I am not sure about my answers. can you check and explain ?

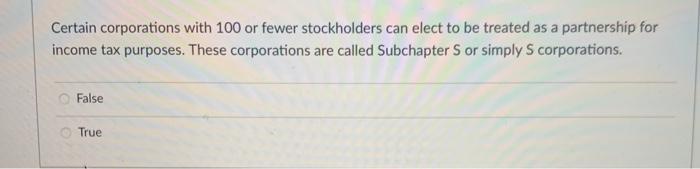

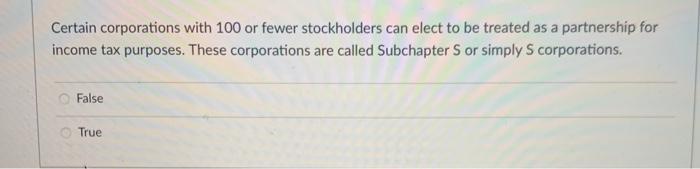

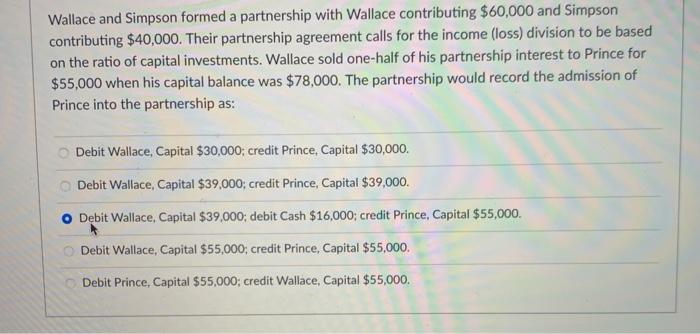

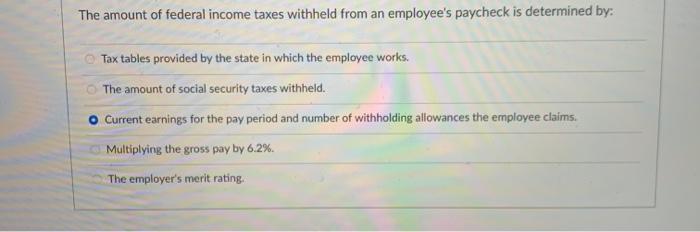

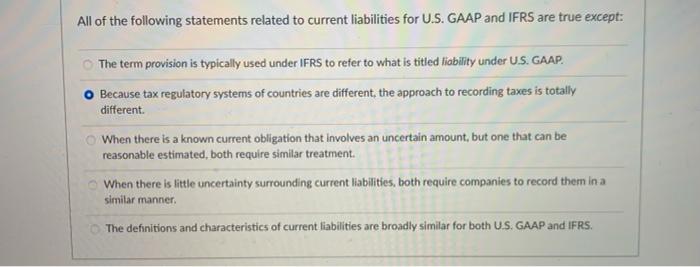

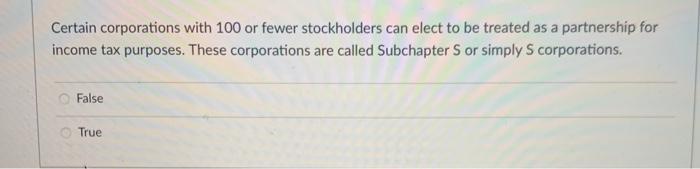

Certain corporations with 100 or fewer stockholders can elect to be treated as a partnership for income tax purposes. These corporations are called Subchapter S or simply S corporations. False True Wallace and Simpson formed a partnership with Wallace contributing $60,000 and Simpson contributing $40,000. Their partnership agreement calls for the income (loss) division to be based on the ratio of capital investments. Wallace sold one-half of his partnership interest to Prince for $55,000 when his capital balance was $78,000. The partnership would record the admission of Prince into the partnership as: Debit Wallace, Capital $30,000; credit Prince, Capital $30,000. Debit Wallace, Capital $39,000; credit Prince, Capital $39,000. Debit Wallace, Capital $39,000; debit Cash $16,000; credit Prince, Capital $55,000. Debit Wallace, Capital $55,000; credit Prince, Capital $55,000. Debit Prince, Capital $55,000; credit Wallace, Capital $55,000. When a partner is added to a partnership: The previous partnership ends. The partnership equity always increases. The underlying business operations must close and then re-open. The partnership must continue. The underlying business operations end. The amount of federal income taxes withheld from an employee's paycheck is determined by: Tax tables provided by the state in which the employee works. The amount of social security taxes withheld. Current earnings for the pay period and number of withholding allowances the employee claims. Multiplying the gross pay by 6.2%. The employer's merit rating. All of the following statements related to current liabilities for U.S. GAAP and IFRS are true except: The term provision is typically used under IFRS to refer to what is titled liability under U.S. GAAP. Because tax regulatory systems of countries are different the approach to recording taxes is totally different. When there is a known current obligation that involves an uncertain amount, but one that can be reasonable estimated, both require similar treatment. When there is little uncertainty surrounding current liabilities, both require companies to record them in a similar manner The definitions and characteristics of current liabilities are broadly similar for both U.S. GAAP and IFRS