Exercise 217 Consider the following independent scenarios: Bazil Company purchased merchandise on account from Office Suppliers for $62,000, with terms of 1/10, n/30. During

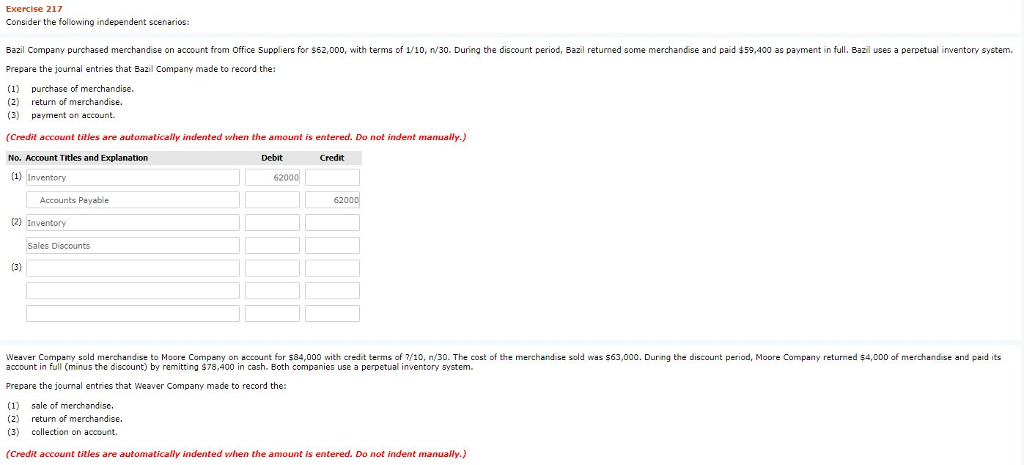

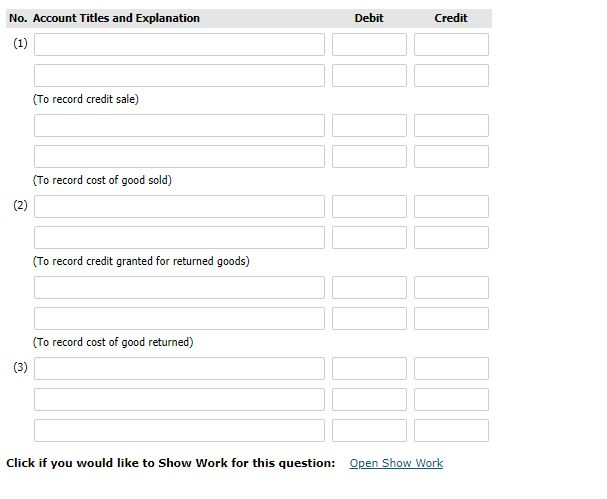

Exercise 217 Consider the following independent scenarios: Bazil Company purchased merchandise on account from Office Suppliers for $62,000, with terms of 1/10, n/30. During the discount period, Bazil returned some merchandise and paid $59,400 as payment in full. Bazil uses a perpetual inventory system. Prepare the journal entries that Bazil Company made to record the: (1) purchase of merchandise. (2) return of merchandise. (3) payment on account. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation (1) Inventory Accounts Payable (2) Inventory (3) Sales Discounts Debit Credit 62000 62000 Weaver Company sold merchandise to Moore Company on account for $84,000 with credit terms of ?/10, n/30. The cost of the merchandise sold was $63,000. During the discount period, Moore Company returned $4,000 of merchandise and paid its account in full (minus the discount) by remitting $78,400 in cash. Both companies use a perpetual inventory system. Prepare the journal entries that Weaver Company made to record the: (1) sale of merchandise. (2) return of merchandise. (3) collection on account. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation (1) Debit Credit (2) (To record credit sale) (To record cost of good sold) (To record credit granted for returned goods) (3) (To record cost of good returned) Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down each scenario step by step Scenario 1 Bazil Company 1 Purchase of merchandise When Bazil Company purchases merchandise the journal ent...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started