Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am looking for help answering questions 3-10. Any help would be wonderful, thank you! 1. a. How much did the materials cost per unit

I am looking for help answering questions 3-10. Any help would be wonderful, thank you!

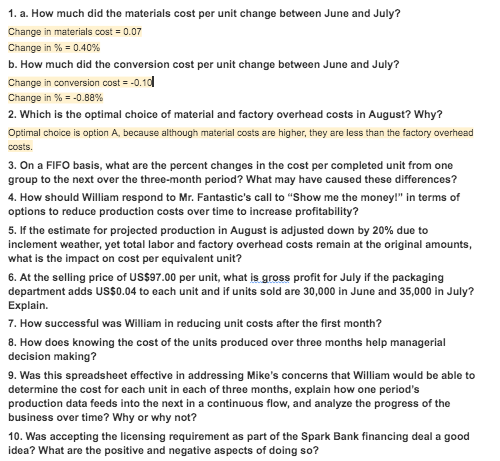

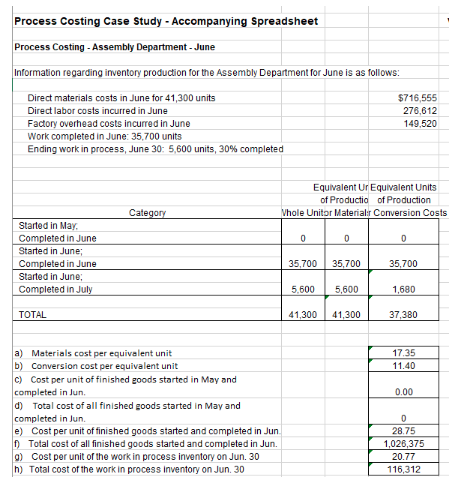

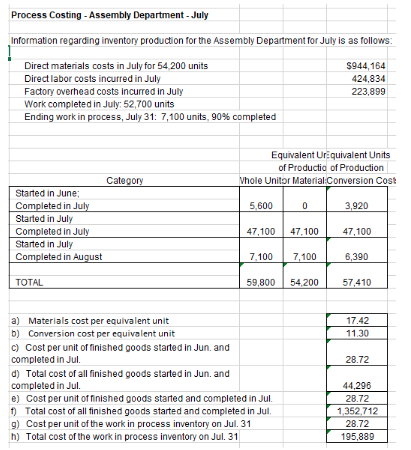

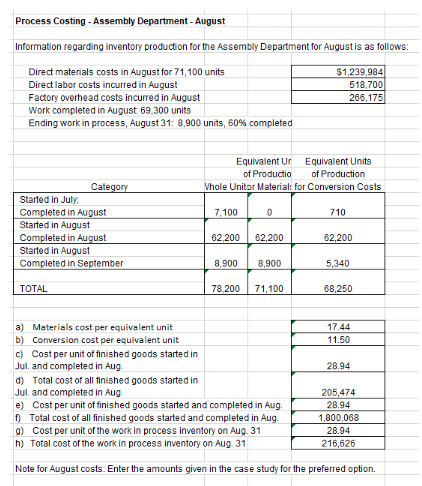

1. a. How much did the materials cost per unit change between June and July? Change in materials cost=0.07 Change in % = 0.40% b. How much did the conversion cost per unit change between June and July? Change in conversion cost = -0.10 Change in % = -0.82% 2. Which is the optimal choice of material and factory overhead costs in August? Why? Optimal choice is option A, because although material costs are higher, they are less than the factory overhead costs. 3. On a FIFO basis, what are the percent changes in the cost per completed unit from one group to the next over the three-month period? What may have caused these differences? 4. How should William respond to Mr. Fantastic's call to "Show me the money!" in terms of options to reduce production costs over time to increase profitability? 5. If the estimate for projected production in August is adjusted down by 20% due to inclement weather, yet total labor and factory overhead costs remain at the original amounts, what is the impact on cost per equivalent unit? 6. At the selling price of US$97.00 per unit, what is gross profit for July if the packaging department adds US$0.04 to each unit and if units sold are 30,000 in June and 35,000 in July? Explain. 7. How successful was William in reducing unit costs after the first month? 8. How does knowing the cost of the units produced over three months help managerial decision making ? 9. Was this spreadsheet effective in addressing Mike's concerns that William would be able to determine the cost for each unit in each of three months, explain how one period's production data feeds into the next in a continuous flow, and analyze the progress of the business over time? Why or why not? 10. Was accepting the licensing requirement as part of the Spark Bank financing deal a good idea? What are the positive and negative aspects of doing so? Process Costing Case Study - Accompanying Spreadsheet Process Costing - Assembly Department - June Information regarding inventory production for the Assembly Department for June is as follows: Direct materials costs in June for 41,300 units $716,555 Direct labor costs incurred in June 276,612 Factory overhead costs incurred in June 149,520 Work completed in June: 35,700 units Ending work in process, June 30: 5,600 units, 30% completed Equivalent Ur Equivalent Units of Productio of Production Vhole Unitor Material: Conversion Costs Category 0 0 0 Started in May. Completed in June Started in June; Completed in June Started in June; Completed in July 35,700 35,700 35,700 5,600 5,600 1,680 TOTAL 41,300 41,300 37,380 17.35 11.40 0.00 a) Materials cost per equivalent unit b) Conversion cost per equivalent unit C) Cost per unit of finished goods started in May and completed in Jun d) Total cost of all finished goods started in May and completed in Jun. e) Cost per unit of finished goods started and completed in Jun. Total cost of all finished goods started and completed in Jun. 9) Cost per unit of the work in process inventory on Jun. 30 m) Total cost of the work in process inventory on Jun 30 0 28.75 1,026,375 20.77 116,312 Process Costing - Assembly Department - July Information regarding inventory production for the Assembly Department for July is as follows: Direct materials costs in July for 54 200 units Direct labor costs incurred in July Factory overhead costs incurred in July Work completed in July: 52,700 units Ending work in process, July 31: 7,100 units, 90% completed $944,164 424,834 223,899 Equivalent Urquivalent Units of Productio of Production vhole Unitor Material:Conversion Cost 5,600 0 3,920 Category Started in June; Completed in July Started in July Completed in July Started in July Completed in August 47.100 47.100 47.100 7.100 7,100 6,390 TOTAL 59,800 54,200 57,410 17.42 11.30 28.72 a) Materials cost per equivalent unit b) Conversion cost per equivalent unit C) Cost per unit of finished goods started in Jun. and completed in Jul d) Total cost of all finished goods started in Jun. and completed in Jul. e) Cost per unit of finished goods started and completed in Jul. 1) Total cost of all finished goods started and completed in Jul 9) Cost per unit of the work in process inventory on Jul. 31 h) Total cost of the work in process inventory on Jul. 31 44,296 28.72 1,352,712 28.72 195,889 Process Costing - Assembly Department - August Information regarding inventory production for the Assembly Department for Augustis as follows: Direct materials costs in August for 71,100 units $1,239,984 Direct labor costs incurred in August 518,700 Factory overhead costs incurred in August 266,175 Work completed in August 69,300 units Ending work in process, August 31: 8,900 units, 50% completed Equivalent Ur Equivalent Units of Productio of Production Vhole Unitor Material: for Conversion Costs 7.100 0 710 Category Started in July Completed in August Started in August Completed in August Started in August Completed in September 62.200 82,200 62,200 8.900 8.900 5,340 TOTAL 78.200 71,100 88,250 17.44 11.50 28.94 a) Materials cost per equivalent unit b) Conversion cost per equivalent unit c) Cost per unit of finished goods started in Jul, and completed in Aug d) Total cost of all finished goods started in Jul and completed in Aug. e) Cost per unit of finished goods started and completed in Aug. Total cost of all finished goods started and completed in Aug. C) Cost per unit of the work in process inventory on Aug. 31 h) Total cost of the work in process inventory on Aug. 31 205,474 28.94 1,800,068 28.94 216,626 Note for August costs: Enter the amounts given in the case study for the preferred option. 1. a. How much did the materials cost per unit change between June and July? Change in materials cost=0.07 Change in % = 0.40% b. How much did the conversion cost per unit change between June and July? Change in conversion cost = -0.10 Change in % = -0.82% 2. Which is the optimal choice of material and factory overhead costs in August? Why? Optimal choice is option A, because although material costs are higher, they are less than the factory overhead costs. 3. On a FIFO basis, what are the percent changes in the cost per completed unit from one group to the next over the three-month period? What may have caused these differences? 4. How should William respond to Mr. Fantastic's call to "Show me the money!" in terms of options to reduce production costs over time to increase profitability? 5. If the estimate for projected production in August is adjusted down by 20% due to inclement weather, yet total labor and factory overhead costs remain at the original amounts, what is the impact on cost per equivalent unit? 6. At the selling price of US$97.00 per unit, what is gross profit for July if the packaging department adds US$0.04 to each unit and if units sold are 30,000 in June and 35,000 in July? Explain. 7. How successful was William in reducing unit costs after the first month? 8. How does knowing the cost of the units produced over three months help managerial decision making ? 9. Was this spreadsheet effective in addressing Mike's concerns that William would be able to determine the cost for each unit in each of three months, explain how one period's production data feeds into the next in a continuous flow, and analyze the progress of the business over time? Why or why not? 10. Was accepting the licensing requirement as part of the Spark Bank financing deal a good idea? What are the positive and negative aspects of doing so? Process Costing Case Study - Accompanying Spreadsheet Process Costing - Assembly Department - June Information regarding inventory production for the Assembly Department for June is as follows: Direct materials costs in June for 41,300 units $716,555 Direct labor costs incurred in June 276,612 Factory overhead costs incurred in June 149,520 Work completed in June: 35,700 units Ending work in process, June 30: 5,600 units, 30% completed Equivalent Ur Equivalent Units of Productio of Production Vhole Unitor Material: Conversion Costs Category 0 0 0 Started in May. Completed in June Started in June; Completed in June Started in June; Completed in July 35,700 35,700 35,700 5,600 5,600 1,680 TOTAL 41,300 41,300 37,380 17.35 11.40 0.00 a) Materials cost per equivalent unit b) Conversion cost per equivalent unit C) Cost per unit of finished goods started in May and completed in Jun d) Total cost of all finished goods started in May and completed in Jun. e) Cost per unit of finished goods started and completed in Jun. Total cost of all finished goods started and completed in Jun. 9) Cost per unit of the work in process inventory on Jun. 30 m) Total cost of the work in process inventory on Jun 30 0 28.75 1,026,375 20.77 116,312 Process Costing - Assembly Department - July Information regarding inventory production for the Assembly Department for July is as follows: Direct materials costs in July for 54 200 units Direct labor costs incurred in July Factory overhead costs incurred in July Work completed in July: 52,700 units Ending work in process, July 31: 7,100 units, 90% completed $944,164 424,834 223,899 Equivalent Urquivalent Units of Productio of Production vhole Unitor Material:Conversion Cost 5,600 0 3,920 Category Started in June; Completed in July Started in July Completed in July Started in July Completed in August 47.100 47.100 47.100 7.100 7,100 6,390 TOTAL 59,800 54,200 57,410 17.42 11.30 28.72 a) Materials cost per equivalent unit b) Conversion cost per equivalent unit C) Cost per unit of finished goods started in Jun. and completed in Jul d) Total cost of all finished goods started in Jun. and completed in Jul. e) Cost per unit of finished goods started and completed in Jul. 1) Total cost of all finished goods started and completed in Jul 9) Cost per unit of the work in process inventory on Jul. 31 h) Total cost of the work in process inventory on Jul. 31 44,296 28.72 1,352,712 28.72 195,889 Process Costing - Assembly Department - August Information regarding inventory production for the Assembly Department for Augustis as follows: Direct materials costs in August for 71,100 units $1,239,984 Direct labor costs incurred in August 518,700 Factory overhead costs incurred in August 266,175 Work completed in August 69,300 units Ending work in process, August 31: 8,900 units, 50% completed Equivalent Ur Equivalent Units of Productio of Production Vhole Unitor Material: for Conversion Costs 7.100 0 710 Category Started in July Completed in August Started in August Completed in August Started in August Completed in September 62.200 82,200 62,200 8.900 8.900 5,340 TOTAL 78.200 71,100 88,250 17.44 11.50 28.94 a) Materials cost per equivalent unit b) Conversion cost per equivalent unit c) Cost per unit of finished goods started in Jul, and completed in Aug d) Total cost of all finished goods started in Jul and completed in Aug. e) Cost per unit of finished goods started and completed in Aug. Total cost of all finished goods started and completed in Aug. C) Cost per unit of the work in process inventory on Aug. 31 h) Total cost of the work in process inventory on Aug. 31 205,474 28.94 1,800,068 28.94 216,626 Note for August costs: Enter the amounts given in the case study for the preferred optionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started