Answered step by step

Verified Expert Solution

Question

1 Approved Answer

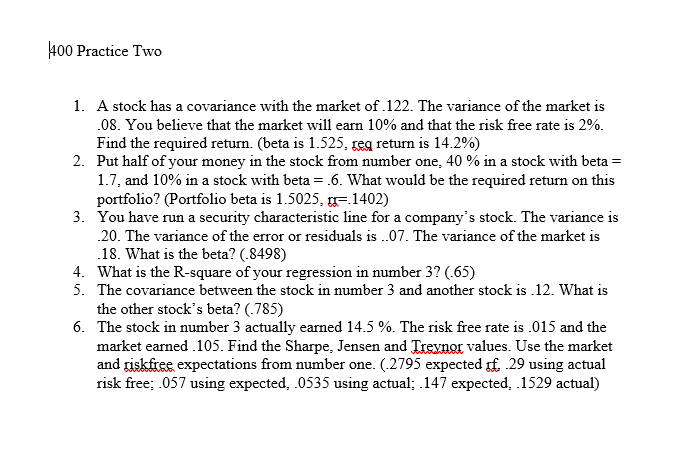

I am looking for the answer to number 6. The numbers inside parenthesis at the end of each question are the answers we are suppose

I am looking for the answer to number 6. The numbers inside parenthesis at the end of each question are the answers we are suppose to come up with. I would like for work to be shown so I can understand how you got to the answer in #6. Thank you

1. A stock has a covariance with the market of .122 . The variance of the market is .08. You believe that the market will earn 10% and that the risk free rate is 2%. Find the required return. (beta is 1.525 , req return is 14.2% ) 2. Put half of your money in the stock from number one, 40% in a stock with beta = 1.7 , and 10% in a stock with beta =.6. What would be the required return on this portfolio? (Portfolio beta is 1.5025,rs=.1402 ) 3. You have run a security characteristic line for a company's stock. The variance is 20. The variance of the error or residuals is ..07. The variance of the market is 18. What is the beta? (.8498) 4. What is the R-square of your regression in number 3 ? (.65) 5. The covariance between the stock in number 3 and another stock is .12. What is the other stock's beta? (.785) 6. The stock in number 3 actually earned 14.5%. The risk free rate is .015 and the market earned .105. Find the Sharpe, Jensen and Treynor values. Use the market and riskfree expectations from number one. (.2795 expected ff . 29 using actual risk free; .057 using expected, .0535 using actual; .147 expected, .1529 actual)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started