Question: I am needing help with 5,6,7 please Set up the entire general ledger using these accounts before you start into the project. Keep the accounts

I am needing help with 5,6,7 please

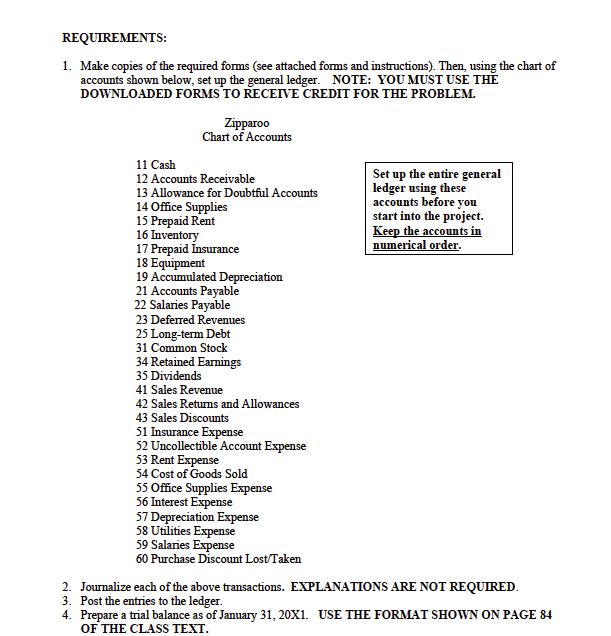

Set up the entire general ledger using these accounts before you start into the project. Keep the accounts in numerical order.

5. Journalize and post the adjusting entries using the following information: a. Zipparoo estimates that 10% of accounts owed to the company would not be collected. Round to the dollar.

b. Office Supplies at the end of the year totaled $3,000.

c. Must take depreciation for equipment use this month for both old and new equipment. Round Total depreciation to the dollar.

d. Salaries of $2,Y00 for January will not be paid until February 5 of next month.

e. In a prior month, 12 months rent had been purchased in advance for $96,000.

f. Must record insurance use this month.

g. A physical count of inventory indicates there is $2,500 of inventory on hand.

6. Prepare an adjusted trial balance. USE THE FORMAT SHOWN ON PAGE 132 OF THE CLASS TEXT.

7. Using the adjusted trial balance, prepare an income statement, a statement of retained earnings, and a balance sheet. USE THE FORMATS STARTING ON PAGE 134 OF THE CLASS TEXT. You will have to include the Cost of Goods Sold requirements of the Income Statement. Note: For our problem, there are no income taxes.

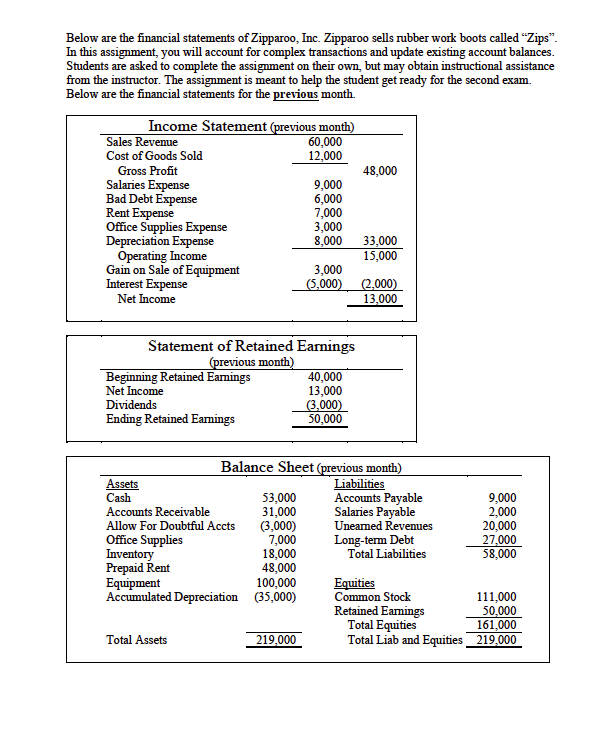

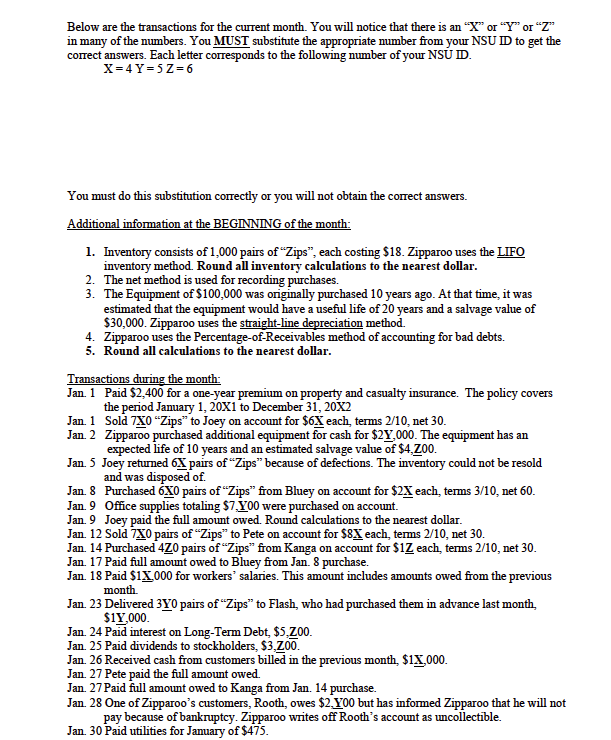

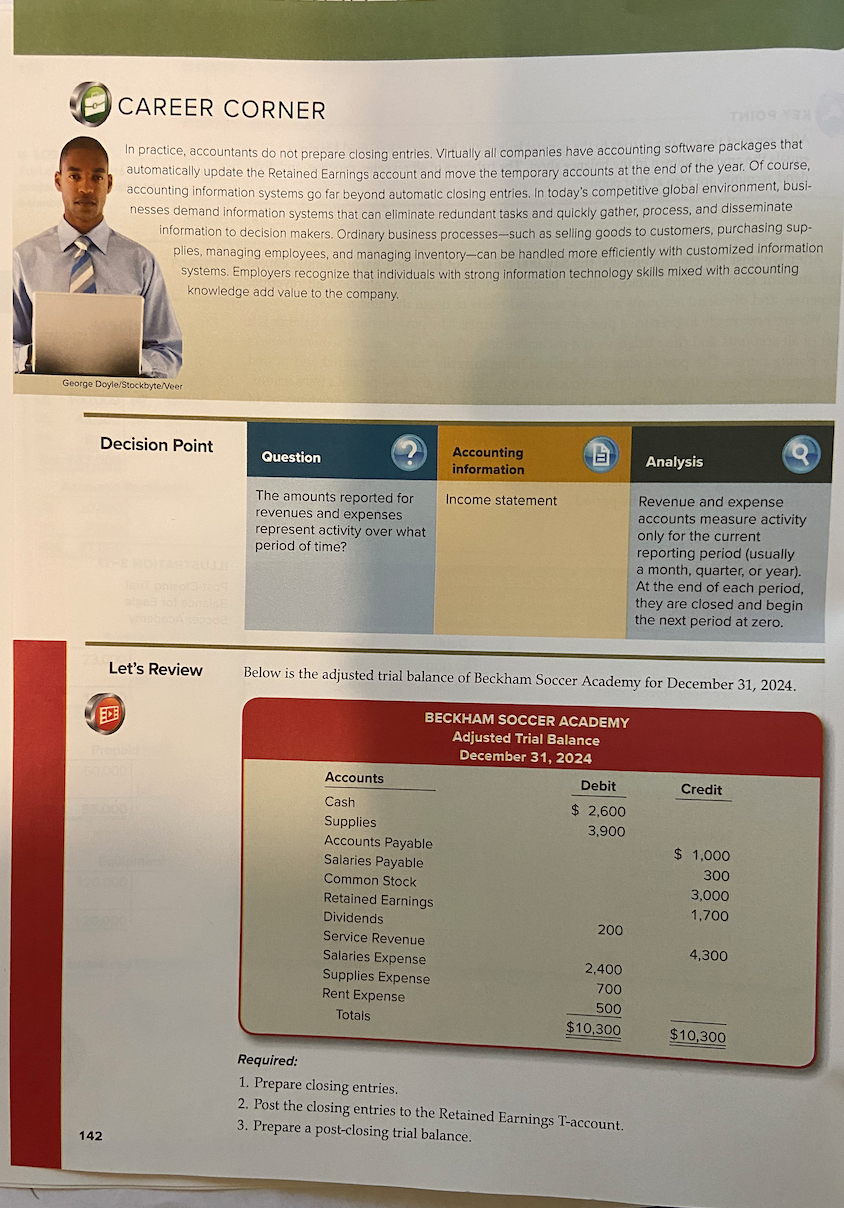

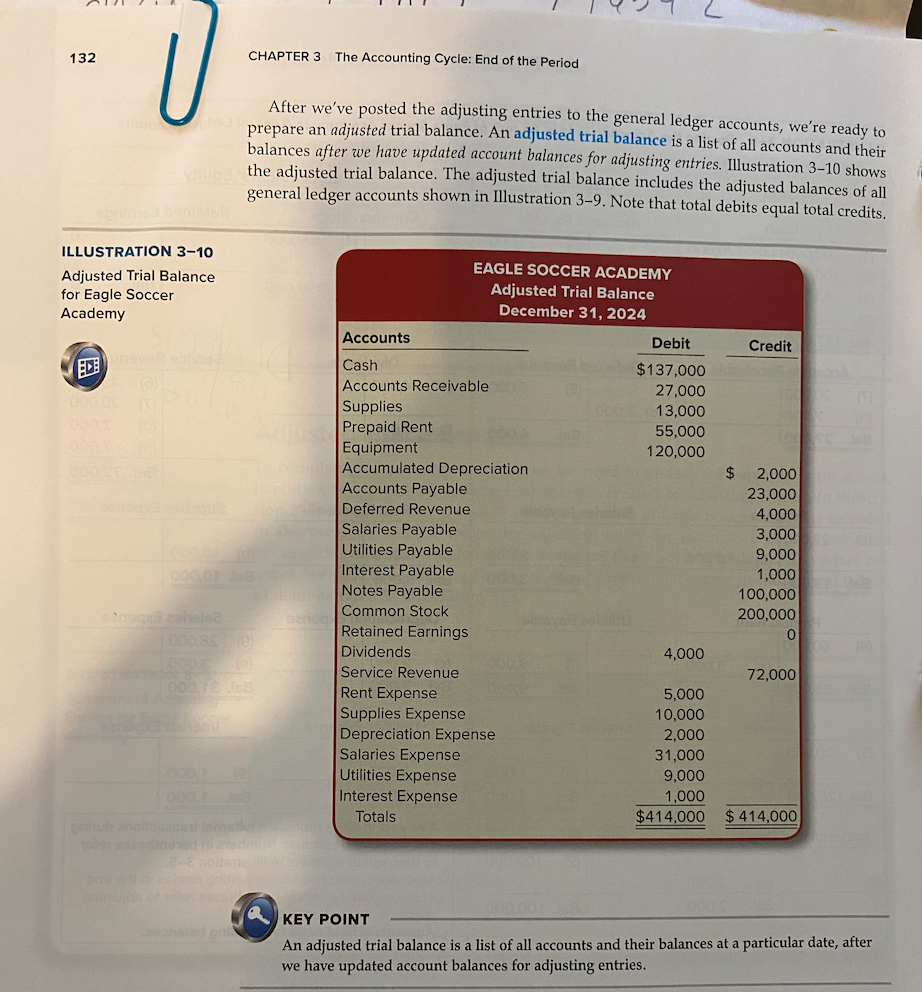

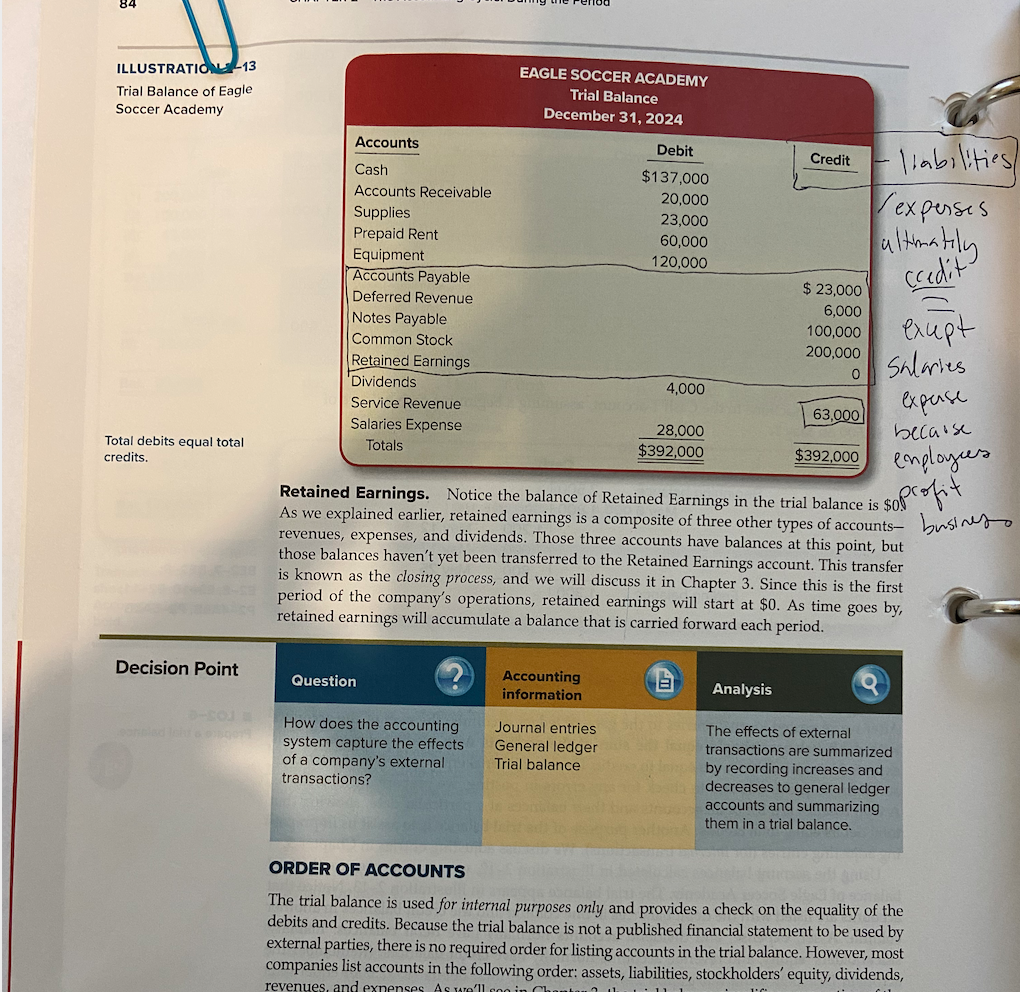

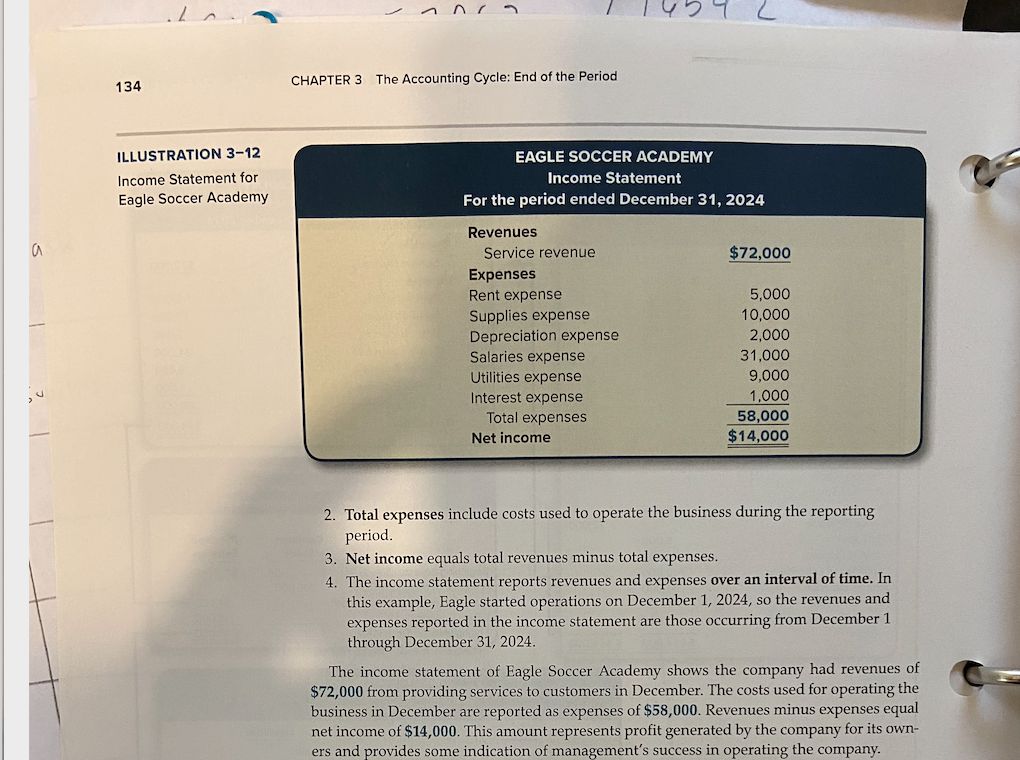

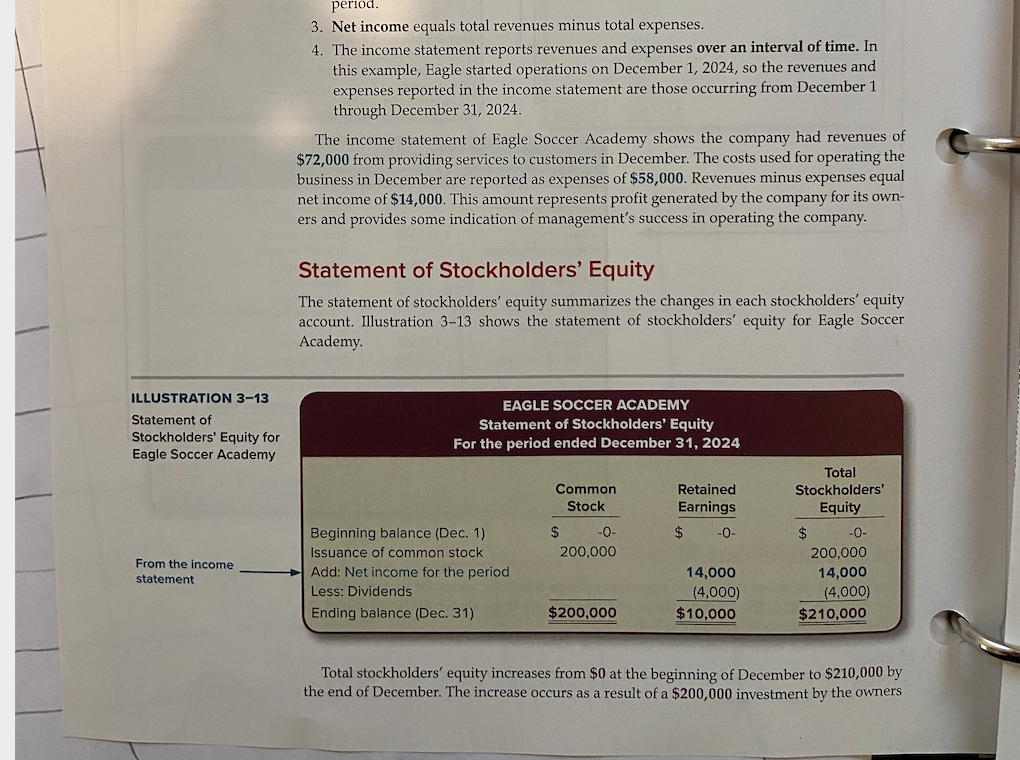

Below are the financial statements of Zipparoo, Inc. Zipparoo sells rubber work boots called "Zips". In this assignment, you will account for complex transactions and update existing account balances. Students are asked to complete the assignment on their own, but may obtain instructional assistance from the instructor. The assignment is meant to help the student get ready for the second exam. Below are the financial statements for the previous month. Below are the transactions for the current month. You will notice that there is an " X " or " Y " or " Z " in many of the numbers. You MUST substitute the appropriate number from your NSU ID to get the correct answers. Each letter corresponds to the following number of your NSU ID. X=4Y=5Z=6 You must do this substitution correctly or you will not obtain the correct answers. Additional information at the BEGINNING of the month: 1. Inventory consists of 1,000 pairs of "Zips", each costing $18. Zipparoo uses the LIFO inventory method. Round all inventory calculations to the nearest dollar. 2. The net method is used for recording purchases. 3. The Equipment of $100,000 was originally purchased 10 years ago. At that time, it was estimated that the equipment would have a useful life of 20 years and a salvage value of $30,000. Zipparoo uses the straight-line depreciation method. 4. Zipparoo uses the Percentage-of-Receivables method of accounting for bad debts. 5. Round all calculations to the nearest dollar. Transactions during the month: Jan. 1 Paid $2,400 for a one-year premium on property and casualty insurance. The policy covers the period January 1,20X1 to December 31,20X2 Jan. 1 Sold 7X0 "Zips" to Joey on account for $6X each, terms 2/10, net 30 . Jan. 2 Zipparoo purchased additional equipment for cash for $2Y,000. The equipment has an expected life of 10 years and an estimated salvage value of $4,Z00. Jan. 5 Joey returned 6X pairs of "Zips" because of defections. The inventory could not be resold and was disposed of. Jan. 8 Purchased 6X0 pairs of "Zips" from Bluey on account for $2X each, terms 3/10, net 60 . Jan. 9 Office supplies totaling $7,Y00 were purchased on account. Jan. 9 Joey paid the full amount owed. Round calculations to the nearest dollar. Jan. 12 Sold 7X0 pairs of "Zips" to Pete on account for $8X each, terms 2/10, net 30 . Jan. 14 Purchased 4Z0 pairs of "Zips" from Kanga on account for $1Z each, terms 2/10, net 30 . Jan. 17 Paid full amount owed to Bluey from Jan. 8 purchase. Jan. 18 Paid $1X,000 for workers' salaries. This amount includes amounts owed from the previous month. Jan. 23 Delivered 3 Y0 pairs of "Zips" to Flash, who had purchased them in advance last month, $1Y,000. Jan. 24 Paid interest on Long-Term Debt, $5,Z00. Jan. 25 Paid dividends to stockholders, $3,Z00. Jan. 26 Received cash from customers billed in the previous month, $1X,000. Jan. 27 Pete paid the full amount owed. Jan. 27 Paid full amount owed to Kanga from Jan. 14 purchase. Jan. 28 One of Zipparoo's customers, Rooth, owes $2,Y00 but has informed Zipparoo that he will not pay because of bankruptcy. Zipparoo writes off Rooth's account as uncollectible. Jan. 30 Paid utilities for January of $475. REQUIREMENTS: 1. Make copies of the required forms (see attached forms and instructions). Then, using the chart of accounts shown below, set up the general ledger. NOTE: YOU MUST USE THE DOWNLOADED FORMS TO RECEIVE CREDIT FOR THE PROBLEM. 4. 1 4 OF THE CLASS TEXT. ictice, accountants do not prepare closing entries. Virtually all companies have accounting software packages that natically update the Retained Earnings account and move the temporary accounts at the end of the year. Of course, unting information systems go far beyond automatic closing entries. In today's competitive global environment, busies demand information systems that can eliminate redundant tasks and quickly gather, process, and disseminate information to decision makers. Ordinary business processes-such as selling goods to customers, purchasing supplies, managing employees, and managing inventory-can be handled more efficiently with customized information systems. Employers recognize that individuals with strong information technology skills mixed with accounting knowledge add value to the company. Let's Review Below is the adjusted trial balance of Beckham Soccer Academy for December 31, 2024. 1. Prepare closing entries. 2. Post the closing entries to the Retained Earnings T-account. 3. Prepare a post-closing trial balance. 132 CHAPTER 3 The Accounting Cycle: End of the Period After we've posted the adjusting entries to the general ledger accounts, we're ready to prepare an adjusted trial balance. An adjusted trial balance is a list of all accounts and their balances after we have updated account balances for adjusting entries. Illustration 3-10 shows the adjusted trial balance. The adjusted trial balance includes the adjusted balances of all general ledger accounts shown in Illustration 3-9. Note that total debits equal total credits. ILLUSTRATION 3-10 Adjusted Trial Balance for Eagle Soccer Academy KEY POINT An adjusted trial balance is a list of all accounts and their balances at a particular date, after we have updated account balances for adjusting entries. Total debits equal total credits. Retained Earnings. Notice the balance of Retained Earnings in the trial balance is $0. As we explained earlier, retained earnings is a composite of three other types of accountsrevenues, expenses, and dividends. Those three accounts have balances at this point, but those balances haven't yet been transferred to the Retained Earnings account. This transfer is known as the closing process, and we will discuss it in Chapter 3 . Since this is the first period of the company's operations, retained earnings will start at $0. As time goes by, retained earnings will accumulate a balance that is carried forward each period. Decision Point ORDER OF ACCOUNTS The trial balance is used for internal purposes only and provides a check on the equality of the debits and credits. Because the trial balance is not a published financial statement to be used by external parties, there is no required order for listing accounts in the trial balance. However, most companies list accounts in the following order: assets, liabilities, stockholders' equity, dividends, 134 CHAPTER 3 The Accounting Cycle: End of the Period ILLUSTRATION 3-12 Income Statement for Eagle Soccer Academy 2. Total expenses include costs used to operate the business during the reporting period. 3. Net income equals total revenues minus total expenses. 4. The income statement reports revenues and expenses over an interval of time. In this example, Eagle started operations on December 1, 2024, so the revenues and expenses reported in the income statement are those occurring from December 1 through December 31, 2024. The income statement of Eagle Soccer Academy shows the company had revenues of $72,000 from providing services to customers in December. The costs used for operating the business in December are reported as expenses of $58,000. Revenues minus expenses equal net income of $14,000. This amount represents profit generated by the company for its owners and provides some indication of management's success in operating the company. 3. Net income equals total revenues minus total expenses. 4. The income statement reports revenues and expenses over an interval of time. In this example, Eagle started operations on December 1, 2024, so the revenues and expenses reported in the income statement are those occurring from December 1 through December 31,2024. The income statement of Eagle Soccer Academy shows the company had revenues of $72,000 from providing services to customers in December. The costs used for operating the business in December are reported as expenses of $58,000. Revenues minus expenses equal net income of $14,000. This amount represents profit generated by the company for its owners and provides some indication of management's success in operating the company. Statement of Stockholders' Equity The statement of stockholders' equity summarizes the changes in each stockholders' equity account. Illustration 3-13 shows the statement of stockholders' equity for Eagle Soccer Academy. ILLUSTRATION 3-13 Statement of Stockholders' Equity for Eagle Soccer Academy From the income statement Total stockholders' equity increases from $0 at the beginning of December to $210,000 by the end of December. The increase occurs as a result of a $200,000 investment by the owners Below are the financial statements of Zipparoo, Inc. Zipparoo sells rubber work boots called "Zips". In this assignment, you will account for complex transactions and update existing account balances. Students are asked to complete the assignment on their own, but may obtain instructional assistance from the instructor. The assignment is meant to help the student get ready for the second exam. Below are the financial statements for the previous month. Below are the transactions for the current month. You will notice that there is an " X " or " Y " or " Z " in many of the numbers. You MUST substitute the appropriate number from your NSU ID to get the correct answers. Each letter corresponds to the following number of your NSU ID. X=4Y=5Z=6 You must do this substitution correctly or you will not obtain the correct answers. Additional information at the BEGINNING of the month: 1. Inventory consists of 1,000 pairs of "Zips", each costing $18. Zipparoo uses the LIFO inventory method. Round all inventory calculations to the nearest dollar. 2. The net method is used for recording purchases. 3. The Equipment of $100,000 was originally purchased 10 years ago. At that time, it was estimated that the equipment would have a useful life of 20 years and a salvage value of $30,000. Zipparoo uses the straight-line depreciation method. 4. Zipparoo uses the Percentage-of-Receivables method of accounting for bad debts. 5. Round all calculations to the nearest dollar. Transactions during the month: Jan. 1 Paid $2,400 for a one-year premium on property and casualty insurance. The policy covers the period January 1,20X1 to December 31,20X2 Jan. 1 Sold 7X0 "Zips" to Joey on account for $6X each, terms 2/10, net 30 . Jan. 2 Zipparoo purchased additional equipment for cash for $2Y,000. The equipment has an expected life of 10 years and an estimated salvage value of $4,Z00. Jan. 5 Joey returned 6X pairs of "Zips" because of defections. The inventory could not be resold and was disposed of. Jan. 8 Purchased 6X0 pairs of "Zips" from Bluey on account for $2X each, terms 3/10, net 60 . Jan. 9 Office supplies totaling $7,Y00 were purchased on account. Jan. 9 Joey paid the full amount owed. Round calculations to the nearest dollar. Jan. 12 Sold 7X0 pairs of "Zips" to Pete on account for $8X each, terms 2/10, net 30 . Jan. 14 Purchased 4Z0 pairs of "Zips" from Kanga on account for $1Z each, terms 2/10, net 30 . Jan. 17 Paid full amount owed to Bluey from Jan. 8 purchase. Jan. 18 Paid $1X,000 for workers' salaries. This amount includes amounts owed from the previous month. Jan. 23 Delivered 3 Y0 pairs of "Zips" to Flash, who had purchased them in advance last month, $1Y,000. Jan. 24 Paid interest on Long-Term Debt, $5,Z00. Jan. 25 Paid dividends to stockholders, $3,Z00. Jan. 26 Received cash from customers billed in the previous month, $1X,000. Jan. 27 Pete paid the full amount owed. Jan. 27 Paid full amount owed to Kanga from Jan. 14 purchase. Jan. 28 One of Zipparoo's customers, Rooth, owes $2,Y00 but has informed Zipparoo that he will not pay because of bankruptcy. Zipparoo writes off Rooth's account as uncollectible. Jan. 30 Paid utilities for January of $475. REQUIREMENTS: 1. Make copies of the required forms (see attached forms and instructions). Then, using the chart of accounts shown below, set up the general ledger. NOTE: YOU MUST USE THE DOWNLOADED FORMS TO RECEIVE CREDIT FOR THE PROBLEM. 4. 1 4 OF THE CLASS TEXT. ictice, accountants do not prepare closing entries. Virtually all companies have accounting software packages that natically update the Retained Earnings account and move the temporary accounts at the end of the year. Of course, unting information systems go far beyond automatic closing entries. In today's competitive global environment, busies demand information systems that can eliminate redundant tasks and quickly gather, process, and disseminate information to decision makers. Ordinary business processes-such as selling goods to customers, purchasing supplies, managing employees, and managing inventory-can be handled more efficiently with customized information systems. Employers recognize that individuals with strong information technology skills mixed with accounting knowledge add value to the company. Let's Review Below is the adjusted trial balance of Beckham Soccer Academy for December 31, 2024. 1. Prepare closing entries. 2. Post the closing entries to the Retained Earnings T-account. 3. Prepare a post-closing trial balance. 132 CHAPTER 3 The Accounting Cycle: End of the Period After we've posted the adjusting entries to the general ledger accounts, we're ready to prepare an adjusted trial balance. An adjusted trial balance is a list of all accounts and their balances after we have updated account balances for adjusting entries. Illustration 3-10 shows the adjusted trial balance. The adjusted trial balance includes the adjusted balances of all general ledger accounts shown in Illustration 3-9. Note that total debits equal total credits. ILLUSTRATION 3-10 Adjusted Trial Balance for Eagle Soccer Academy KEY POINT An adjusted trial balance is a list of all accounts and their balances at a particular date, after we have updated account balances for adjusting entries. Total debits equal total credits. Retained Earnings. Notice the balance of Retained Earnings in the trial balance is $0. As we explained earlier, retained earnings is a composite of three other types of accountsrevenues, expenses, and dividends. Those three accounts have balances at this point, but those balances haven't yet been transferred to the Retained Earnings account. This transfer is known as the closing process, and we will discuss it in Chapter 3 . Since this is the first period of the company's operations, retained earnings will start at $0. As time goes by, retained earnings will accumulate a balance that is carried forward each period. Decision Point ORDER OF ACCOUNTS The trial balance is used for internal purposes only and provides a check on the equality of the debits and credits. Because the trial balance is not a published financial statement to be used by external parties, there is no required order for listing accounts in the trial balance. However, most companies list accounts in the following order: assets, liabilities, stockholders' equity, dividends, 134 CHAPTER 3 The Accounting Cycle: End of the Period ILLUSTRATION 3-12 Income Statement for Eagle Soccer Academy 2. Total expenses include costs used to operate the business during the reporting period. 3. Net income equals total revenues minus total expenses. 4. The income statement reports revenues and expenses over an interval of time. In this example, Eagle started operations on December 1, 2024, so the revenues and expenses reported in the income statement are those occurring from December 1 through December 31, 2024. The income statement of Eagle Soccer Academy shows the company had revenues of $72,000 from providing services to customers in December. The costs used for operating the business in December are reported as expenses of $58,000. Revenues minus expenses equal net income of $14,000. This amount represents profit generated by the company for its owners and provides some indication of management's success in operating the company. 3. Net income equals total revenues minus total expenses. 4. The income statement reports revenues and expenses over an interval of time. In this example, Eagle started operations on December 1, 2024, so the revenues and expenses reported in the income statement are those occurring from December 1 through December 31,2024. The income statement of Eagle Soccer Academy shows the company had revenues of $72,000 from providing services to customers in December. The costs used for operating the business in December are reported as expenses of $58,000. Revenues minus expenses equal net income of $14,000. This amount represents profit generated by the company for its owners and provides some indication of management's success in operating the company. Statement of Stockholders' Equity The statement of stockholders' equity summarizes the changes in each stockholders' equity account. Illustration 3-13 shows the statement of stockholders' equity for Eagle Soccer Academy. ILLUSTRATION 3-13 Statement of Stockholders' Equity for Eagle Soccer Academy From the income statement Total stockholders' equity increases from $0 at the beginning of December to $210,000 by the end of December. The increase occurs as a result of a $200,000 investment by the owners

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts