Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am not sure why some of my answers were incorrect, please show me some details on how you get your answers. Thank you. Cortez

I am not sure why some of my answers were incorrect, please show me some details on how you get your answers. Thank you.

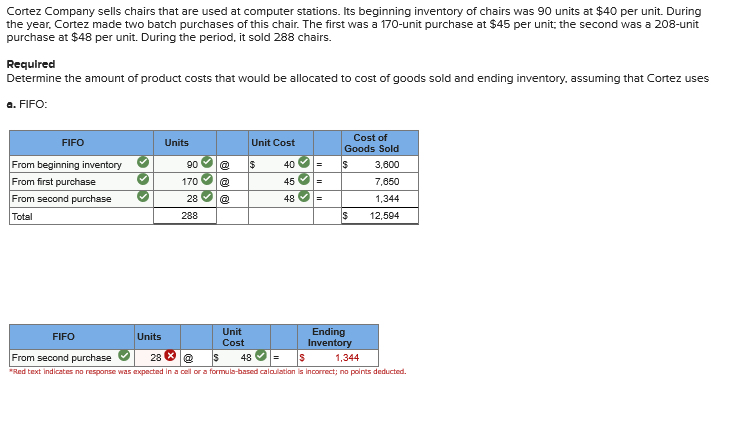

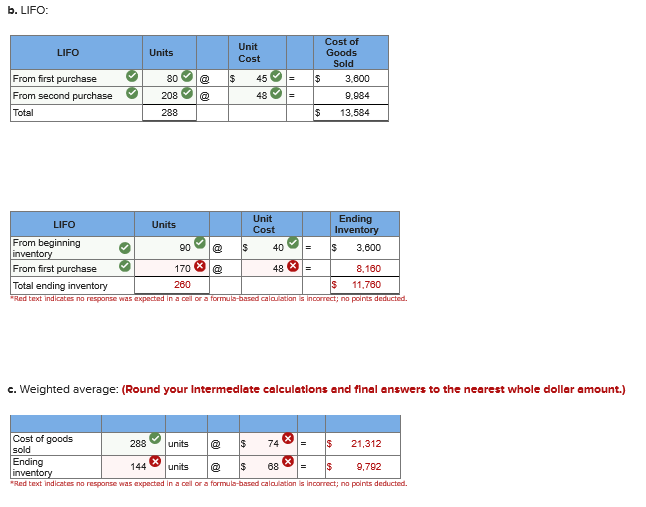

Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 90 units at $40 per unit. During the year. Cortez made two batch purchases of this chair. The first was a 170-unit purchase at $45 per unit: the second was a 208-unit purchase at $48 per unit. During the period, it sold 288 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses a. FIFO: FIFO From beginning inventory From first purchase From second purchase Total Units 90 170 28 Unit Cost $ 40 45 48 @ @ = = = Cost of Goods Sold $ 3,600 7,650 1,344 $ 12,594 Units Unit Ending Cost Inventory 5 1,344 "Red text Indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. FIFO From second purchase 2 8 @ 48 - b. LIFO: LIFO Units Unit $ From first purchase From second purchase Total 80 208 288 @ @ Cost 45 48 = = | Cost of Goods Sold $ 3.600 9.984 $ 13,584 Units LIFO Unit Ending Cost Inventory From beginning $ 3.600 inventory From first purchase 170 @ 48 = 8,160 Total ending inventory 260 $ 11,760 Red text indicates no response was expected in a celor a formula-based s Incorrect na points deducted. c. Weighted average: (Round your Intermediate calculations and final answers to the nearest whole dollar amount.) Cost of goods 288 units @ $ 74 = $ 21,312 sold Ending 144 units @ $ 68 = $ 9,792 inventory "Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deductedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started