Answered step by step

Verified Expert Solution

Question

1 Approved Answer

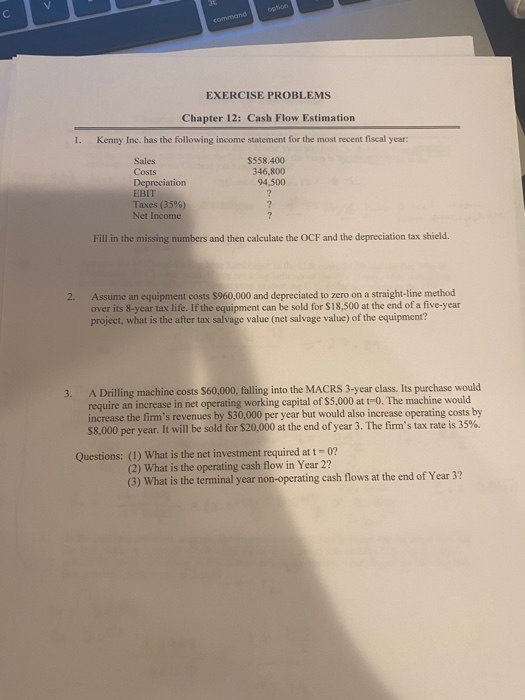

I AM NOT SURE THATS ALL THAT WAS GIVING TO ME. SORRY option command EXERCISE PROBLEMS Chapter 12: Cash Flow Estimation 1. Kenny Inc. has

I AM NOT SURE THATS ALL THAT WAS GIVING TO ME. SORRY

option command EXERCISE PROBLEMS Chapter 12: Cash Flow Estimation 1. Kenny Inc. has the following income statement for the most recent fiscal year: $558.400 346,800 94,500 Sales Costs Depreciation EBIT Taxes (35%) Net Income Fill in the missing numbers and then calculate the OCF and the depreciation tax shield. 2. Assume an equipment costs $960,000 and depreciated to zero on a straight-line method over its 8-year tax life. If the equipment can be sold for $18.500 at the end of a five-year project, what is the after tax salvage value (net salvage value) of the equipment? 3. A Drilling machine costs $60,000, falling into the MACRS 3-year class. Its purchase would require an increase in net operating working capital of $5,000 at t=0. The machine would increase the firm's revenues by $30,000 per year but would also increase operating costs by 58.000 per year. It will be sold for $20,000 at the end of year 3. The firm's tax rate is 35%. Questions: (1) What is the net investment required at t-0? (2) What is the operating cash flow in Year 2? (3) What is the terminal year non-operating cash flows at the end of Year 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started