Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am posting this for the second time because it was wrong. Stockholders' Equity Category 2 Peeler Company was incorporated as a new business on

I am posting this for the second time because it was wrong.

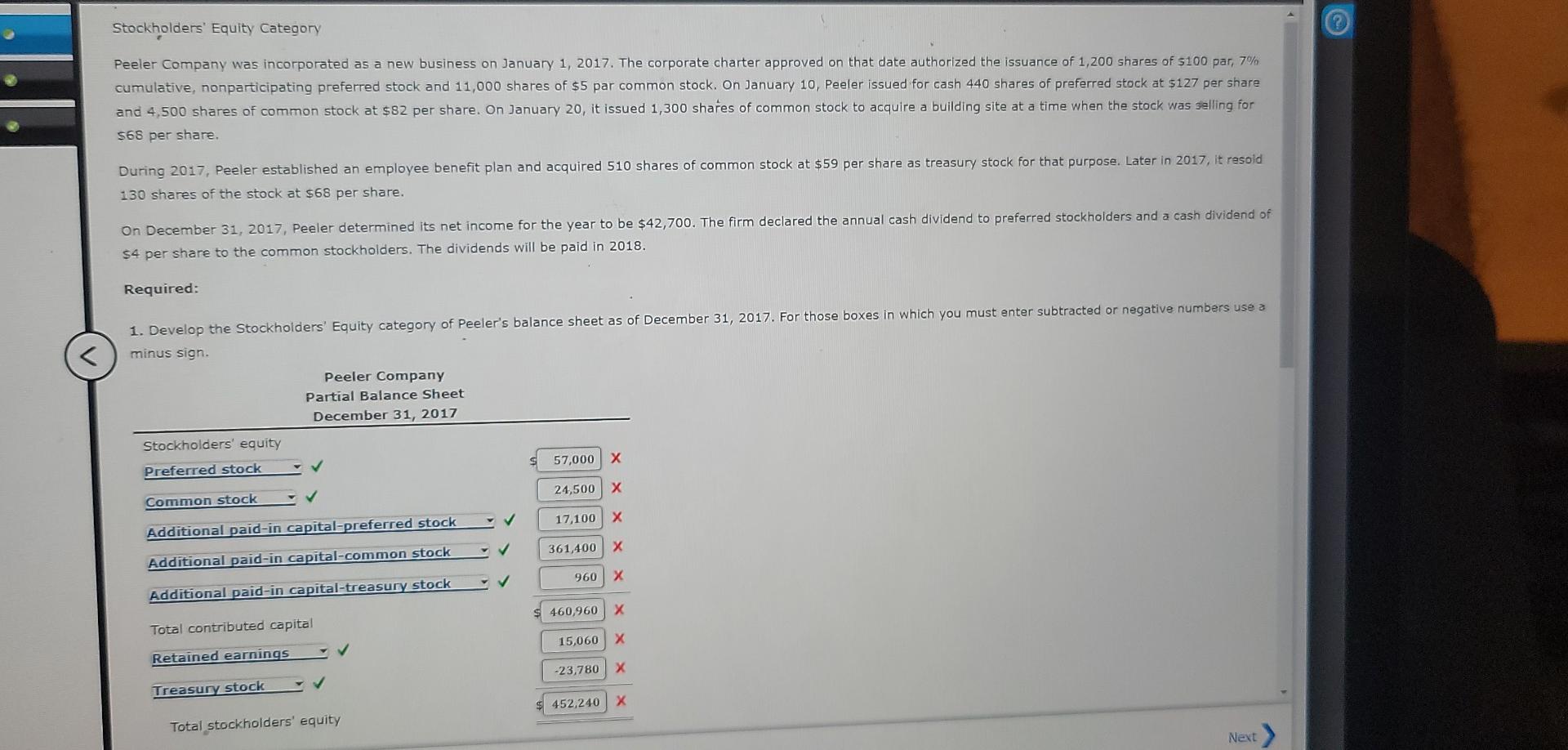

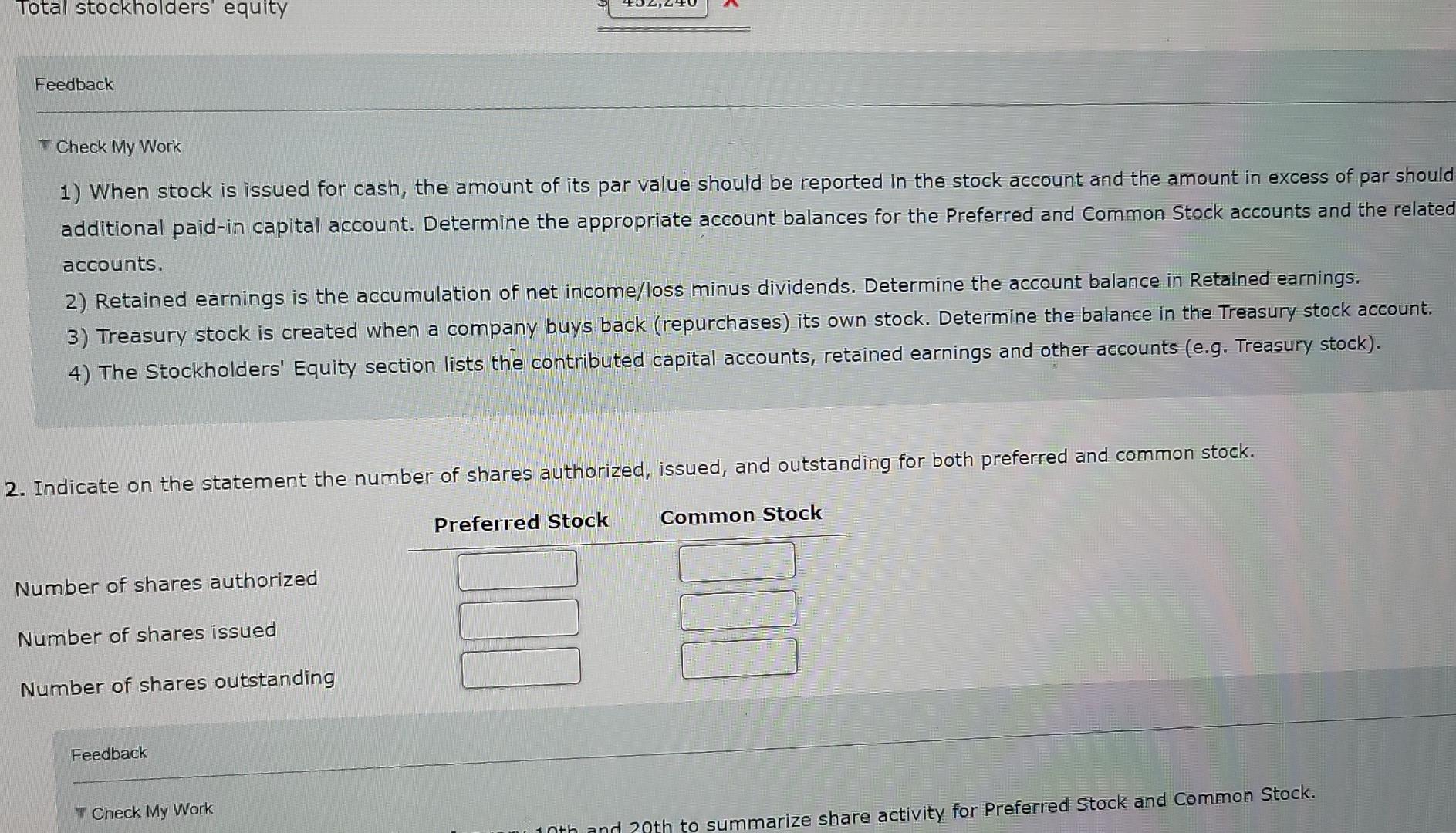

Stockholders' Equity Category 2 Peeler Company was incorporated as a new business on January 1, 2017. The corporate charter approved on that date authorized the issuance of 1,200 shares of $100 par, 7% cumulative, nonparticipating preferred stock and 11,000 shares of $5 par common stock. On January 10, Peeler issued for cash 440 shares of preferred stock at $127 per share and 4.500 shares of common stock at $82 per share. On January 20, it issued 1,300 shares of common stock to acquire a building site at a time when the stock was selling for 568 per share During 2017, Peeler established an employee benefit plan and acquired 510 shares of common stock at $59 per share as treasury stock for that purpose. Later in 2017, it resold 130 shares of the stock at $68 per share. On December 31, 2017, Peeler determined its net income for the year to be $42,700. The firm declared the annual cash dividend to preferred stockholders and a cash dividend of $4 per share to the common stockholders. The dividends will be paid in 2018. Required: 1. Develop the Stockholders' Equity category of Peeler's balance sheet as of December 31, 2017. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Peeler Company Partial Balance Sheet December 31, 2017 Stockholders' equity 57,000 Preferred stock 24,500 Common stock 17,100 X Additional paid-in capital-preferred stock 361,400 X Additional paid-in capital-common stock 960 x Additional paid-in capital-treasury stock 460,960 x Total contributed capital 15,060 x Retained earnings -23,780 X Treasury_stock $ 452,240 X Total stockholders' equity Next Total stockholders' equity Feedback Check My Work 1) When stock is issued for cash, the amount of its par value should be reported in the stock account and the amount in excess of par should additional paid-in capital account. Determine the appropriate account balances for the Preferred and Common Stock accounts and the related accounts. 2) Retained earnings is the accumulation of net income/loss minus dividends. Determine the account balance in Retained earnings. 3) Treasury stock is created when a company buys back (repurchases) its own stock. Determine the balance in the Treasury stock account. 4) The Stockholders' Equity section lists the contributed capital accounts, retained earnings and other accounts (e.g. Treasury stock). 2. Indicate on the statement the number of shares authorized, issued, and outstanding for both preferred and common stock. Preferred Stock Common Stock Number of shares authorized Number of shares issued Number of shares outstanding Feedback Check My Work 10th and 20th to summarize share activity for Preferred Stock and Common StockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started