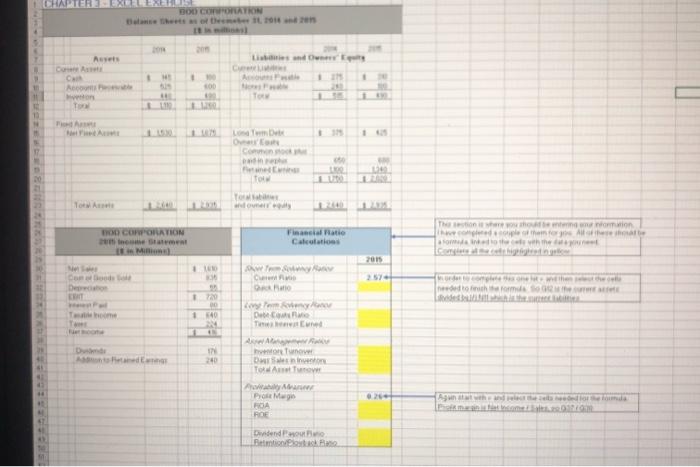

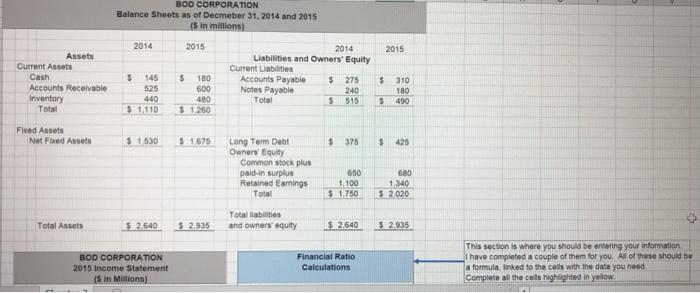

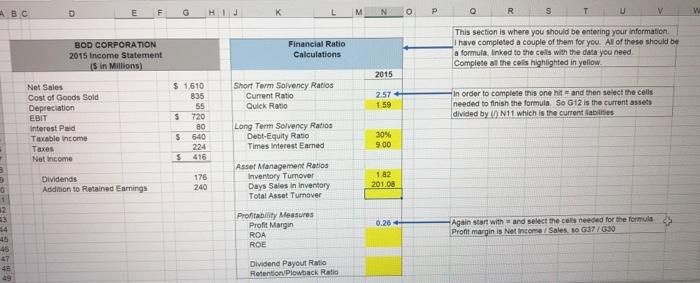

i am just needing help with the last 5 yellow boxes.

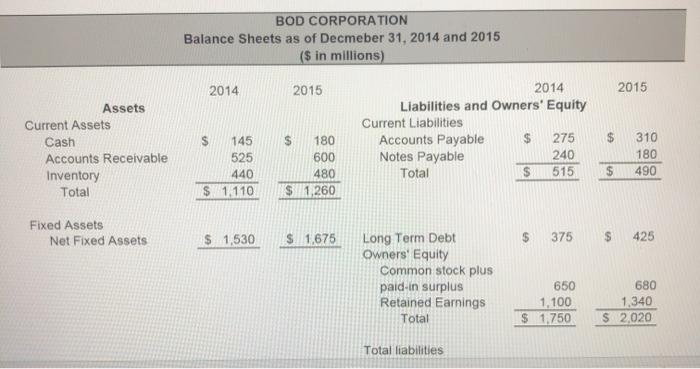

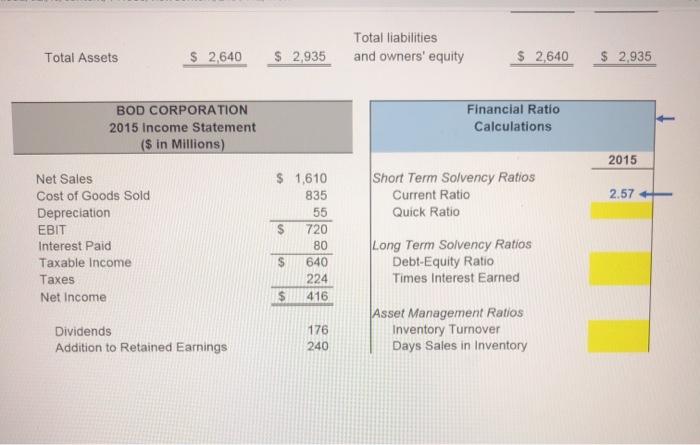

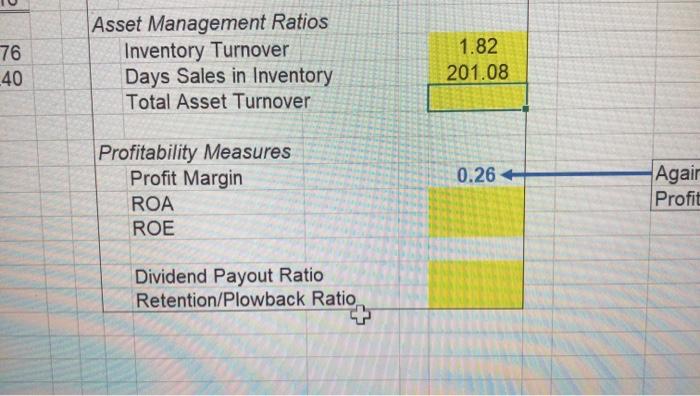

BOD COWORATON Ave AO To 13 O To Towe CORPORATION Financial atie Calculations The winnamon Import me the high Min 2015 Www CA Det nich 140 Deco hun Denne Tour # Agathamda Pro Mugo FOA ROE Dend out Beton Post BOD CORPORATION Balance Sheets as of Decmeber 31, 2014 and 2015 ($ in millions) 2014 2015 2015 2014 Liabilities and Owners' Equity Current Liabilities Accounts Payable 275 Notes Payable 240 Total 515 S Assets Current Assets Cash Accounts Receivable Inventory Total $ 145 525 440 $ 1.110 S 180 600 480 $ 1,260 310 180 490 $ Fixed Assets Net Fixed Assets $ 1,530 $ 1,675 375 $ 425 Long Term Debt Owners' Equity Common stock plus paid-in surplus Retained Earnings Total 650 1,100 $ 1.750 680 1,340 $ 2,020 Total liabilities Total liabilities and owners' equity Total Assets $ 2,640 $ 2,935 $ 2,640 $ 2,935 BOD CORPORATION 2015 Income Statement ($ in Millions) Financial Ratio Calculations 2015 Short Term Solvency Ratios Current Ratio Quick Ratio 2.57 Net Sales Cost of Goods Sold Depreciation EBIT Interest Paid Taxable income Taxes Net Income $ 1,610 835 55 $ 720 80 640 224 $ 416 Long Term Solvency Ratios Debt-Equity Ratio Times Interest Earned Dividends Addition to Retained Earnings 176 240 Asset Management Ratios Inventory Turnover Days Sales in Inventory 76 -40 Asset Management Ratios Inventory Turnover Days Sales in Inventory Total Asset Turnover 1.82 201.08 0.26 + Profitability Measures Profit Margin ROA ROE Again Profit Dividend Payout Ratio Retention/Plowback Ratio BOD CORPORATION Balance Sheets as of Decmeber 31, 2014 and 2015 (5 in millions) 2014 2015 2015 Assets Current Assets Cash Accounts Receivable Inventory Total 5 145 525 440 $ 1.110 $ 2014 Liabilities and Owners' Equity Current Liabilities Accounts Payable $ 275 Notes Payable 240 Total $ 515 $ 180 600 480 5 1260 310 180 490 $ Fixed Assets Net Fred Assets $ 1530 $ 1675 5 375 $ 425 Long Term Debt Owners' Equity Common och plus paid in surplus Retained Earnings Total 650 1100 5 1.750 680 1 340 5. 2020 Total liabilities and owners equity Total Assets 5 2.540 5 2935 5.2.640 5 2.935 BOD CORPORATION 2015 Income Statement s in Millions) Financial Ratio Calculations This section is where you should be entering your information I have completed a couple of them for you. All of these should be a formula linked to the cells with the data you need Complete all the cells highlighted in yellow E ABC G N P R T BOD CORPORATION 2015 Income Statement (5 in Millions) Financial Ratio Calculations This section is where you should be entering your information have completed a couple of them for you. All of these should be a formula, linked to the cells with the data you need Complete all the cells highlighted in yellow 2015 $ 1,610 Short Term Solvency Ratios Current Ratio Quick Ratio 2.57 1.59 in order to complete this one hit and then select the cells needed to finish the formula So G12 is the current assets divided by N11 which is the current is $ Net Sales Cost of Goods Sold Depreciation EBIT Interest Paid Taxable income Taxes Net Income 55 720 80 640 224 416 $ Long Term Solvency Ratios Debt-Equity Ratio Times interest Earned 30% 9.00 $ Dividends Addition to retained Earnings 176 240 Asset Management Ratio Inventory Turnover Days Sales In Inventory Total Asset Turnover 1.82 201.00 1 12 3 44 45 45 0.26 Profitability Measures Profit Margin ROA ROE Again start with = and select the celis needed for the formula Pront margin is Not Income Sales, 10 037/6.30 45 Dividend Payout Ratio Retention Plowback Ratio