I am looking for the answers to 23-2B. you will need the info from the second picture which is 23-1B.

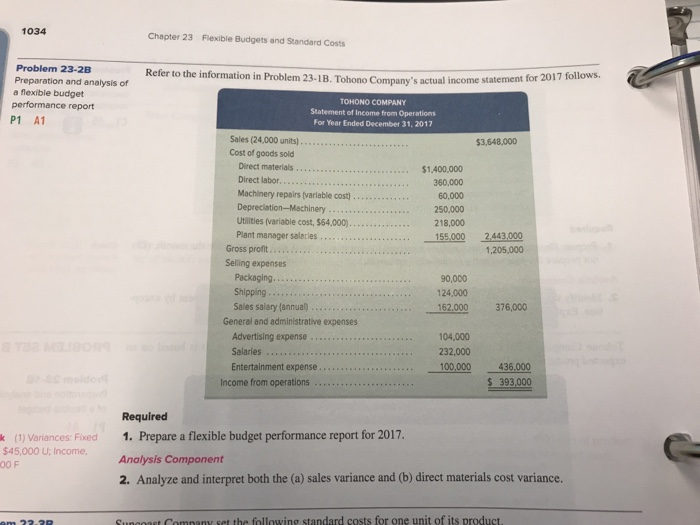

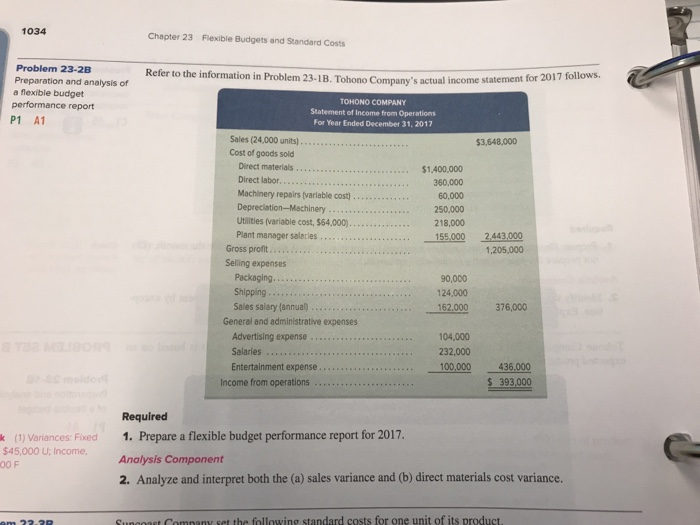

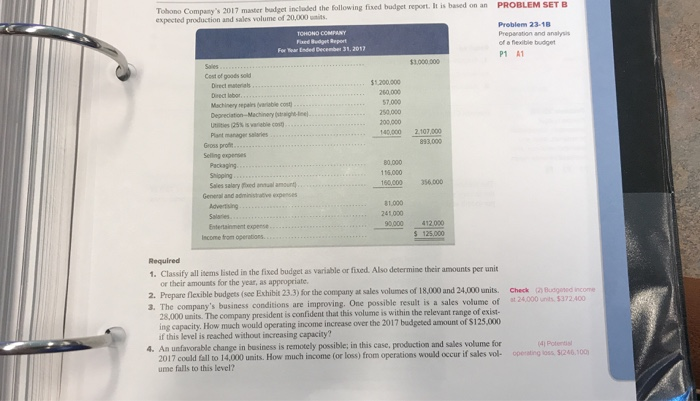

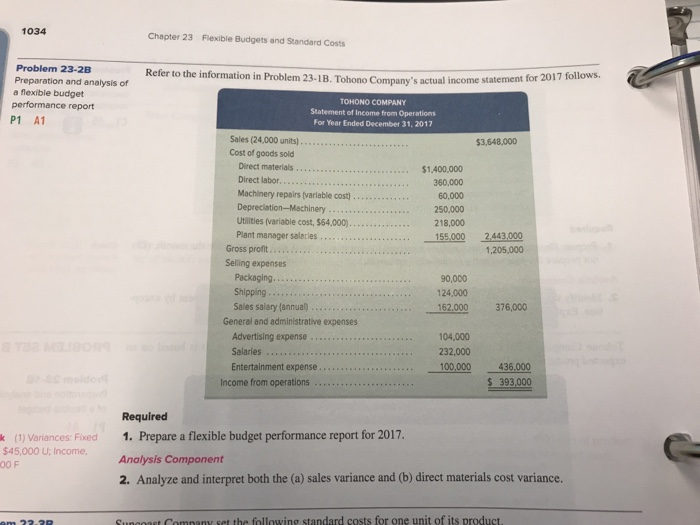

1034 Chapter 23 Flexible Budgets and Standard Costs Problem 23-2B Preparation and analysis of a flexible budget performance report P1 A1 Refer to the information in Problem 23-1B. Tohono Company's actual income statement for 2017 follows. TOHONO COMPANY Statement of Income from Operations For Year Ended December 31, 2017 Sales (24,000 units) Cost of goods sold Direct materials $3,648.000 $1,400,000 360,000 60,000 250,000 218,000 Direct labor Machinery repairs (variable cost) Depreciation-Machinery Utilities (variable cost, $64,000). Plant manager salarles Gross proft... Selling expenses 1,205,000 Packaging Shipping Sales salary (annual.... 90,000 124,000 162.000 376,000 General and administrative expenses Advertising expense Salaries 104,000 232,000 436,000 Income from operations- S 393,000 Required (1) Variances: Fixed 1. Prepare a flexible budget performance report for 2017. $45,000 U. Incme.Analysis 00 F 2. Analyze and interpret both the (a) sales variance and (b) direct materials cost variance. t Comnany set the following standard costs for one unit of its product. PROBLEM SET B 2017 master budget incladed the following fixed budget report. It is based on an expected production and sales volume of 20,000 units Problem 23-18 Preparation and analys of a flexible budget P1 A1 Fixed Budg R For Tear Ended December 31 Cost of goods sold 1200000 260.000 7,000 250,000 00,000 Dieect lbor Machinery repelrs (arable cost 140.0002.107.000 83,000 Plant manager salaries Gross profe Selling expenses Packaging Sipping Sales salary fxed antual amount 16,000 General and administrative expenses 1,000 Entertainment expense lscome fom operations 90000 412000 125,000 Required 1. Classify all inems listed in the fixed budget as variable or fixed. Also determine their amounts per unit or their amounts for the year, as appropriate 2. Prepare flexible budgets ( 3. The company's business conditions are improving. One possible result is a sales volume (see Exhibit 23.3) for the company at sales volumes of 18,000 and 24,000 units. Check Busgened income of at 24,000 units $372.400 28,000 units. The company president is confident that this volume is within the relevant range of exist- ing capacity. How much would operating income increase over the 2017 budgeted amount of $125,000 if this level is reached without increasing capacity? 4An unfavorable change in besiness is remotely possible, in this case, prodaction and sales volume for 4) Potentis 2017 could fall to 14,000 units. How much income (or loss) from operations would occur if sales vol ume falls to this level? operating