Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am not sure where the adjusting entries go or if there even needs to be one. If there is an adjusting entries how do

I am not sure where the adjusting entries go or if there even needs to be one. If there is an adjusting entries how do I know what needs to be adjusted?

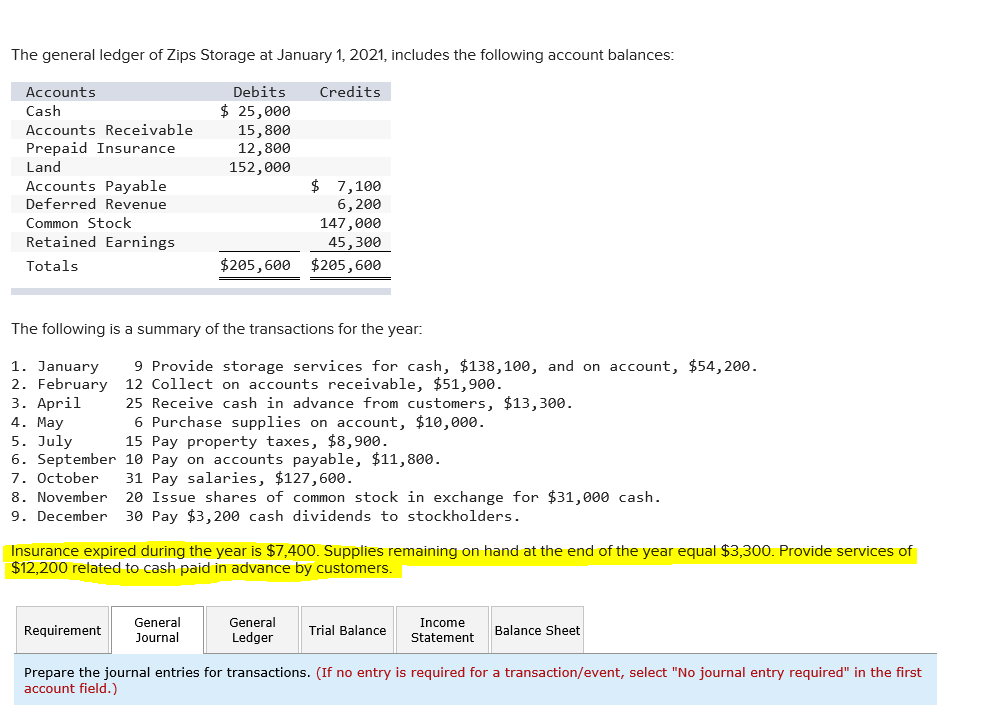

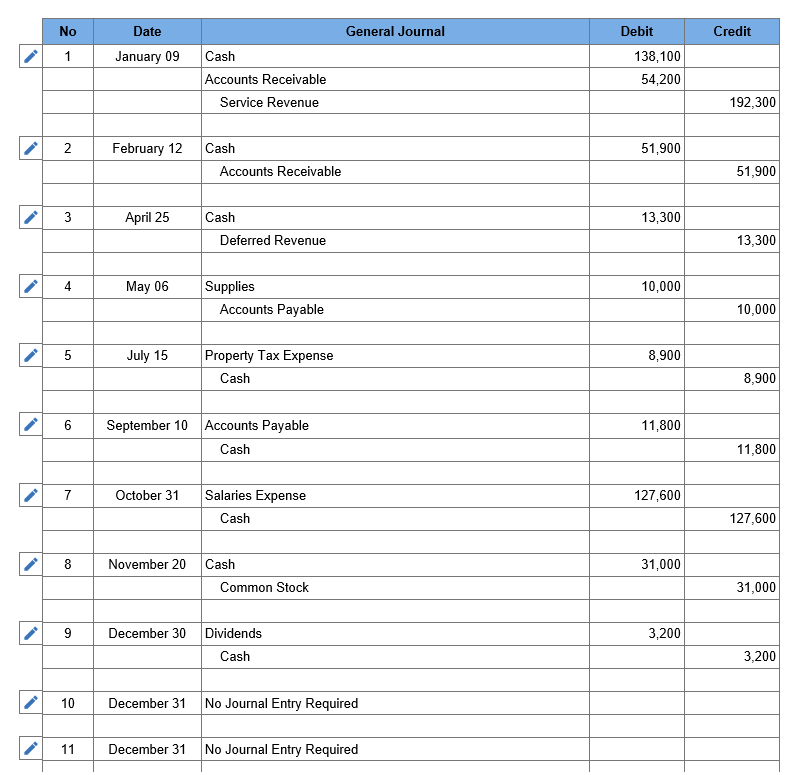

The general ledger of Zips Storage at January 1, 2021, includes the following account balances: Credits Debits $ 25,000 15,800 12,800 152,000 Accounts Cash Accounts Receivable Prepaid Insurance Land Accounts Payable Deferred Revenue Common Stock Retained Earnings Totals $ 7,100 6, 200 147,000 45,300 $205,600 $205,600 The following is a summary of the transactions for the year: 1. January 9 Provide storage services for cash, $138, 100, and on account, $54,200. 2. February 12 Collect on accounts receivable, $51,900. 3. April 25 Receive cash in advance from customers, $13,300. 4. May 6 Purchase supplies on account, $10,000. 5. July 15 Pay property taxes, $8,900. 6. September 10 Pay on accounts payable, $11,800. 7. October 31 Pay salaries, $127,600. 8. November 20 Issue shares of common stock in exchange for $31,000 cash. 9. December 30 Pay $3,200 cash dividends to stockholders. Insurance expired during the year is $7,400. Supplies remaining on hand at the end of the year equal $3,300. Provide services of $12,200 related to cash paid in advance by customers. Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) General Journal Credit No 1 Date January 09 Cash Accounts Receivable Service Revenue Debit 138,100 54,200 192,300 1 2 February 12 51,900 Cash Accounts Receivable 51,900 April 25 13,300 Cash Deferred Revenue 13,300 May 06 10,000 Supplies Accounts Payable 10,000 5 July 15 8,900 Property Tax Expense Cash 8,900 6 September 10 11,800 Accounts Payable Cash 11,800 7 October 31 127,600 Salaries Expense Cash 127,600 8 November 20 31,000 Cash Common Stock 31,000 December 30 3,200 Dividends Cash 3,200 10 December 31 No Journal Entry Required December 31 No Journal Entry Required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started