Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am not sure how to answer this. Diltz Farms is considering investing in an automated egg-sorting system to increase production for international (web-based) sales

I am not sure how to answer this.

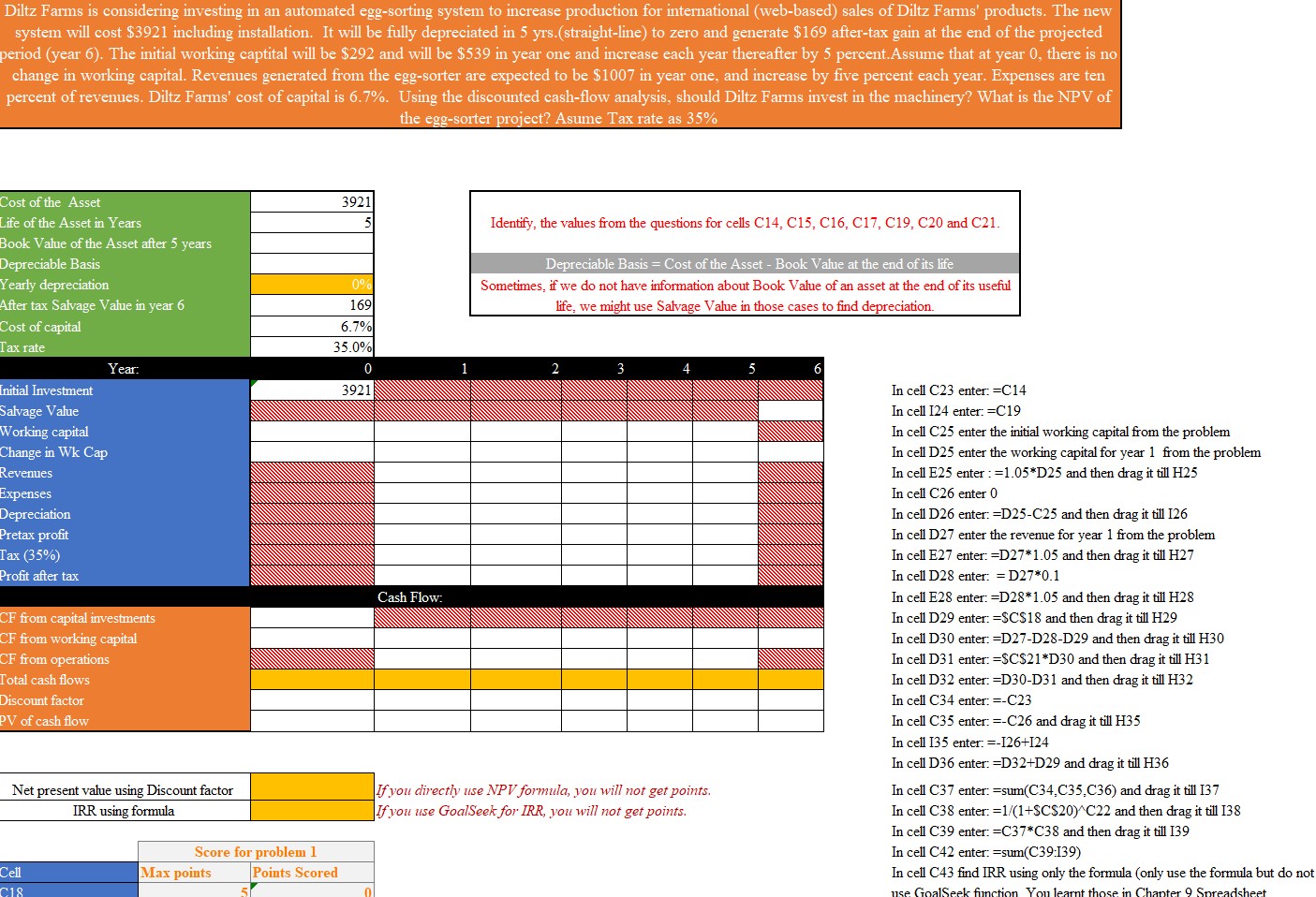

Diltz Farms is considering investing in an automated egg-sorting system to increase production for international (web-based) sales of Diltz Farms' products. The new system will cost $3921 including installation. It will be fully depreciated in 5 yrs.(straight-line) to zero and generate $169 after-tax gain at the end of the projected eriod (year 6). The initial working captital will be $292 and will be $539 in year one and increase each year thereafter by 5 percent. Assume that at year 0 , there is no change in working capital. Revenues generated from the egg-sorter are expected to be $1007 in year one, and increase by five percent each year. Expenses are ten percent of revenues. Diltz Farms' cost of capital is 6.7%. Using the discounted cash-flow analysis, should Diltz Farms invest in the machinery? What is the NPV of the egg-sorter project? Asume Tax rate as 35% i, C17,C19,C20 and C21 at the end of its life in asset at the end of its useful nd depreciation. In cell C23 enter: =C14 In cell I24 enter: =C19 In cell C25 enter the initial working capital from the problem In cell D25 enter the working capital for year 1 from the problem In cell E25 enter : =1.05D25 and then drag it till H25 In cell C26 enter 0 In cell D26 enter: =D25-C25 and then drag it till I26 In cell D27 enter the revenue for year 1 from the problem In cell E27 enter: = D27*1.05 and then drag it till H27 In cell D28 enter: = D27*0.1 In cell E28 enter: = D28*1.05 and then drag it till H28 In cell D29 enter: =$C$18 and then drag it till H29 In cell D30 enter: = D27-D28-D29 and then drag it till H30 In cell D31 enter: =$C$21D30 and then drag it till H31 In cell D32 enter: =D30-D31 and then drag it till H32 In cell C 34 enter: =C23 In cell C35 enter: =C26 and drag it till H35 In cell I 35 enter: =I26+I24 In cell D36 enter: =D32+D29 and drag it till H36 Ifyou directly use NPV formula, you will not get points. In cell C37 enter: =sum(C34,C35,C36) and drag it till I37 If you use GoalSeek for IRR, you will not get points. In cell C38 enter: =1/(1+SCS20)C22 and then drag it till I 38 In cell C39 enter: =C37C38 and then drag it till I39 In cell C42 enter: =sum(C39:I39) In cell C43 find IRR using only the formula (only use the formula but do no Diltz Farms is considering investing in an automated egg-sorting system to increase production for international (web-based) sales of Diltz Farms' products. The new system will cost $3921 including installation. It will be fully depreciated in 5 yrs.(straight-line) to zero and generate $169 after-tax gain at the end of the projected eriod (year 6). The initial working captital will be $292 and will be $539 in year one and increase each year thereafter by 5 percent. Assume that at year 0 , there is no change in working capital. Revenues generated from the egg-sorter are expected to be $1007 in year one, and increase by five percent each year. Expenses are ten percent of revenues. Diltz Farms' cost of capital is 6.7%. Using the discounted cash-flow analysis, should Diltz Farms invest in the machinery? What is the NPV of the egg-sorter project? Asume Tax rate as 35% i, C17,C19,C20 and C21 at the end of its life in asset at the end of its useful nd depreciation. In cell C23 enter: =C14 In cell I24 enter: =C19 In cell C25 enter the initial working capital from the problem In cell D25 enter the working capital for year 1 from the problem In cell E25 enter : =1.05D25 and then drag it till H25 In cell C26 enter 0 In cell D26 enter: =D25-C25 and then drag it till I26 In cell D27 enter the revenue for year 1 from the problem In cell E27 enter: = D27*1.05 and then drag it till H27 In cell D28 enter: = D27*0.1 In cell E28 enter: = D28*1.05 and then drag it till H28 In cell D29 enter: =$C$18 and then drag it till H29 In cell D30 enter: = D27-D28-D29 and then drag it till H30 In cell D31 enter: =$C$21D30 and then drag it till H31 In cell D32 enter: =D30-D31 and then drag it till H32 In cell C 34 enter: =C23 In cell C35 enter: =C26 and drag it till H35 In cell I 35 enter: =I26+I24 In cell D36 enter: =D32+D29 and drag it till H36 Ifyou directly use NPV formula, you will not get points. In cell C37 enter: =sum(C34,C35,C36) and drag it till I37 If you use GoalSeek for IRR, you will not get points. In cell C38 enter: =1/(1+SCS20)C22 and then drag it till I 38 In cell C39 enter: =C37C38 and then drag it till I39 In cell C42 enter: =sum(C39:I39) In cell C43 find IRR using only the formula (only use the formula but do no

Diltz Farms is considering investing in an automated egg-sorting system to increase production for international (web-based) sales of Diltz Farms' products. The new system will cost $3921 including installation. It will be fully depreciated in 5 yrs.(straight-line) to zero and generate $169 after-tax gain at the end of the projected eriod (year 6). The initial working captital will be $292 and will be $539 in year one and increase each year thereafter by 5 percent. Assume that at year 0 , there is no change in working capital. Revenues generated from the egg-sorter are expected to be $1007 in year one, and increase by five percent each year. Expenses are ten percent of revenues. Diltz Farms' cost of capital is 6.7%. Using the discounted cash-flow analysis, should Diltz Farms invest in the machinery? What is the NPV of the egg-sorter project? Asume Tax rate as 35% i, C17,C19,C20 and C21 at the end of its life in asset at the end of its useful nd depreciation. In cell C23 enter: =C14 In cell I24 enter: =C19 In cell C25 enter the initial working capital from the problem In cell D25 enter the working capital for year 1 from the problem In cell E25 enter : =1.05D25 and then drag it till H25 In cell C26 enter 0 In cell D26 enter: =D25-C25 and then drag it till I26 In cell D27 enter the revenue for year 1 from the problem In cell E27 enter: = D27*1.05 and then drag it till H27 In cell D28 enter: = D27*0.1 In cell E28 enter: = D28*1.05 and then drag it till H28 In cell D29 enter: =$C$18 and then drag it till H29 In cell D30 enter: = D27-D28-D29 and then drag it till H30 In cell D31 enter: =$C$21D30 and then drag it till H31 In cell D32 enter: =D30-D31 and then drag it till H32 In cell C 34 enter: =C23 In cell C35 enter: =C26 and drag it till H35 In cell I 35 enter: =I26+I24 In cell D36 enter: =D32+D29 and drag it till H36 Ifyou directly use NPV formula, you will not get points. In cell C37 enter: =sum(C34,C35,C36) and drag it till I37 If you use GoalSeek for IRR, you will not get points. In cell C38 enter: =1/(1+SCS20)C22 and then drag it till I 38 In cell C39 enter: =C37C38 and then drag it till I39 In cell C42 enter: =sum(C39:I39) In cell C43 find IRR using only the formula (only use the formula but do no Diltz Farms is considering investing in an automated egg-sorting system to increase production for international (web-based) sales of Diltz Farms' products. The new system will cost $3921 including installation. It will be fully depreciated in 5 yrs.(straight-line) to zero and generate $169 after-tax gain at the end of the projected eriod (year 6). The initial working captital will be $292 and will be $539 in year one and increase each year thereafter by 5 percent. Assume that at year 0 , there is no change in working capital. Revenues generated from the egg-sorter are expected to be $1007 in year one, and increase by five percent each year. Expenses are ten percent of revenues. Diltz Farms' cost of capital is 6.7%. Using the discounted cash-flow analysis, should Diltz Farms invest in the machinery? What is the NPV of the egg-sorter project? Asume Tax rate as 35% i, C17,C19,C20 and C21 at the end of its life in asset at the end of its useful nd depreciation. In cell C23 enter: =C14 In cell I24 enter: =C19 In cell C25 enter the initial working capital from the problem In cell D25 enter the working capital for year 1 from the problem In cell E25 enter : =1.05D25 and then drag it till H25 In cell C26 enter 0 In cell D26 enter: =D25-C25 and then drag it till I26 In cell D27 enter the revenue for year 1 from the problem In cell E27 enter: = D27*1.05 and then drag it till H27 In cell D28 enter: = D27*0.1 In cell E28 enter: = D28*1.05 and then drag it till H28 In cell D29 enter: =$C$18 and then drag it till H29 In cell D30 enter: = D27-D28-D29 and then drag it till H30 In cell D31 enter: =$C$21D30 and then drag it till H31 In cell D32 enter: =D30-D31 and then drag it till H32 In cell C 34 enter: =C23 In cell C35 enter: =C26 and drag it till H35 In cell I 35 enter: =I26+I24 In cell D36 enter: =D32+D29 and drag it till H36 Ifyou directly use NPV formula, you will not get points. In cell C37 enter: =sum(C34,C35,C36) and drag it till I37 If you use GoalSeek for IRR, you will not get points. In cell C38 enter: =1/(1+SCS20)C22 and then drag it till I 38 In cell C39 enter: =C37C38 and then drag it till I39 In cell C42 enter: =sum(C39:I39) In cell C43 find IRR using only the formula (only use the formula but do no Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started