i am posting the same question again because before that only only requirement 1 is solved

do i need all the requirements solved step by step not in one journal

please solve full question

thankyou

and i have one more questions which i posted 1 day ago that one is also not solved

please solve the questions

thankyou

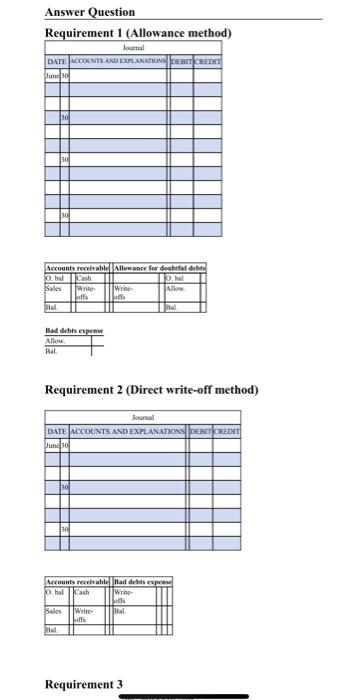

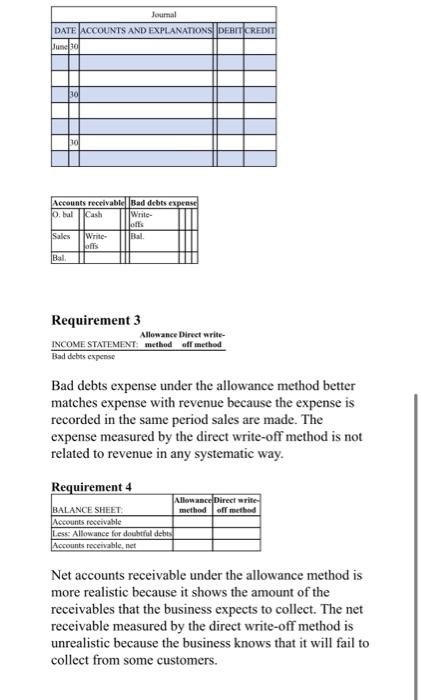

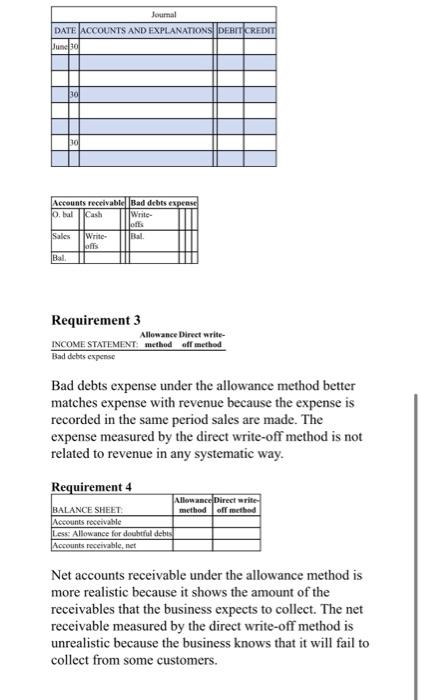

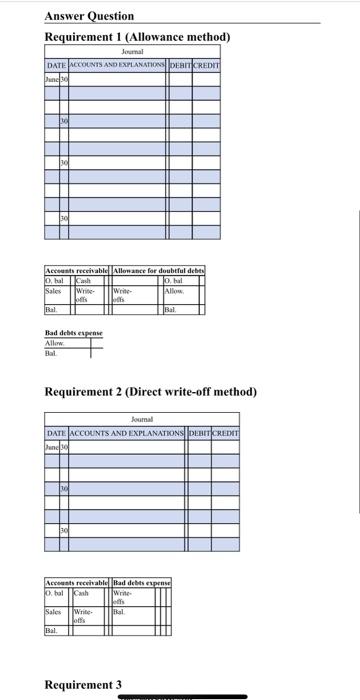

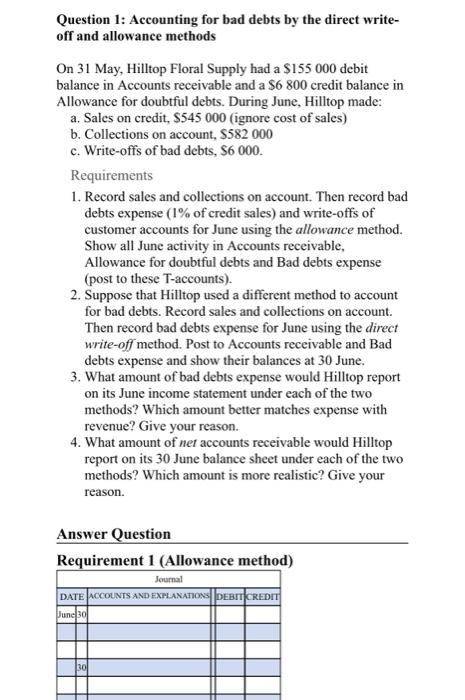

Answer Question Requirement 1 (Allowance method) Journal DATENCOUNTS AND EXPLANATIONS DERCREDET Lund Accounts receivable Allowance for de folder Obal Cash 10 Sales vinte Write New Joffs Hal Baddebis expense Allow Bal Requirement 2 (Direct write-off method) Semal DATE ACCOUNTS AND EXPLANATIONS PERTEREDIT Mundo Accounts receivable Bad de exprend hal Cash Write Sales Write Bal Requirement 3 Journal DATE ACCOUNTS AND EXPLANATIONS DERIT CREDIT und 30 30 10 Accounts receivable Bad debts expense obal Cash Write ots Sales Write El Joffs Bal Requirement 3 Allowance Direct write- INCOME STATEMENT method off method Bad debts expense Bad debts expense under the allowance method better matches expense with revenue because the expense is recorded in the same period sales are made. The expense measured by the direct write-off method is not related to revenue in any systematic way. Requirement 4 Allowance Direct write BALANCE SHEET method off method Accounts receivable Less Allowance for doubtfuldebt Accounts receivable.net Net accounts receivable under the allowance method is more realistic because it shows the amount of the receivables that the business expects to collect. The net receivable measured by the direct write-off method is unrealistic because the business knows that it will fail to collect from some customers. Journal DATE ACCOUNTS AND EXPLANATIONS DERIT CREDIT pund 30 ad 10 Accounts receivable Bad debts expense obal Cash Write ots Sales Write El Joffs Ral Requirement 3 Allowance Direct write- INCOME STATEMENT method off method Bad debts expense Bad debts expense under the allowance method better matches expense with revenue because the expense is recorded in the same period sales are made. The expense measured by the direct write-off method is not related to revenue in any systematic way. Requirement 4 Allowance Direct write- BALANCE SHEET method off method Accounts receivable Less: Allowance for doubtful debts Accounts receivable, net Net accounts receivable under the allowance method is more realistic because it shows the amount of the receivables that the business expects to collect. The net receivable measured by the direct write-off method is unrealistic because the business knows that it will fail to collect from some customers. Answer Question Requirement 1 (Allowance method) Journal DATE ACCOUNTS AND EXPLANATIONS DE CREDIT unds Accounts receivable Allowance for doubtfuldebt O, hal Kash O hal Write Weite pos Ral Bal Sales Bad debts espre Allow Bal Requirement 2 (Direct write-off method) femal DATE ACCOUNTS AND EXPLANATIONS DEBIT CREDIT Pend Accounts receivable Rad debits experts O halk Write os Sales Write Bal ots Bal. Requirement 3 Question 1: Accounting for bad debts by the direct write- off and allowance methods On 31 May, Hilltop Floral Supply had a $155 000 debit balance in Accounts receivable and a $6 800 credit balance in Allowance for doubtful debts. During June, Hilltop made: a. Sales on credit, S545 000 (ignore cost of sales) b. Collections on account, S582 000 c. Write-offs of bad debts, S6 000. Requirements 1. Record sales and collections on account. Then record bad debts expense (1% of credit sales) and write-offs of customer accounts for June using the allowance method. Show all June activity in Accounts receivable, Allowance for doubtful debts and Bad debts expense (post to these T-accounts). 2. Suppose that Hilltop used a different method to account for bad debts. Record sales and collections on account Then record bad debts expense for June using the direct write-off method. Post to Accounts receivable and Bad debts expense and show their balances at 30 June. 3. What amount of bad debts expense would Hilltop report on its June income statement under each of the two methods? Which amount better matches expense with revenue? Give your reason. 4. What amount of net accounts receivable would Hilltop report on its 30 June balance sheet under each of the two methods? Which amount is more realistic? Give your reason. Answer Question Requirement 1 (Allowance method) Journal DATE ACCOUNTS AND EXPLANATIONS DEBIT CREDIT June 30 30