Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am preparing to Make Clothes Production Company the available fund Is $81,000, the required is Making Financial Plan That Contain: 1. Funding Requirements 2.

I am preparing to Make Clothes Production Company the available fund Is $81,000, the required is Making Financial Plan That Contain:

1. Funding Requirements

2. Financial information

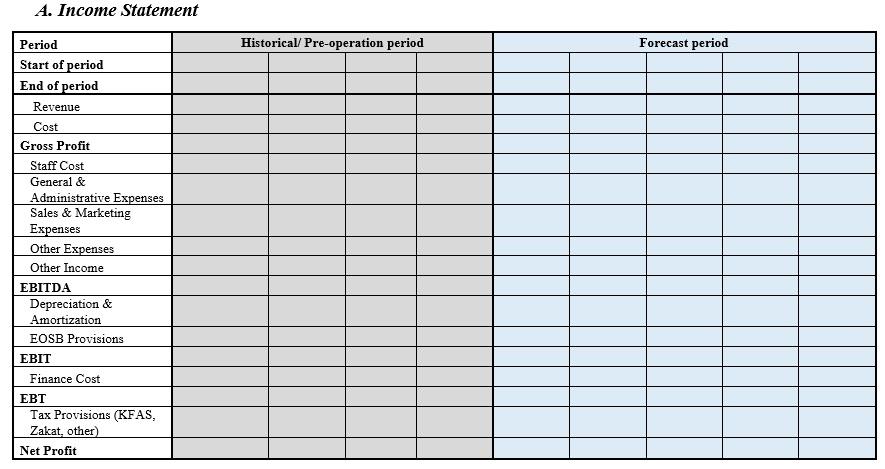

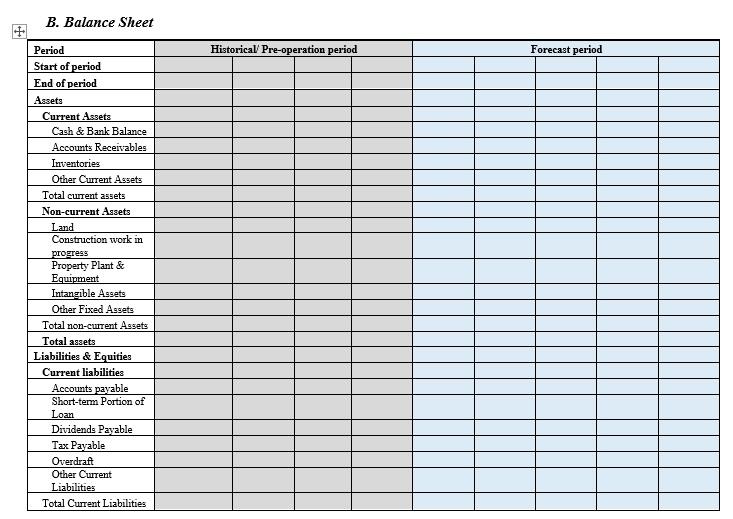

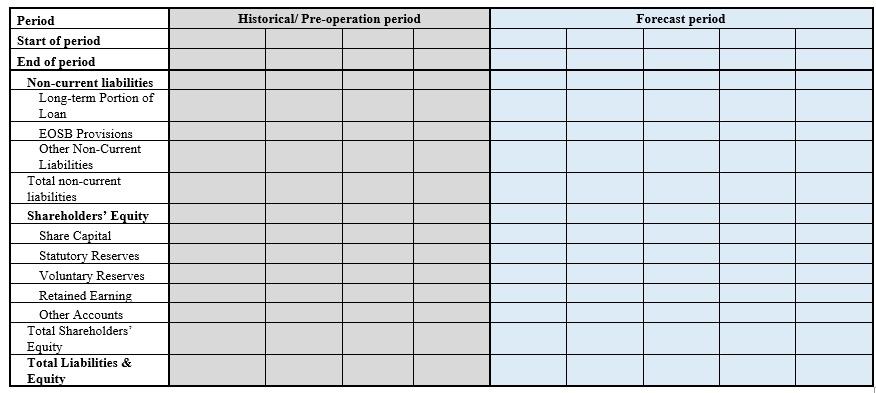

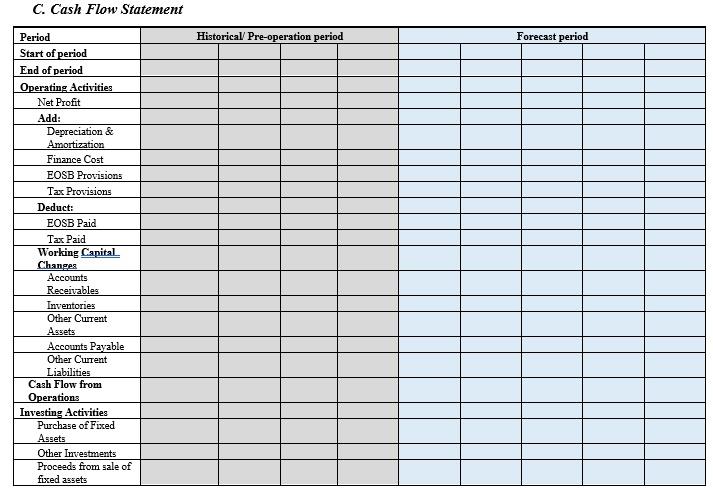

3. Financial Statements (Income Statement - Balance Sheet - Cash Flow Statement)

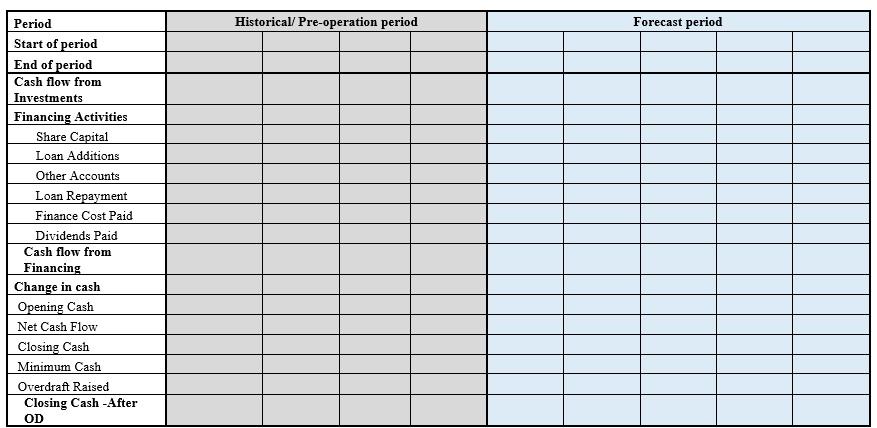

A. Income Statement Historical/Pre-operation period Forecast period Period Start of period End of period Revenue Cost Gross Profit Staff Cost General & Administrative Expenses Sales & Marketing Expenses Other Expenses Other Income EBITDA Depreciation & Amortization EOSB Provisions EBIT Finance Cost EBT Tax Provisions (KFAS, Zakat, other) Net Profit B. Balance Sheet Historical Pre-operation period Forecast period Period Start of period End of period Assets Current Assets Cash & Bank Balance Accounts Receivables Inventories Other Current Assets Total current assets Non-current Assets Land Construction work in progress Property Plant & Equipment Intangible Assets Other Fixed Assets Total non-current Assets Total assets Liabilities & Equities Current liabilities Accounts payable Short-term Portion of Loan Dividends Payable Tax Payable Overdraft Other Current Liabilities Total Current Liabilities Historical/Pre-operation period Forecast period Period Start of period End of period Non-current liabilities Long-term Portion of Loan EOSB Provisions Other Non-Current Liabilities Total non-current liabilities Shareholders' Equity Share Capital Statutory Reserves Voluntary Reserves Retained Earning Other Accounts Total Shareholders Equity Total Liabilities & Equity C. Cash Flow Statement Historical Pre-operation period Forecast period Period Start of period End of period Operating Activities Net Profit Add: Depreciation & Amortization Finance Cost EOSB Provisions Tax Provisions Deduct: EOSB Paid Tax Paid Working Capital Changes Accounts Receivables Inventories Other Current Assets Accounts Payable Other Current Liabilities Cash Flow from Operations Investing Activities Purchase of Fixed Assets Other Investments Proceeds from sale of fixed assets Historical/Pre-operation period Forecast period Period Start of period End of period Cash flow from Investments Financing Activities Share Capital Loan Additions Other Accounts Loan Repayment Finance Cost Paid Dividends Paid Cash flow from Financing Change in cash Opening Cash Net Cash Flow Closing Cash Minimum Cash Overdraft Raised Closing Cash - After OD A. Income Statement Historical/Pre-operation period Forecast period Period Start of period End of period Revenue Cost Gross Profit Staff Cost General & Administrative Expenses Sales & Marketing Expenses Other Expenses Other Income EBITDA Depreciation & Amortization EOSB Provisions EBIT Finance Cost EBT Tax Provisions (KFAS, Zakat, other) Net Profit B. Balance Sheet Historical Pre-operation period Forecast period Period Start of period End of period Assets Current Assets Cash & Bank Balance Accounts Receivables Inventories Other Current Assets Total current assets Non-current Assets Land Construction work in progress Property Plant & Equipment Intangible Assets Other Fixed Assets Total non-current Assets Total assets Liabilities & Equities Current liabilities Accounts payable Short-term Portion of Loan Dividends Payable Tax Payable Overdraft Other Current Liabilities Total Current Liabilities Historical/Pre-operation period Forecast period Period Start of period End of period Non-current liabilities Long-term Portion of Loan EOSB Provisions Other Non-Current Liabilities Total non-current liabilities Shareholders' Equity Share Capital Statutory Reserves Voluntary Reserves Retained Earning Other Accounts Total Shareholders Equity Total Liabilities & Equity C. Cash Flow Statement Historical Pre-operation period Forecast period Period Start of period End of period Operating Activities Net Profit Add: Depreciation & Amortization Finance Cost EOSB Provisions Tax Provisions Deduct: EOSB Paid Tax Paid Working Capital Changes Accounts Receivables Inventories Other Current Assets Accounts Payable Other Current Liabilities Cash Flow from Operations Investing Activities Purchase of Fixed Assets Other Investments Proceeds from sale of fixed assets Historical/Pre-operation period Forecast period Period Start of period End of period Cash flow from Investments Financing Activities Share Capital Loan Additions Other Accounts Loan Repayment Finance Cost Paid Dividends Paid Cash flow from Financing Change in cash Opening Cash Net Cash Flow Closing Cash Minimum Cash Overdraft Raised Closing Cash - After OD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started