I am not sure how to work this question:

Suppose that you are only allowed to make a balloon payment to the principal of the compound interest loan.

You have $1,000 to put down at the beginning of year

* How many payments will you save?

( info sourced from this questions:

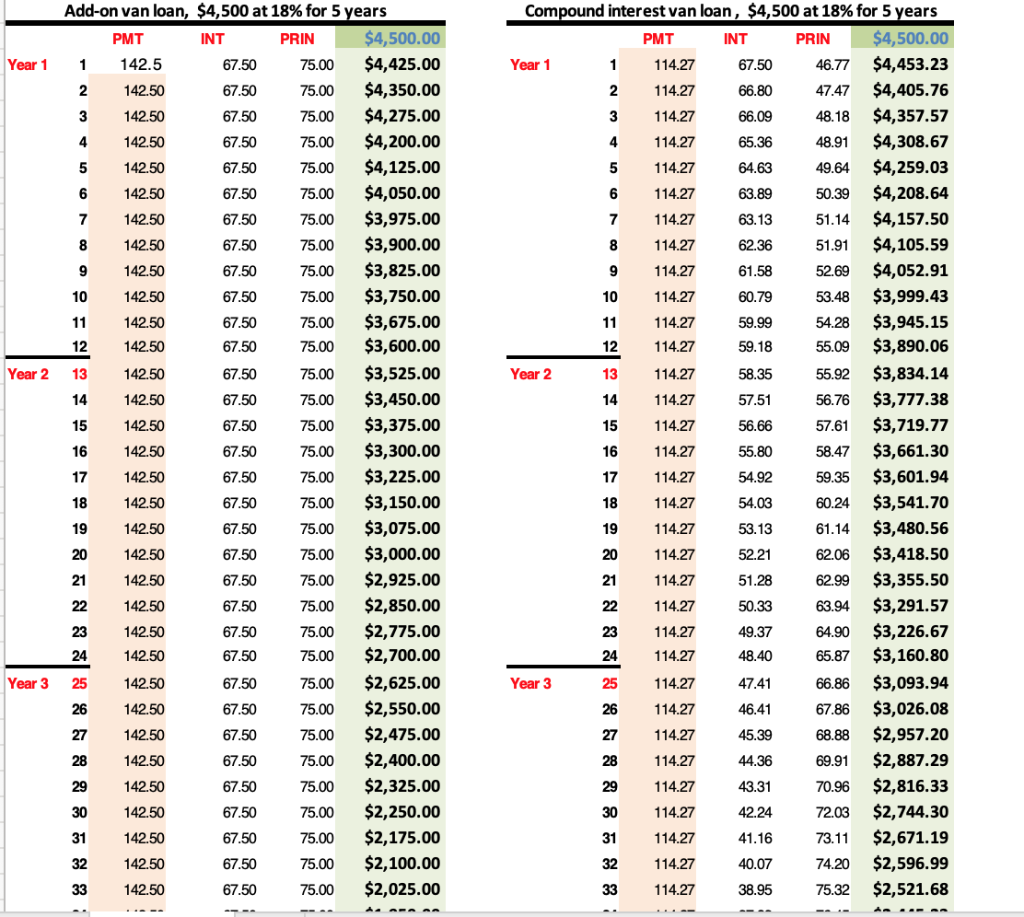

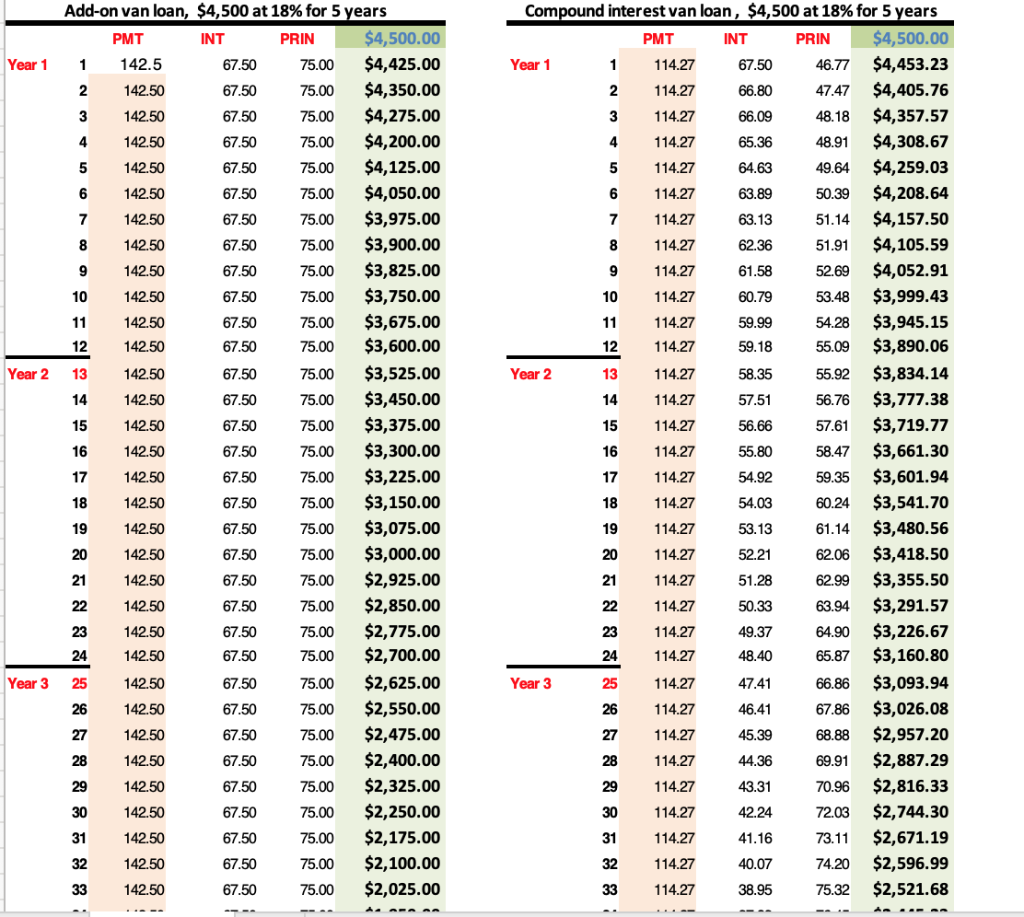

- You are offered an add-on loan for $4,500 at 18% for 5 years.

- What is the monthly payment?

- What is the amount of interest?

- What is the true interest rate cost of this loan?

If you could pay the same loan above at a compound rate,

- What would the monthly payment be?

- What would the amount of interest be?

Add-on van loan, $4,500 at 18% for 5 years Compound interest van loan, $4,500 at 18% for 5 years $4,500.00 75.00 $4,425.00 67.5075.00 $4,350.00 67.5075.00 $4,275.00 67.5075.00 $4,200.00 67.5075.00 $4,125.00 67.50 75.00 $4,050.00 67.5075.00 $3,975.00 67.5075.00 $3,900.00 67.5075.00 $3,825.00 67.50 75.00 $3,750.00 67.5075.00 $3,675.00 67.5075.00 $3,600.00 67.5075.00 $3,525.00 67.50 75.00 $3,450.00 67.50 75.00 3,375.00 67.5075.00 $3,300.00 67.5075.00 $3,225.00 67.5075.00 3,150.00 67.50 75.00 $3,075.00 67.5075.00 $3,000.00 67.5075.00 $2,925.00 67.5075.00 $2,850.00 67.5075.00$2,775.00 67.5075.00$2,700.00 67.5075.00 $2,625.00 67.5075.00 $2,550.00 67.5075.00 $2,475.00 67.5075.00 $2,400.00 67.5075.00 $2,325.00 67.5075.00 $2,250.00 67.5075.00 $2,175.00 67.5075.00$2,100.00 67.50 75.00 $2,025.00 PRIN $4,500.00 .5046.77 $4,453.23 2114.27 66.80 7.47 $4,405.76 3114.27 66.09 48.18 $4,357.57 4 114.2765.36 48.91 $4,308.67 5 114.2764.63 49.64 $4,259.03 50.39 $4,208.64 7 114.27 63.13 51.14 $4,157.50 8114.27 62.36 51.91 $4,105.59 9114.27 61.58 5269 $4,052.91 10 114.27 60.7953.48 $3,999.43 11 114.27 59.99 54.28 $3,945.15 12114.27 59.18 55.09 $3,890.06 Year 2 13 114.2758.3555.92 $3,834.14 14114.27 57.5 56.76 $3,777.38 15 114.27 56.66 57.61 $3,719.77 16 11427 55.80 58.47 $3,661.30 17114.27 54.92 59.35 $3,601.94 18114.27 54.03 60.24 $3,541.70 19 114.2753.13 61.14 $3,480.56 20114.27 52.21 62.06 $3,418.50 21114.27 51.28 62.99 $3,355.50 22114.2750.33 63.94 $3,291.57 23114.2749.37 64.90 $3,226.67 24114.2748.40 65.87 $3,160.80 25 114.2747.41 66.86 $3,093.94 26114.27 46.41 67.86 $3,026.08 27114.27 45.39 68.88 $2,957.20 28114.274436 69.91 $2,887.29 29114.27 43.31 70.96 $2,816.33 30 114.27 42.24 7203 $2,744.30 31 114.27 41.16 73.11 $2,671.19 32114.2740.07 74.20 $2,596.99 33 114.2738.95 75.32 $2,521.68 INT PRIN PMT INT 142.5 67.50 ear 1 114.27 114.27 63.89 12 18 20 21 ear 3 27 142.50 29 31 Add-on van loan, $4,500 at 18% for 5 years Compound interest van loan, $4,500 at 18% for 5 years $4,500.00 75.00 $4,425.00 67.5075.00 $4,350.00 67.5075.00 $4,275.00 67.5075.00 $4,200.00 67.5075.00 $4,125.00 67.50 75.00 $4,050.00 67.5075.00 $3,975.00 67.5075.00 $3,900.00 67.5075.00 $3,825.00 67.50 75.00 $3,750.00 67.5075.00 $3,675.00 67.5075.00 $3,600.00 67.5075.00 $3,525.00 67.50 75.00 $3,450.00 67.50 75.00 3,375.00 67.5075.00 $3,300.00 67.5075.00 $3,225.00 67.5075.00 3,150.00 67.50 75.00 $3,075.00 67.5075.00 $3,000.00 67.5075.00 $2,925.00 67.5075.00 $2,850.00 67.5075.00$2,775.00 67.5075.00$2,700.00 67.5075.00 $2,625.00 67.5075.00 $2,550.00 67.5075.00 $2,475.00 67.5075.00 $2,400.00 67.5075.00 $2,325.00 67.5075.00 $2,250.00 67.5075.00 $2,175.00 67.5075.00$2,100.00 67.50 75.00 $2,025.00 PRIN $4,500.00 .5046.77 $4,453.23 2114.27 66.80 7.47 $4,405.76 3114.27 66.09 48.18 $4,357.57 4 114.2765.36 48.91 $4,308.67 5 114.2764.63 49.64 $4,259.03 50.39 $4,208.64 7 114.27 63.13 51.14 $4,157.50 8114.27 62.36 51.91 $4,105.59 9114.27 61.58 5269 $4,052.91 10 114.27 60.7953.48 $3,999.43 11 114.27 59.99 54.28 $3,945.15 12114.27 59.18 55.09 $3,890.06 Year 2 13 114.2758.3555.92 $3,834.14 14114.27 57.5 56.76 $3,777.38 15 114.27 56.66 57.61 $3,719.77 16 11427 55.80 58.47 $3,661.30 17114.27 54.92 59.35 $3,601.94 18114.27 54.03 60.24 $3,541.70 19 114.2753.13 61.14 $3,480.56 20114.27 52.21 62.06 $3,418.50 21114.27 51.28 62.99 $3,355.50 22114.2750.33 63.94 $3,291.57 23114.2749.37 64.90 $3,226.67 24114.2748.40 65.87 $3,160.80 25 114.2747.41 66.86 $3,093.94 26114.27 46.41 67.86 $3,026.08 27114.27 45.39 68.88 $2,957.20 28114.274436 69.91 $2,887.29 29114.27 43.31 70.96 $2,816.33 30 114.27 42.24 7203 $2,744.30 31 114.27 41.16 73.11 $2,671.19 32114.2740.07 74.20 $2,596.99 33 114.2738.95 75.32 $2,521.68 INT PRIN PMT INT 142.5 67.50 ear 1 114.27 114.27 63.89 12 18 20 21 ear 3 27 142.50 29 31