99 Jun-99 Jul-99 Aug-99 Sep-99 Oct-99 Nov-99 Dec-99 Jan-00 5.89 6.78 7.11 8.46 8.4 8.5 7.5 7.92 8.9 8.16 8.48 9.68 9.71 10.96 11.78 11 11.76 12.66 13.08 16.23 15.04 14.98 12.81 11.73 12.49 13.94 13.67 12.56 14.67 13.01 12.17 12.99 11 13.72 15.74 14.82 14.9 17.11 16.98 17.32 27.71 24.42 27.83 26.84 29.46 28.22 27.57 30.24 38.96 32.32 3.44 4.23 4.02 4.87 4.77 5.69 6.35 6.06 6.21 7.98 8.94 10.15 9.81 10.59 10.48 10.4 12.36 13.98 15.52 17.49 14.97 17.06 15.92 19 19.13 20.51 20.59 23.71 23.37 22.77 25.27 25.09 21.94 22.1 24.74 25.7 29.93 30.88 29.36 33.15 31.4 30.17 33.94 32.96 34.06 36.5 42.14 40.35 48.97 42.05 13.61 16.24 15.94 15.63 15.69 17.29 17.7 16.83 17.76 18.76 17.76 19.95 18.2 22.2 22.27 19.96 24.09 23.74 25.93 24.81 22.3 22.8 22.65 25.65 27.12 27.65 32.09 31.12 30.15 29.18 31.65 33.28 29.4 34.03 35.65 35.78 37.09 37.71 38.09 42.15 44.15 41.99 44.68 41.21 47.08 41.9 48.33 48.12 42.87 39.27 9.73 10.25 12.67 12.11 11.38 15.11 15.42 15.72 17.59 16.44 16.46 16.17 17.61 16.08 18.57 21.11 22.3 22.45 21.12 27.01 27.41 23.91 27.43 26.39 30.42 34.59 43.67 37.45 44.73 40.57 40.26 45.01 42.82 46.2 45.2 46.2 45.44 58.29 48.85 7.97 9.74 9.7 10.81 10.82 9.95 9.59 9.6 9.6 10.4 10.94 12.64 14.31 16.13 17.26 15.4 17.61 18.83 20.45 23.77 21.81 23.16 22.19 22.47 26.17 24.34 26.43 27.01 30.71 30.85 34.81 33.7 23.04 22.91 26.68 30.63 31.44 31.86 33.72 37.08 41.37 38.18 41.49 42.03 43.94 43.11 49.73 48.76 53.81 53.62 3.38 3.21 2.93 4.32 5.01 6.31 4.39 1.85 3.13 1.98 5.95 9.46 8.13 10.43 10.49 8.7 10.49 10.99 9.81 14.23 15.74 18.78 16.78 15.26 21.38 19.2 28.67 27.74 27.45 31.87 27.88 32.21 21.85 19.27 25.87 32.1 33.45 48.01 43.11 46.68 48.34 59.02 56.09 51.32 57.36 54.09 61.49 65.83 64.73 72.56 18.9 21.65 23.19 22.82 22.32 22.65 22.86 22.49 24.11 26.03 27.9 30.82 29.11 30.15 32.69 30.61 30.03 30.82 31.67 37.17 36.38 38.65 37.8 35.57 35.82 35.05 40.67 44.28 45.51 44.63 49.65 49.73 34.32 28.07 37.19 41.61 46.65 50.61 52.4 53.57 54.32 47.57 56.99 50.69 55.11 49.57 57.49 50.82 51.11 53.11 29.51 30.41 29.41 30.79 31.06 32.75 34.12 33.89 33.7 38.01 39.21 44.09 43.52 47.97 50.22 47.54 53.49 59.55 61.24 67.18 57.68 60.18 59.37 67.56 71.18 69.99 76.49 75.99 74.07 75.75 82.93 71.53 68.66 63.28 81.14 80.07 83.75 83.6 82.23 90.67 86.82 86.39 81.14 83.89 92.58 87.08 98.53 101.65 103.21 95.03 33.21 32.77 34.81 37.53 35.31 37.13 38,06 38.73 40 41.98 42.41 44.66 48.18 48.49 46.11 44.57 44.57 48.18 48.55 54.11 50.11 50.05 43.7 48.9 44.76 43.47 50.15 48.05 46.01 43.87 40.72 35.05 27.41 30.74 33.95 37.12 29.22 31.25 32.32 30.72 37.26 38.95 40.87 42.23 42.44 39.77 43.19 38.06 38.87 41.92 9.08 8.69 8.08 9.13 9.04 9.88 10.57 9.77 10.38 11.28 10.83 10.22 9.84 9.69 10.84 10.64 11.64 12.78 14.16 15.43 14.56 16.26 17.46 17.57 18.56 19.1 20.22 21.52 22.21 25.17 26.73 26.96 24.46 25.4 28.11 32.24 39.89 39.43 38.89 40.63 38.96 36.84 42.13 41.71 40.21 44.96 49.71 52.06 68.02 55.9 SS 56 57 58 Monthly Returns (as a decimal) General Electric Johnson and Johnson American Express General Motors JP Morgan Chase Procter and Gamble Period Alcoa Microsoft Boeing Home Depot A #DIV/0! 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

I am having trouble with the equation. I had =('Question #1 Calculations'!C10'-Question #1 Calculations'!C9)/'Question #1 Calculations'!C9 but it did not give me a number which resulted to being able to drag to the other companies.

I am having trouble with the equation. I had =('Question #1 Calculations'!C10'-Question #1 Calculations'!C9)/'Question #1 Calculations'!C9 but it did not give me a number which resulted to being able to drag to the other companies.