prepare income statement and sofp

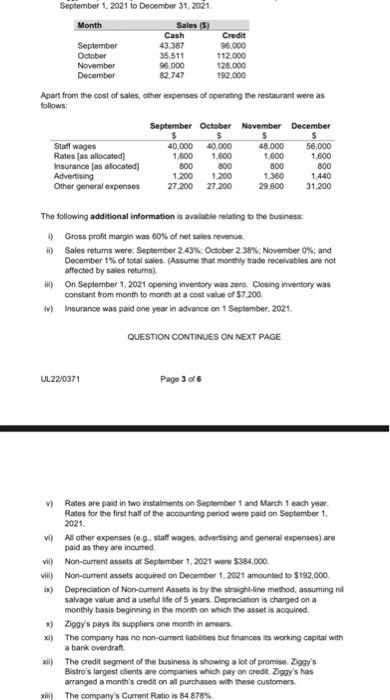

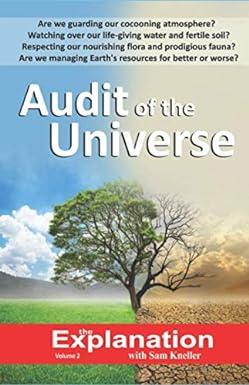

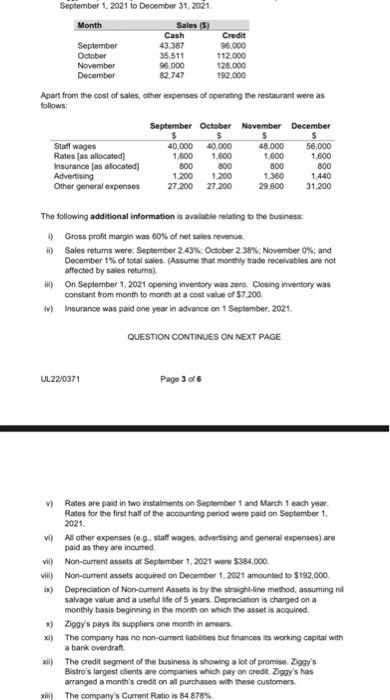

September 1, 2021 to December 31, 2021 Month September October November December Sales Cash 43.387 35,511 96.000 82.747 Credit 96.000 112.000 128,000 192.000 Apart from the cost of sales, other expenses of operating the restaurant were as follows: Staff wages Rates (as allocated Insurance fas alocated Advertising Other general expenses September October November December $ $ $ $ 40,000 40.000 48.000 56,000 1,600 1.600 1.600 1,600 800 800 800 800 1.200 1.200 1.360 1.440 27,200 27200 29,500 31,200 The following additional information is available relating to the business i) Gross profit margin was 60% of net sales revenue #) Sales retums were: September 243%: October 238% November 0% and December 1% of total sales. (Assume that monthly trade receivables are not affected by sales returns). On September 1, 2021 opening inventory was 200. Closing inventory was constant from month to month at a cost value of $7.200. 1) Insurance was paid one year in advance on September 2021. QUESTION CONTINUES ON NEXT PAGE UL 22/0371 Page 36 Rates are paid in two instalments on September 1 and March 1 each year, Rates for the first half of the accounting period were paid on September 1. 2021 vi All other expenses (9 staf wages, advertising and general expenses) are paid as they are incurred vil) Non-current assets at September 1, 2021 were $384.000 vil) Non-current assets acquired on December 1, 2021 amounted to $192.000 x) Depreciation of Non-current Assets is by the straight-line method, assuming nit salvage value and a useful life of 5 years. Depreciation is charged on a monthly basis beginning in the month on which the asset is acquired *) Ziggy's pays its suppliers one month in areas *) The company has no non-current liabies but finances its working capital with a bank overdraft xil) The credit segment of the business is showing a lot of promise Ziggy's Bistro's largest clients are companies which pay on credit Ziggy's has arranged a month's credit on all purchases with these customers dil) The company's Current Ratio is 84 878% September 1, 2021 to December 31, 2021 Month September October November December Sales Cash 43.387 35,511 96.000 82.747 Credit 96.000 112.000 128,000 192.000 Apart from the cost of sales, other expenses of operating the restaurant were as follows: Staff wages Rates (as allocated Insurance fas alocated Advertising Other general expenses September October November December $ $ $ $ 40,000 40.000 48.000 56,000 1,600 1.600 1.600 1,600 800 800 800 800 1.200 1.200 1.360 1.440 27,200 27200 29,500 31,200 The following additional information is available relating to the business i) Gross profit margin was 60% of net sales revenue #) Sales retums were: September 243%: October 238% November 0% and December 1% of total sales. (Assume that monthly trade receivables are not affected by sales returns). On September 1, 2021 opening inventory was 200. Closing inventory was constant from month to month at a cost value of $7.200. 1) Insurance was paid one year in advance on September 2021. QUESTION CONTINUES ON NEXT PAGE UL 22/0371 Page 36 Rates are paid in two instalments on September 1 and March 1 each year, Rates for the first half of the accounting period were paid on September 1. 2021 vi All other expenses (9 staf wages, advertising and general expenses) are paid as they are incurred vil) Non-current assets at September 1, 2021 were $384.000 vil) Non-current assets acquired on December 1, 2021 amounted to $192.000 x) Depreciation of Non-current Assets is by the straight-line method, assuming nit salvage value and a useful life of 5 years. Depreciation is charged on a monthly basis beginning in the month on which the asset is acquired *) Ziggy's pays its suppliers one month in areas *) The company has no non-current liabies but finances its working capital with a bank overdraft xil) The credit segment of the business is showing a lot of promise Ziggy's Bistro's largest clients are companies which pay on credit Ziggy's has arranged a month's credit on all purchases with these customers dil) The company's Current Ratio is 84 878%